Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

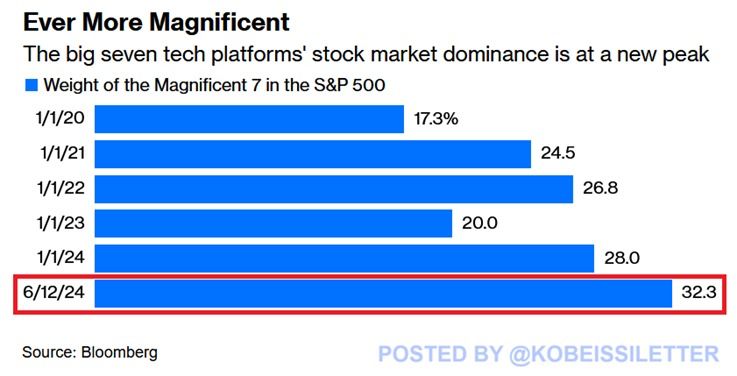

The Magnificent 7's share of the SP500 just hit another all-time high of 32%.

This is 12 percentage points higher than at the beginning of 2023. The weight of these 7 stocks in the index has almost DOUBLED in just over 4 years. This comes as the 3 largest stocks, Apple, Microsoft, and Nvidia, are all officially worth over $3 trillion. Meanwhile, the technology sector just hit another all-time high relative to the S&P 500. Tech is becoming even more dominant. Source: Bloomberg, The Kobeissi Letter

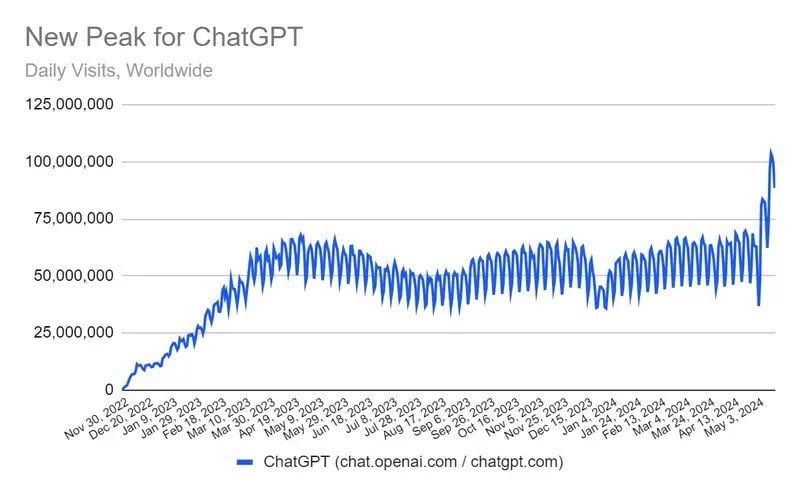

In the first three weeks of May, OpenAI’s ChatGPT averaged 77 million daily visits, putting it on track to reach 2.3 billion visits last month

A new monthly record after setting its previous record of 1.8 billion visits a year ago. Source: Beth Kindig $MSFT $NVDA $GOOG $AMZN

Tech CEOs are the new modern day rockstars $NVDA

Source: Trendspider

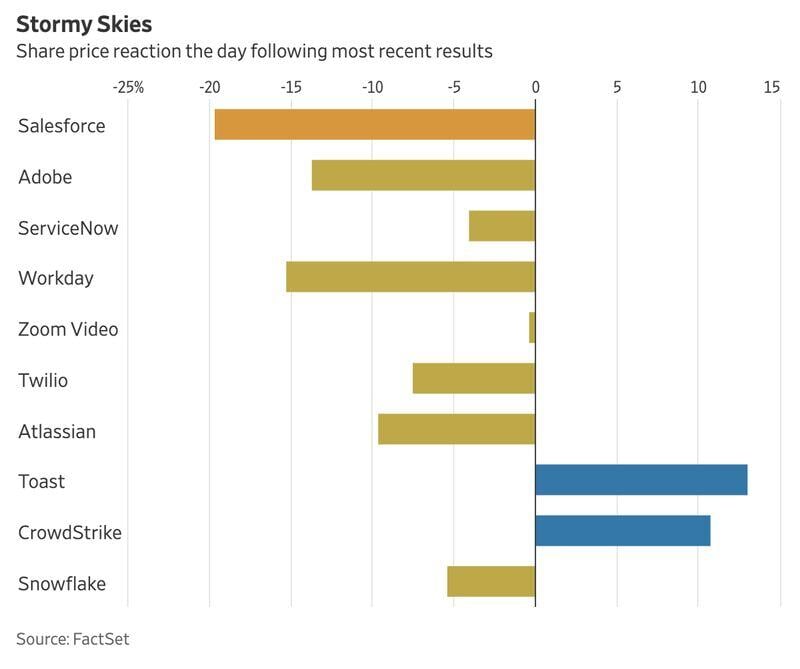

The current earnings season has largely been a rough one for cloud software providers.

Source: Win Smart, Factset

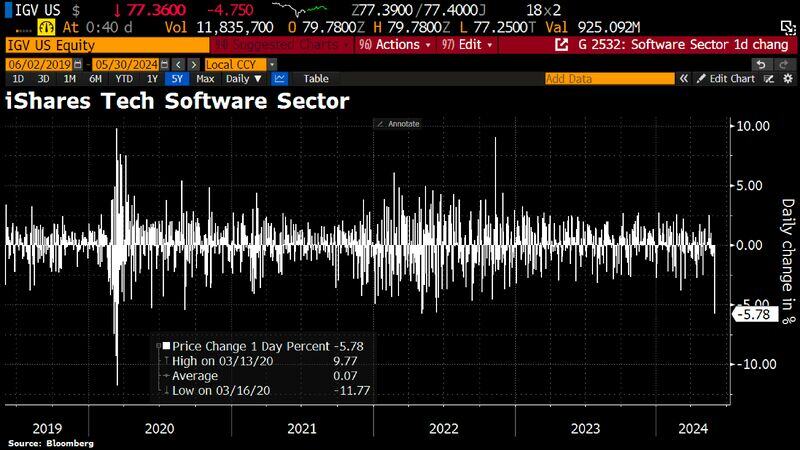

Software stocks got hammered yesterday.

iShares Tech Software Sector ETF finished -5.8% (biggest daily drop since the pandemic w/Salesforce DOWN 20% (worst session in ~20 years), UiPath -35%, Okta -6%, Mongo DB -24%. Source: Bloomberg, HolgerZ

Chinese BYD launches plug-in hybrids with a 2100 km driving range

Source: WSJ

Investing with intelligence

Our latest research, commentary and market outlooks