Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Russel 2000 Index always in the 20 months range

Russel 2000 Index (RTY) remains in the range 1640-2020 since 20 months ! It's now approaching the upper band. Will it have enough strenght to breakout ? Source : Bloomberg

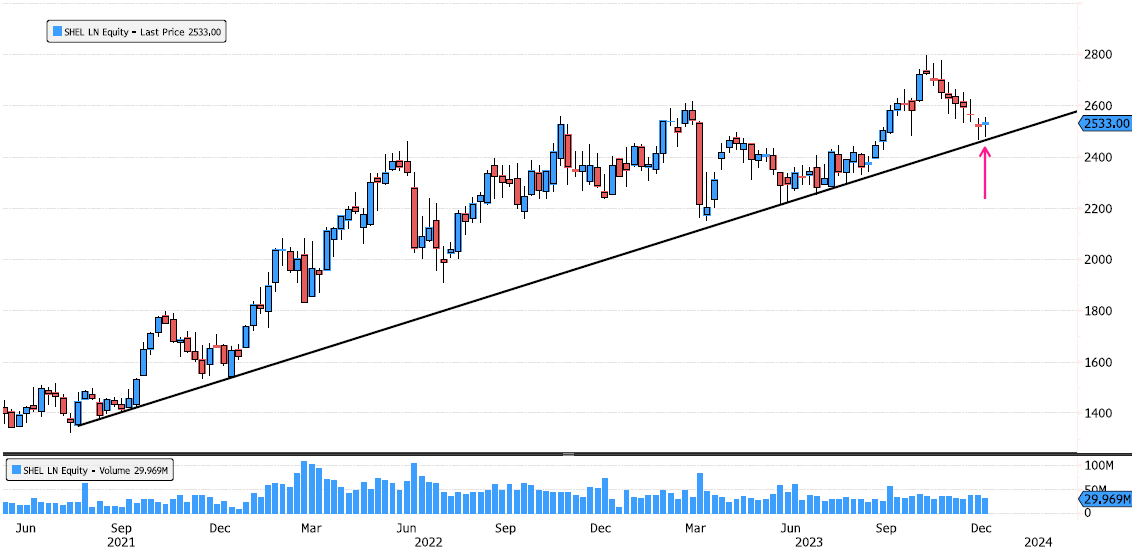

Shell on uptrend support

Shell consolidated 12% since October highs. Bullish trend remains strong. Stock is back on July 2021 uptrend. Is it time for a rebound ? Source : Bloomberg

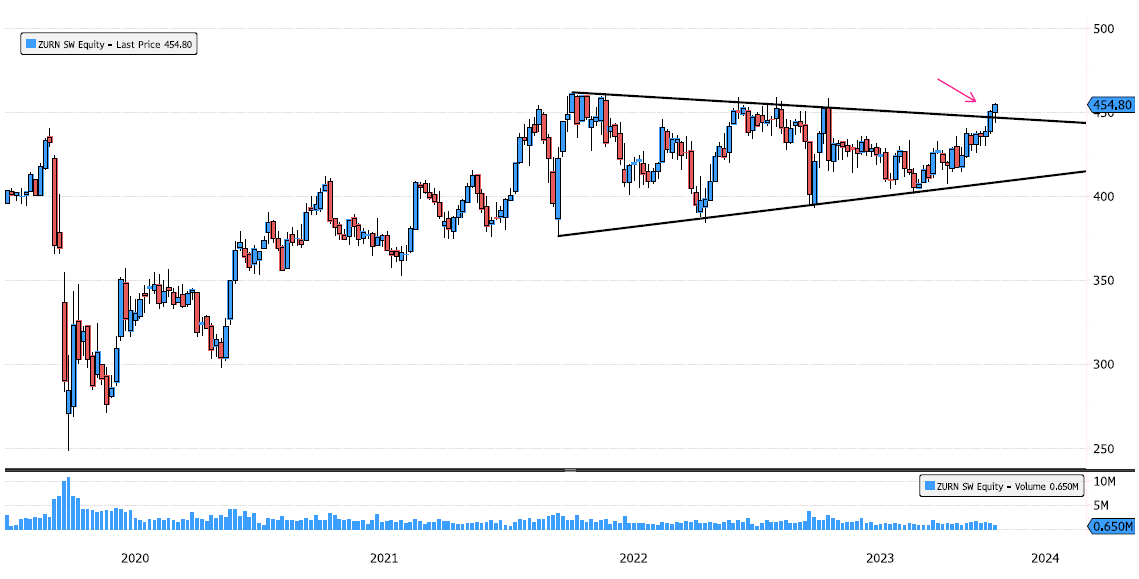

Zurich Insurance breakout ?

Zurich Insurance (ZURN SW) is breaking out the 22 months triangle consolidation. Keep an eye at resistance zone 457-462. Source : Bloomberg

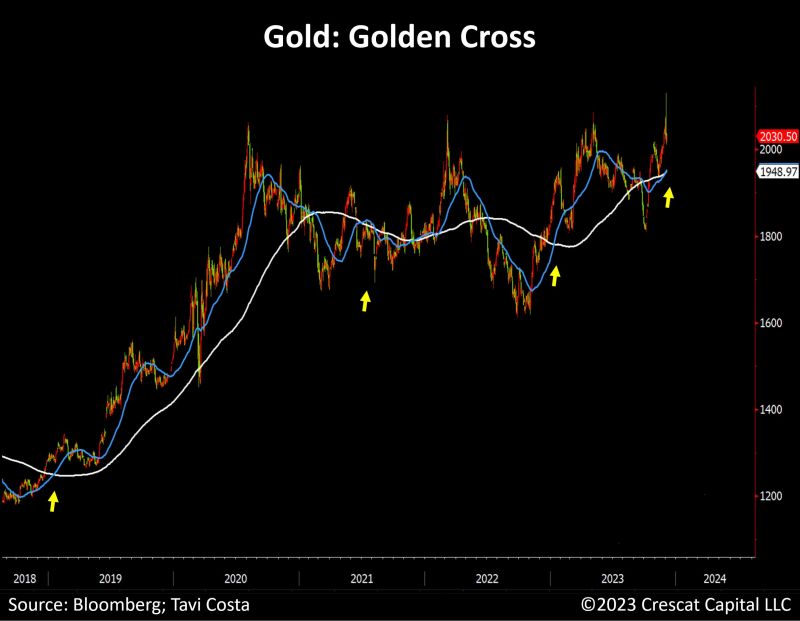

A golden cross on gold (50d MA is trading above 200d MA and both are trending higher)

Source. Bloomberg, Tavi Costa

Crude Oil on major level

Crude Oil WTI has consolidated 27% since September and is now testing August 2022 downtrend line. Source : Bloomberg

Volkswagen finally breaking out

Volkswagen has consolidated more than 60% over the last 30 months !!! End of October it rebounded on 2015 major support zone. It's now trying to breakout March 2021 downtrend. Keep an eye. Source : Bloomberg

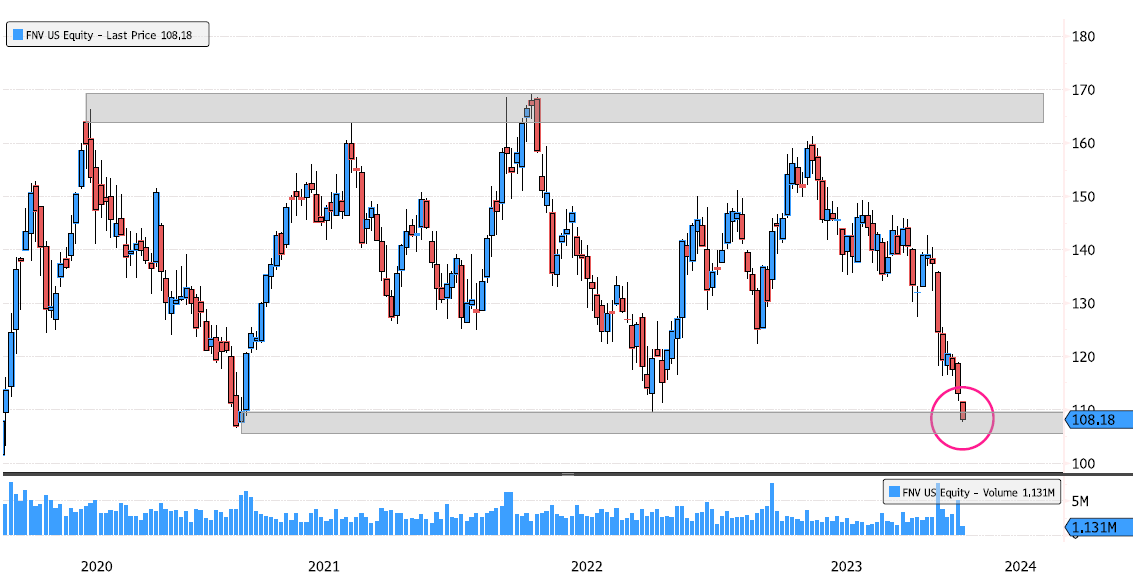

Franco Nevada reaching major support zone

Franco Nevada (FNV US) is in a trading rance 105 - 170 since 2020 ! It's now reaching the lower end 105. Will it rebound once again ? Source : Bloomberg

Crude oil trying to set a low

Crude oil WTI has consolidated 24% since September and nearly tested August 2022 downtrend line. Keep an eye at the pattern that is forming (red circle). Is the low in place ? Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks