Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Buy-now-pay-later firm Klarna reported AI-driven sales growth for the second quarter, enabling the company to generate revenues of $1 million per employee.

👉 The Swedish company said it had 20% like-for-like sales growth in the second quarter, with total revenues coming in at $823 million for the period. 👉The firm also saw adjusted operating profits of $29 million, up significantly from the first quarter’s $3 million. “AI adoption continues to deliver significant, tangible results. As a result of this strategy, average revenue per employee reached $1.0m, up 46% [year on year in the second quarter],” the company said in its quarterly report. 👉Klarna has aggressively leveraged AI to boost productivity performance. It has shed two in five jobs over the past two years as a result. “This shift reflects the growing impact of AI and automation in eliminating manual, time-consuming work across Klarna,” the company had said in its first-quarter results.

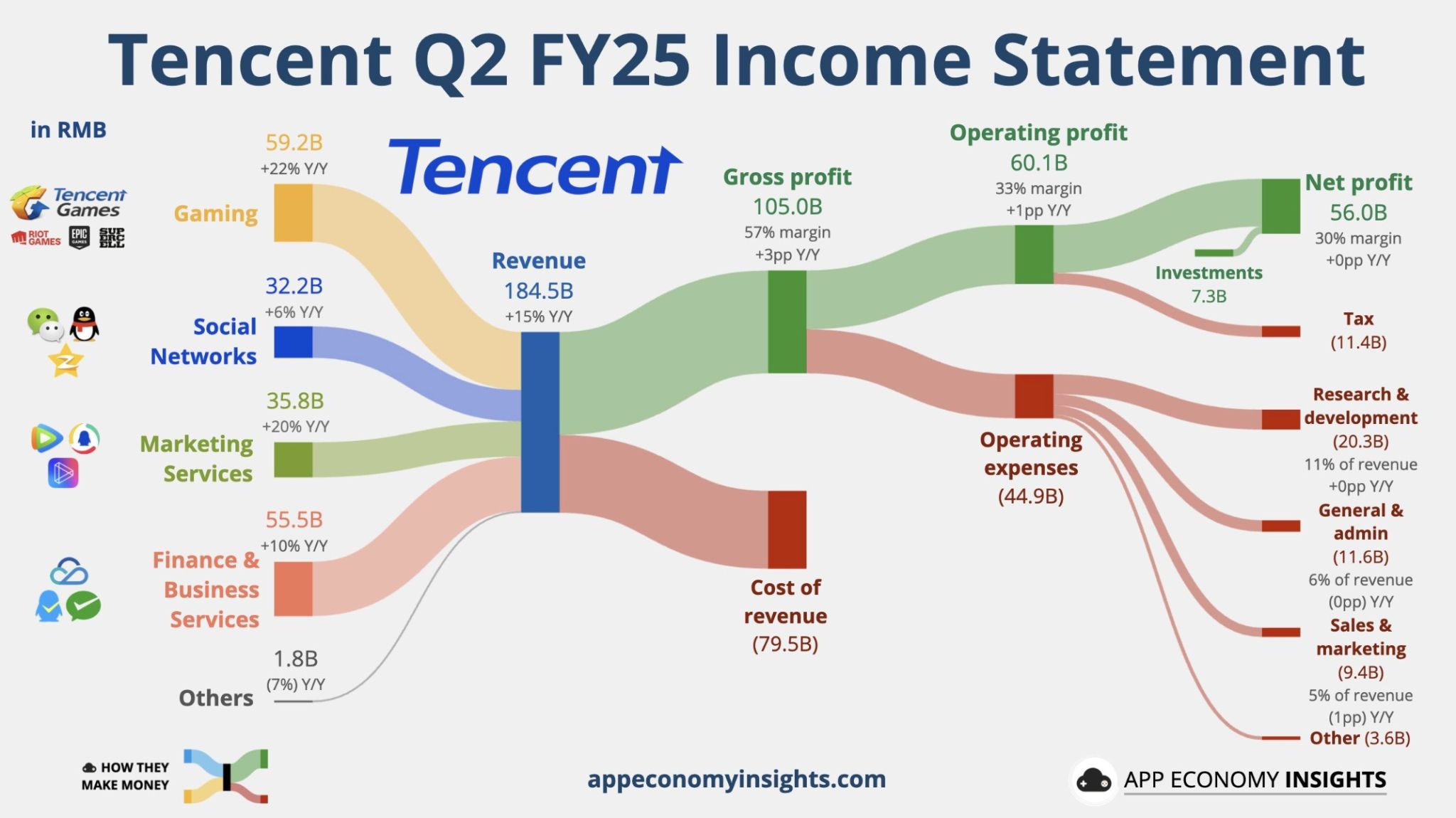

Tencent on Wednesday reported a 15% jump in second-quarter revenue as a strong performance in its gaming unit and AI investments boosted growth.

The ADR is up 7% today $TCEHY Tencent Q2 FY25: Revenue +15% Y/Y to RMB185B ($25.7B). Gaming +22% Social Networks +6% Marketing Services +20% Fintech & Business +10% Weixin/WeChat: 1.4B MAU (+3% Y/Y). Capex +119% to RMB19B ($2.7B). Source: App Economy Insights @EconomyApp

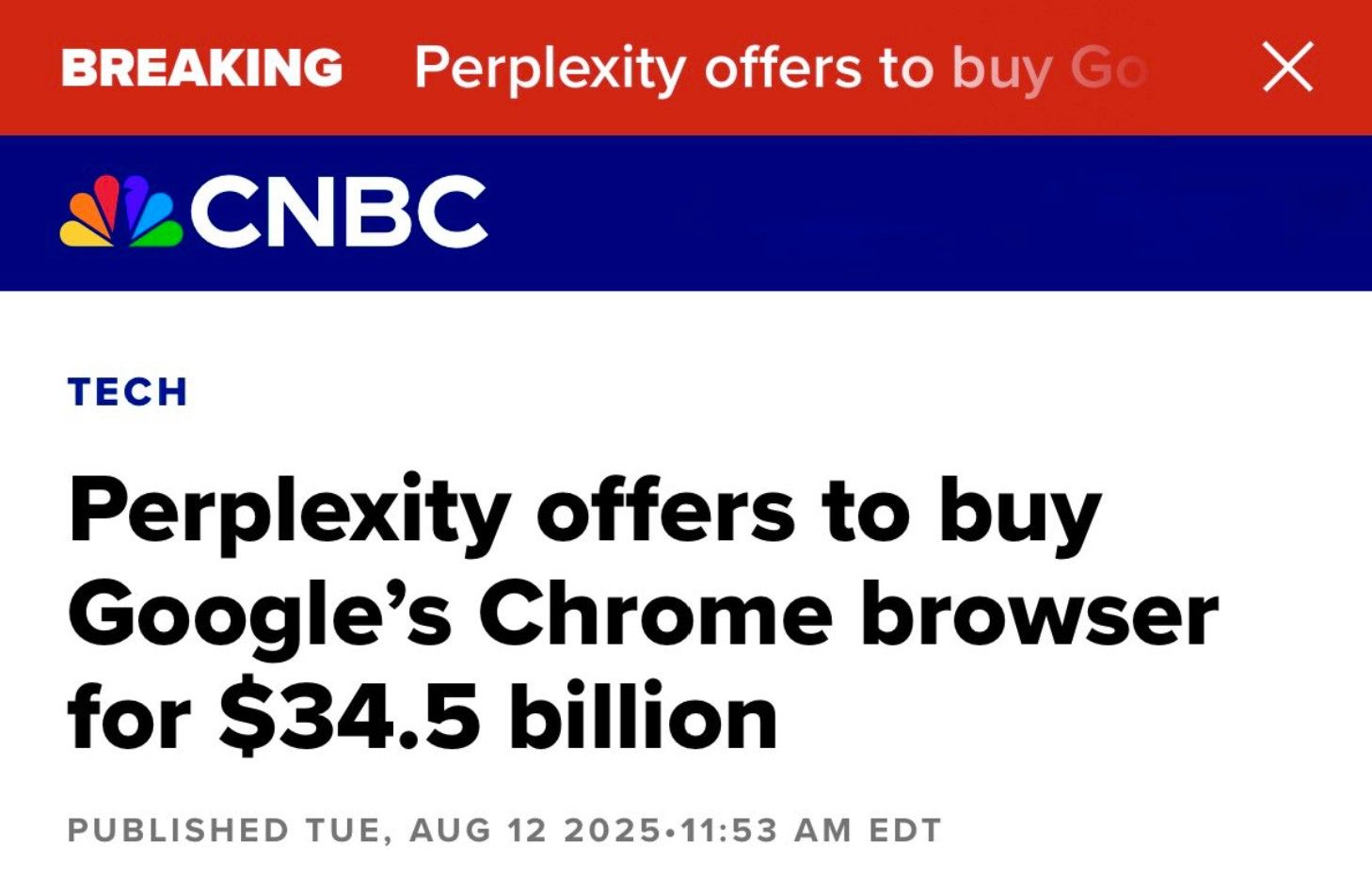

Perplexity, valued at $18 billion, is offering $34.5 billion to buy Google Chrome.

Source: CNBC

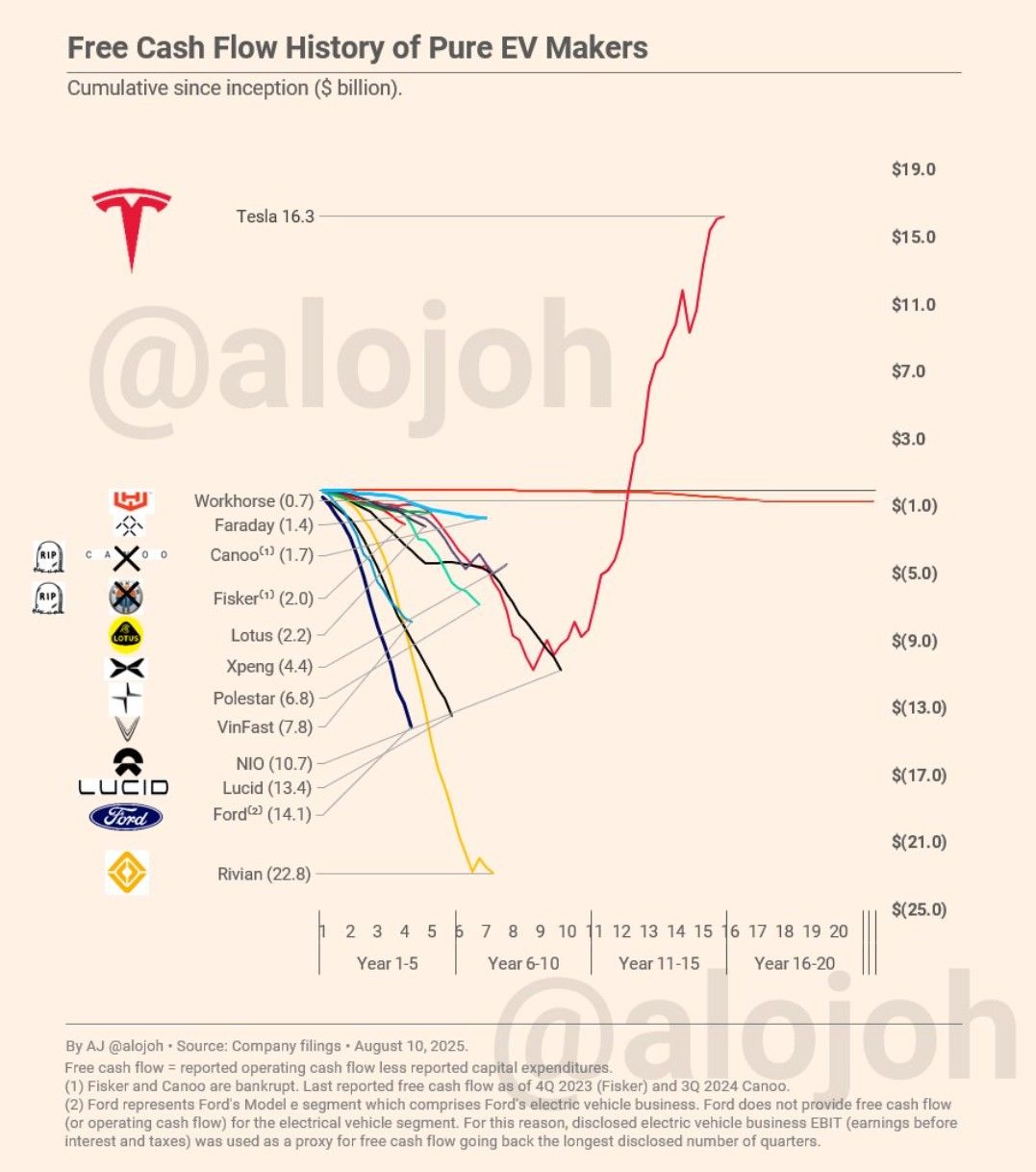

Free cash flow of pure electric vehicles makers

Updated for Tesla, Rivian, Lucid, and Ford EV Q2 2025. His key observations: 1. The EV business is a tough one 2. Only Tesla manages to generate positive free cash flow. 3. Ex Tesla, the shown companies accrued $88 billion in cash burn (net negative cumulative free cash flow). 4. In terms of cash burn, Rivian is the most underperforming EV maker: nobody has accrued a higher cash burn, not nearly. Will we see a similar story with robotaxis? Source: AJ @alojoh

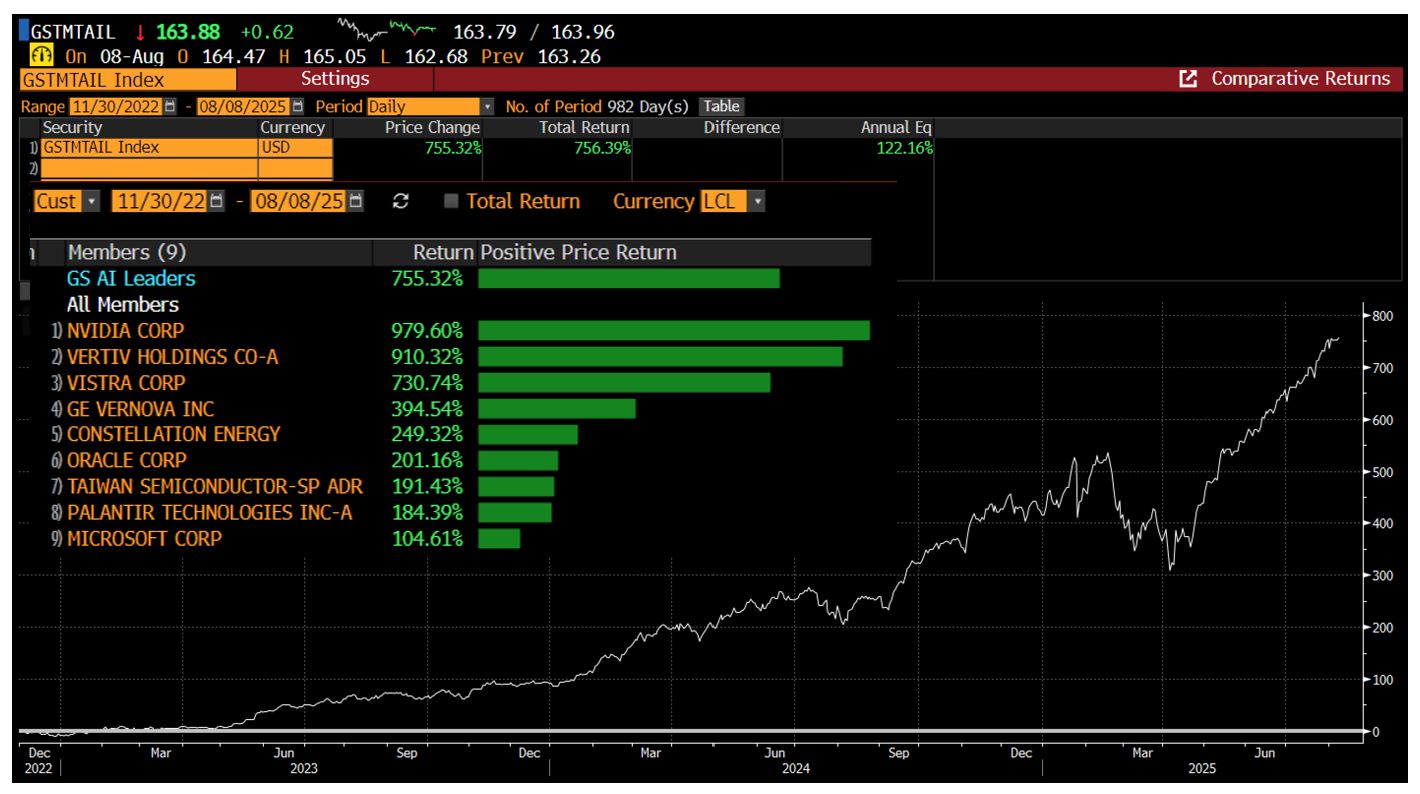

The Goldman Sachs AI Leaders Basket

Consisting of the 9 leading AI stocks (semiconductors: Nvidia, TSMC), software/data center (Palantir, Oracle, Microsoft, Vertiv), and power/infrastructure (GE Vernova, Constellation, Vistra) has made 756% since ChatGPT launch in 2022, an avg of 122% per year! Source: Bloomberg, HolderZ

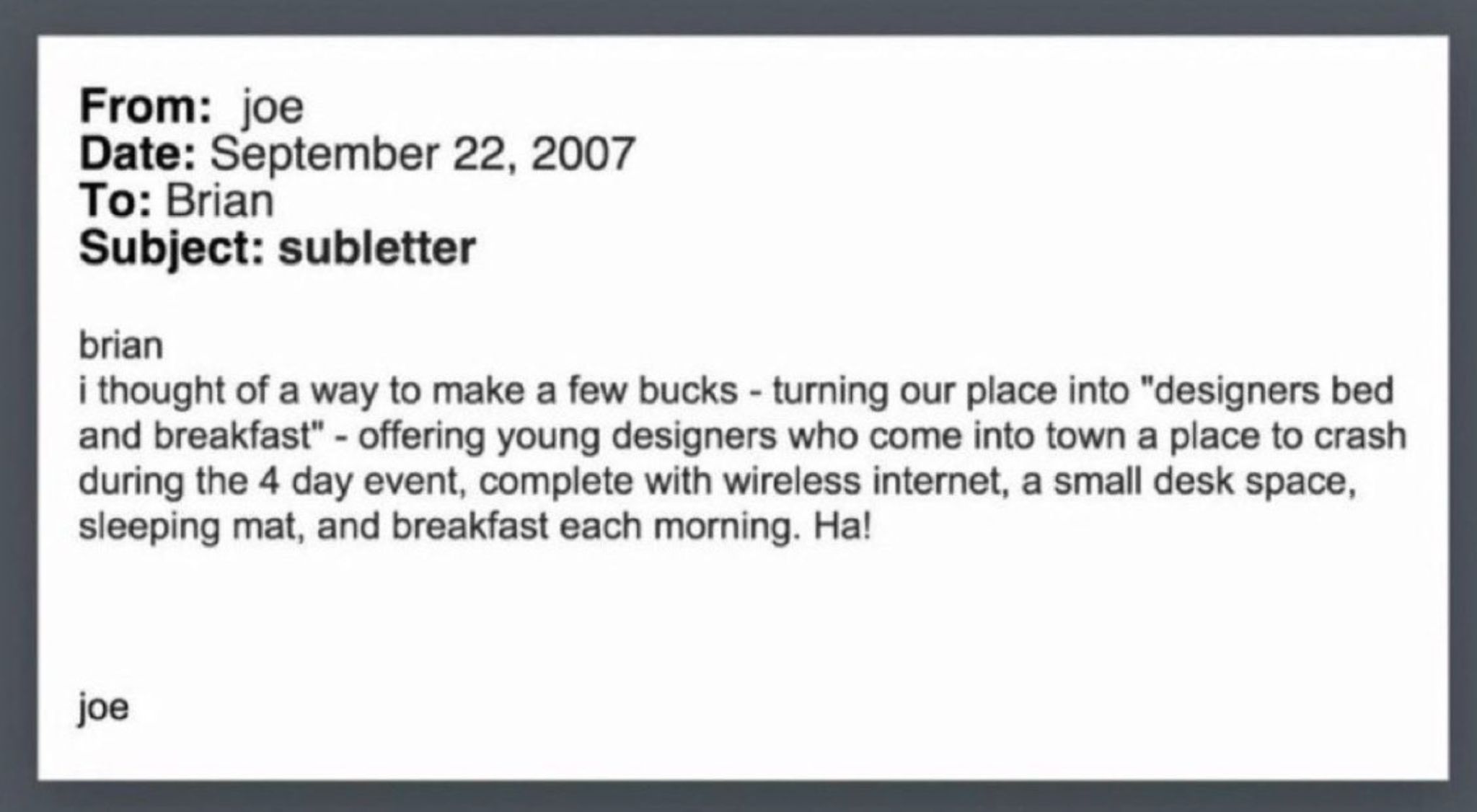

2007: Airbnb was an idea. 2025: $45 million in revenue a day.

Source: Jon Erlichman

Apple $AAPL Proof of Life

White House adviser says new $APPL US investment likely to be announced today. Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks