Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

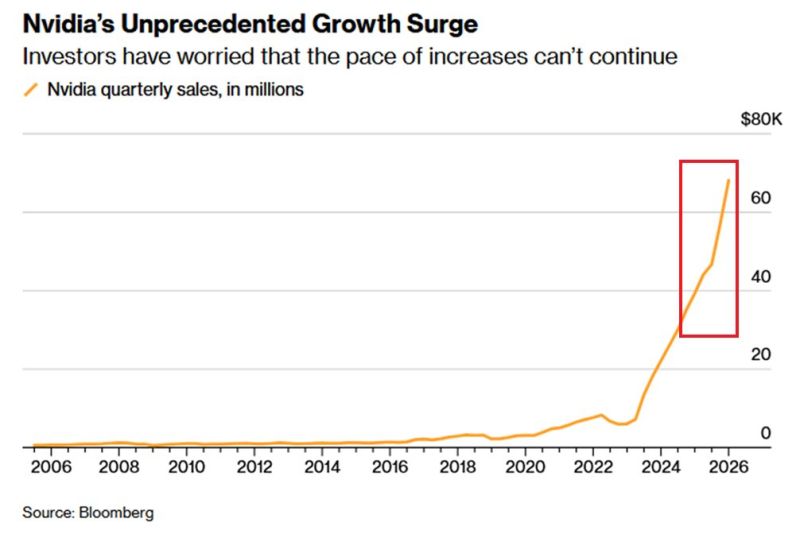

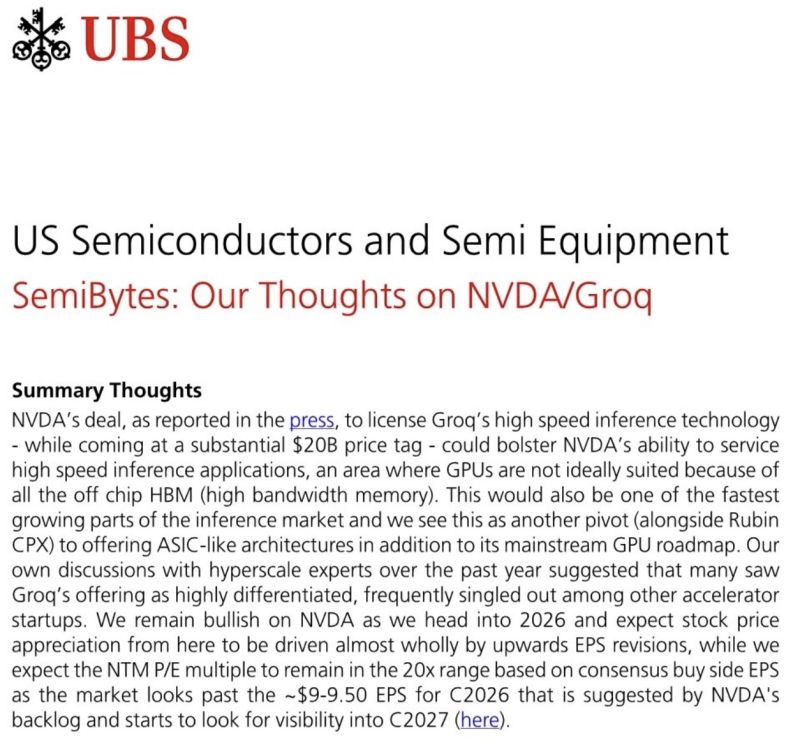

NVIDIA posted its best quarter ever

$68.1B revenue (+73% YoY) and Q1 guidance of ~$78B—but the stock fell, erasing post-earnings gains. CFO Colette Kress flagged potential long-term AI disruption from Chinese chipmakers. China exposure remains limited, with zero H200 chip sales and tariffs on U.S.-licensed shipments. The market reaction shows that when expectations are extremely high, even record results may disappoint. Source: Global Markets Investor, Bloomberg

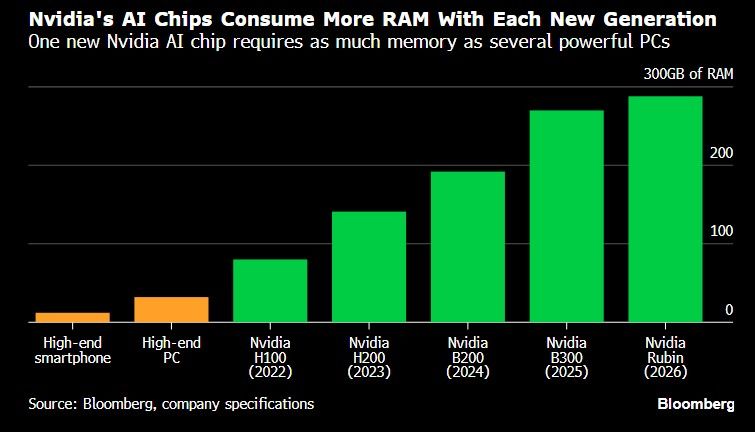

Wondering why memory chips stocks are on fire? Just watch the chart below courtesy of Bloomberg.

Nvidia's chips consume more RAM witch each generation. Rubin requires as much memory as several powerful PCs.

Nvidia CEO said yesterday that the “Memory Bottleneck is Severe”

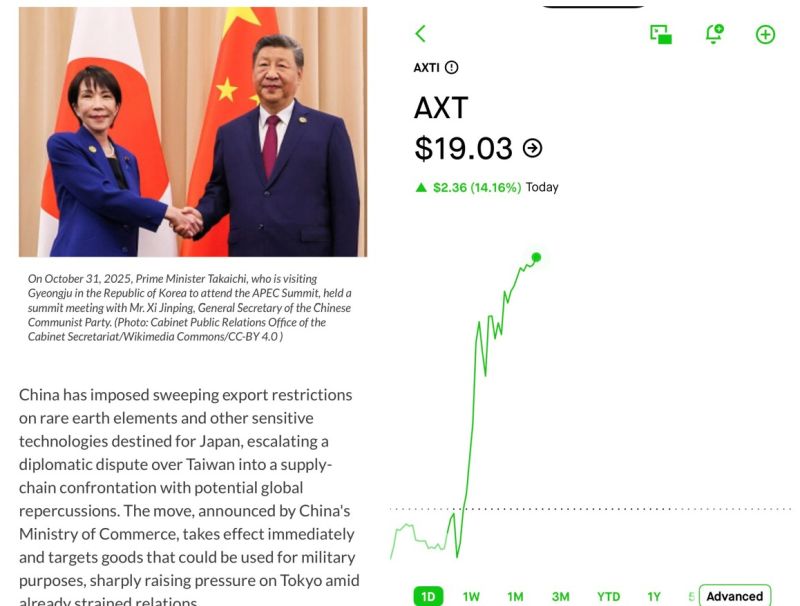

SK Hynix ($330B) $MU ($355B) Samsung ($595B). Wait and see the look on everyone’s face when they find out the entire AI buildout will be bottlenecked by the tiny $AXTI ($1B) after the China’s new export controls. Source: Serenity @aleabitoreddit

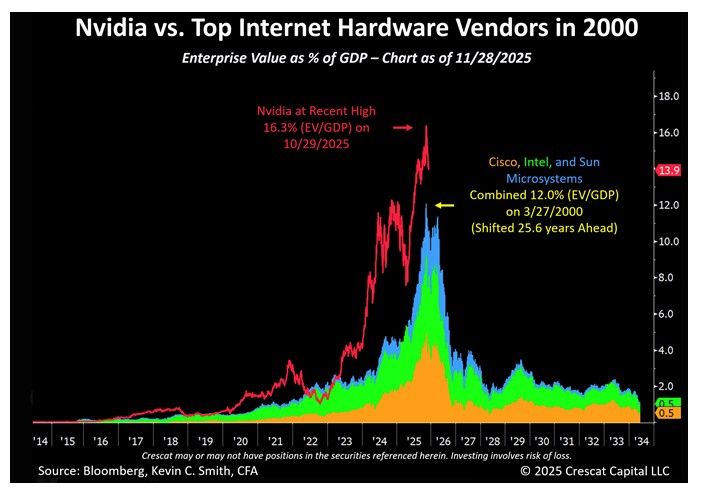

Great chart by Tavi Costa showing Mega-caps hardware stocks Entreprise Value as a % of GDP - 2000 vs. today...

We think Nvidia has a different profile. Still, this is a scary one...

Investing with intelligence

Our latest research, commentary and market outlooks