Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Coca-Cola reaching major supply zone

Coca-Cola (KO US) is reaching major supply zone 62.70-64.99 . Keep an eye at that level. Source : Bloomberg

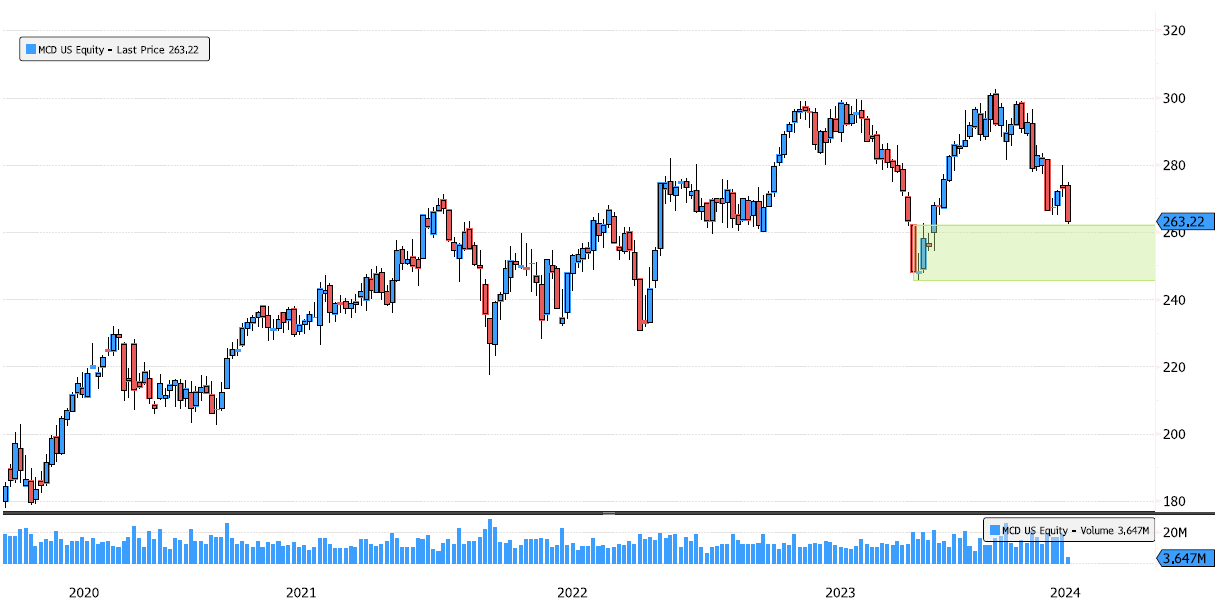

MacDonald reaching strong support demand zone

MacDonald (MCD US) is reaching strong demand zone 245-262. Long term trend remains bullish. Keep an eye at this important level. Source : Bloomberg

Tesla breaking swing high ?

Tesla (TSLA US) is breaking last swing high 184.25 !!! This is an important level, keep an eye at the close. Source : Bloomberg

Meta Platforms breaking the trend and filling the gap

Meta Platforms (META US) under a lot of pressure today, breaking 476 swing support. It's now on it's way to fill end of January Gap. Support zones to keep an eye on over the next few days are : 387-398 / 358-368 / 340-351.

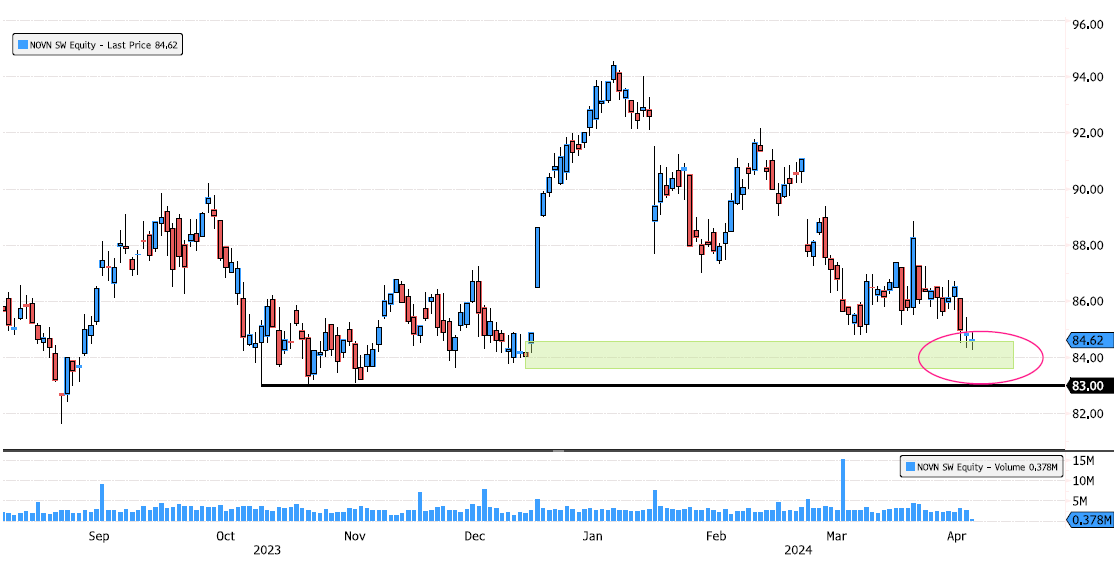

Novartis approaching 2 support zones

Novartis (NOVN SW) has now consolidated 11% since January last swing high. It's approaching two important levels. First zone 83.63-84.56 is a strong institutionnal demand level and second level is 83 which is the swing low support level ! Keep an eye over the next few days. Source : Bloomberg

Bitcoin remains in trading range

Bitcoin (XBTUSD) is in a trading range 59'317-73'797 since January 2024. With halving taking place in a few days, keep an eye for a breakout !!! Source : Bloomberg

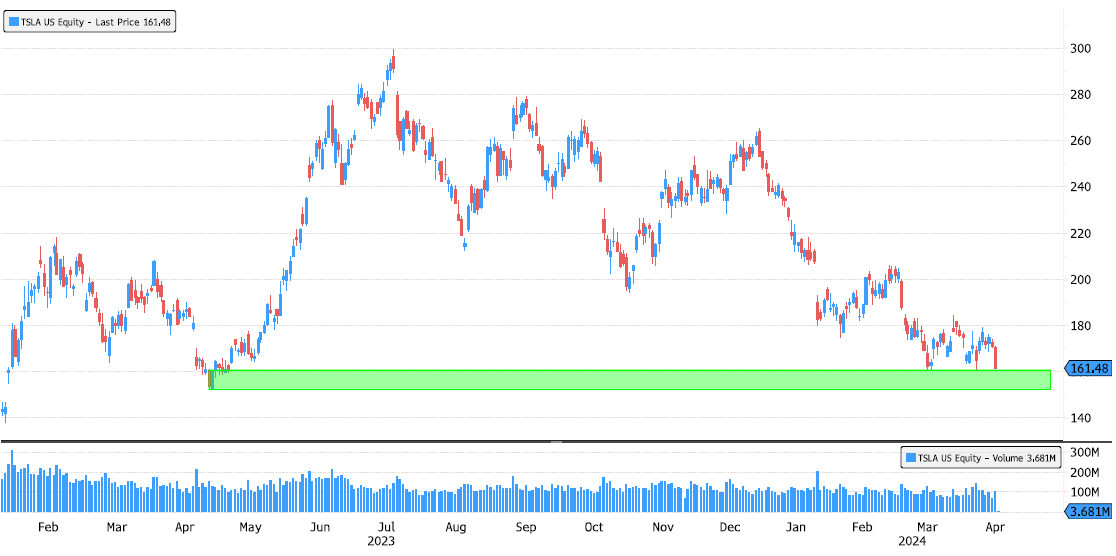

Tesla entering major support zone

Tesla (TSLA US) is entering major support zone 152-160. Keep an eye at this very important level. Source : Bloomberg

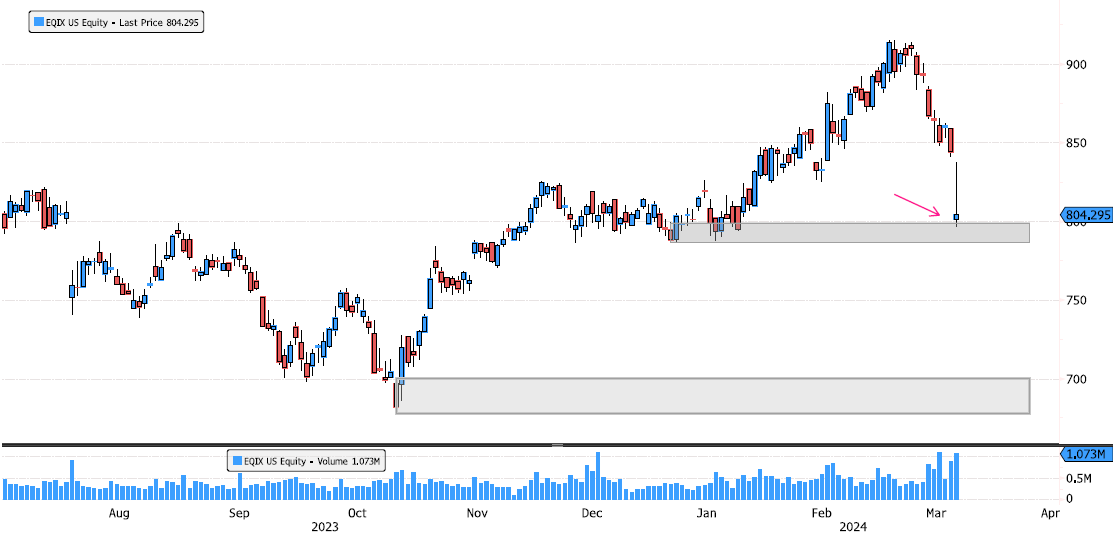

Equinix trying to find support

Equinix (EQIX US) has reached support zone 786-798. It's down 12% since the highs. Keep an eye at this level. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks