Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

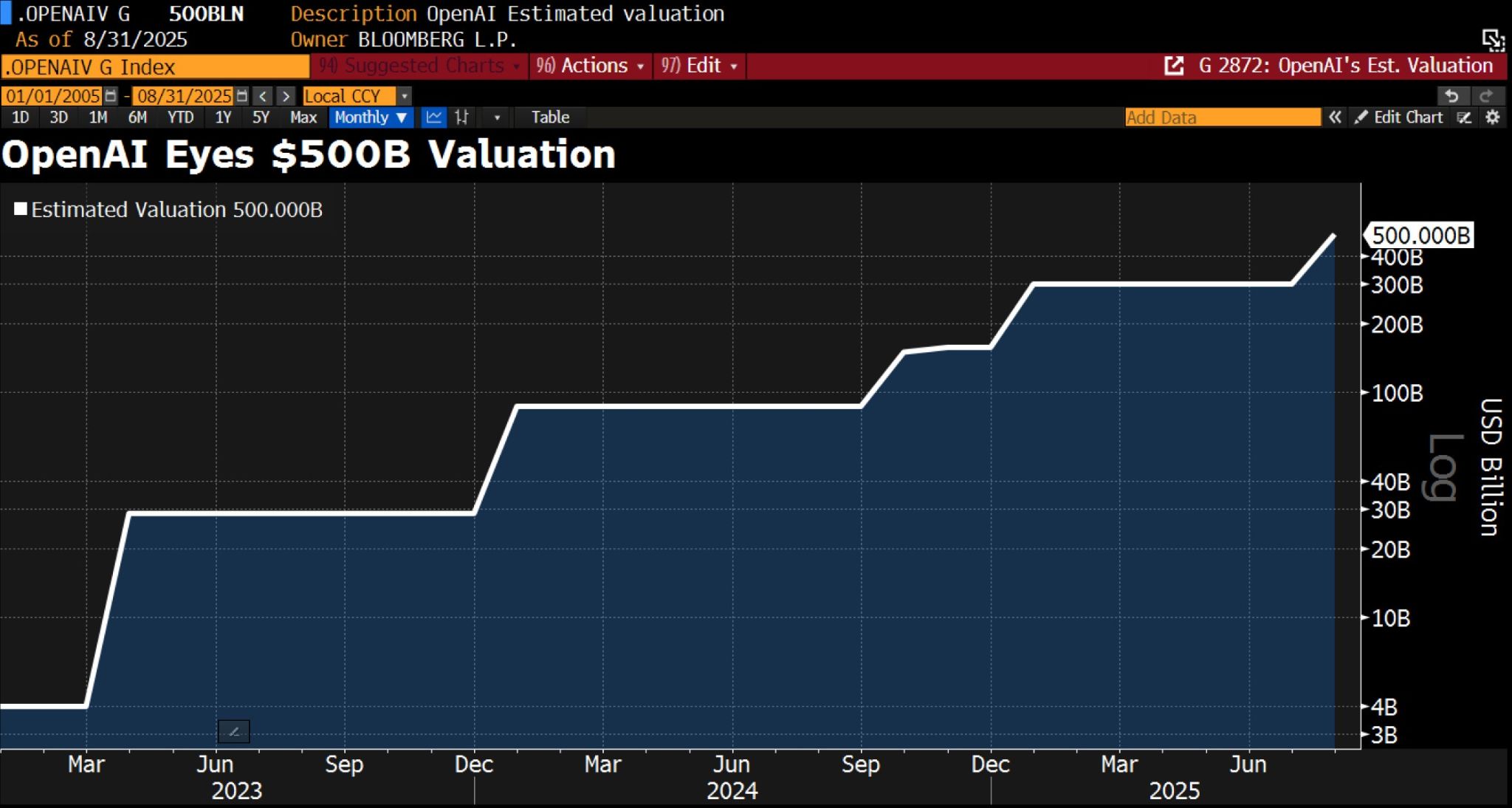

OpenAI might soon be worth $500bn – thanks to a potential stock sale for employees.

The company is reportedly in early discussions to allow current and former employees to sell their shares, which would value OpenAI at roughly $500bn. Source: HolgerZ, Bloomberg

Apple $AAPL increases commitment to $600 billion, announces american manufacturing program.

“Today, we’re proud to increase our investments across the United States to $600 billion over four years and launch our new American Manufacturing Program,” - Tim Cook Source: Evan on X, FT

Trump: 100% tariff on chips, semiconductors. Exempt from tariff if made commitment to build in US.

However, companies like hashtag#Nvidia ( $NVDA ) and hashtag#Apple ( $AAPL ), which have already invested heavily in U.S. manufacturing, are exempt from the new policy... Source: CNBC

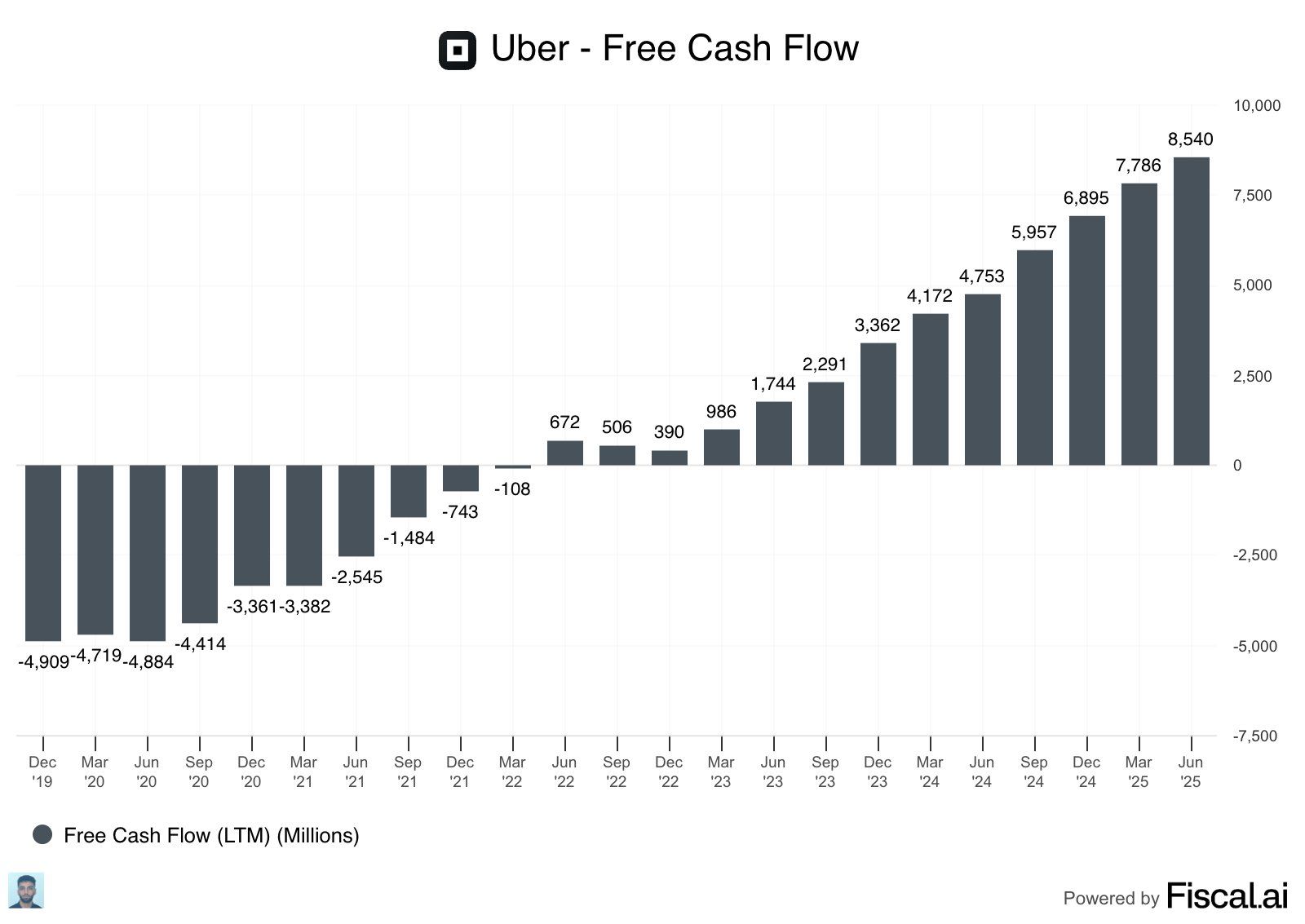

Updated Uber Free Cash Flow chart is incredible.

$8.5B and counting! 🤯 $UBER Source: Fiscal.ai

Super Micro shares plunge 15% on weak results, disappointing guidance...

Nothing super about it.... $SMCI 🩸 Here’s how the company did in comparison with LSEG consensus: - Earnings per share: 41 cents adjusted vs. 44 cents expected - Revenue: $5.76 billion vs. $5.89 billion expected Source: Trend Spider

Top AI companies by Market Cap

Source: Mark Roussin, CPA @Dividend_Dollar

$PLTR absolutely destroyed their Q2 earnings

Palantir topped Wall Street’s estimates Monday, surpassing $1 billion in quarterly revenue for the first time, and hiking its full-year guidance. Shares rallied more than 5%. • Sales $1.0B vs Est. $939M • EPS $0.16 vs Est. $0.13 • US Commercial: $306M -- up 93% YoY • Customer count up 43% YoY Q3 Outlook • Sales $936M vs Est. $899M • Operating Profit $495M vs Est. $417M FY25 Outlook • Sales $4.14B vs Est. $3.90B • Operating Profit $1.92B vs Est. $1.72B Source: Shay Boloor @StockSavvyShay, CNBC

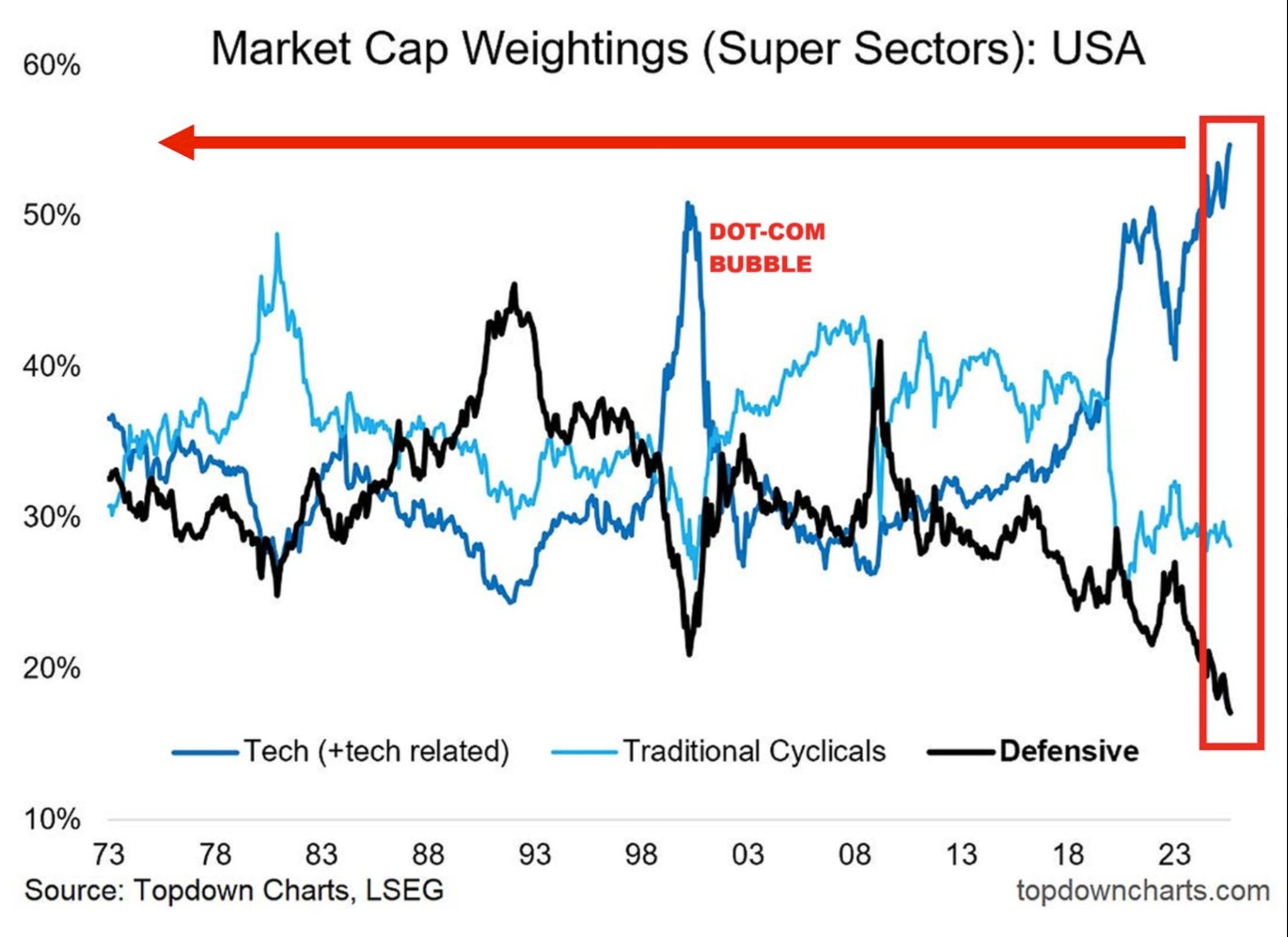

It is all about tech...

US technology and tech-related stocks now account for ~55% of the US stock market, the highest share EVER. It has exceeded the 2000 Dot-Com Bubble levels by ~5 percentage points. By comparison, defensive stocks now reflect ~18% of the market. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks