Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

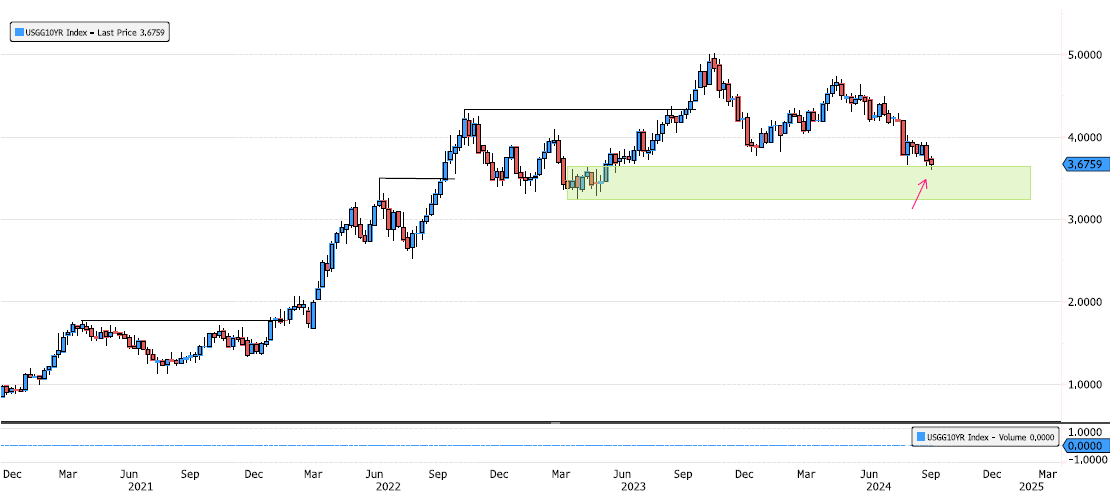

US 10-Year Yield Back on Major Support Zone

Since October 2023, the US 10-year yield has been consolidating from its peak of 5%, and it's now reaching a major support zone between 3.24-3.64. After nearly a 30% consolidation, the big question is: will this level hold? Source: Bloomberg

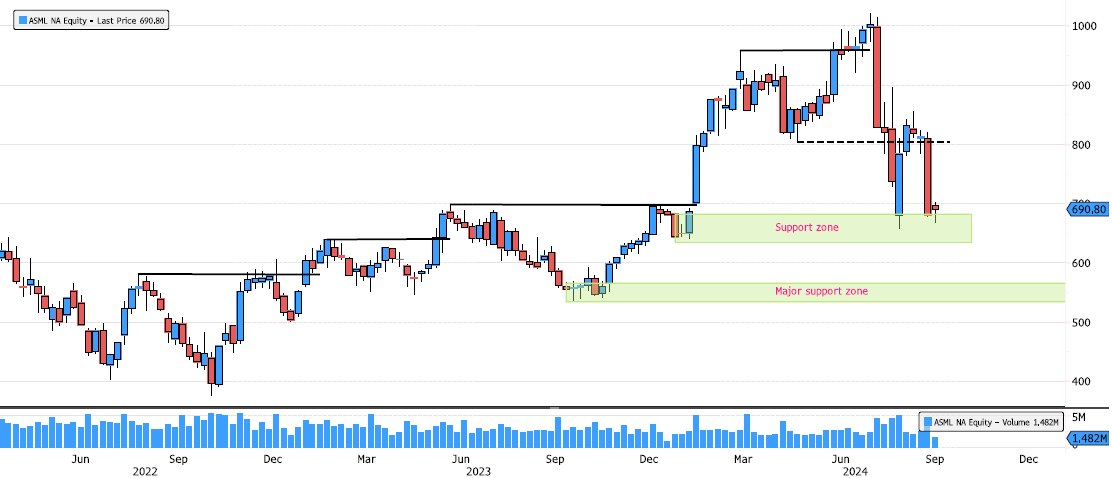

ASML in a More Complex Consolidation

At the beginning of August, ASML broke the swing support at 804, sending the stock into a more complex consolidation. It is now testing the support zone between 635-682 for the second time. If this level breaks, the next major support zone to watch is between 534-566. Source: Bloomberg

Dassault Systèmes Demand Building Up

Dassault Systèmes has spent 10 weeks in the major support swing zone between 32.23-34.20. On the short-term chart, there are signs of demand building up. Keep an eye on this level. Source: Bloomberg

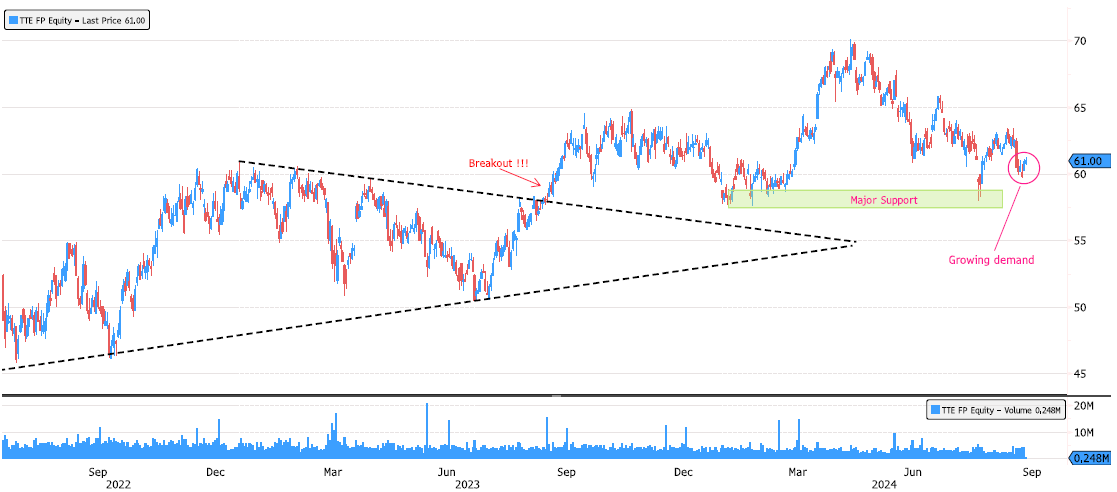

TotalEnergies Growing Demand

Since April, TotalEnergies has consolidated 17%, and the trend remains bullish. In August, it tested the major support zone between 57.45-58.76 and rebounded. We are now seeing growing demand at the 60 level. Keep an eye on this development. Source: Bloomberg

AstraZeneca Under Pressure but Entering Support Zone

AstraZeneca's long-term trend remains positive, though it is under pressure today and has dropped about 10% over the past week. The stock is now entering the major support zone between 11,540-12,050. Keep an eye on these levels. Source: Bloomberg

Crude Oil Back on Major Support Zone

Crude Oil WTI is back once again in the major support zone between 62.43-69.23. It's also testing the March 2022 downtrend line. Keep an eye on these very important levels. Source: Bloomberg

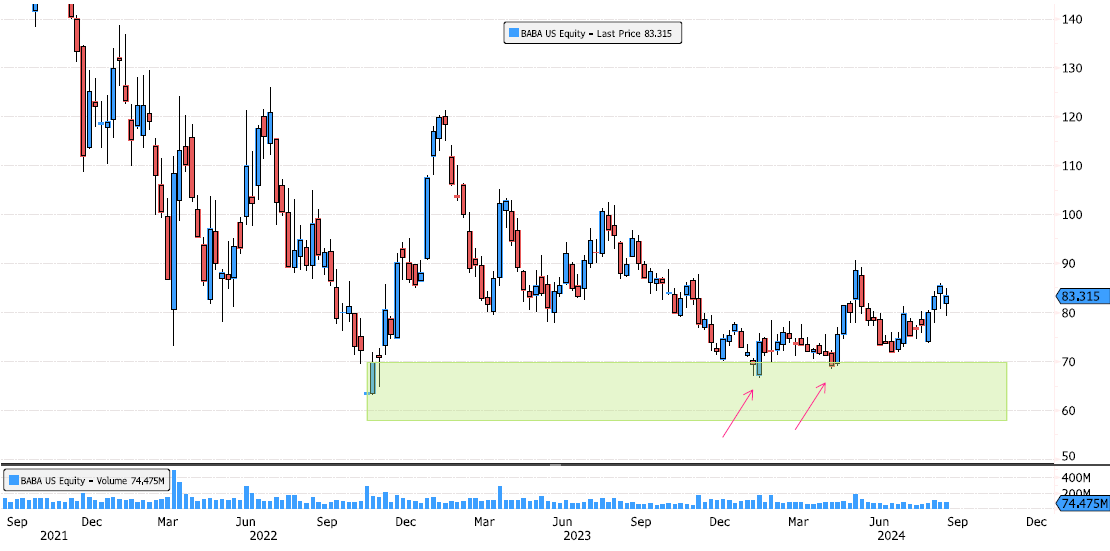

Alibaba Constructive Build-Up

Alibaba (BABA US) has consolidated more than 80% since October 2020! Although the long-term trend is still bearish, there have been some constructive rebounds since the major support zone between 58-70 was tested. Keep an eye on this key level. Source: Bloomberg

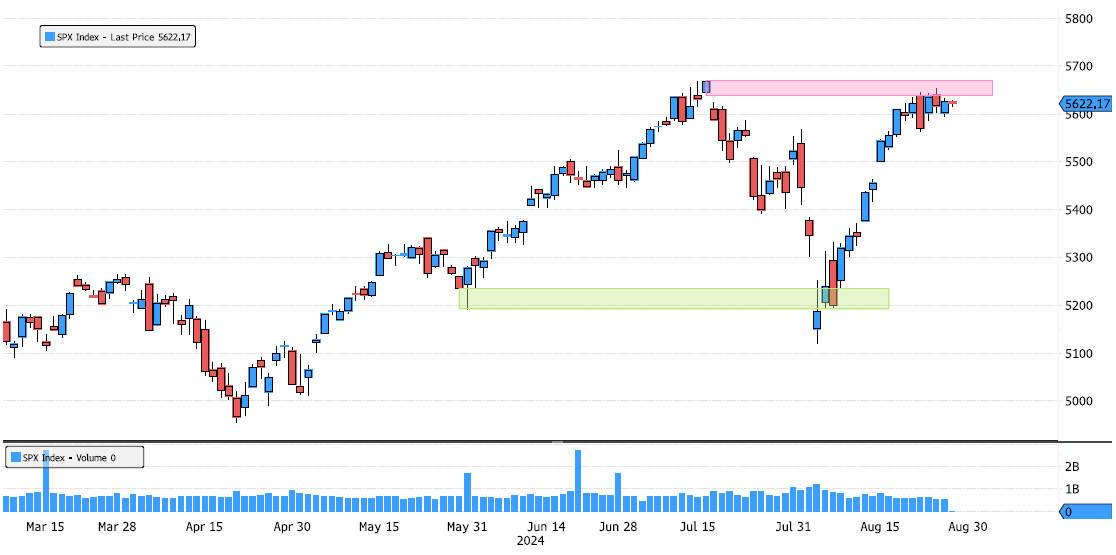

S&P 500 Index Trying to Post a New High

The S&P 500 Index (SPX) has been attempting for several days to break the resistance zone between 5640-5670. The market needs to break through this level to confirm the bullish trend. Keep an eye on it. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks