Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A tough technical picture for Microsoft $MSFT. This is the first 200-Day SMA test since March 2023.

Source: Trendspider

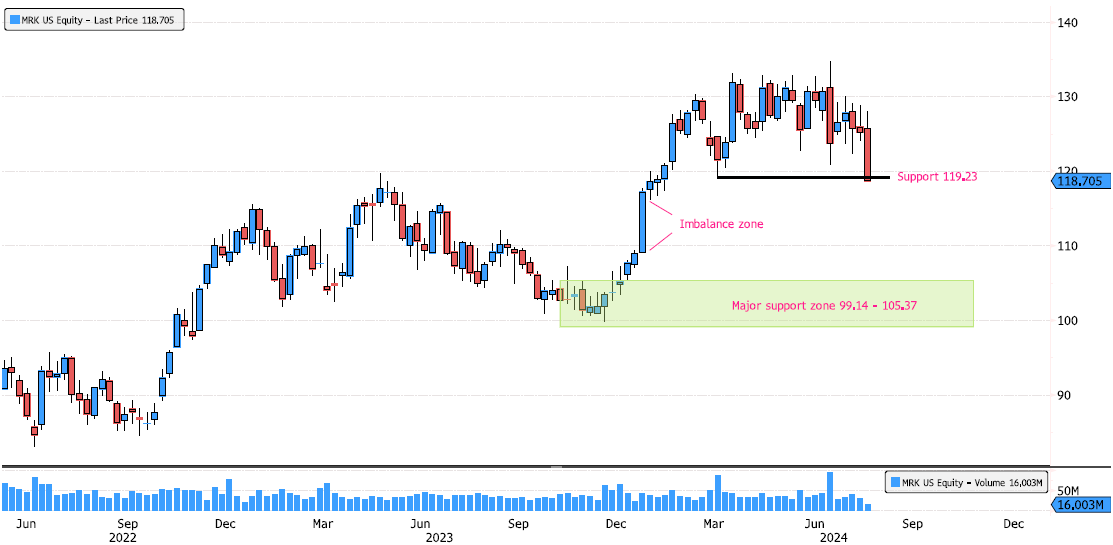

Merck Under a Lot of Pressure

Merck (MRK US) is breaking strong support at 119.23 (confirmation needed at today's close). If that level breaks, the next levels to monitor are the Imbalance zone between 109.24-116.18 and the major support swing zone between 99.14-105.37. Source: Bloomberg

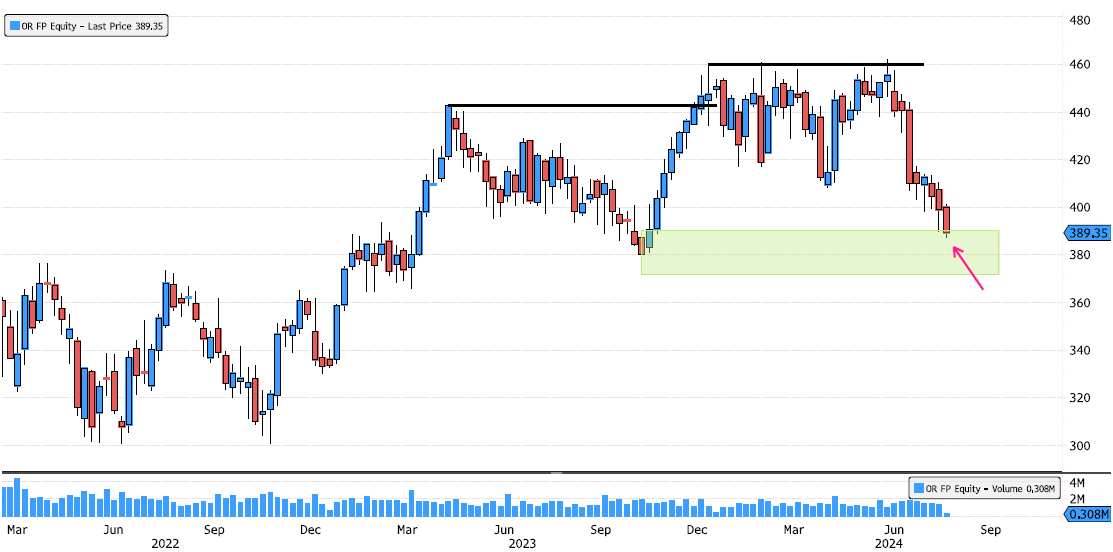

L'Oreal Entering Major Support Zone

L'Oreal (OR FP) is now entering a major support zone between 372-390. Keep an eye on this critical level over the next few days. Source: Bloomberg

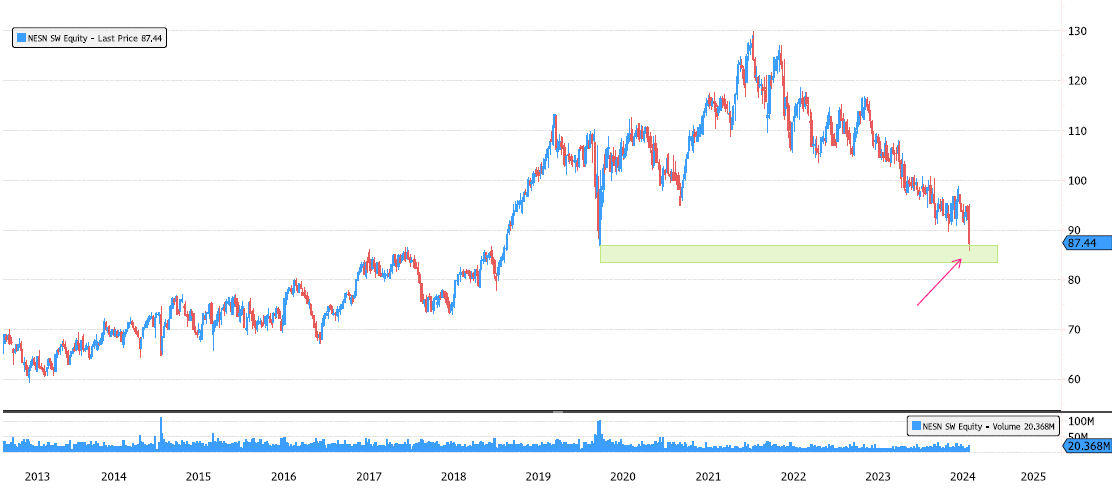

Nestle on Major Support Level

Nestle (NESN SW) has consolidated 33% over the last 30 months! It's now back on a major support zone between 83.37 and 86.91. Keep an eye on the price action over the next few days. Source: Bloomberg

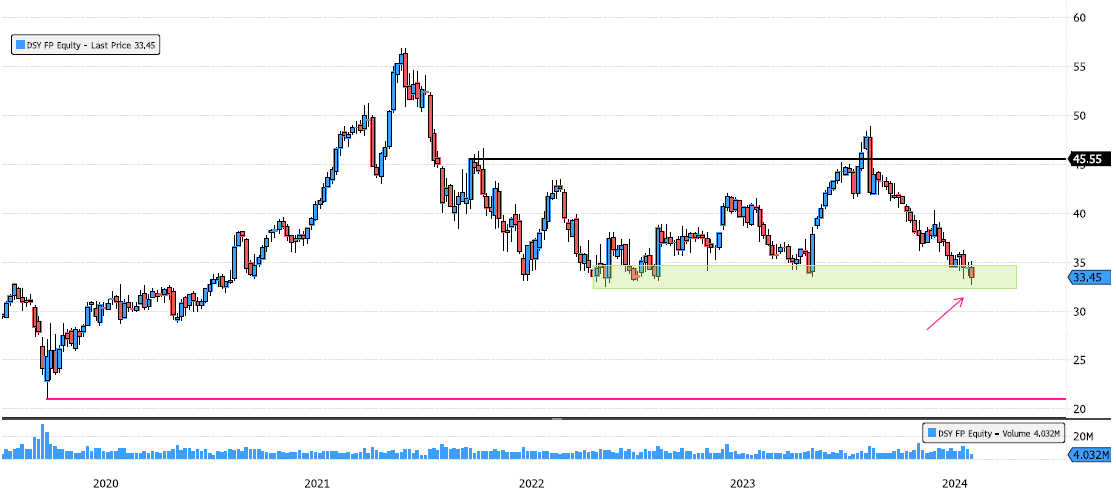

Dassault Systeme on Major Support Level

Dassault Systeme (DSY FP) has consolidated 33% since its January breakout! It is now testing a major support zone between 32.23 and 34.20. Keep an eye on this critical level over the next few days. Source: Bloomberg

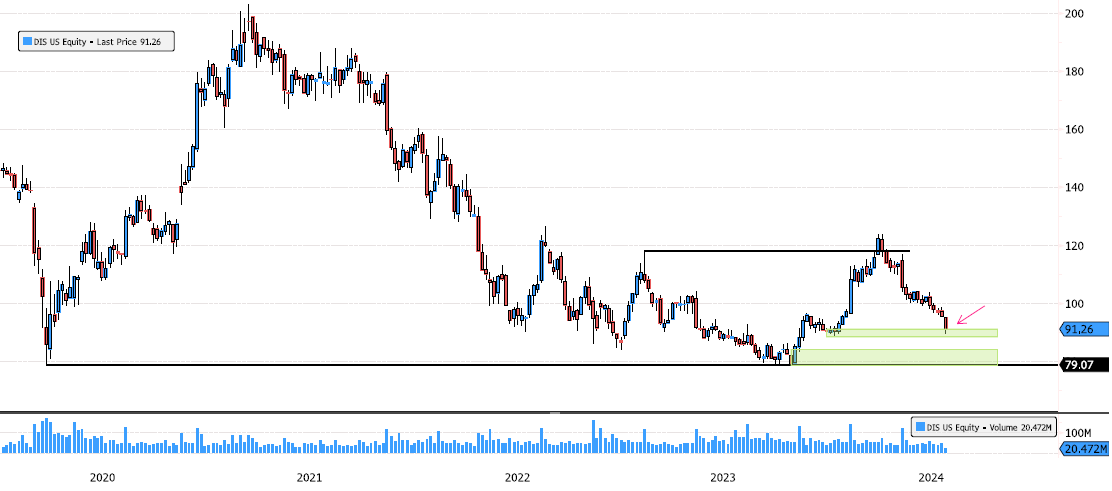

Walt Disney Reaching 1st Support Zone

Walt Disney (DIS US) has consolidated 61% since March 2021 and recently confirmed a change in the bearish trend! The stock is back at very important levels. The 1st support zone at 88-91 is critical to watch, and if it breaks, the next level to keep an eye on is between 78.73 and 84. Source: Bloomberg

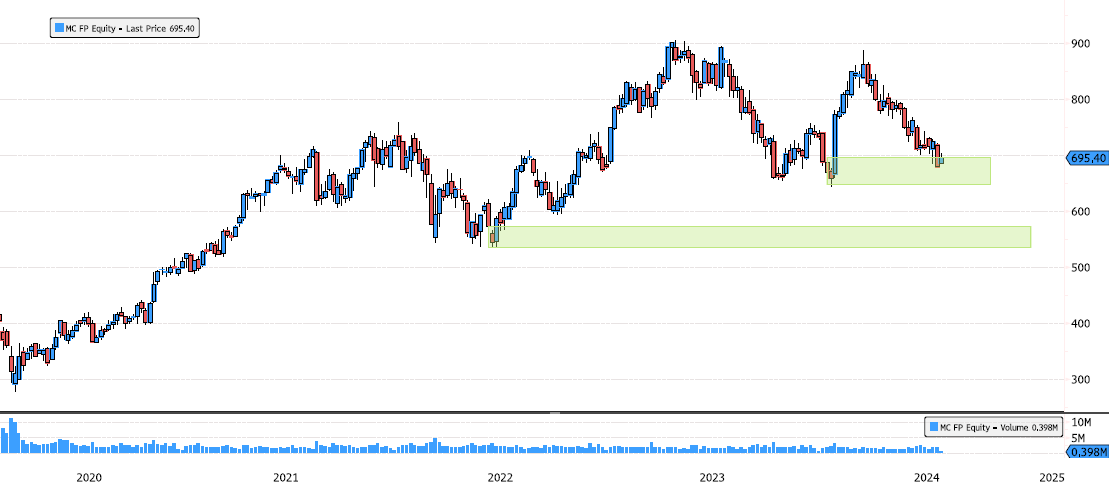

LVMH Seems to Respect Support Zone

LVMH (MC FP) hasn't moved much on earnings today. The stock is still within the support zone of 647-695. This isn't a major swing support, so be careful. A rebound can happen, but the market may still test the last major swing support between 535-573. Source : Bloomberg

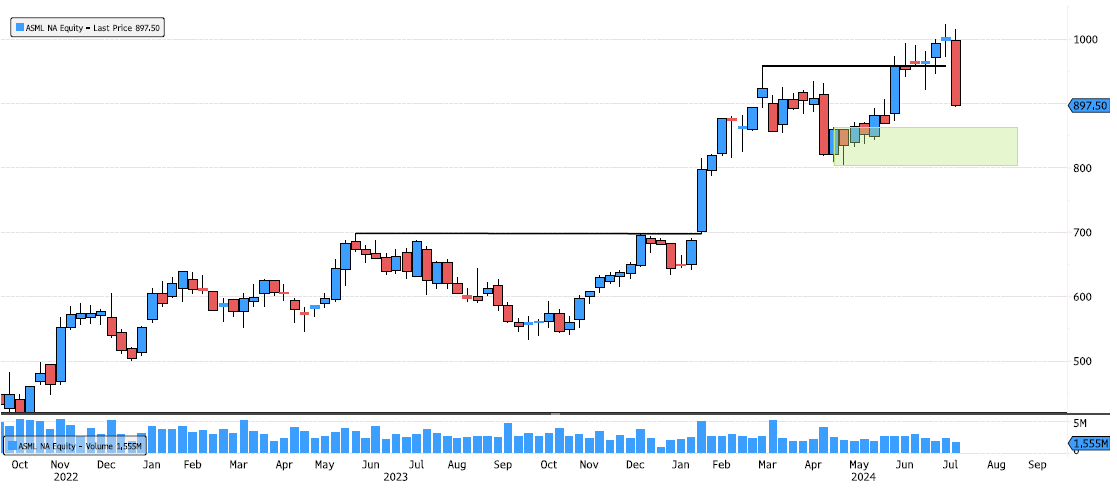

ASML Trying to Find Support

ASML is under pressure today, down 8% due to earnings. The next major support zone to keep an eye on is between 804-862. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks