Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The United States has approved several billion dollars worth of Nvidia’s chip exports to the UAE, as per Bloomberg.

Nvidia is hitting all time highs. Source: The National News, it@amitisinvesting

NVIDIA now has a greater market cap than the entire German stock market and the entire Italian stock market…

Combined. Source: Peter Mallouk @PeterMallouk

$MSFT is following the path of $GOOGL

This translates to around $340,000 for every citizen, making it one of the richest countries per capita. Source: Massimo @Rainmaker1973, Quartr

On September 30, 2025, Nvidia will file its 13F form.

This report will list the companies Nvidia has invested in. Here are Nvidia’s current investment stakes: Source: graniteshares

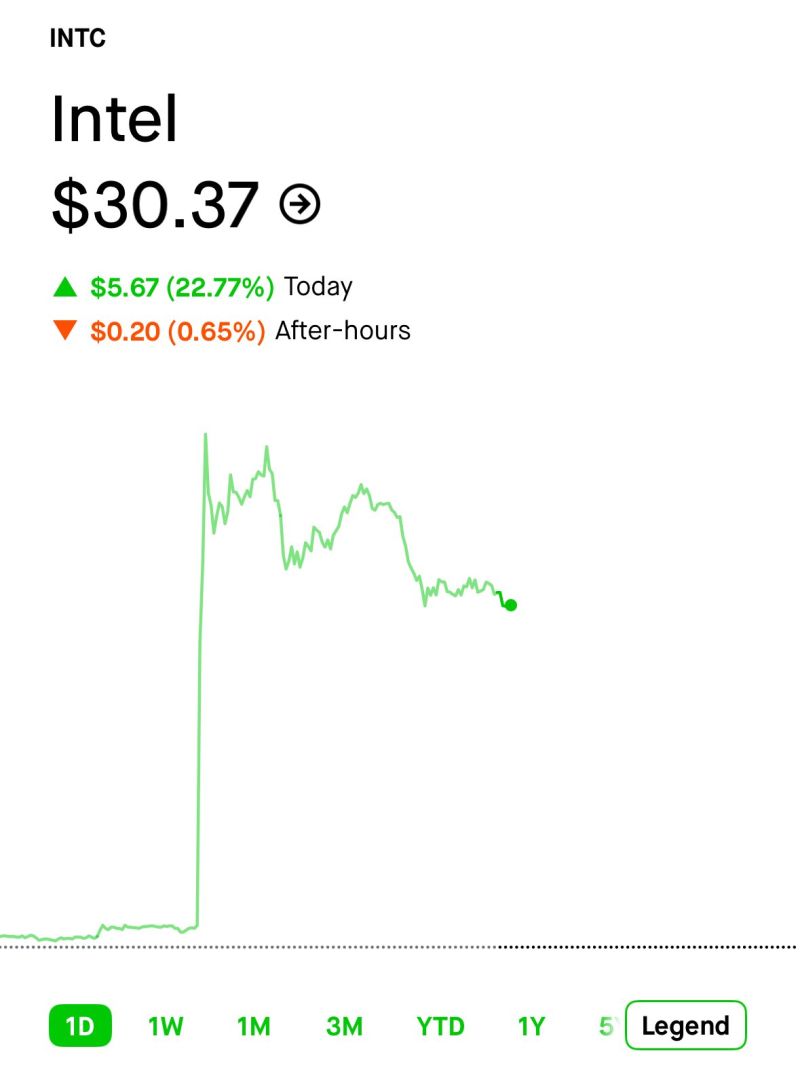

Intel $INTC stock just had its best day since OCTOBER 1987

Nvidia said it will invest $5 billion in Intel as part of a deal to co-develop data center and PC chips with the troubled chipmaker. The Trump administration brokered a 10% stake in the chipmaker in August. The investment, which is subject to regulatory approvals, does not appear to include the manufacturing of Nvidia chips with Intel's foundry. Source. CNBC

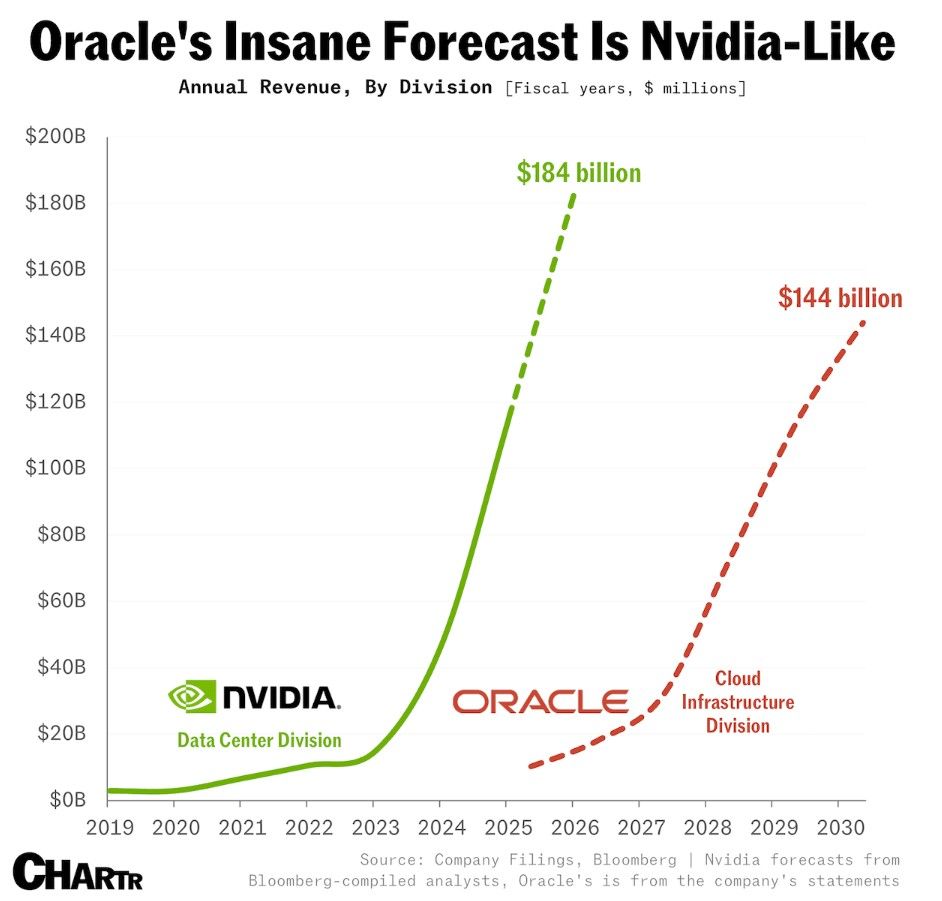

Oracle is expecting its “Cloud Infrastructure” revenue to rise to an eye-watering $144 billion in its fiscal year 2030. That’s up more than 14x on last fiscal year’s ~$10 billion haul

If, and it is an if, the company hits that forecast, it will have shades of another AI enabler’s meteoric rise: Nvidia’s data center business, which saw its revenue increase from $6.7 billion in FY 2021 to $115 billion in FY 2025, with analysts anticipating more than $184 billion in data center revenue this fiscal year. Source: Chartr

Investing with intelligence

Our latest research, commentary and market outlooks