Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

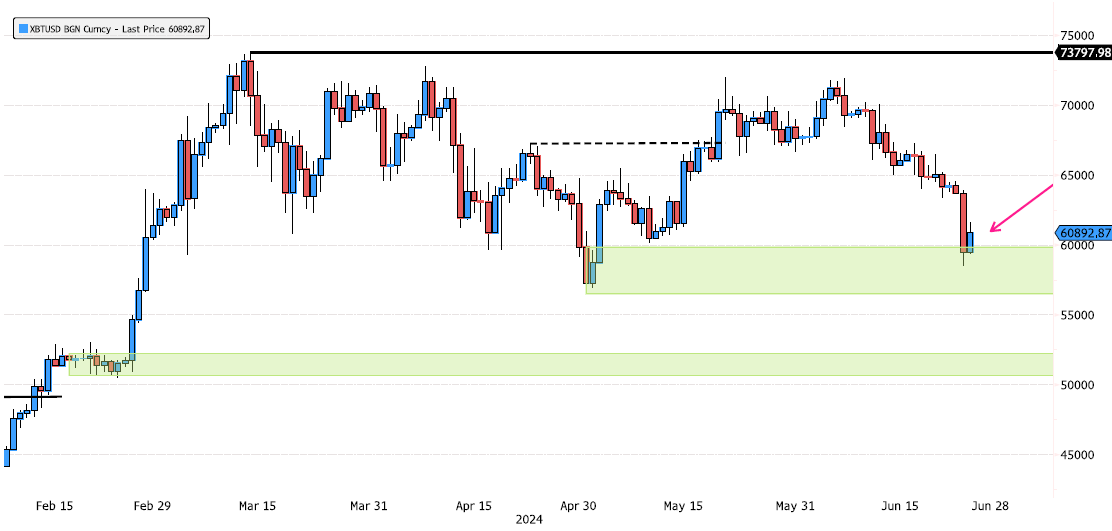

Bitcoin at demand zone

Bitcoin (XBTUSD) showed positive signs in May with a break above the last swing high, suggesting that the consolidation could be over. Yesterday's sell-off (-8%) reached a strong demand zone. Keep an eye on this level. Source: Bloomberg

Roche Very Positive Weekly Close

Roche (ROG SW) closed last week for the first time over its last swing high! This is the first confirmation that the bearish trend has changed. As a reminder, the stock has consolidated 47% since the April 2022 highs. Source: Bloomberg

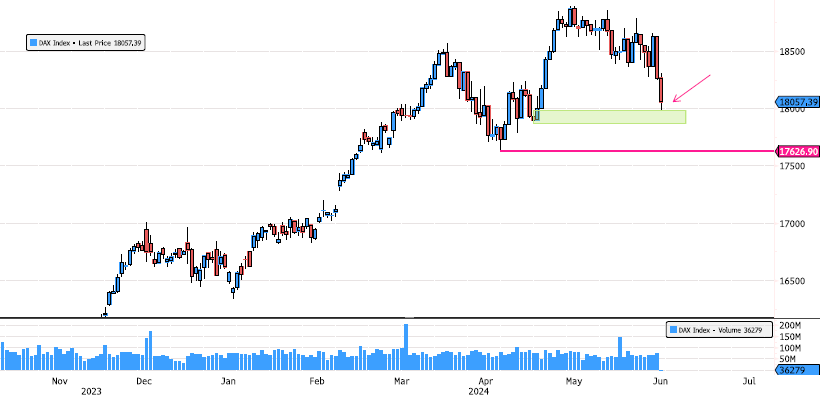

Dax Index Reached First Support

The Dax Index has just reached support zone 17,876-17,982. This level is also a 61.8% Fibonacci retracement of the last swing. The level that mustn't break remains the swing low at 17,626. Source: Bloomberg

TotalEnergies Reaching Support Zone

TotalEnergies (TTE FP) is reaching its first support zone between 60.90-62.30. It is also at the 61.8% Fibonacci retracement level. Keep an eye on it. Source : Bloomberg

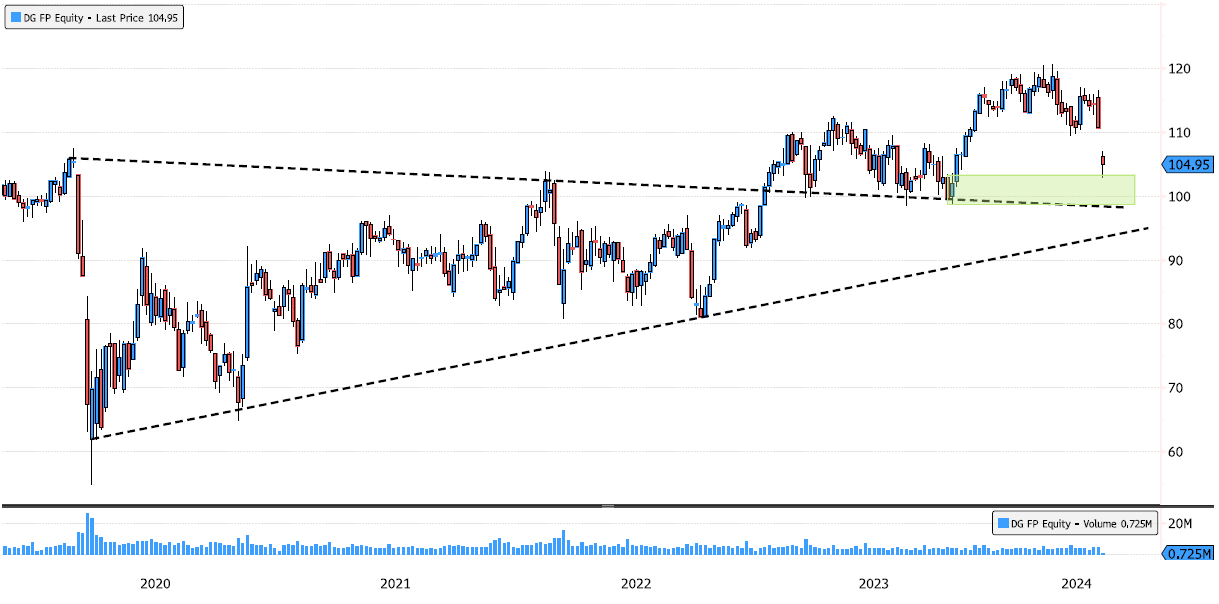

Vinci Testing Back Triangle Breakout Level

Vinci (DG FP) recently posted a new high, confirming once again the bullish trend. It's now retesting the lows of the latest swing. The 98.49 level remains the swing low that mustn't break. Keep an eye on the institutional demand zone between 98.49-103.28. Source: Bloomberg

Bitcoin Logarithmic Monthly Chart

With a logarithmic chart, it is sometimes easier to identify a trend. The trend has been bullish since the start of Bitcoin. It’s now testing again a major resistance level. Will it be able to breakout ? Source : Bloomberg

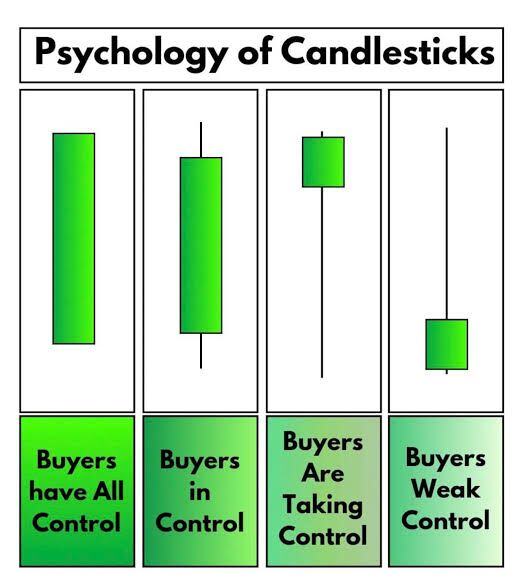

Psychology of candlestick in one image courtesy of Market Insights

Source: Market Insights

McDonald’s Back on Long-Term Swing Low

McDonald’s (MCD US) has consolidated 17% since the January highs. It's now testing a strong support zone between 245-250. Keep an eye on this level. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks