Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

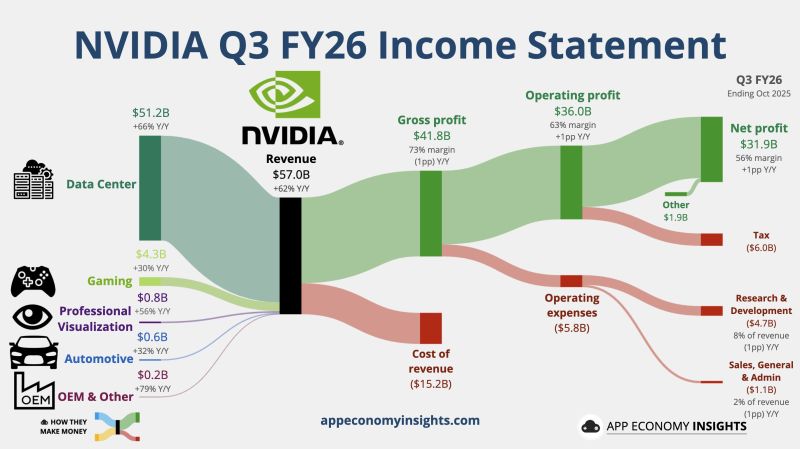

$NVDA NVIDIA Q3 FY26 (October quarter).

• Revenue +62% Y/Y to $57B ($1.9B beat). • Operating margin 63% (+1pp Y/Y). • Non-GAAP EPS $1.30 ($0.04 beat). Q4 FY26 guidance: • Revenue $65B ($3.2B beat). Source: App Economy Insights @EconomyApp

🔥 3 Bullish Signals from NVIDIA’s Earnings Call Last Night — and why the AI trade is far from over.

Most CEOs play it safe on earnings calls. Jensen Huang did the opposite. Here are the 3 comments everyone in tech, AI, and markets should pay attention to: 🚀 1. “No AI Bubble” — Just Three Structural Shifts 1️⃣ The migration from CPU ➝ accelerated computing 2️⃣ Generative AI hitting a tipping point across every workload 3️⃣ The rise of agentic AI All three require massive infrastructure builds. And the kicker? Inference demand is exploding — and is set to become a major revenue engine for NVIDIA. 💰 2. “Funding Is NOT the Problem” Worried customers are running out of capital? NVIDIA is not. Hyperscalers are already monetizing AI, sovereign buying is ramping, and agentic AI opens entirely new revenue pools. Translation: the money is there, and it's accelerating. 🧠 3. “The Ecosystem Is the Moat” This one flew under the radar but is HUGE. The CFO pointed out: A100 GPUs from SIX years ago are still fully utilized — thanks to the Kuda software stack. It means: Longer useful life for GPUs Better ROI on datacenter capex A deeper, stickier NVIDIA ecosystem Plus, NVIDIA is expanding partnerships across enterprise platforms and top AI developers. 📈 Bottom Line This was a monster print: ✔ Strong results ✔ Confident guidance ✔ Constructive multi-year outlook After-hours? NVIDIA popped ~5%, and AI-related names rallied across the board. 📊 Valuation Check (Yes, Really) NVIDIA’s stock has actually de-rated lately — earnings kept growing, the share price didn’t. And now with Q4 guidance out, investors will pivot to 2026–2027. Here’s the jaw-dropper: ➡️ Using 2027 FactSet consensus, NVIDIA trades at 21× P/E. Twenty. One. Times. Earnings. For the company powering the entire AI revolution. 🔮 The Broader Message The AI trade is alive. Healthy. And nowhere near done.

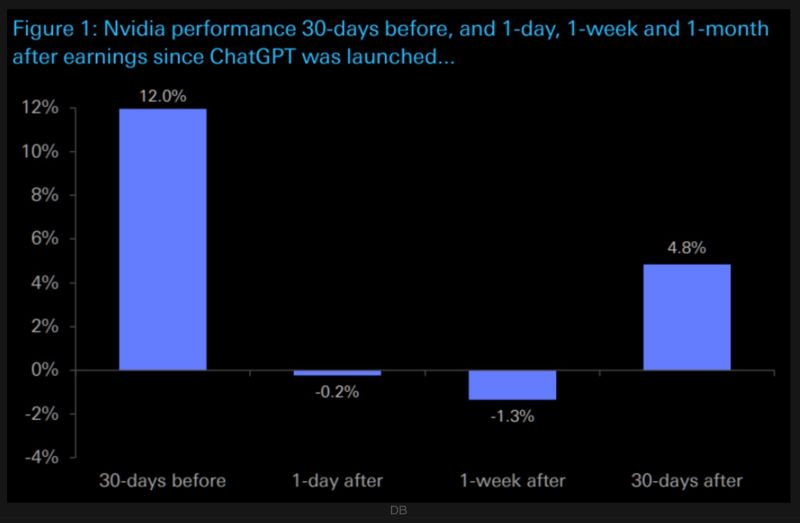

➡️ Over the past eleven releases since ChatGPT launched, NVDA’s massive 10x rally hasn’t come from earnings-day pops:

Day-after and week-after moves have typically lagged, while the month before earnings has usually been the strong stretch. ➡️This quarter breaks that pattern, NVDA is flat heading into results, with recent earnings cycles showing weaker immediate reactions and stronger rallies later in the quarter. Source: The Market Ear, DB

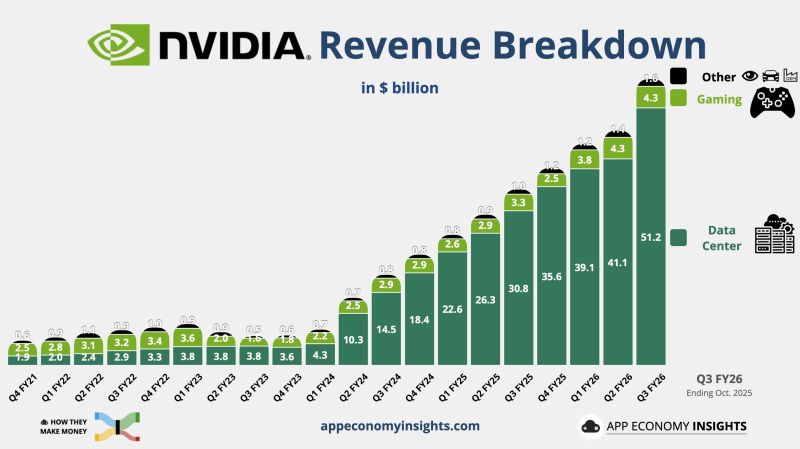

$NVDA NVIDIA Data Center literally off the charts.

Source: App Economy Insights

Is this really sustainable? We will find out more later today

Source: Markets & Mayhem @Mayhem4Markets

Nvidia $NVDA in danger of closing below its 100-day moving average for the first time since May

Source: Barchart

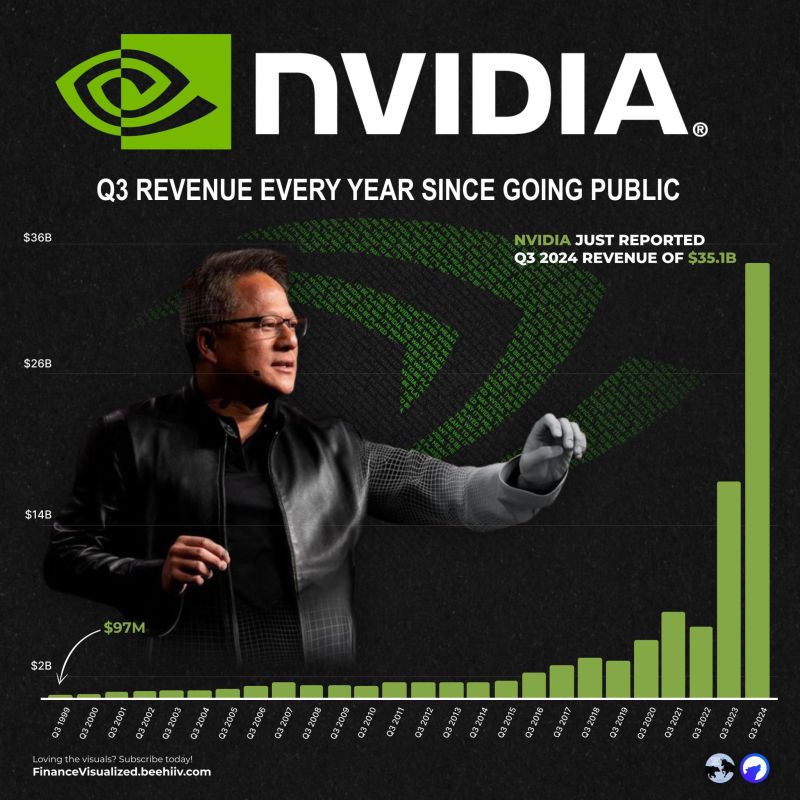

This chart will get soon updated

Wall ST is expecting Nvidia $NVDA to report revenue of $54.9 Billion tomorrow up from $35.1B in the same quarter last year Source: Wolf, https://lnkd.in/enK2fikS

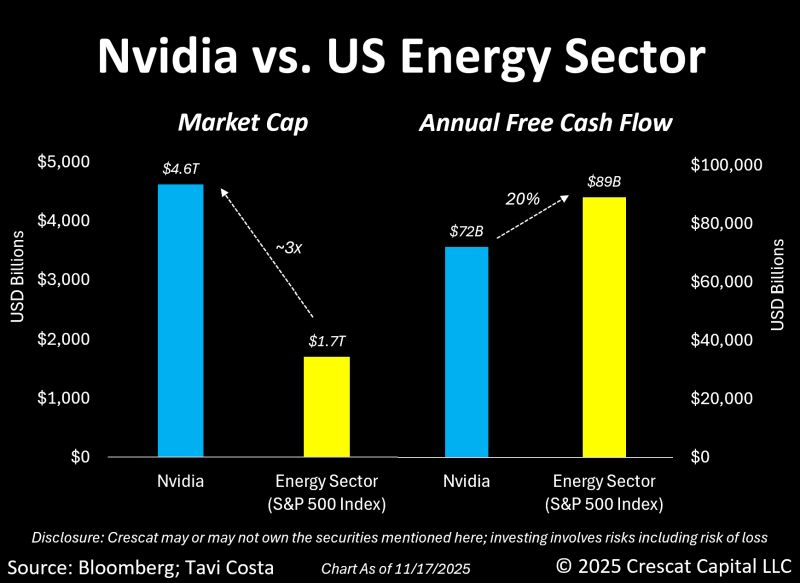

As highlighted by Tavi Costa, Nvidia is now valued at nearly three times the entire energy sector.

Almost three times. And no, it doesn’t generate more profit than energy companies in the S&P 500. In fact, the combined free cash flow of this sector over the last year is about 20% higher than Nvidia’s. Tech innovation is incredible, but let’s not forget that something still has to power it. Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks