Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$UBER announces the launch of Uber Trains

From 2029, 10 high-speed trains could connect Stratford Intl to Brussels, Paris, Lille & more via the Channel Tunnel. Partnering with Gemini Trains, tickets may be booked directly in the app alongside cabs, bikes and more. ➡️ Transport multinational Uber, known for its ride-hailing app, has announced it is launching a new train service between the UK, France and Belgium. ➡️ Uber Trains aims to run 10 high-speed trains from London to Paris, Lille and Brussels using the Channel Tunnel. ➡️ The trains will depart from Stratford International Station in East London and are expected to initially focus on the London to Paris route. Passengers would be able to book tickets via the Uber app. ➡️ Uber will partner with start-up Gemini Trains to launch the new service, which could be operational as soon as 2029, subject to receiving the necessary permits.

For the first time ever

Apple $AAPL is reportedly planning 3 straight years of major iPhone redesigns, according to Bloomberg 2025: The iPhone Air 2026: Foldable iPhone 2027: 20th anniversary iPhone with a curved glass Source: Mario Nawfal

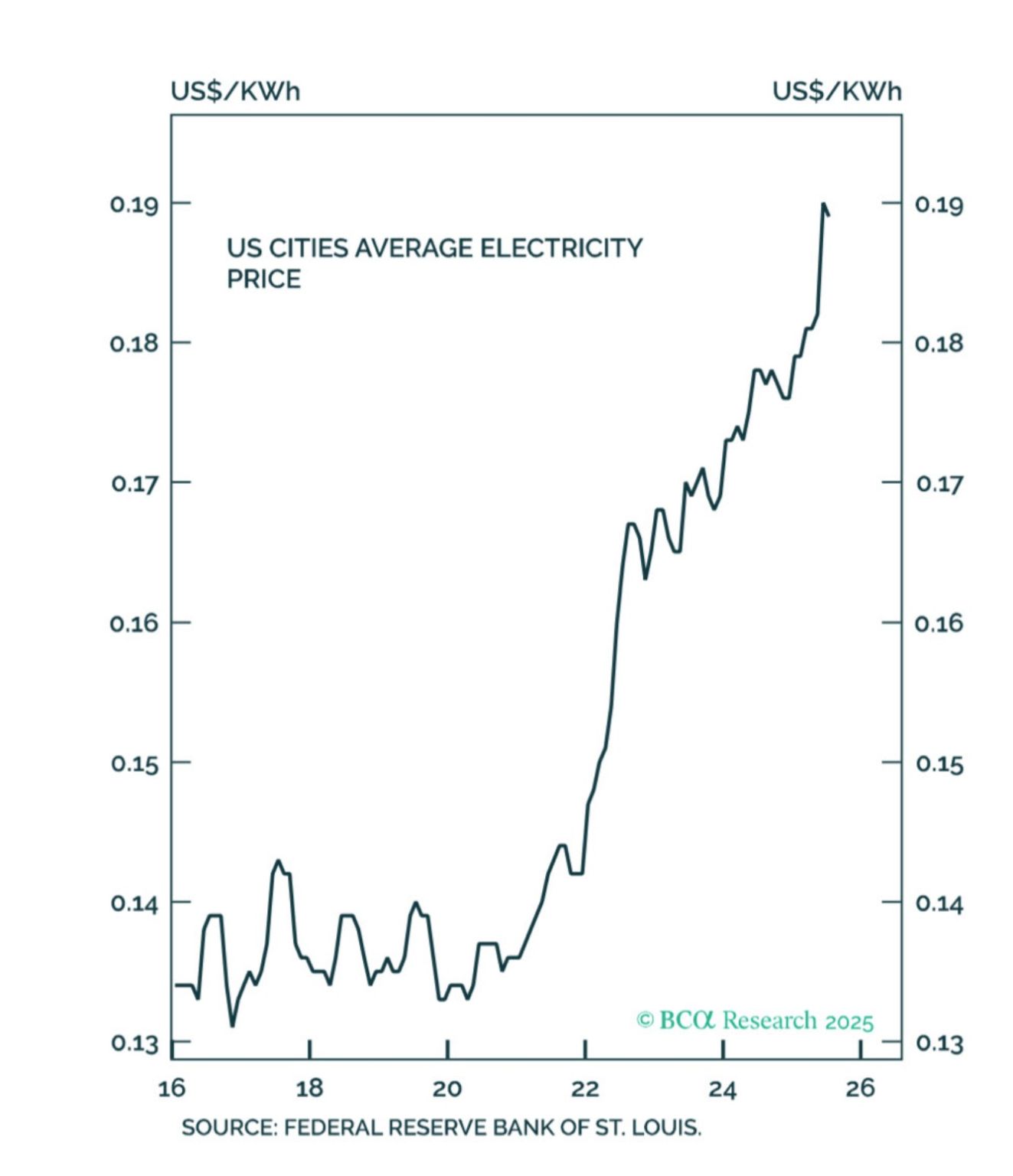

Is data center capex about to hit an energy wall?

Source: Peter Berezin @PeterBerezinBCA

People who bought Palantir last week

(Palantir has officially entered bear market territory). Source: Not Jerome Powell

Another day of rotation out of tech

Source: Daily sp500 heat map by Finwiz

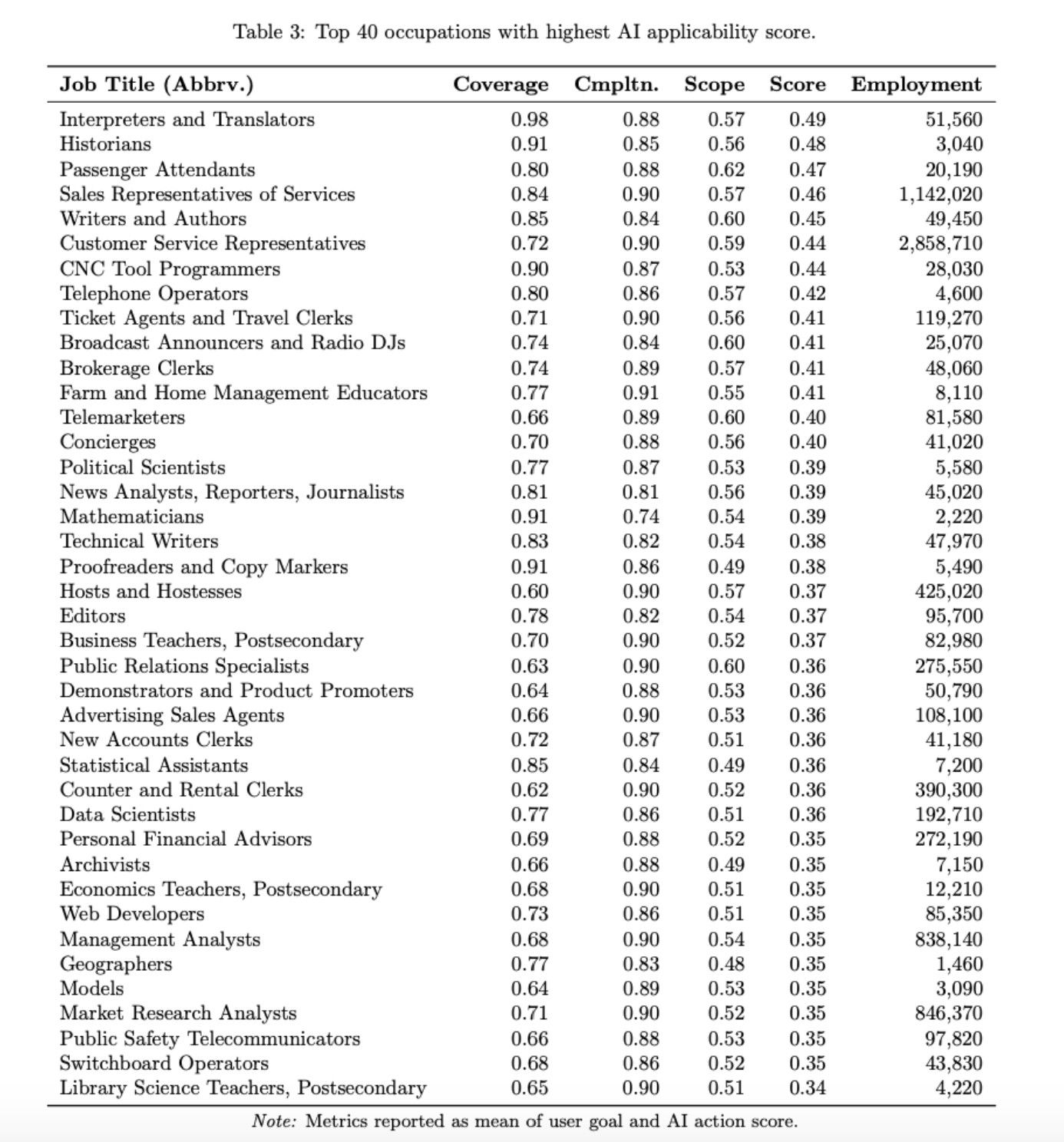

Microsoft, $MSFT, has said that these are the 40 jobs most at risk by AI

Source: unusual whales

Investing with intelligence

Our latest research, commentary and market outlooks