Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️ JUST IN : Taiwan Semiconductor $TSMC’S REVENUE JUMPED OVER 33.8% YoY TO $11.09B IN AUGUST

👉 TSMC (TAIWAN SEMICONDUCTOR) MAKES ALL THE CHIPS FOR NVIDIA , APPLE , AMD AMONG OTHERS 👉So far in 2025 (Through August) TSMC has brought in total revenue of $80.33B up 37.1% YoY. Source: GURGAVIN

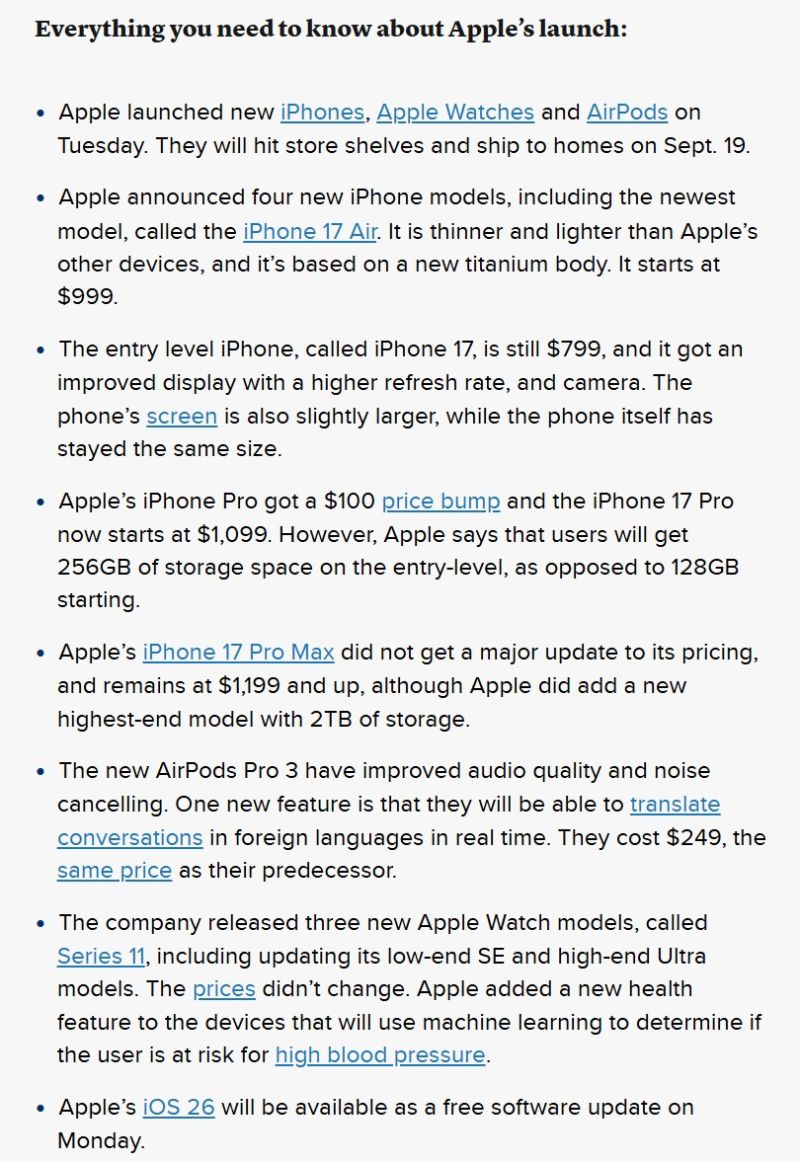

Everything Apple just announced:

iPhone 17 Air, AirPods Pro 3, Apple Watch Series 11 and more, a summary by CNBC 👇

How All the Billionaires in 2025 Made Their Money

Forbes found that nearly one in six billionaires (or 464 billionaires in 2025) made their money in finance and investments. Tech is the second most common sector to find billionaires in (401 in 2025, an increase of 59 billionaires since 2024). Source : Visualcapitalist

A bunch of tech CEOs had dinner with President Trump

Including: Meta CEO Mark Zuckerberg, Microsoft CEO Satya Nadella, Google CEO Sundar Pichai, Apple CEO Tim Cook, AMD CEO Lisa Us and OpenAI CEO Sam Altman. Note that Tesla CEO Elon Musk is not around the table. Nvidia CEO Jensen Huang is missing as well. Key takeaways: 1) Trump said he would be placing semiconductors tariffs “very shortly,” and that they will be “fairly substantial.” 2) Trump also signaled that companies that invest in the U.S., like Apple, would be safe from the brunt of the tariffs. 3) President Donald Trump congratulated Google CEO Sundar Pichai on his company’s Tuesday antitrust penalties ruling, which came in lighter-than-expected and caused Alphabet shares to jump. Pichai said he is “glad it’s over” and thanked Trump for dialogue and resolution. Source: Evan on X

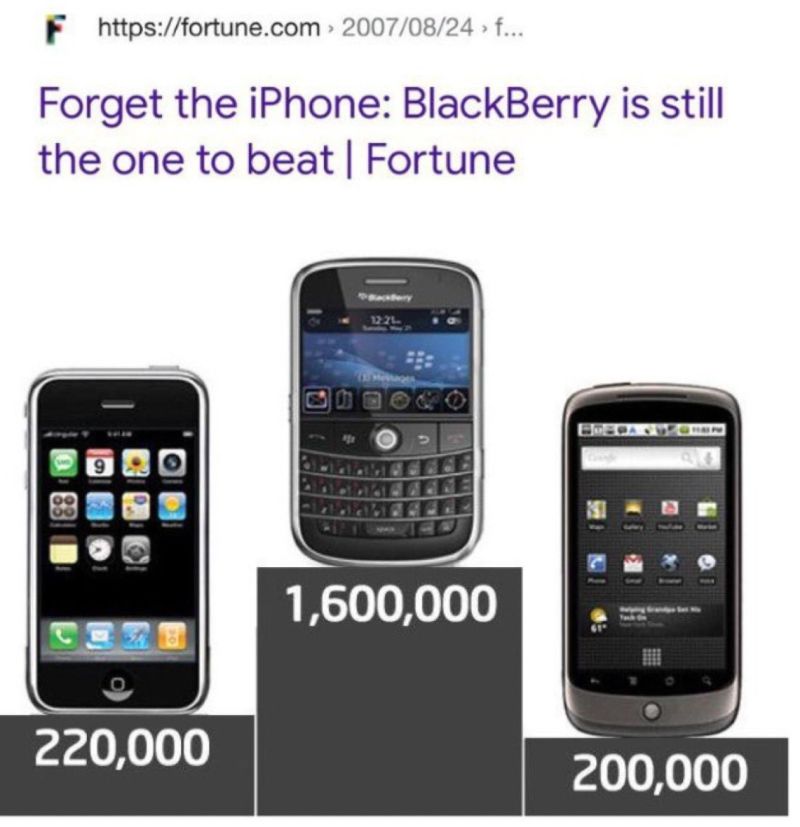

In 2007, BlackBerry was worth more than Amazon, AMD, Netflix, Nvidia and Salesforce combined

Barry Ritholtz: How little do we know about the future? A great way to figure that out is to look to our past, to see what we previously thought about what the future will hold. To wit: 26 years ago, the image above came from the cover story of Fortune magazine: “There’s a lot of buzz in the smartphone business lately, with Apple’s (AAPL) iPhone turning the mobile world upside down and Nokia’s (NOK) upcoming phone announcement providing a new challenge. Despite all the hype, though, Research in Motion’s (RIMM) BlackBerry is still the most formidable force in U.S. smartphones. This statement, of course, is gadget heresy. Popular opinion holds that the iPhone is today’s must-have device, and none of the others stand a chance. But while the iPhone is revolutionary, it’s not yet positioned to truly challenge RIM’s foothold in the smartphone market.” Source: Jon Erlichman @JonErlichman

U.S. Top 10 Tech Giants Reach $22 Trillion Market Cap in August 2025

As of August 29, 2025, the combined market capitalization of ten leading U.S. tech companies: Alphabet, Amazon, Apple, Broadcom, Meta, Microsoft, Netflix, Nvidia, Oracle, and Tesla, hit a record $21.95 trillion, representing roughly one-third of the U.S. equity market. From 2012 to 2025, their market cap grew at a 23% compound annual growth rate (CAGR), underscoring their dominant role in shaping market performance. Source: Econovis

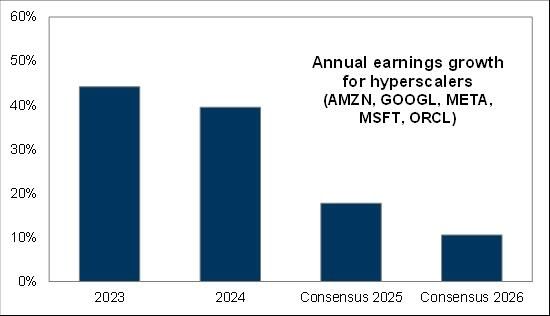

Hyperscaler growth is set to slow meaningfully over the next year

Will AI CapEx follow? Chart: Goldman Sachs thru Markets & Mayhem

Nvidia $NVDA said sales to just one customer represented 23% of its total $46.7 Billion of revenue from the quarter‼️

Someone spent $10.75 Billion with Nvidia during the quarter 😨 Half of $NVDA data center revenues this quarter tied to just two customers - Most likely amazon $AMZN and microsoft $MSFT 🤔... Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks