Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

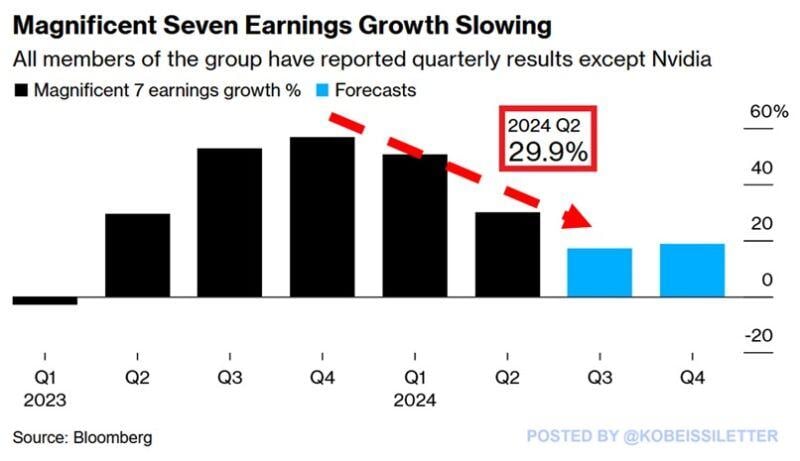

Has the Magnificent 7's earnings growth peaked?

In Q2 2024, the Magnificent 7' net income, excluding Nvidia, $NVDA, rose by 30% year-over-year, the slowest growth since Q2 2023. This is down from 51% in Q1 2024 and below the record 57% seen in Q4 2023. It is estimated that the growth rate will decelerate further to ~17% in Q3 2024. Source: The Kobeissi Letter

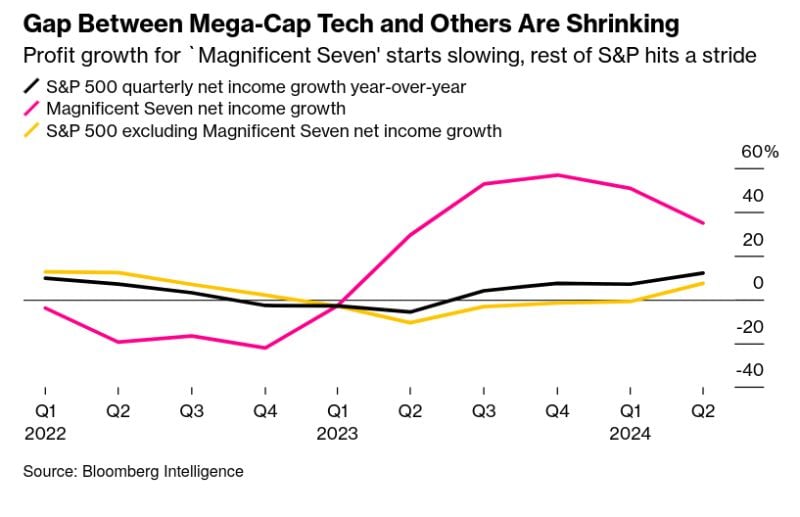

As the Mag 7 slow the rest of the SP500 is showing signs of improving growth

Source: Bloomberg intelligence, Markets & Mayhem

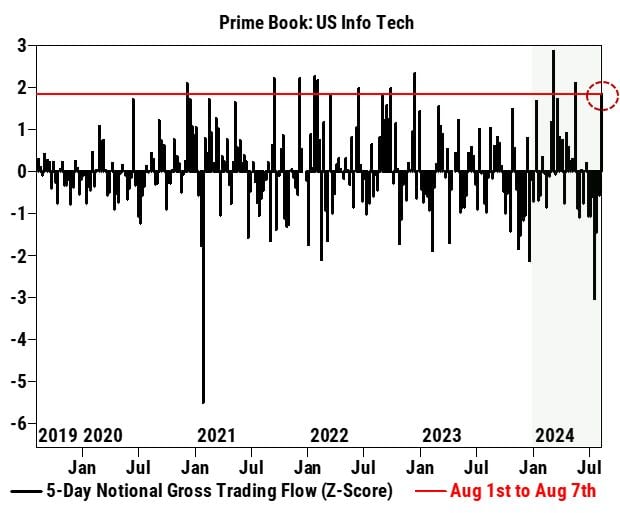

Hedgefunds are buying the dip in tech, per Goldman

Source: Goldman Sachs, Markets & Mayhem

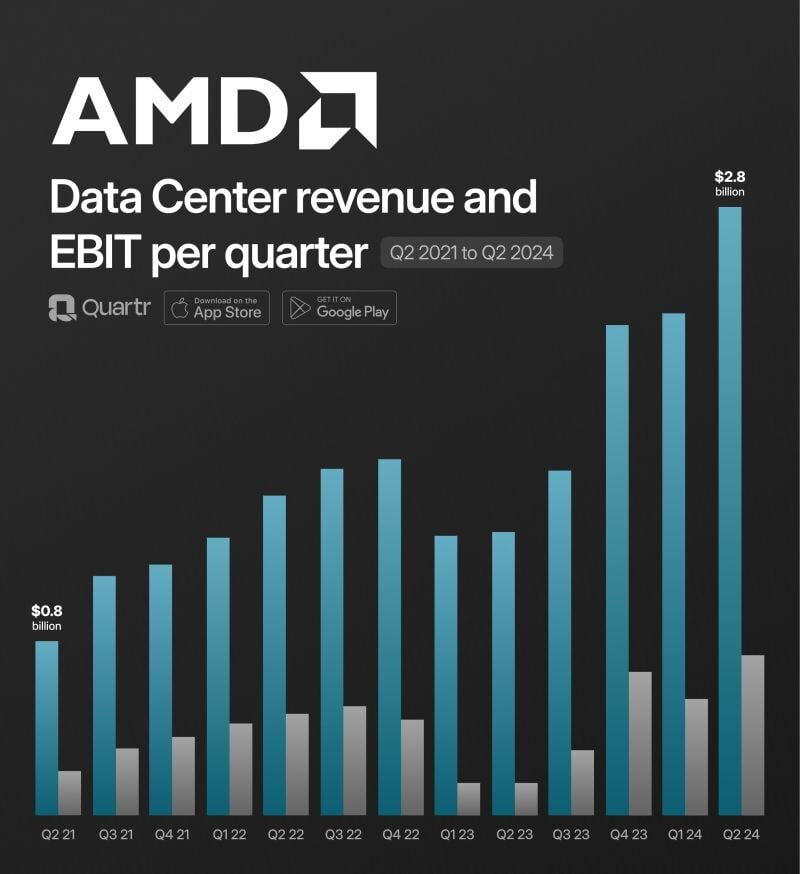

$AMD Q2 2024: "Our AI business continued accelerating and we are well positioned to deliver strong revenue growth in the second half of the year" - Lisa Su, CEO

Details by Quartr: Revenue +9% *Data Center +115% *Client +49% *Gaming -59% *Embedded -41% Gross Profit +17% *marg. 49% (46%) EBIT +1445% *marg. 5% (0) EPS +700%

Microsoft and Alphabet are now exactly on par since the launch of ChatGPT at the end of November 2022.

Source: HolgerZ, Bloomberg

The last time Tech stocks were at these levels relative to the S&P500, Tech stocks crashed, particularly relative to the rest of the market.

Source: J-C Parets

One for the Bulls... As shown below, during this tech pullback, forward 12-months EPS in tech has actually ticked higher.

So you could argue that this is mostly a positioning and sentiment pullback, especially in tech... Source: Bloomberg, RBC

Thank you Crowdstrike... that's soooo king of you....

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks