Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

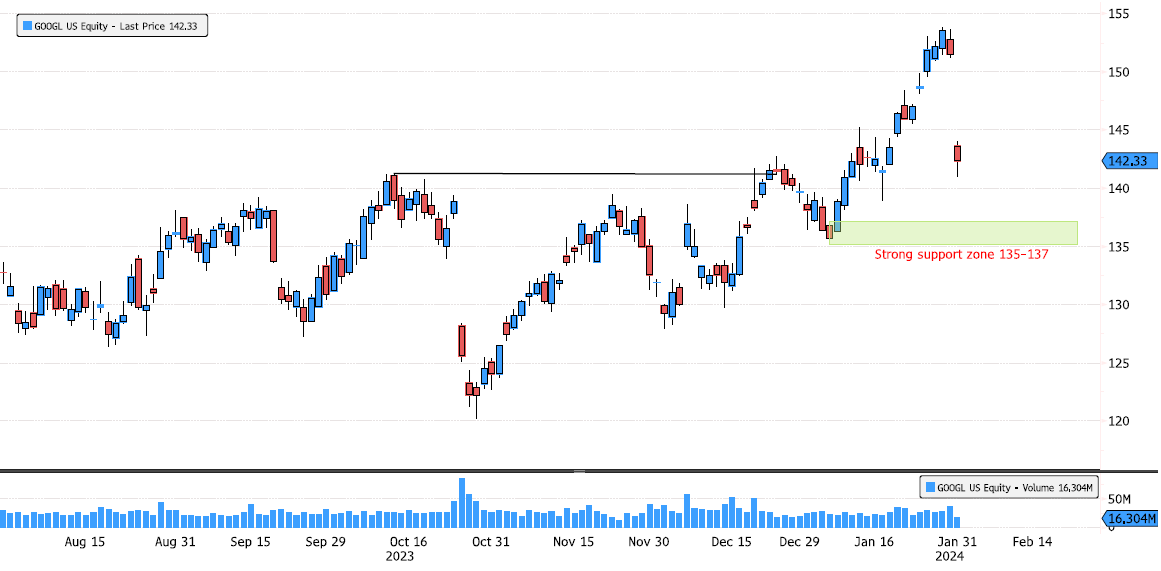

Google looking for support

Google is under strong pressure but trend remains bullish. Stock is trying to find some support. 1st support is around 139-140 and major zone to keep an eye on is 135-137. Source : Bloomberg

Procter & Gamble breakout ?

Procter & Gamble remains in a bullish trend. Keep an eye at these levels, is this the breakout ? Source : Bloomberg

Novartis under pressure and looking for support

Novartis is under pressure but remains in a bullish trend. If your are looking for support, keep an eye at 83-86 strong support zone. Source : Bloomberg

Diageo approaching a strong support level

Diageo (DGE LN) is down 35% since January 2022 and now reaching 2009 uptrend support and also strong demand support zone 2475-2635. Keep an over the next few days at these key levels. Source : Bloomberg

SGS breakout ?

SGS (SGSN SW) is up 6%, trying to breakout March 2022 downtrend ! Recent double bottom without any close below 72.06 is very positive news. Trend long term remains bullish. Keep an eye at it. Source : Bloomberg

Tesla looking for support

Tesla (TSLA US) is under a lot of pressure. It broke October low and confirming the bearish trend that started in July 2023. Keep an eye at next support zone 178-184. Source : Bloomberg

Givaudan approaching major resistance

Givaudan (GIVN SW) is approaching major resistance 3'536. Last time in December stock wasn't able to break. Keep an eye at this key level. Source : Bloomberg

ASML near all time high

ASML (ASML NA) confirmed once again the bull trend by breaking 700 to the upside. Next level to keep an eye is all time high 777.50. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks