Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

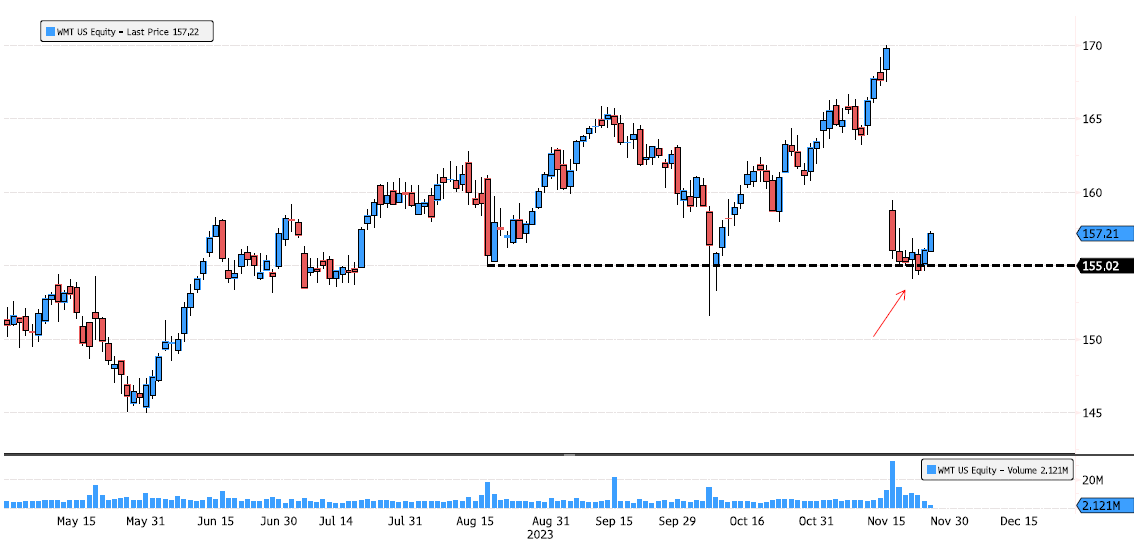

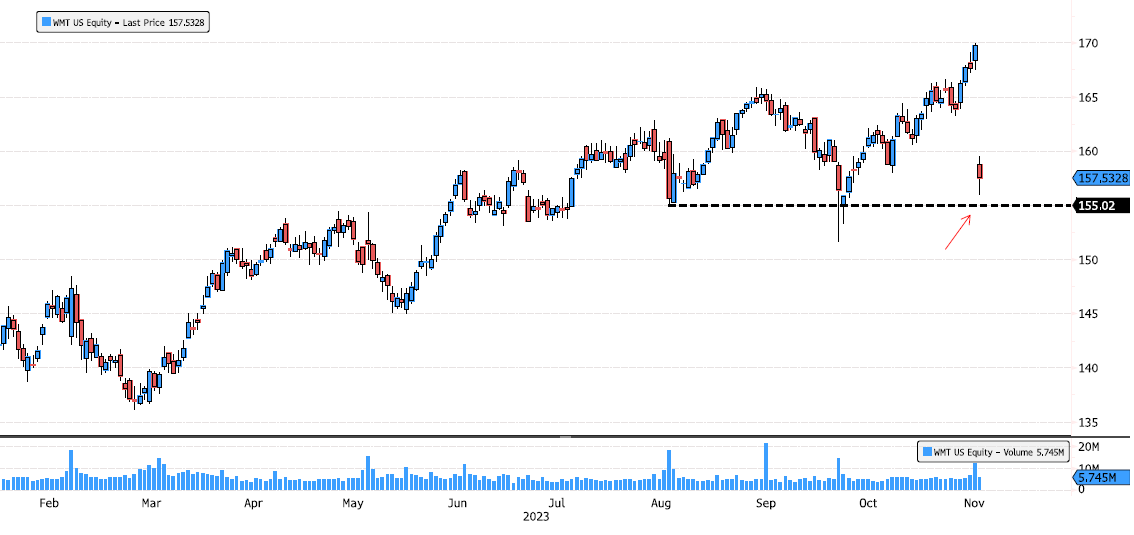

Walmart rebounds on last swing low

Walmart (WMT US) is rebounding on last swing low support at 155. Trend remains bullish. Source : Bloomberg

Energy Sector on major level

Energy Sector (XLE US) has tested again July 2022 uptrend support. Source : Bloomberg

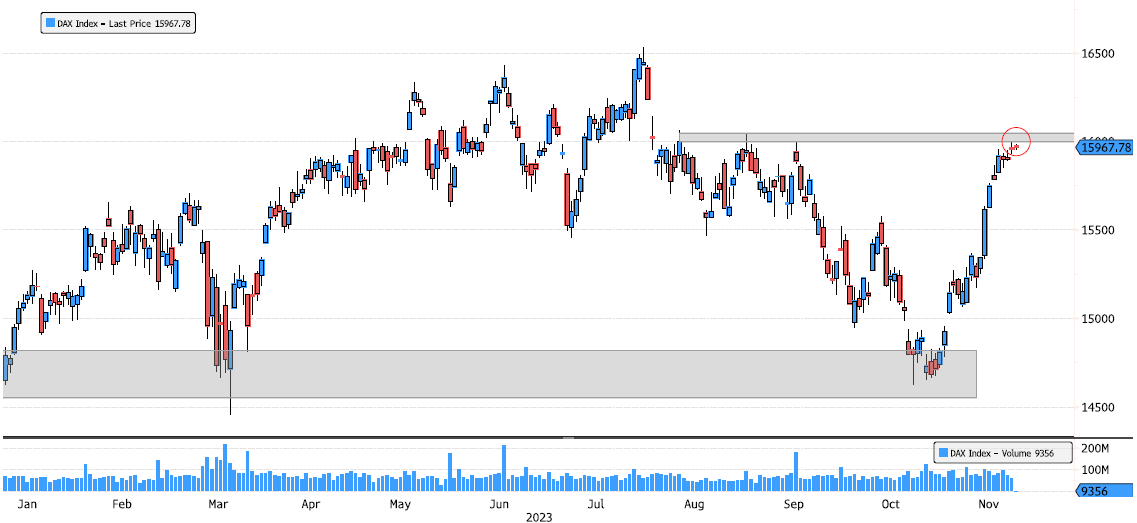

Dax Index reaching a strong resistance level

Dax Index has rebounded more than 9% since one month. It's now approaching resistance level 16'000-16'050. Source : Bloomberg

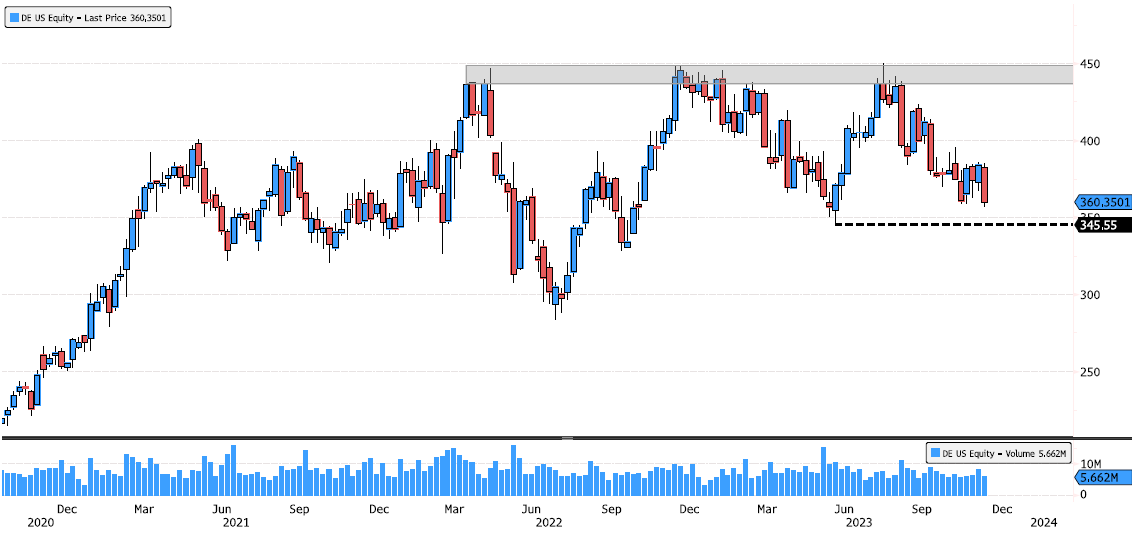

Deere looking for support after earnings

Deere (DE US) is down 6% today and testing first support 358.80. If it breaks, next level to look at will be 345.55. Source : Bloomberg

Gold trying to break resistance

Gold (XAU) has reached the last resistance 2009 level before the major resistance zone 2050-2075. Will it have enough strenght after a 10% rallye since October ? Source : Bloomberg

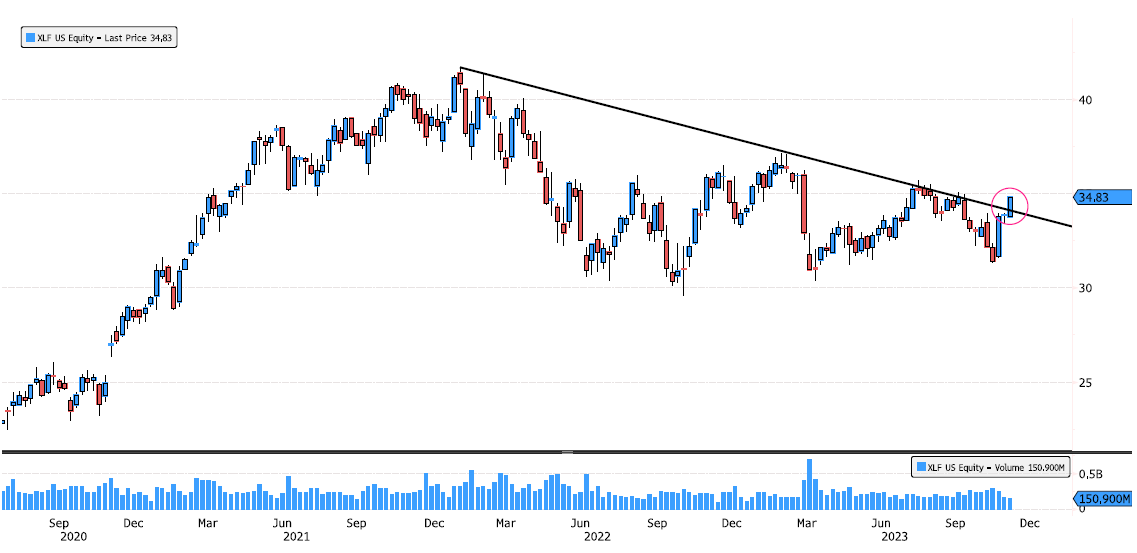

Financial Sector breakout ?

Financial Sector (XLF US) showing signs of breakout ! On this weekly chart, trading above January 2022 downtrend. Keep an eye at the closing tonight. Source : Bloomberg

Walmart looking for support after earnings

Walmart (WMT US) is down strongly after earnings. Keep an eye at latest swing low support 155. Source : Bloomberg

Siemens breakout on earnings

Siemens (SIE GY) broke out this morning October last swing high at 139.34. It also broke recently the June downtrend after a 28% consolidation. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks