Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JP MORGAN is making a big bullish call on oil and energy stocks.

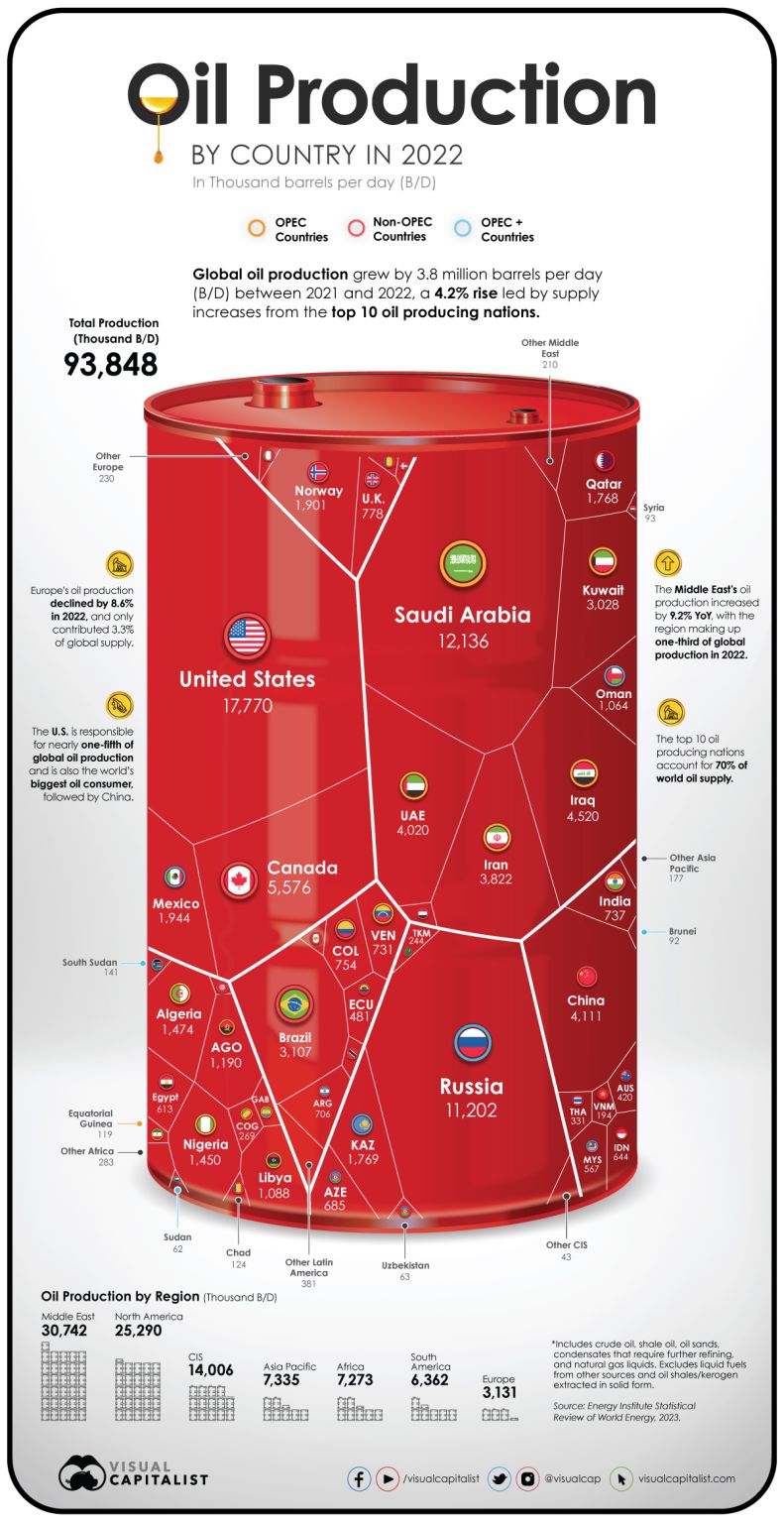

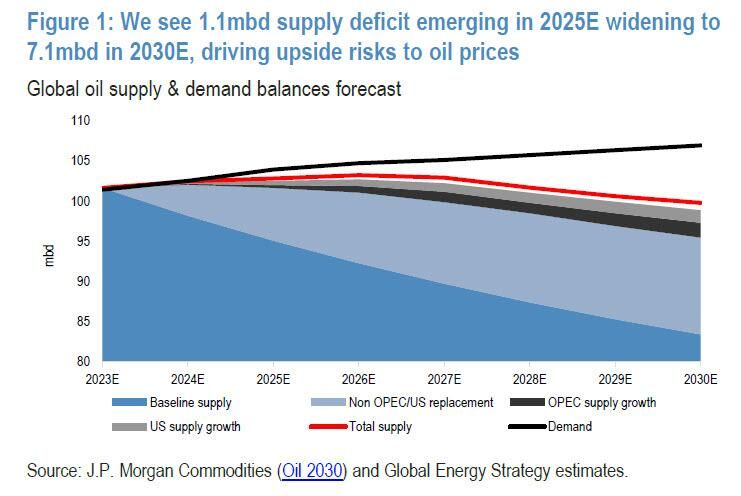

The largest US bank expects the global oil deficit hitting a record 7mmb/d in 2030, a staggering shortfall which would require prices to rise higher... much higher. In a nutshell: JPM is reiterating their $80/bbl LT target and their view framed in Supercycle IV that the upside risk to oil is $150/bbl over the near to medium term term and $100/bbl LT. The primary drivers of their structural thesis are : 1) higher for longer rates tempering the flow of capital into new supply, 2) higher cost of equity driving elevated Cash Breakevens of >$75/bbl Brent (post buybacks) as companies return structurally more cash to shareholders, in turn, pushing the marginal cost of oil higher, 3) Institutional and policy led pressures driving an accelerated transition away from hydrocarbons and peak demand fears. Taken together, their corollary is a self-reinforcing ‘higher-for-longer’ energy macro outlook as the industry struggles to justify large investments beyond 2030. Consequently, they forecast a 1.1mbd S/D gap in 2025 widening to 7.1mbd in 2030 driven by both a robust demand outlook and limited supply sources.

Oil, diesel crack sread soar after Russia bans diesel, gasoline exports

With Diesel prices already soaring, recently sending the diesel crack to 2023 highs and assuring that refiners have another blowout quarter, Russia just handed a gift to the Exxons of the world when it "temporarily banned" exports of the diesel in a bid to stabilize domestic supplies, adding pressure on already tight global fuel markets. “Temporary restrictions will help saturate the fuel market, that in turn will reduce prices for consumers” in Russia, the government’s press office said on its website. The "temporary" ban, which also applies to gasoline, comes into force today, Sept. 21, and doesn’t have the final date, according to the government decree, signed by Prime Minister Mikhail Mishustin. Source: www.zerohedge.com, Bloomberg

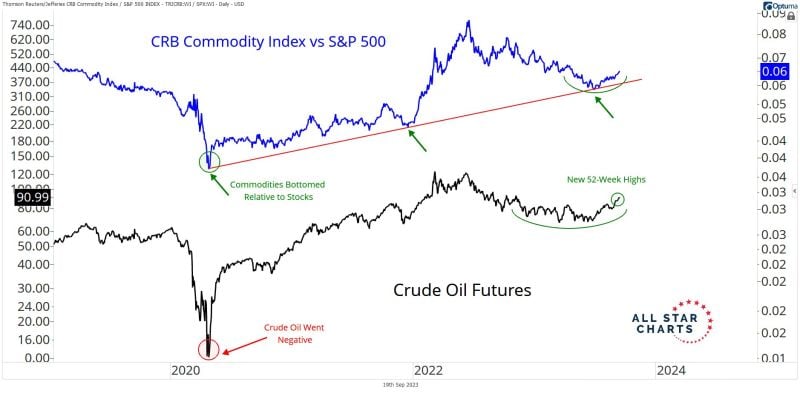

With the rise of oil prices, there is currently a revival of the "commodities super-cycle thesis"...

Source: J-C Parets

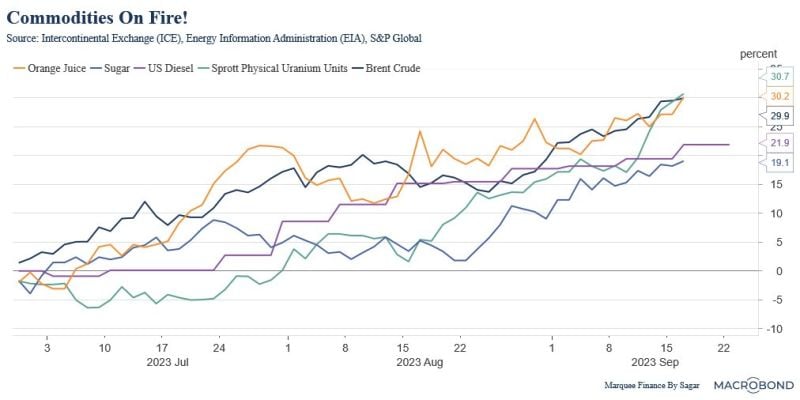

Since the June bottom, crude oil, uranium, sugar and orange juice are up 20-30%. Is the risk of a second wave increasing?

Source: The Macro Guy

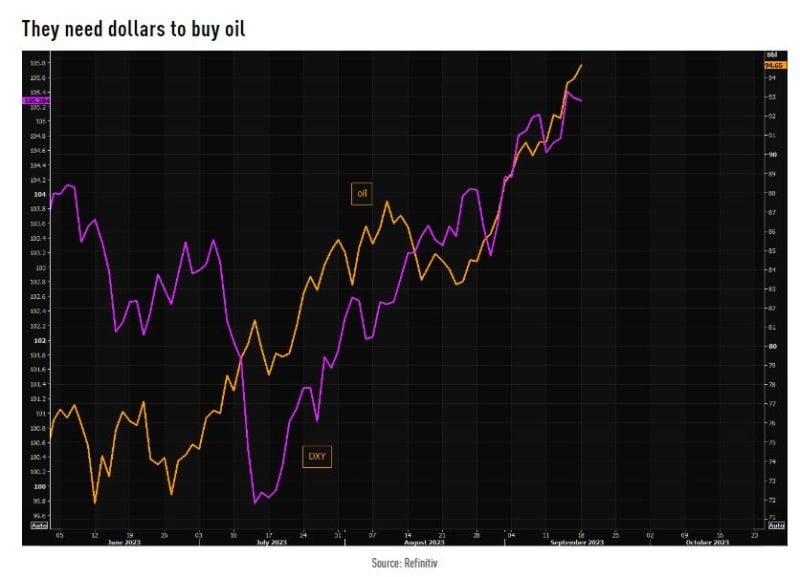

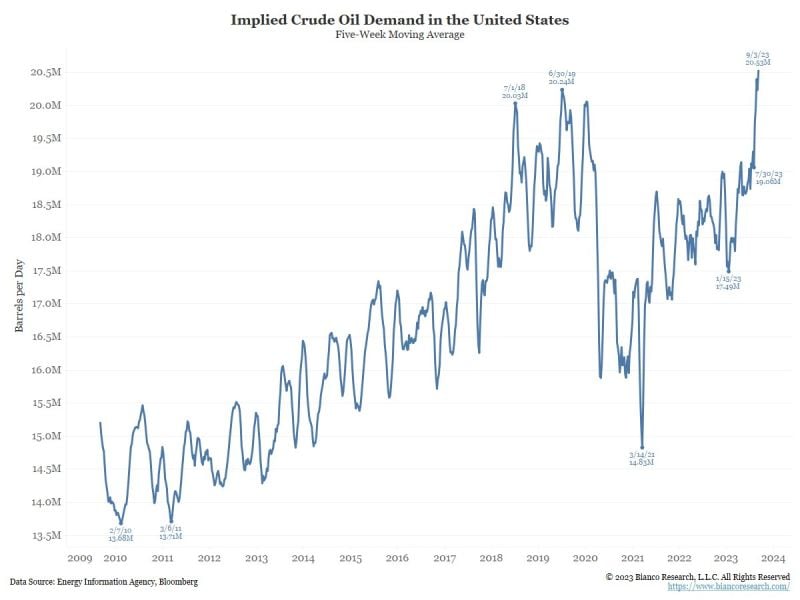

Crude oil prices are booming and is now up 34.5% since late June BUT THIS IS NOT JUST A SUPPLY STORY - WATCH OUT DEMAND AS WELL!!!

The OPEC+ (Saudi/Russian) production cuts are the easy culprit to blame for higher prices. They do matter. But another equally important factor is booming demand. Bloomberg uses Department of Energy data for production, imports, and inventory changes to "input" the weekly demand for crude oil. Below is a five-week average to smooth the noise. Demand is through the roof! This suggests the economy is okay (aka "no landing") as there are few if any, signs of "demand destruction." The combo OPEC+ cutting back + demand booming = 34.5% crude oil rally in 10 weeks... Is there more to come? Source: Jim Bianco

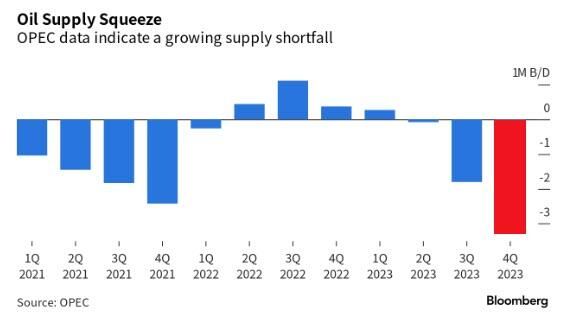

This chart from Bloomberg shows the massive supply shortfall oil markets will face next quarter

OPEC expects a supply shortfall of more than 3 million barrels per day. If OPEC is correct, it would result in the biggest inventory drawdown since 2007. Voluntary production cuts by OPEC members are removing 1.3 million additional barrels of oil supply every day. Higher oil prices are back and the US reserves are at record lows. Source: Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks