Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Home Depot testing strong support again

Home Depot (HD US) has just tested support zone 330-335 after earnings report. Keep an eye at this important level. Source : Bloomberg

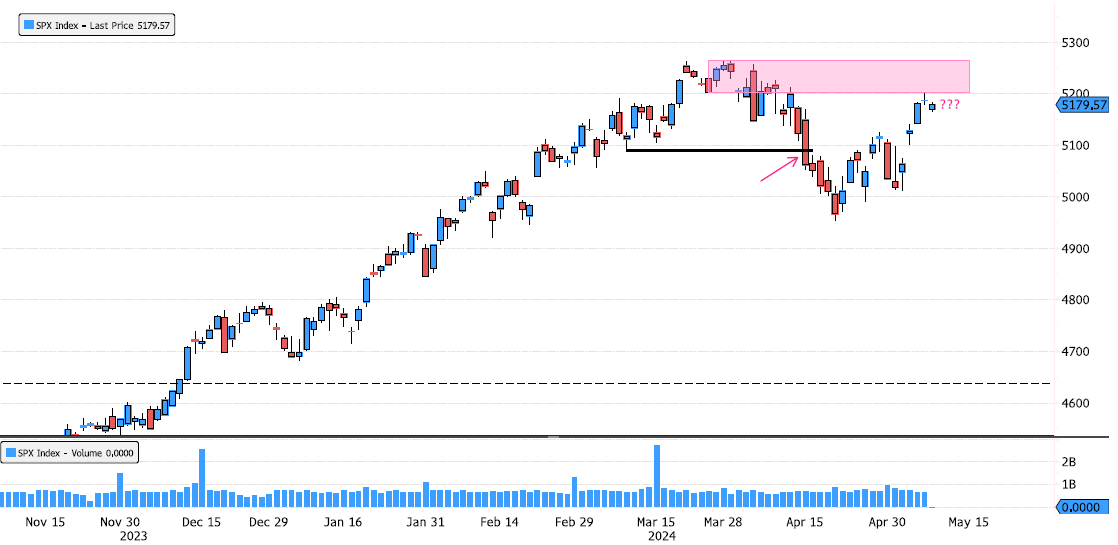

S&P 500 pullback to supply zone

S&P 500 Index broke the swing low on 15th September suggesting a change in trend ! Market has made more than the 50% Fibonacci retracement and is approaching supply zone 5200-5265 !!! Market needs to break 5265 if not risk of pressure will grow. Source : Bloomberg

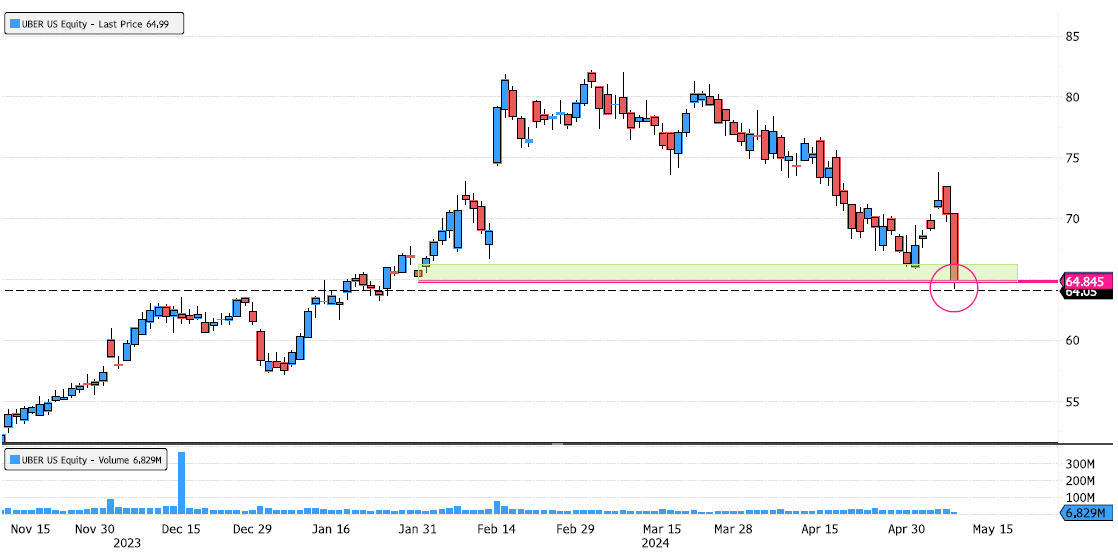

Uber testing again swing low.

Uber (UBER US) is testing for a second time in less than 7 days swing low support 64.84. Keep an eye at this important level. Source : Bloomberg

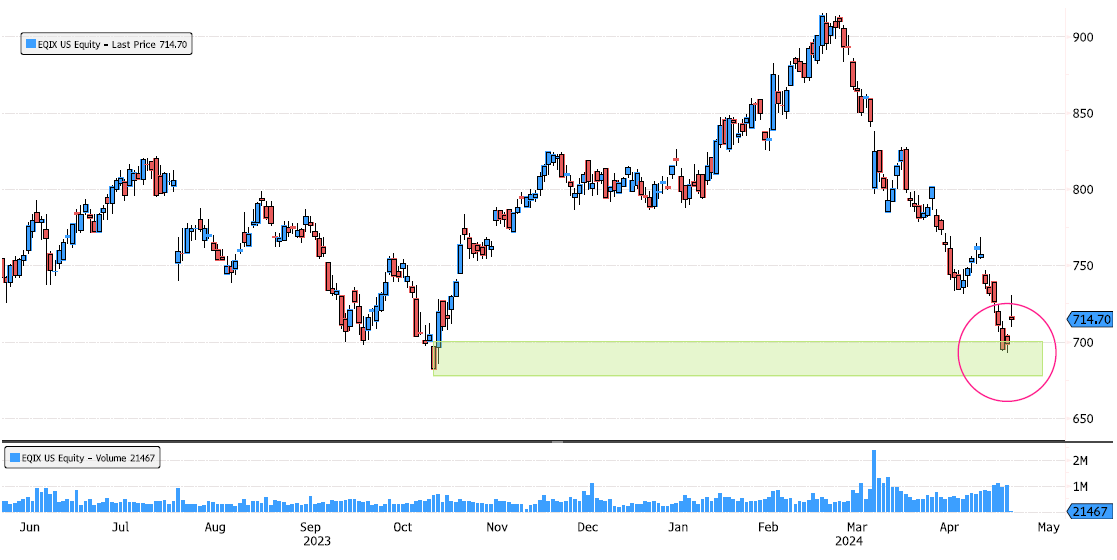

Equinix rebounding on support post earnings

Equinix (EQIX US) has consolidated 24% since March swing high ! Stock is rebounding from support zone 677-700. For the moment volume is a bit low. Keep an eye. Source : Bloomberg

Roche on a very important level

Roche (ROG SW) has consolidated 47% since April 2022 all time high ! It's now entering a very important support zone 206-215. Keep an eye over the next few days for price action. Source : Bloomberg

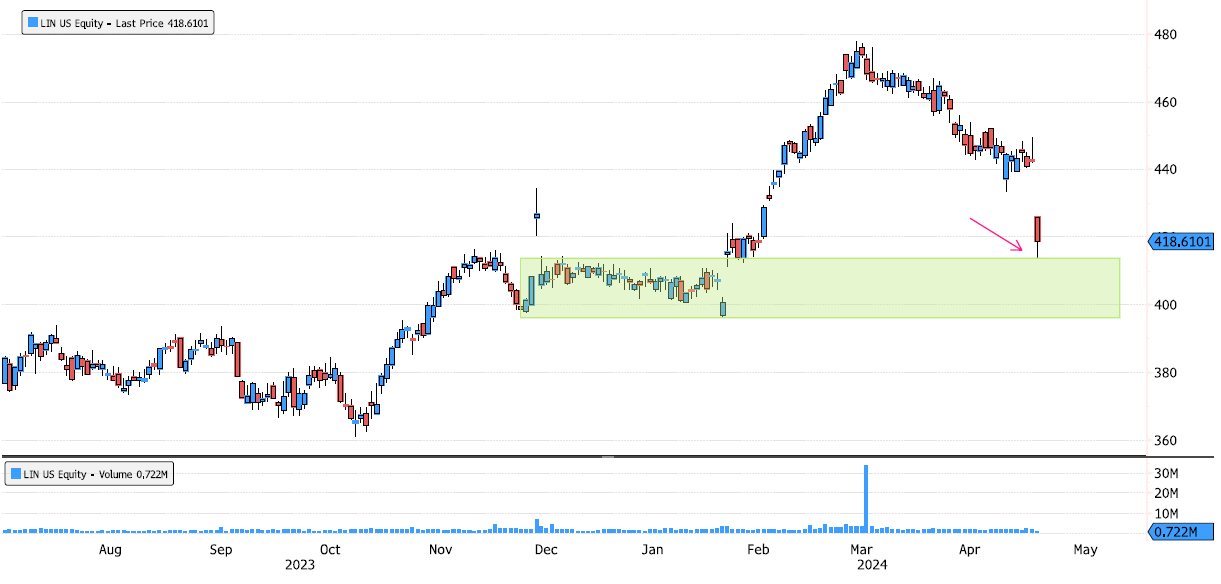

Linde under pressure but approaching support zone

Linde (LIN US) is continuing it's March consolidation. It's now approaching support zone 396-414. Swing low is 396. Source : Bloomberg

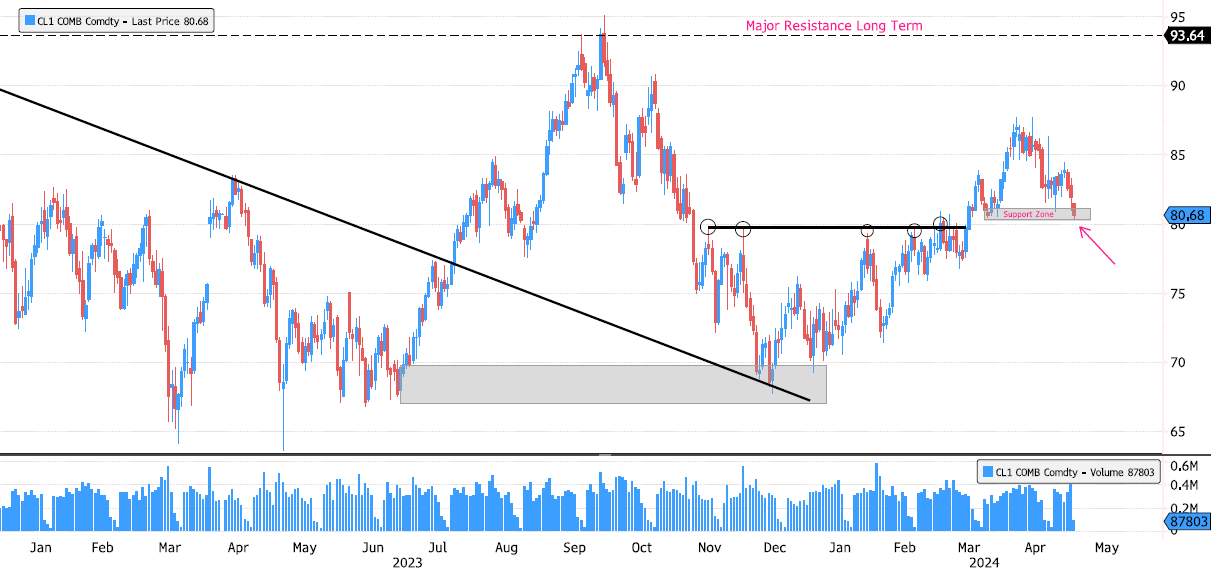

Crude Oil on support zone and retesting breakout level

Crude Oil WTI is back on support zone 80.30-81.09 and also approaching March breakout 79.77 !!! Keep an eye at these important levels. Source : Bloomberg

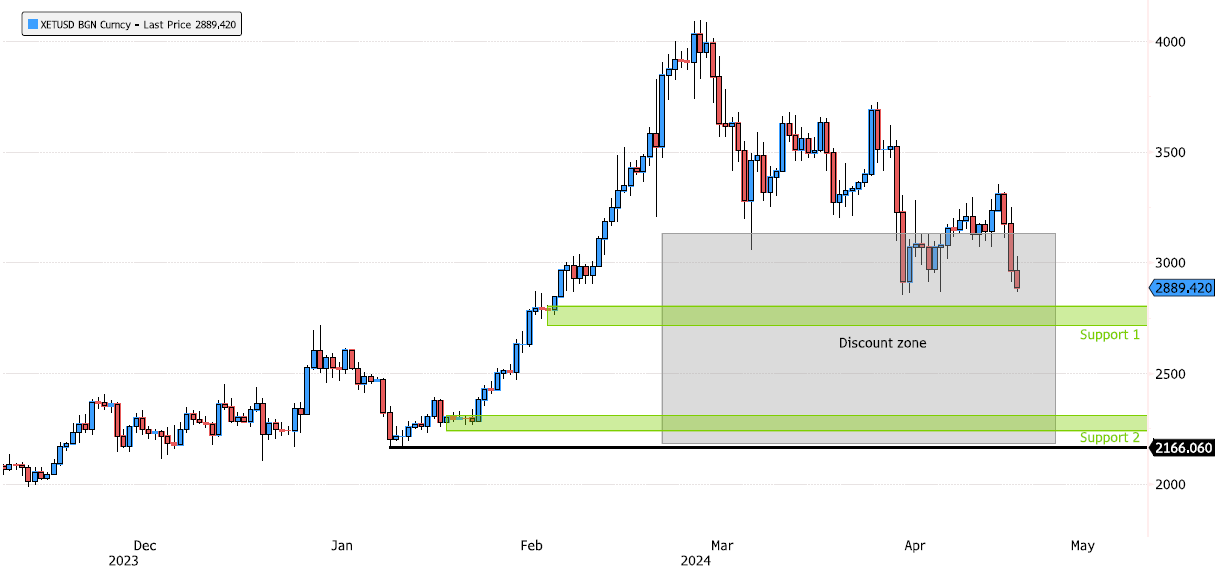

Ethereum still consolidating but in discount zone

Ethereum (XETUSD) is still consolidating since March. It's now in discount zone (below 50% Fibonacci retracement). For the moment no signs of reverse but keep an eye at next support zone 2720-2800 and if that level doesn't hold next support could be arround 2240-2310. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks