Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bitcoin (XBTUSD) Keep an eye at support

Bitcoin (XBTUSD) remains in a bull trend since mars 2023 but be carreful at this pullback as it's testing latest swing support 40'968.50 . This level needs to hold for the trend to remain valid. Source : Bloomberg

Hang Send Index reaching a multisupport zone

Hang Seng Index (HSI) is retesting October 2022 low. It's also on 1989 uptrend support !!! Keep an eye at this zone 14'600-15'200 over the next few days. Source : Bloomberg

BREAKING: PPI data

- Core PPI comes in at 0% m/m vs 0.2% forecast - Core PPI comes in at 1.8% y/y vs 2% forecast - Headline PPI comes in at -0.1% m/m vs forecast of 0.1% - Headline PPI comes in at 1% y/y vs 1.3% forecast A colder than expected print across all readings! Source: Bloomberg, Markets & Mayhem

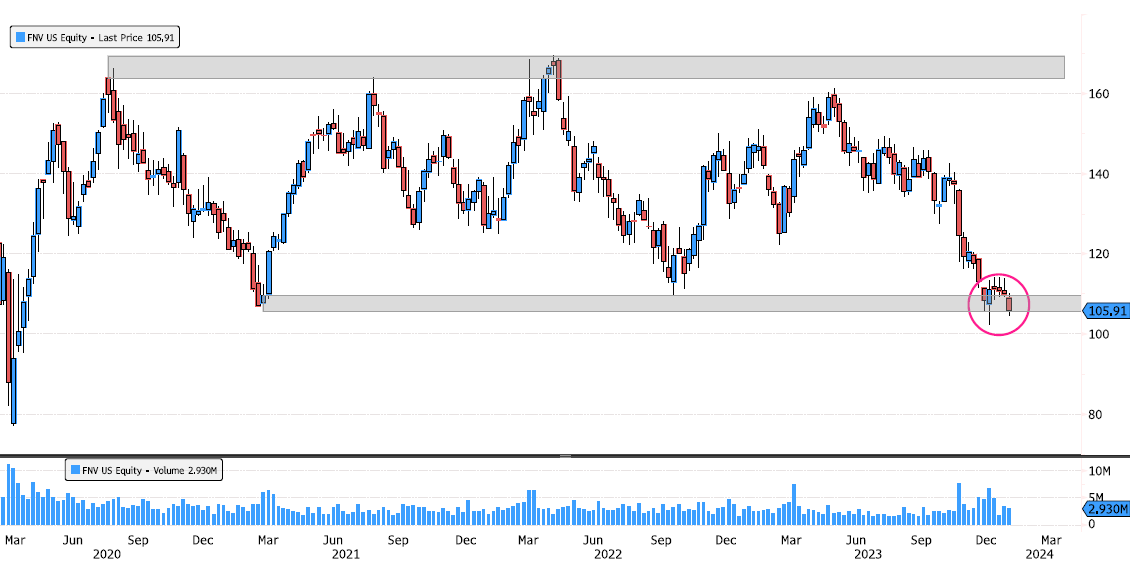

Franco-Nevada testing again major support zone

Franco-Nevada (FNV US) is testing for a second time since December major support zone 105-109 ! This level is key as stock is in a trading range 105 - 170 since 2020 ! . Will it rebound once again ? Source : Bloomberg

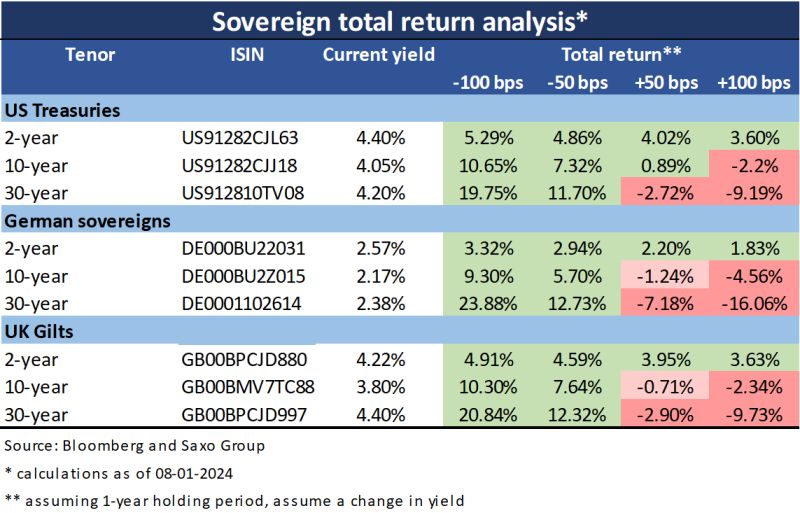

Total return bond analysis update

Source: Althea Spinozzi, Saxo, Bloomberg

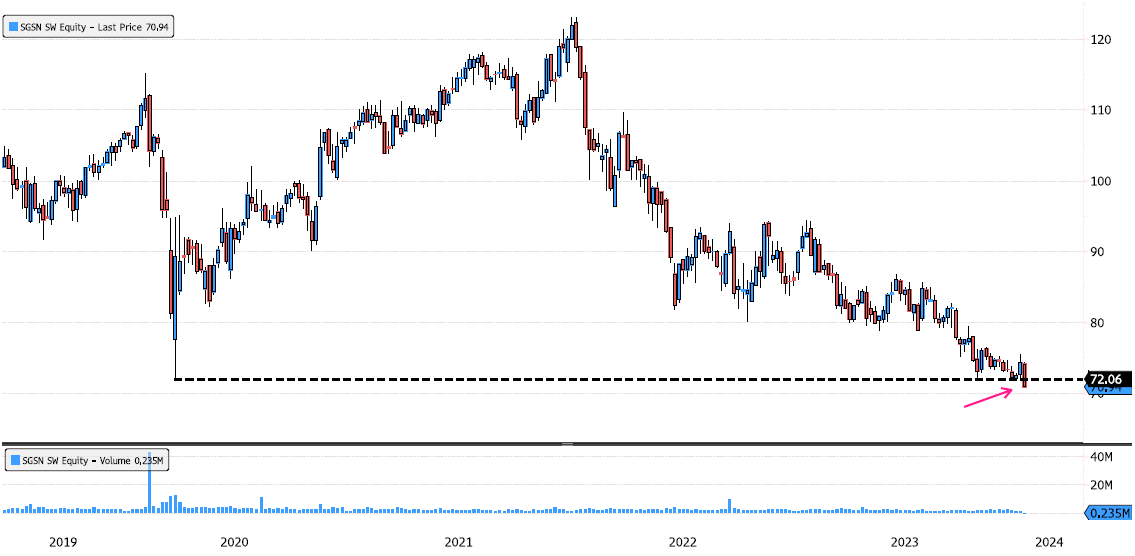

SGS under pressure, on long term swing support

SGS (SGSN SW) is down more than 5% this morning and 43% since January 2022 highs ! Keep an eye at 72.06 support over the next few days. Source : Bloomberg

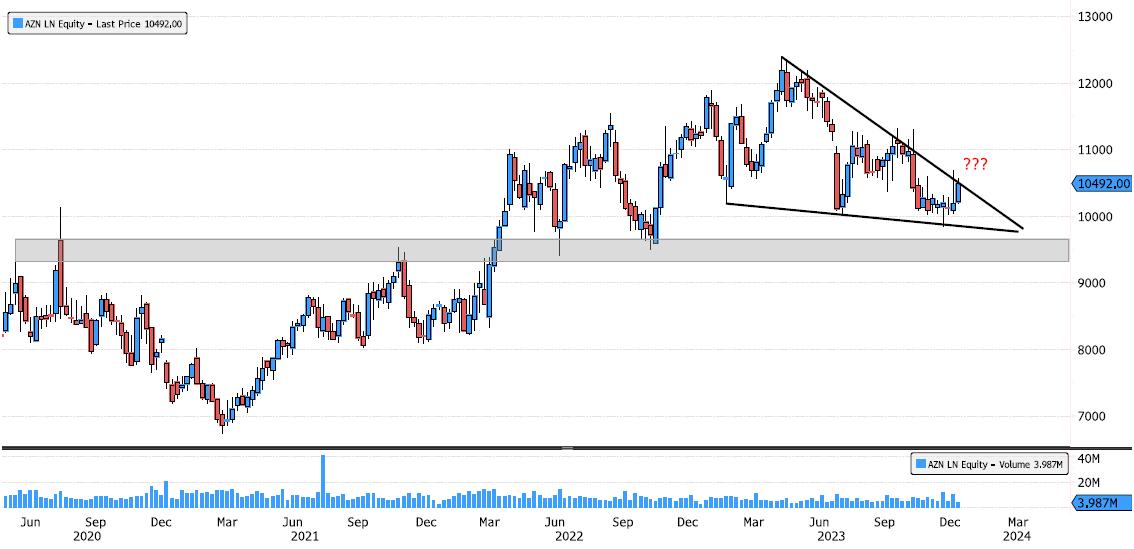

AstraZeneca still in consolidation mode

AstraZeneca (AZN LN) is still consolidating since April (down 20%) but it's getting close to the tip of the triangle, so keep an eye, could see a move soon ! Source : Bloomberg.

Nestle back on major level

Nestle (NESN VX) has consolidated 25% since July 2022. It's now on 2009 majort support level. Keep an eye at this key level. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks