Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

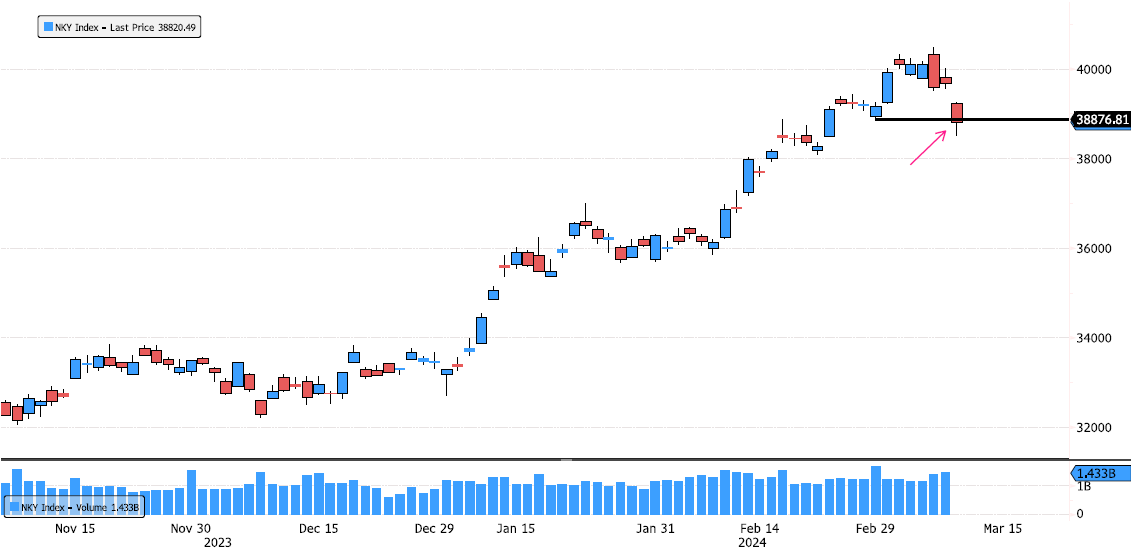

Nikkei 225 Index broke swing support

Nikkei 225 Index (NKY) closed below swing support 38'876. This is the first sign of a trend change. Keep an eye over the next few days at this level. Source : Bloomberg

Chainlink always bullish trend

Chainlink (XLIUSD) always in a bullish trend. Last week consolidation hit a low at 16.84 intraday and a very strong candel reversal with a close above the strong support 17.60. This is good news for the trend. Today up 15%, trying to break all time high 21.709. Keep an eye at that level. Source : Bloomberg

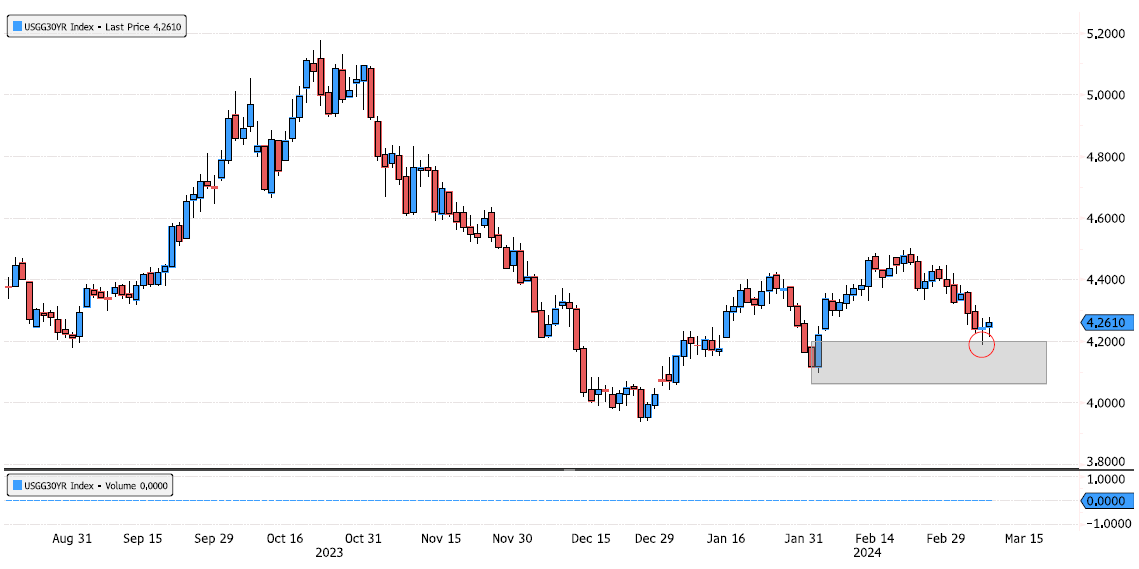

US 30 year yield on support zone

US 30 year yield (USGG30YR) has just reached it's demand zone 4.0623 - 4.2000. Keep an eye at this level. Source : Bloomberg

Gold confirmed long term bullish trend and now what ?

Gold (XAU) confirmed the weekly bullish trend with a close last week above 2075. Long term new swing low is now 1615. Is it time for the big rallye or shall we see a consolidation from here ? Source : Bloomberg

Apple in the support zone

Apple (AAPL US) has now reached the support zone 165.67-171, after a 15% consolidation since December. Do you think support will hold ? Source : Bloomberg

Taiwan Semiconductor Manufacturing breakout ?

Taiwan Semiconductor Manufacturing (TSM US) is approaching 142.195 resistance. Last time it reached this level it was in January 2022 creating a double top and sending the stock down 58% in only 9 months !!! Is this time different ? Keep an eye on this key level. Source : Bloomberg.

Gold (XAU) is trying to break resistance

Gold (XAU) is breaking resistance 2062. This would end December consolidation. Keep an eye at the closing price. Source : Bloomberg

Crude Oil WTI trying to break key level

Crude Oil is on key resistance level 79.71 ! Since December it has tried several times to break but this time the trend is to the upside. Keep an eye. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks