Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Sox plunged 6.8% in semi conductor sector's worst selloff since March 2020

on the prospect of increased export restrictions on advanced semiconductor technology, and by Donald Trump's latest comments on Taiwan. Taiwan "did take about 100% of our chip business" and "should pay us for defense," Trump said in a Bloomberg Businessweek interview. Intel and GlobalFoundries bucked the trend as potential US domestic semi 'winners.' Source: Bloomberg, HolgerZ

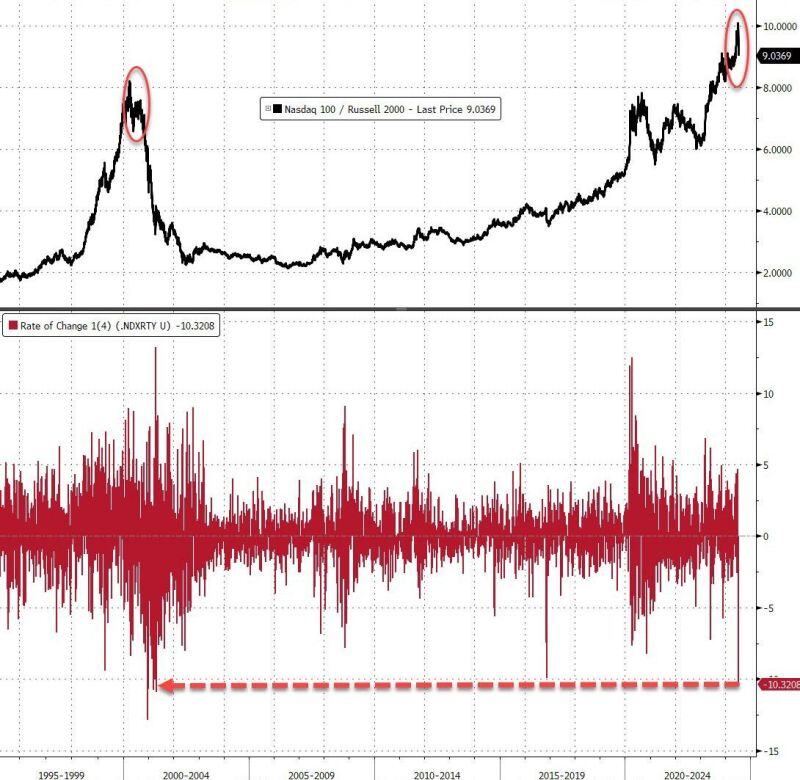

For context, the four-day reversal in the Nasdaq 100 / Russell 2000 ratio is the greatest shift in the US Big-Tech / small cap pair since the collapse of the DotCom bubble...

Source: Bloomberg, www.zerohedge.com

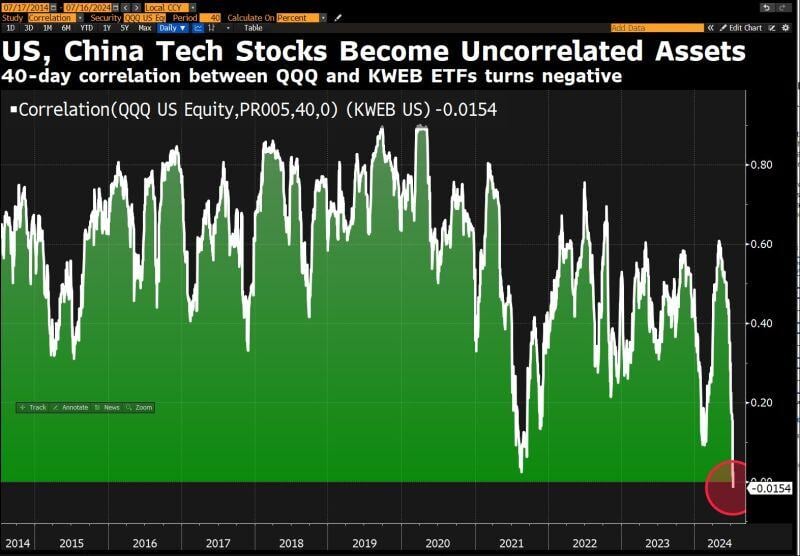

Us and China tech stocks have now become completely decoupled from each other, from a markets perspective.

David Ingles: "The 40-day correlation of $QQQ & $KWEB has turned negative. These are two behaviourally different assets FOR NOW. What might be good for one, may not necessarily boost the other. Chart underscores many global stories: difference in AI representation in each market, tech decoupling, geopolitical rifts, economies in different parts of their cycles". Source: David Ingles on X, Bloomberg

From Elon Musk to David Sacks, Silicon Valley’s Trump Backers Cheer Vance as VP Pick - Bloomberg

-> Many in the startup world rejoiced at Trump’s VP pick -> Vance has criticized big tech and has backed small players Major Silicon Valley investors hailed Donald Trump’s choice of Ohio senator and former venture capitalist JD Vance as his running mate, a move that puts the technology industry closer to center stage in Washington if the former president takes the White House in November. Elon Musk called the decision a “great choice” and said the lineup “resounds with victory” on X, the social platform he owns. David Sacks, an investor and Trump supporter scheduled to speak at the GOP convention on Monday night, called Vance an “American patriot” in a post. According to Tech Crunch >>> "Vance spent years as a venture capitalist before leaving the industry when elected to the U.S. Senate in 2022. After graduating from Yale Law School in 2013, Vance moved to San Francisco, where he was a principal at Mithril Capital, a fund co-founded by Peter Thiel and Ajay Royan. Mithril raised two funds, a $540 million and an $850 million vehicle in 2013 and 2017, respectively. Thiel was publicly active in politics in 2016, backing Trump’s first presidential campaign, and helped fund Vance’s Senate race, but has said he’s not planning to donate to any Republicans in the 2024 election. In 2017, Vance left Mithril and joined Steve Case’s Washington, D.C.-based Revolution as a managing director. His move came when his wife, Usha Chilukuri Vance, landed a role as a Supreme Court clerk. While at Revolution, Vance helped Case launch Rise of the Rest, a strategy focused on investing in startups outside the main U.S. tech hubs. At Revolution, the Republican VP nominee led deals into Michigan-based Aatmunn, a startup that develops software and wearable devices for on-the-job safety for construction workers. He also backed and served on the board of Kentucky-based AppHarvest, an indoor farming startup, that went public via a SPAC in 2021 but filed for bankruptcy protection in 2023". Source: Bloomberg, Tech Crunch

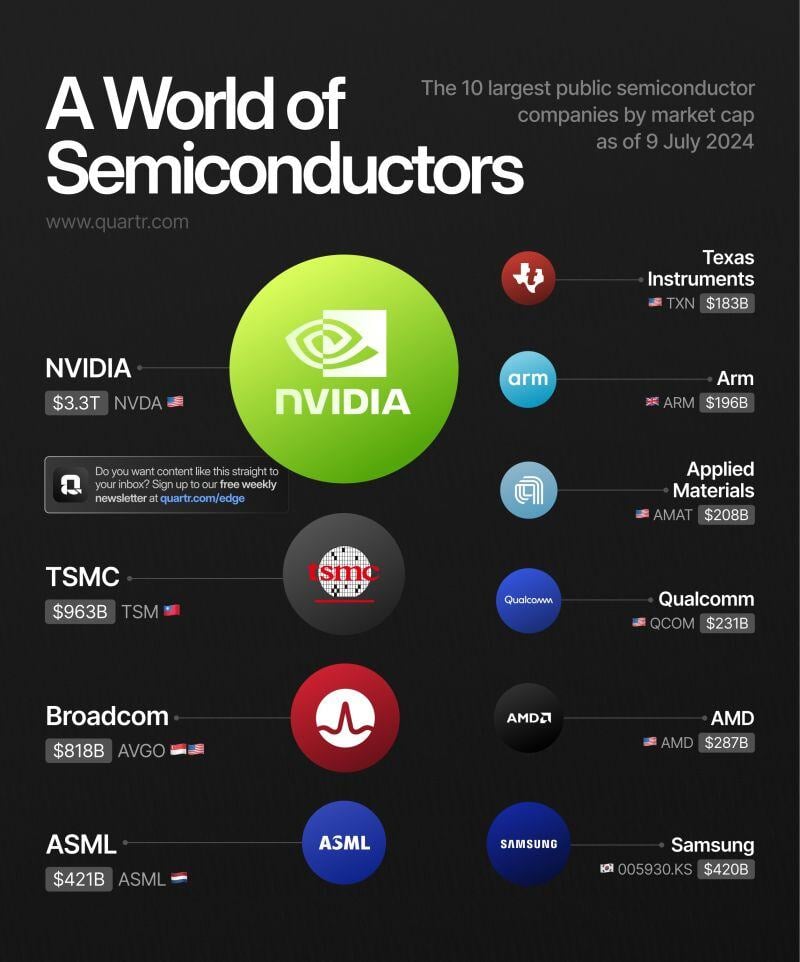

A visual overview of the world's 10 largest public semi conductor companies' market caps:

$NVDA $TSM $AVGO $ASML $TXN $ARM $AMAT $QCOM $AMD Source: Quartr

Big Tech is eating the world with Apple once again the undisputed Number 1.

Apple gained 2% after bullish Bloomberg report about the upcoming AI-enabled iPhone sales prospects. Apple is now worth almost $3.6tn in market cap, Microsoft is number 2 with $3.5tn ahead of Nvidia with $3.3tn. Source: HolgerZ, Bloomberg

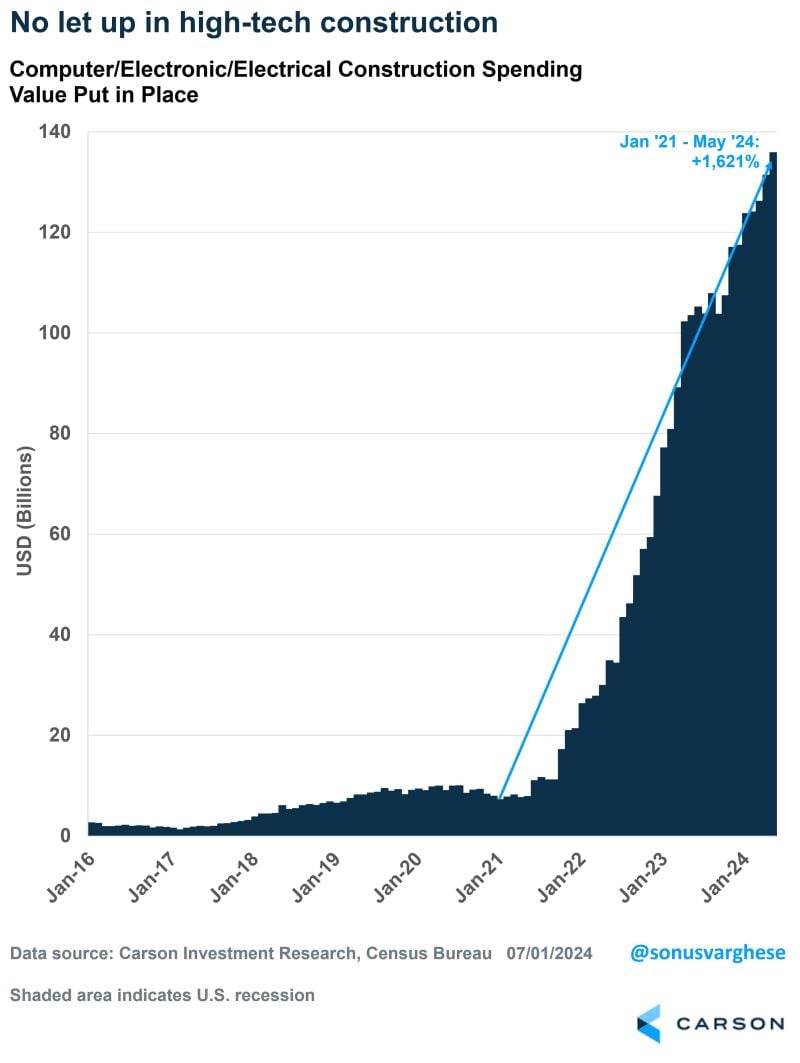

Amazing stat here from Sonus Varghese / Carson thru Ryan Detrick.

High-tech construction was only 11% of overall manufacturing construction in late '20. Today it is 58%!

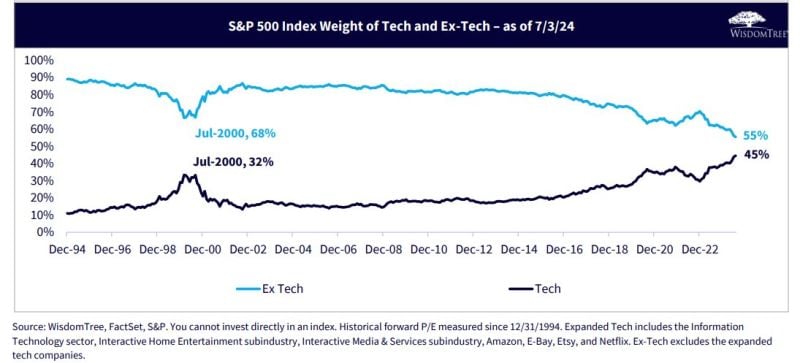

Almost half of the S&P500 is now essentially tech...

Source: Wisdom Tree, Mike Zaccardi

Investing with intelligence

Our latest research, commentary and market outlooks