Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

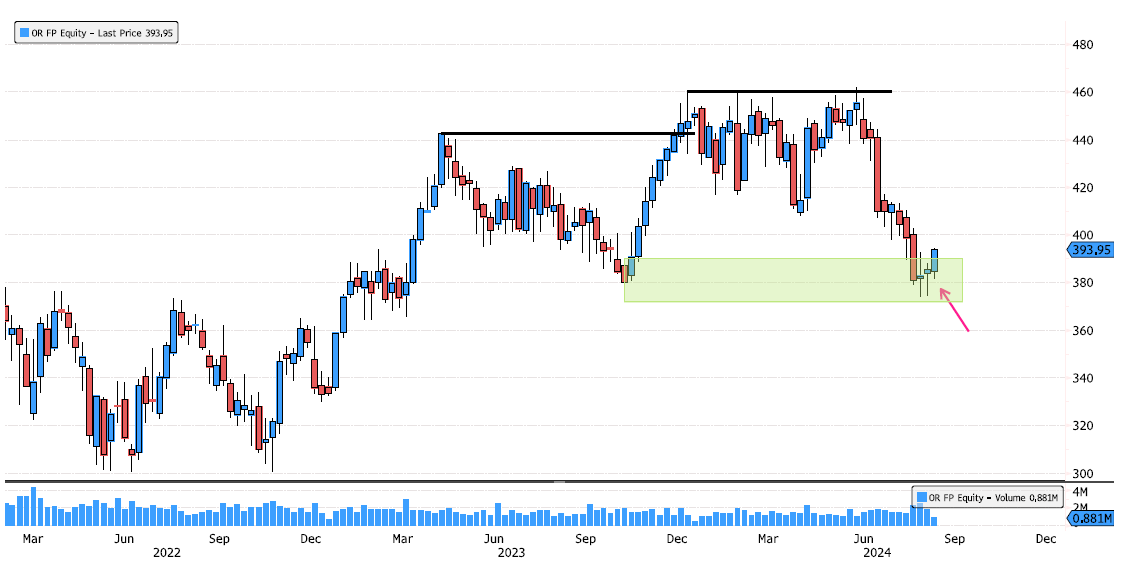

L'Oreal Starting to Rebound on Major Support

L'Oreal has tested the major support zone of 372-390 over the last three weeks and has started to break out to the upside from that zone! The trend remains bullish. Source: Bloomberg

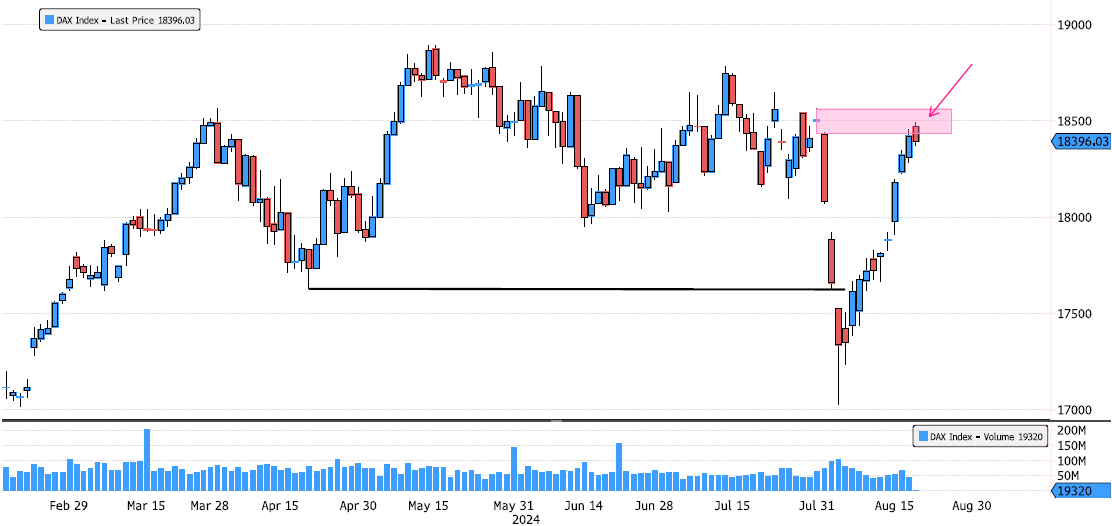

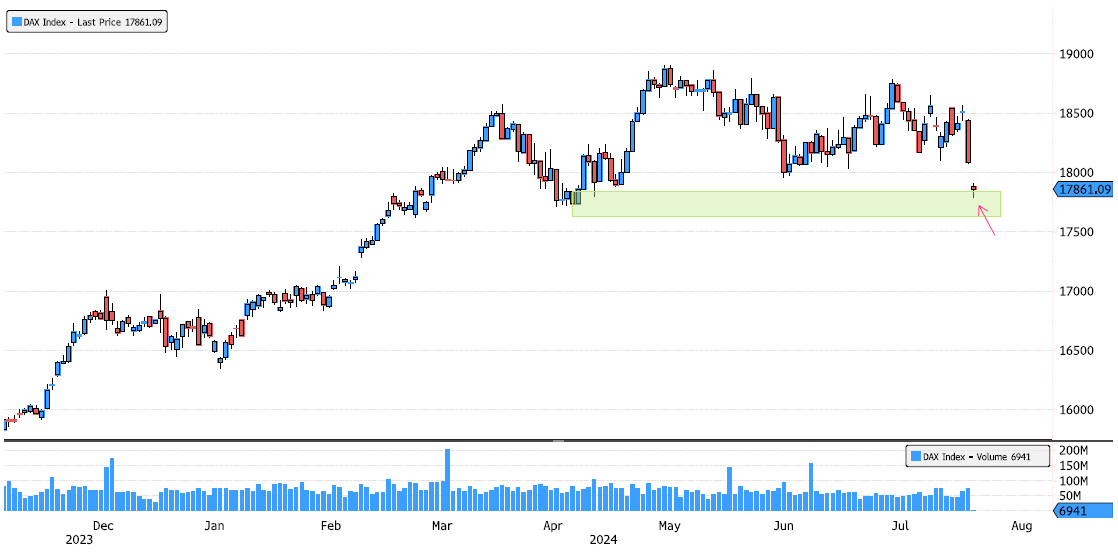

DAX Index Reaching Supply Zone

The DAX Index has now rebounded more than 8% since the lows on August 5th! Keep an eye on the supply zone between 18,430-18,565. Source: Bloomberg

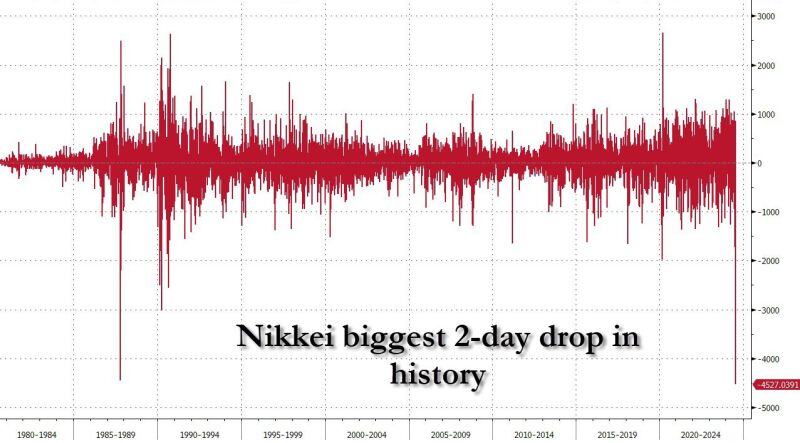

This is the biggest 2-day drop for the Nikkei in history, surpassing Black Monday

Source: www.zerohedge.com, Bloomberg

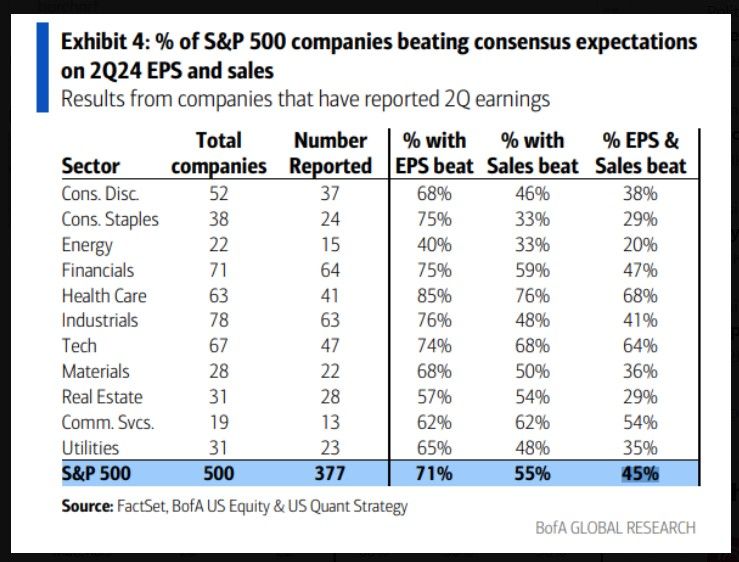

US earnings: The beat rate is the smallest since 4th quarter of 2022 377 S&P 500 companies (80% of index EPS) have reported, beating consensus by 2%, the smallest since 4Q22.

71%/55%/45% beat on EPS/sales/both Source: BofA, Mike Z.

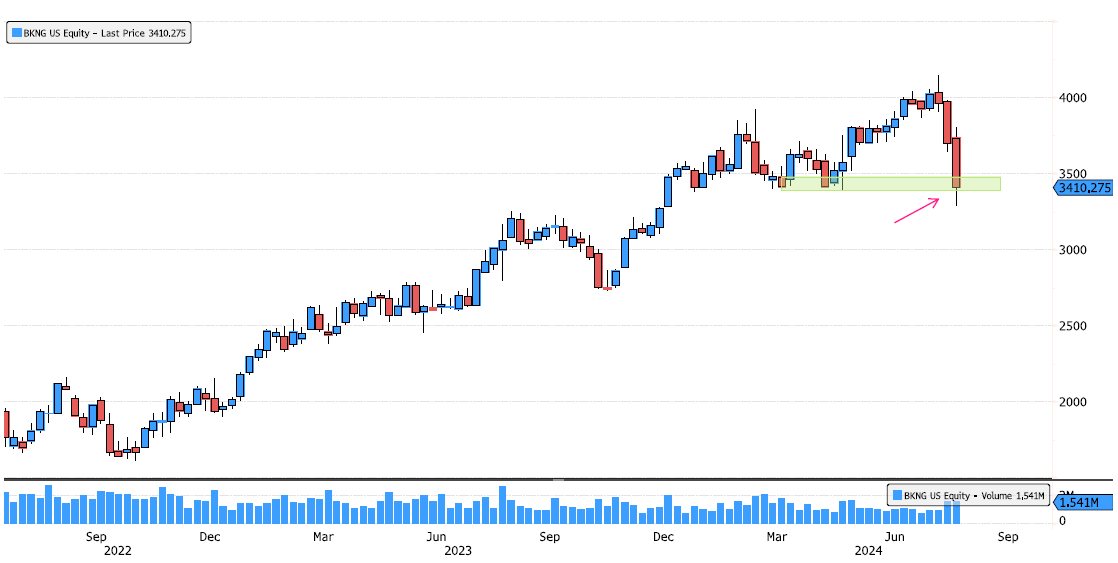

Booking Holdings Trying to Rebound on Support

Booking Holdings (BKNG US) is trying to rebound on a major swing support zone between 3394-3477. Keep an eye on the close today. Source: Bloomberg

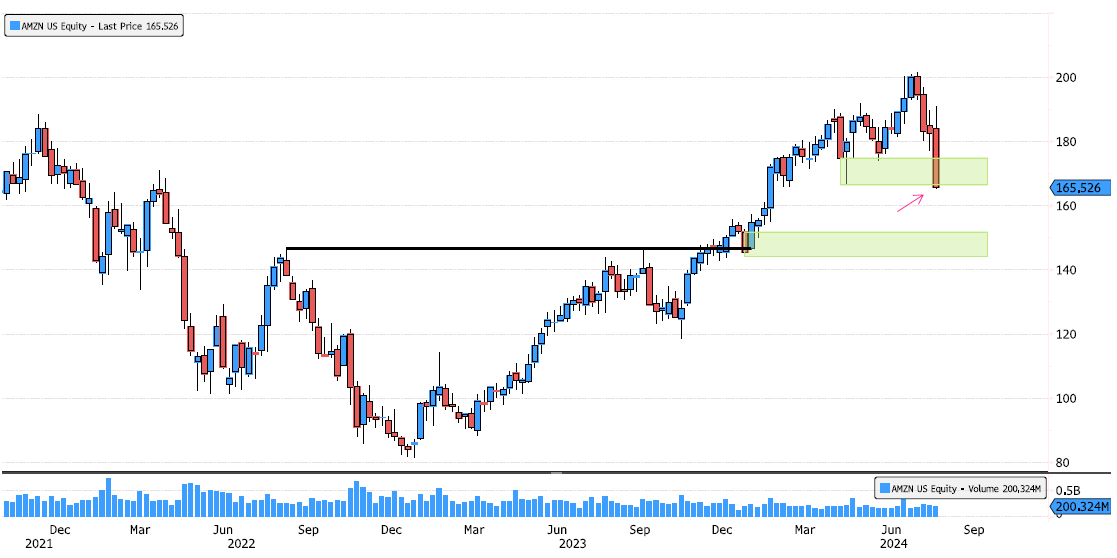

Amazon Under Pressure

Amazon is down strongly after earnings. Keep an eye on the close today; it mustn't close below 166, as this could open the door for a more complex consolidation. The next major support zone is between 144-151. Source: Bloomberg

DAX Index Reaching Major Support Zone

The DAX Index is reaching a major swing support zone between 17,626 and 17,834. This level needs to hold; otherwise, the consolidation that started in May could become more complex and last longer. Keep an eye on this development. Source: Bloomberg

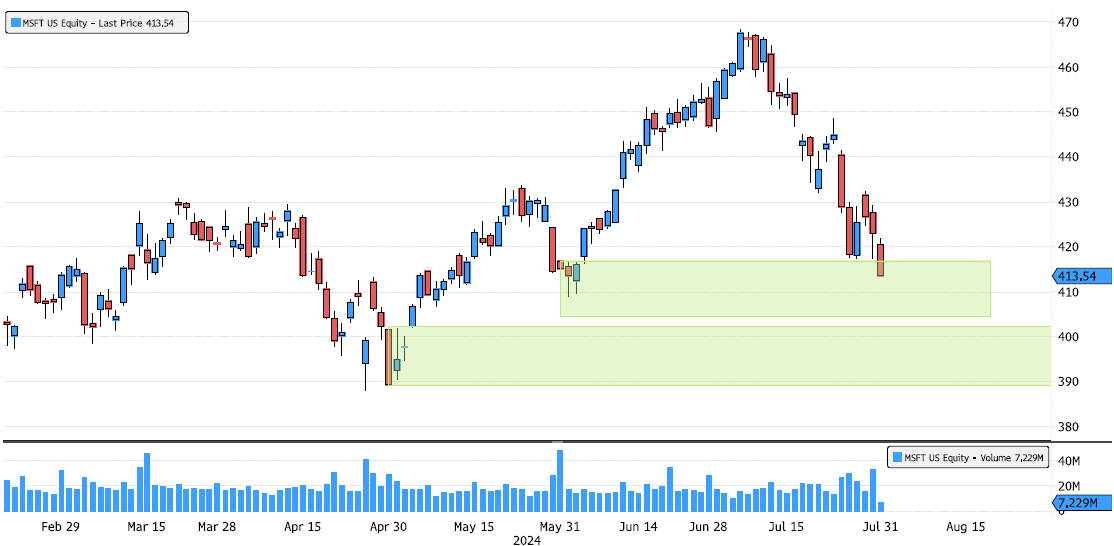

Microsoft Entering Major Support Zone

Microsoft (MSFT US) is under pressure since yesterday's earnings! It's now entering a major swing support zone between 404.51 and 416.75. Keep an eye on whether this level can hold. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks