Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

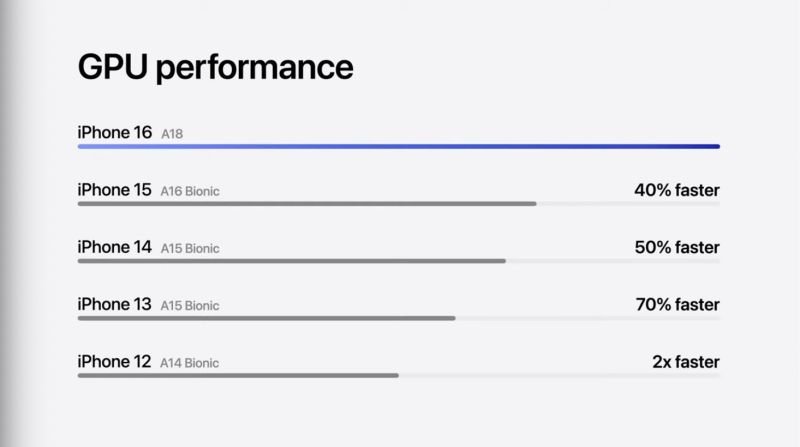

Apple's $AAPL new A18 chip for the iPhone 16 has 40% faster GPU performance than the iPhone 15

Source: Evan

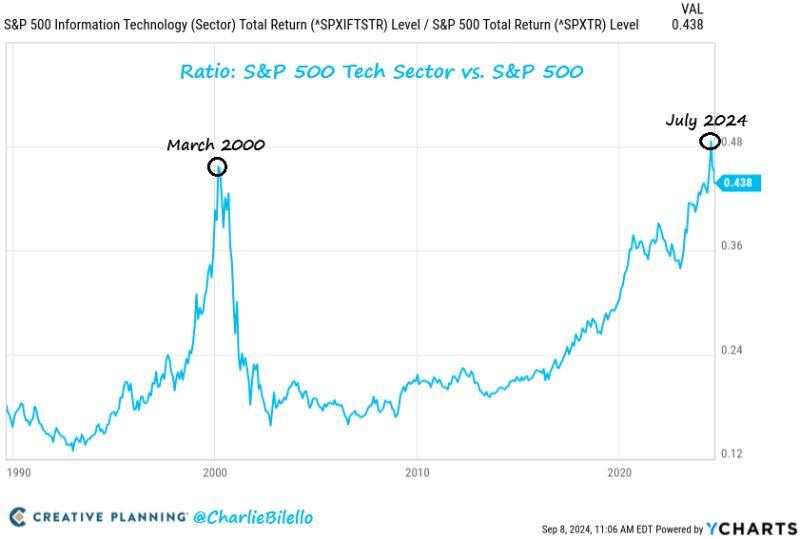

After surpassing the March 2000 relative strength high, the Tech sector has sharply underperformed over the last 2 months.

Is this the start of a secular change in leadership? Source: Charlie Bilello

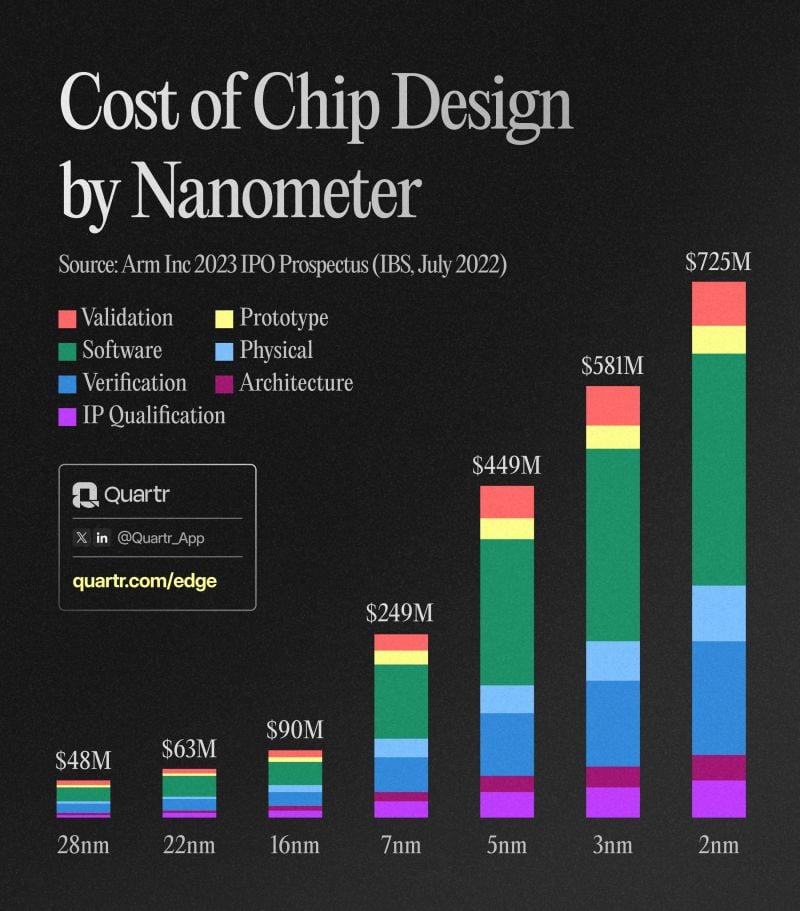

The cost of chip designs has risen at an incredibly rapid pace.

From the 28nm design in 2011 to 3nm in 2022, the cost of designing a chip increased by 12x – benefiting design tool and IP giants such as $SNPS, $CDNS, and $ARM. Source: Quartr

Massive money pours into the Invesco S&P 500 Top 50 ETF

Source: Bloomberg

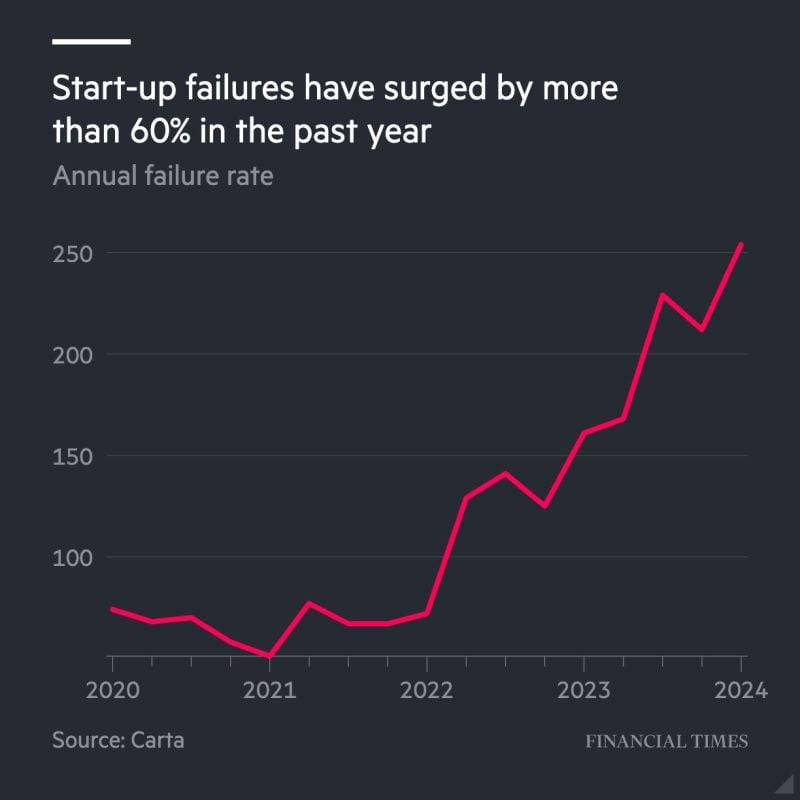

FT article: "The rate at which US start-ups are going bust is more than seven times higher than in 2019, threatening millions of jobs and risking spillover to the wider economy"

Source: FT

Is long AI short yen the same trade?

Gray line is 30-year T-bond yield relative to tech 12 month forward earnings yield ratio Dotted green line is EUR/JPY Source: www.zerohedge.com

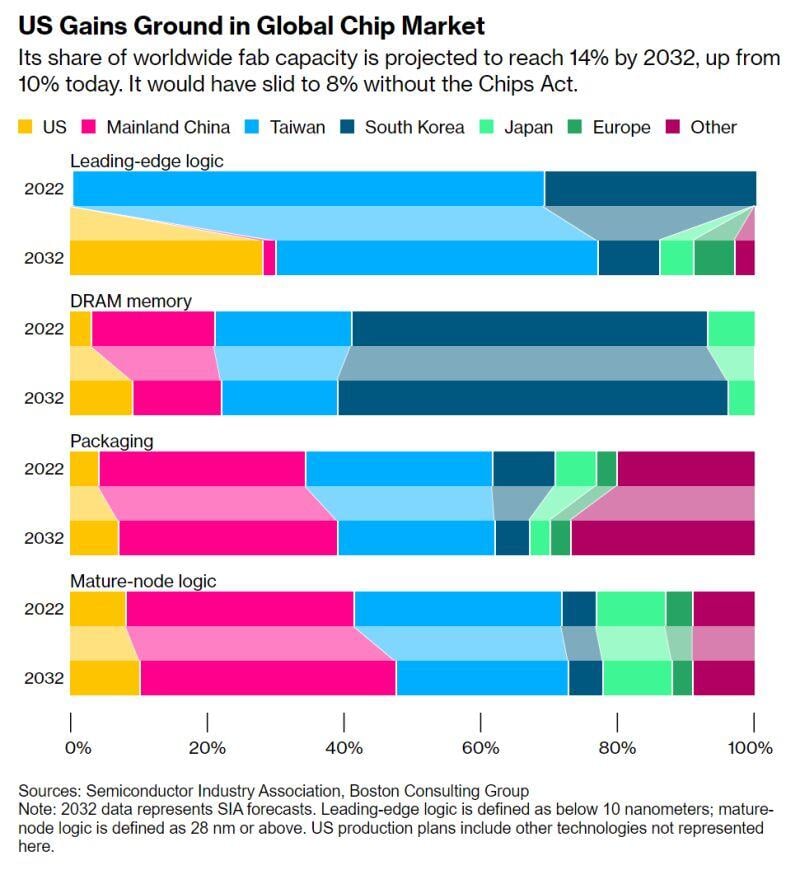

US Chips Act is reshaping global semiconductor landscape

• America looks set to produce around one-third of global supply for leading-edge chips by 2032 • US rise will come at expense of South Korea, which could become minor player for top-notch chips Source: Agathe Demarais

Bank of America survey shows continued optimism on Big Techs

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks