Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

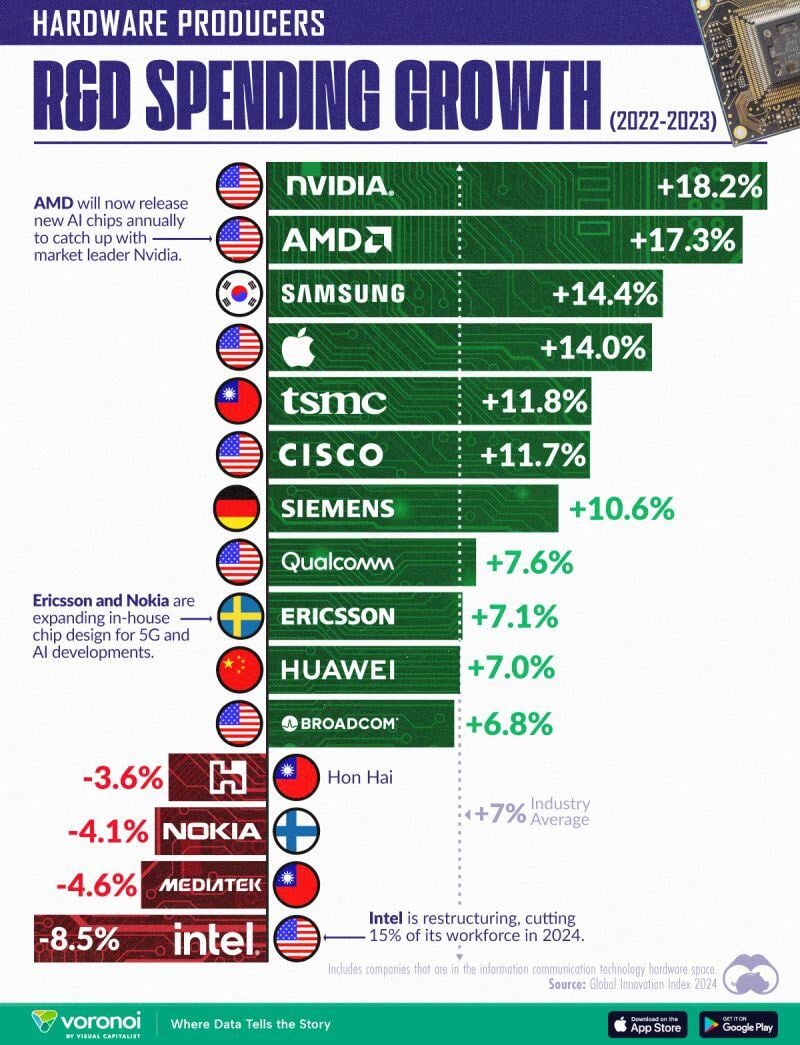

Ranked: Tech Manufacturers by R&D Investment Change in 2023

Source: Visual Capitalist

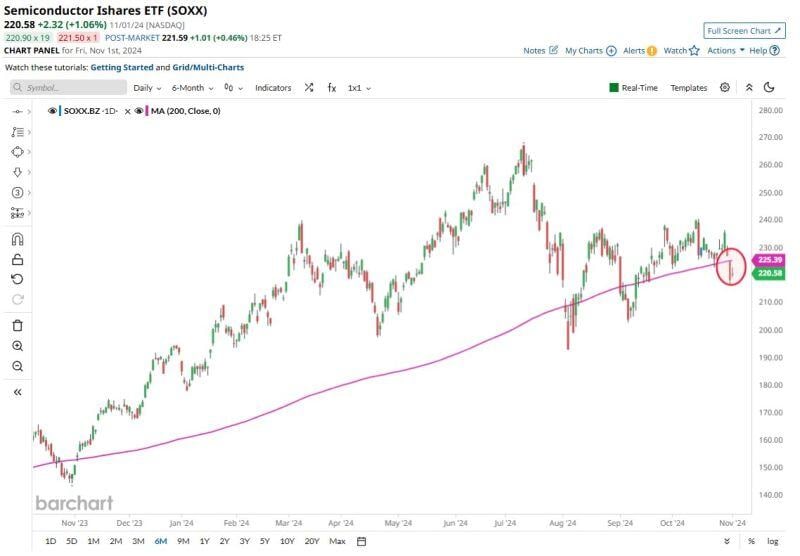

Semiconductor Stocks $SOXX have broken below the 200D moving average for only the 3rd time this year - Uh Oh

Source: Barchart

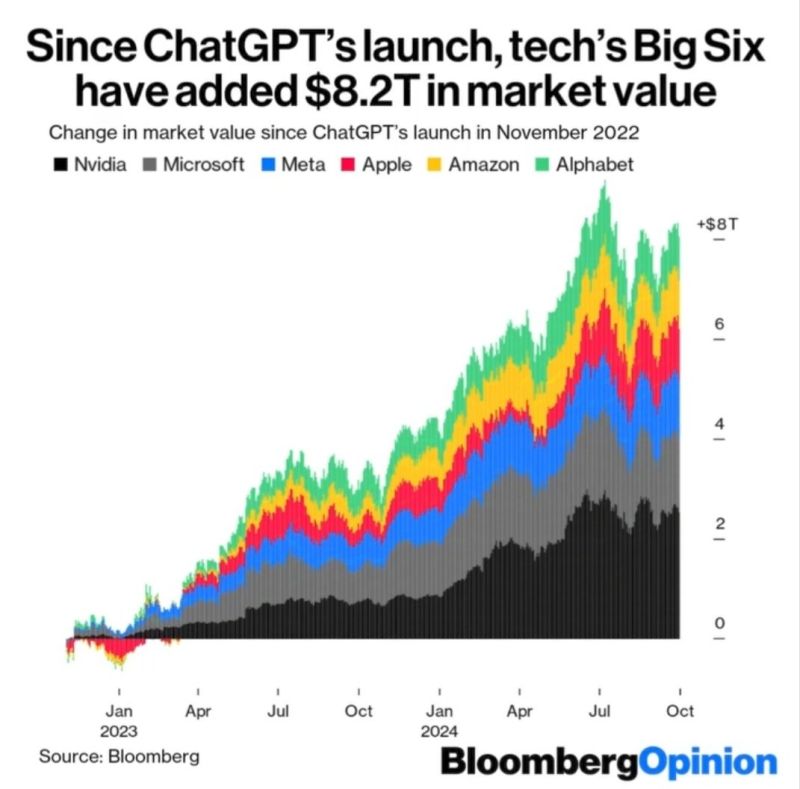

Since the launch of ChatGPT, the 6 biggest tech companies have added $8.2T in market value.

Nvidia added the most, with more than $2.5B! $NVDA $MSFT $META $AAPL $AMZN $GOOGL Source: Bloomberg Opinion, The Future Investors

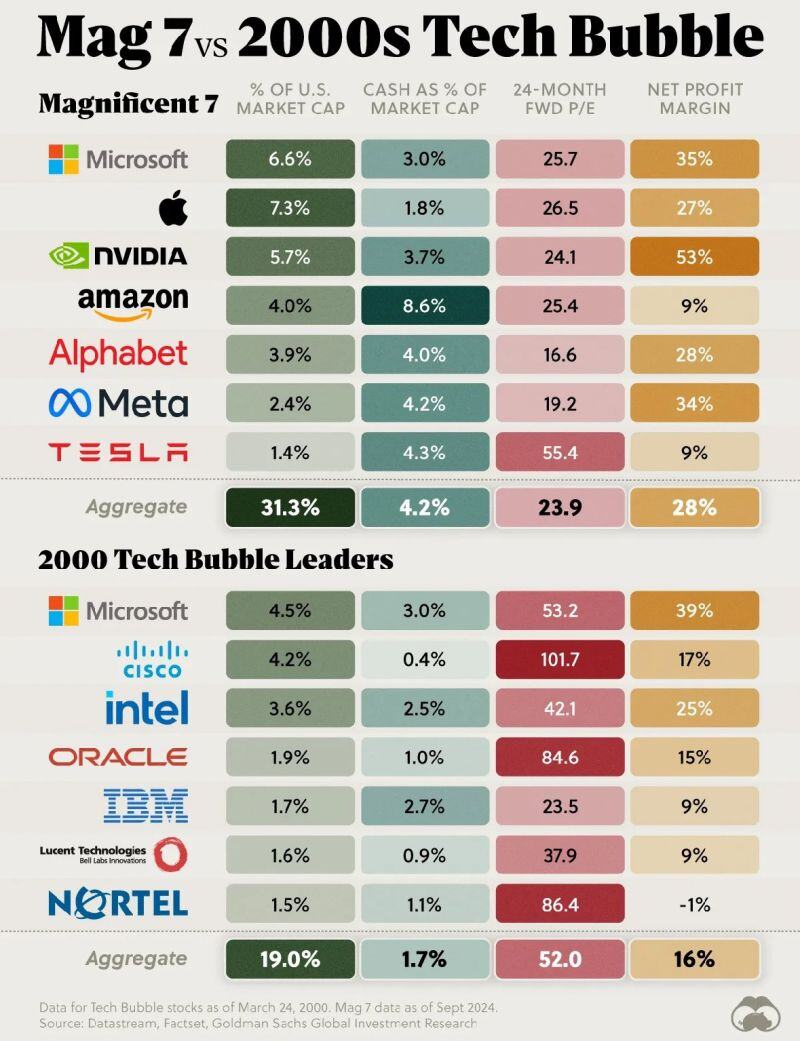

How are the 'Magnificent 7' Tech stocks doing so far this year?

🟢 Nvidia Is Up +134.2% $NVDA 🟢 Meta Is Up +58.6% $META 🟢 Amazon Is Up +26.1% $AMZN 🟢 Apple Is Up +18.5% $AAPL 🟢 Alphabet Is Up +16.8% $GOOGL 🟢 Microsoft Is Up +15.7% $MSFT 🔴 Tesla Is Down -4.1% $TSLA Note that S&P 500 and Nasdaq are both up +19.6% YTD

The old playbook is back thus far this week. Semis and AI leading back bid, growth outperforming.

Source: RBC, Bloomberg

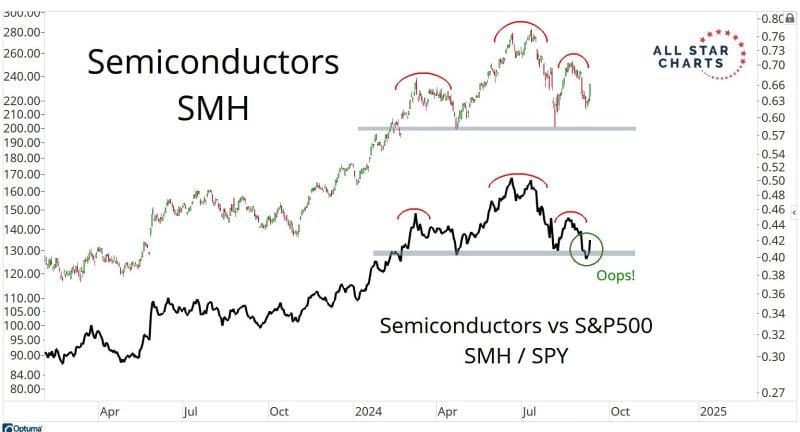

Semiconductors index: Was it a "head & shoulders top" (going to bring down the entire stock market)?

Or is it just a correction in a bull market??? Source: J-C Parets

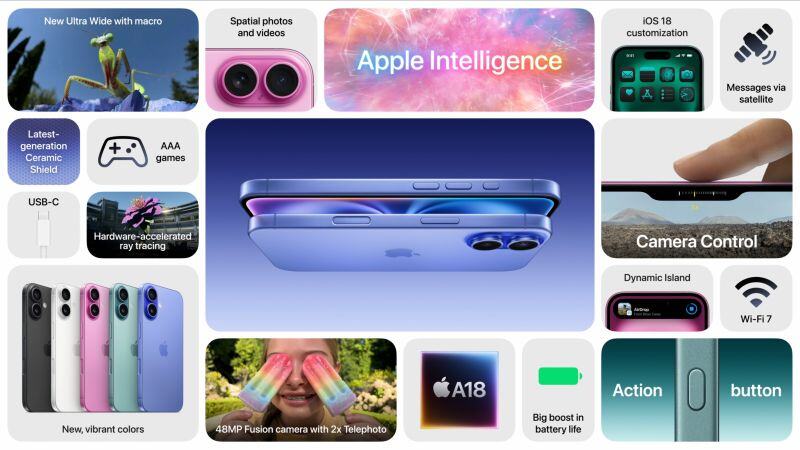

Here’s a full breakdown of the $AAPL iPhone 16 and 16 Plus Price starts at $799 and $899 for the Plus

Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks