Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

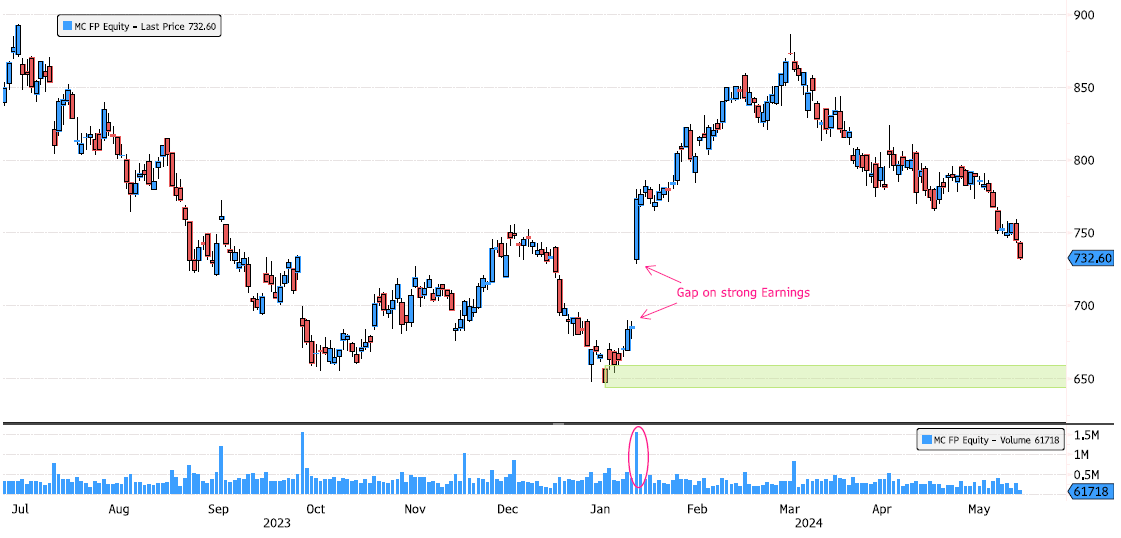

LVMH Approaching an Interesting Zone

LVMH (MC FP) has consolidated 17% since the March highs. It's now filling in the January earnings gap zone between 690-730. It has also reached the 61.8% Fibonacci retracement level and is in the discount zone for prop traders. The major long-term support swing low is at 644. Keep an eye on this stock over the next few days. Source : Bloomberg

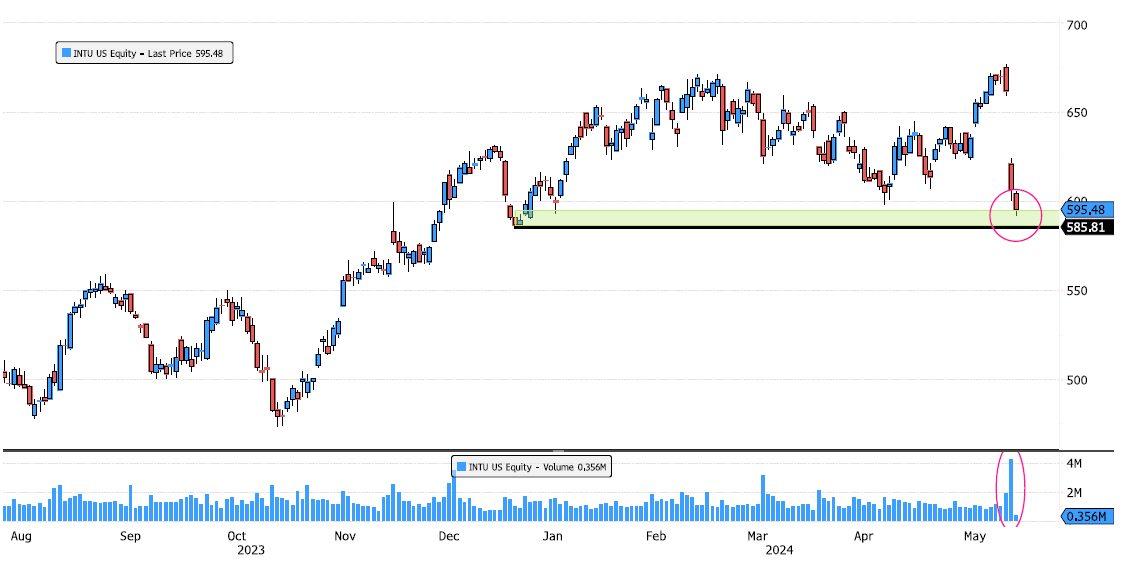

Intuit Reaching Strong Support

Intuit (INTU US) has been under significant pressure since the earnings release last Thursday, dropping by 12%. The stock is now approaching the last swing low support on the long-term trend (weekly chart). Keep an eye on this crucial support zone between 585-595. Source: Bloomberg

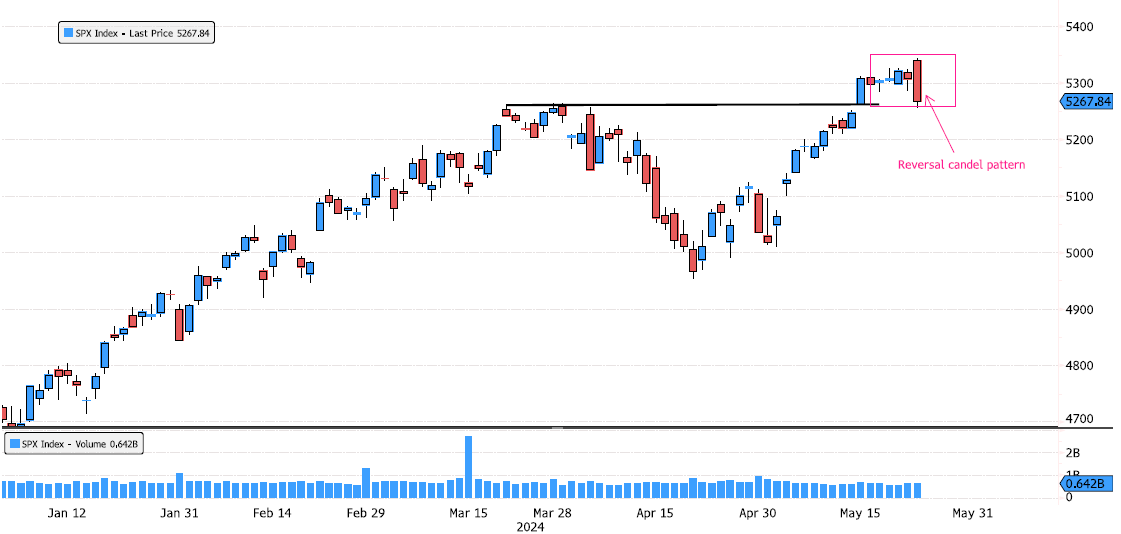

S&P 500 Index reversal candelstick pattern

Yesterday, the S&P 500 index posted a reversal candlestick pattern. The market opened at a new all-time high but closed at the day's lows, wiping out all of last week's gains! This pattern is typically a warning sign. While the trend remains bullish, a consolidation often follows after reaching a new high. Keep an eye on it. Source : Bloomberg

Exciting Developments for Dassault Systemes

In January, Dassault Systemes broke its long-term downtrend—a very positive sign. Since then, the market has consolidated by more than 25%. Recently, we're seeing signs of demand, confirmed by stronger-than-average volume in the short-term trend. Keep an eye on it. Source : Bloomberg

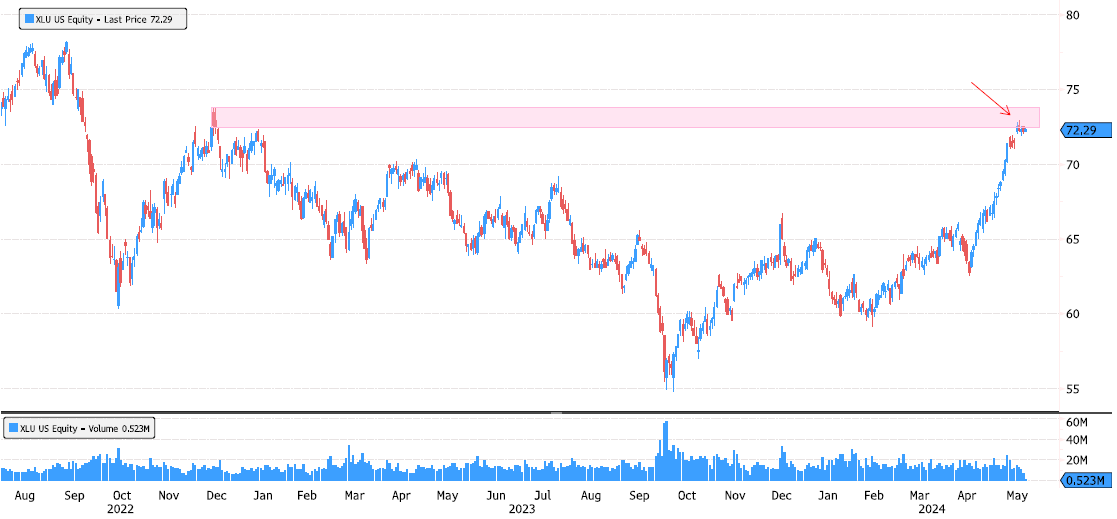

Utilities Sector reaching an important level

Utilities sector (XLU US) has reached an important resistance zone (72,50-73,80), with its short-term trend showing bullish momentum against a long-term bearish trend. After rallying more than 30% since October, the question is whether the market can break through this significant resistance. Source : Bloomberg

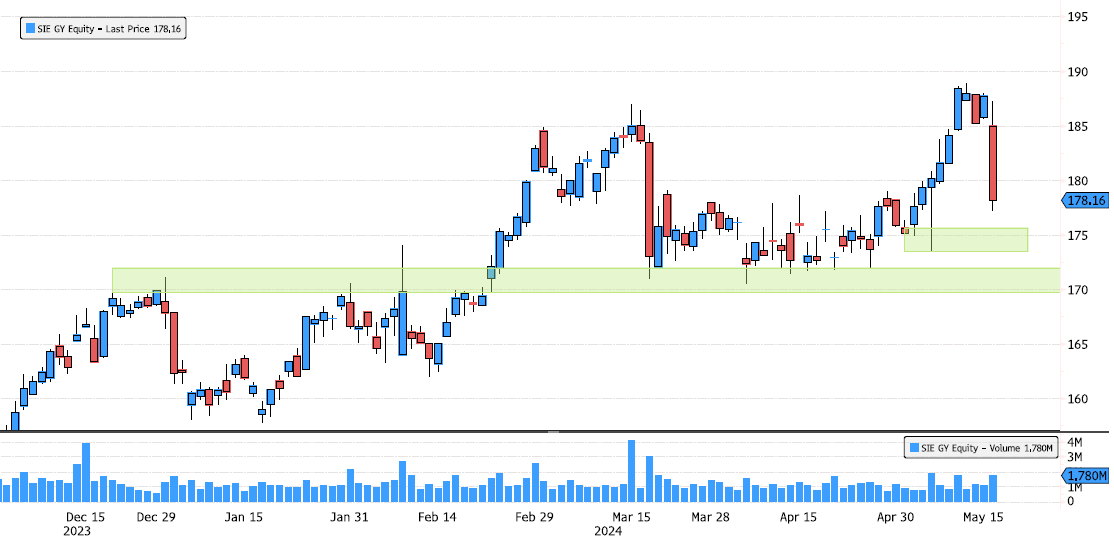

Siemens looking for support after earnings

Siemens (SIE GY) under a lot of pressure after earnings report. Trend remains bullish. For the moment consolidating after recent new all time high. Support zones to look at are 173,52-175.64 and major 169,70-171,95. Source : Bloomberg

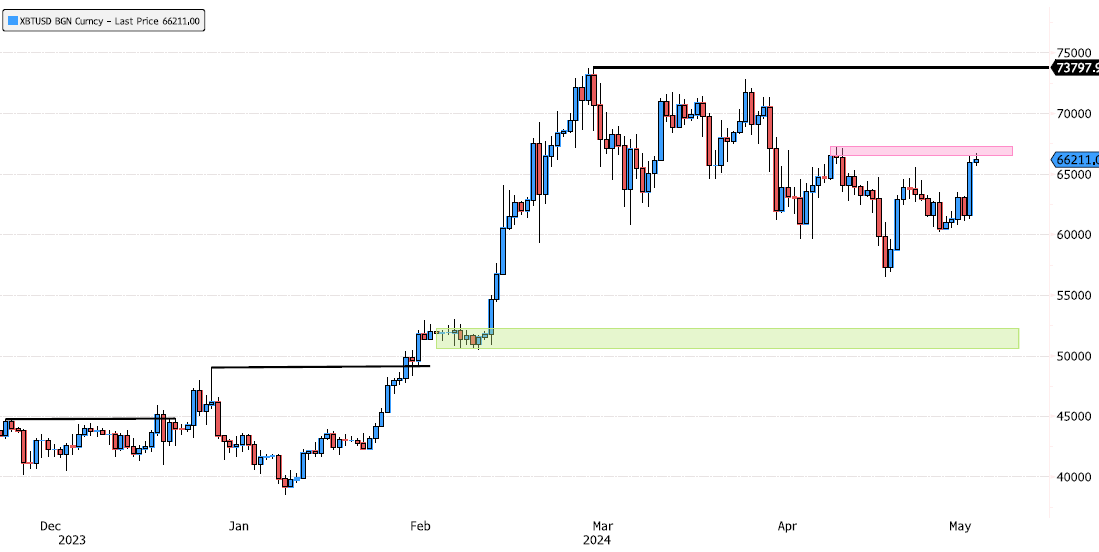

Bitcoin showing strenght but entering resistance zone

Bitcoin (XBTUSD) is approaching resistance zone 66'500-67'300. If it can close above that level, this could be the end of March consolidation. Keep an eye at this key level. Source : Bloomberg

Salesforce showing strenght for the first time since February

Salesforce (CRM US) has consolidated 16% since February highs ! Today it's trading above last swing high. Keep an eye if it closes above 279.70. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks