Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Stoxx 600 Index unable to break resistance

Stoxx 600 Index (SXXP) wasn't able to break 457 resistance. Trend remains in a downtrend for the moment. Keep an eye at that level. Source : Bloomberg

Taiwan Semiconductor 2nd attempt

Taiwan Semiconductor (TSM US) is trying to breakout June downtrend resistance for the second time. This time volume is very strong. Source : Bloomberg

Diageo looking for support

Diageo (DGE LN) down 15% today, under a lot of pressure. Next support level is the 2009 uptrend support around 2660. There is also another support at 2500. Source : Bloomberg

Walt Disney breaking out ?

Walt Disney (DIS US) has consolidated 60% since March 2021 ! Has tested the last two months the 79 support represented by March 2020 low. Now the stock is showing signs of breakout August 2022 downtrend. Keep an eye. Source : Bloomberg

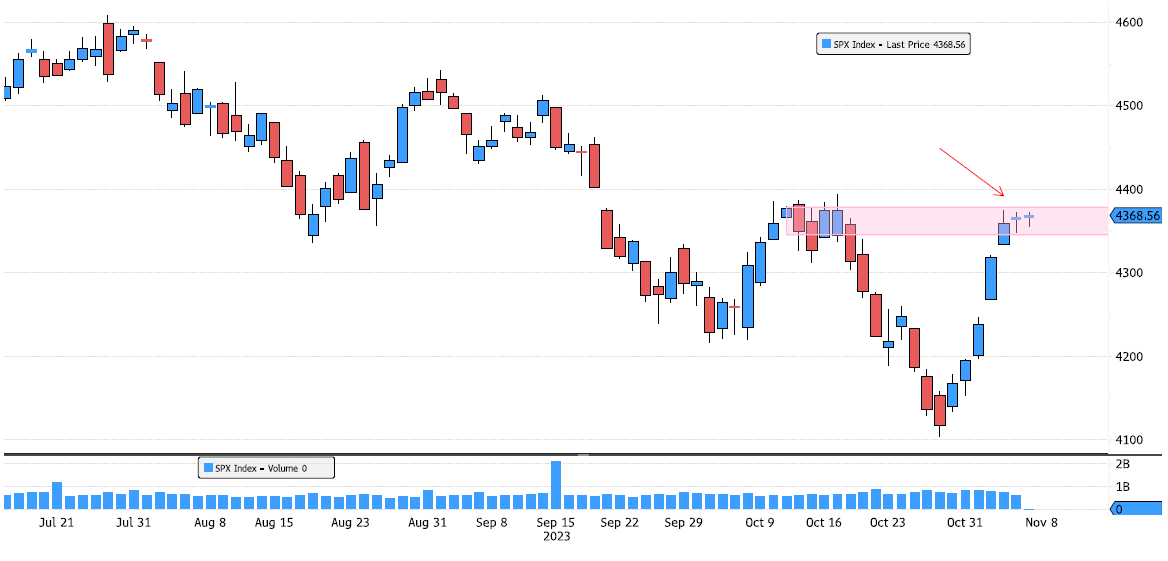

S&P 500 Index at resistance level

S&P 500 Index has made a 6.5% rebound since end of October lows. Trend remains bearish, keep an eye on last swing high resistance 4345-4378. Will it have enough strenght to break this level ?

Crude Oil approaching support

Crude Oil WTI has now consolidated 17% since September high ! It's approaching last swing low support. Keep an eye at 77.62 level.

US 10 year yield on support

US 10 year yield (USGG10YR) is testing support 4.5153. This is a key level for the trend to remain bullish. Keep an eye at the close. Source : Bloomberg

Geberit rebounds after earnings

Geberit (GEBN SW) is rebounding strongly after earnings. Stock is up 8% today and more than 12% since October low. Keep an eye at next resistance zone 468.80-476 represented by February downtrend resistance. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks