Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

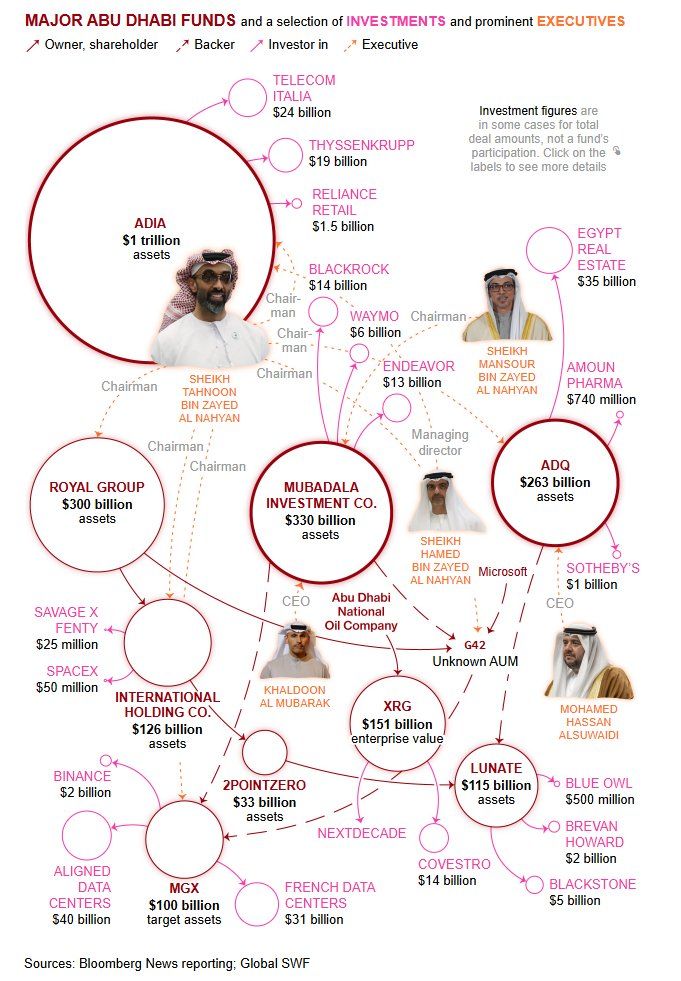

"It’s uncommon for a city to have even one sovereign wealth fund; the UAE’s capital has three"

This bloomberg article is a nice overview of how and where Abu Dhabi invests its wealth. Source: Ziad Daoud @ZiadMDaoud

Major Move from Saudi Arabia’s PIF — Right Before a White House Visit

Saudi Arabia’s Public Investment Fund (PIF) just made a big statement. In Q3, the near-$1 trillion sovereign wealth fund fully exited nine US-listed companies — including names like Visa and Pinterest — cutting its exposure to US equities by 18%. Yet PIF still holds $19.4B across six US-listed giants, including Uber and Take-Two Interactive. For context? Its US equity holdings once peaked at $56B in late 2021. And then there’s the gaming play. 🎮 PIF has kept its stake in Electronic Arts — but that will soon shift off the US-listed books once the $55B take-private mega-deal closes. It’s the largest leveraged buyout in history. PIF is leading the consortium alongside Silver Lake Capital and Jared Kushner, with PIF writing the biggest equity check — positioning it as EA’s majority owner. This is just the latest move in a fast-growing gaming investment spree driven by Crown Prince Mohammed bin Salman’s personal interest in the sector. All of this lands right before the crown prince’s highly anticipated visit to the White House on Tuesday, where he is expected to meet President Trump and sign a series of major defence and trade agreements. 💬 Big question: Is this a strategic portfolio rebalance? A geopolitical signal? Or the beginning of a new investment era focused on entertainment, gaming, and national digital transformation? What’s your read on this move? Source: FT https://lnkd.in/e69yETNc

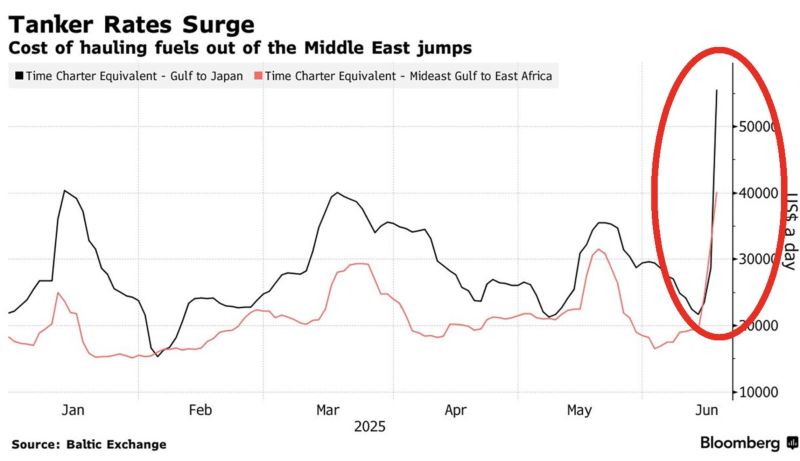

⚠️Middle East oil shipping costs are SPIKING:

Persian Gulf-Japan tanker rates hit $55k/day, the highest in over a year, while East Africa routes hit $40k, a multi-month peak. Costs doubled in 2 weeks amid the Israel-Iran conflict.

🟥 Crude Oil is now back above its 100 day moving average for the first time in more than 2 months.

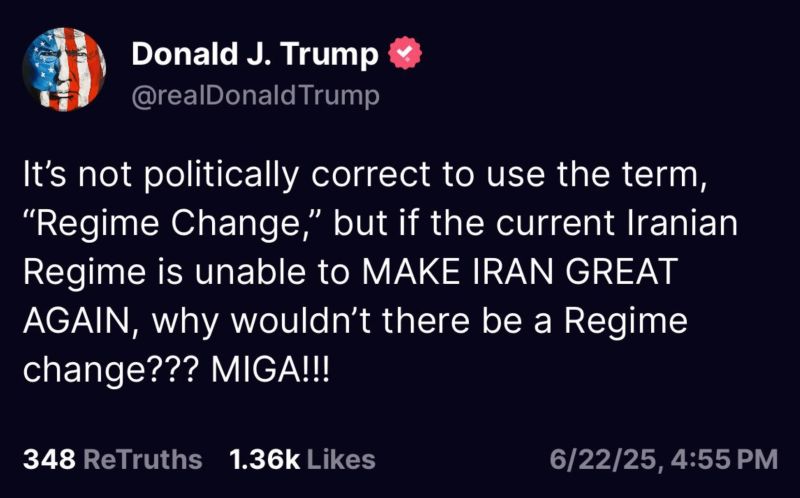

‼️ Oil prices edged higher on Thursday to their highest in more than two months, after U.S. President Donald Trump said U.S. personnel were being moved out of the Middle East, which raised fear that escalating tensions with Iran could disrupt supply. ➡️ Trump on Wednesday said U.S. personnel were being moved out of the Middle East because “it could be a dangerous place,” adding that the United States would not allow Iran to have a nuclear weapon. ⚠️ Reuters reported earlier on Wednesday that the U.S. is preparing a partial evacuation of its Iraqi embassy and will allow military dependents to leave locations around the Middle East due to heightened security risks in the region, according to U.S. and Iraqi sources.

BREAKING: OpenAI and $NVDA unveil “UAE Stargate”

• Massive 5 GW AI campus planned for Abu Dhabi • 200 MW AI cluster set to launch in 2026 • Oracle, SoftBank, and Cisco onboard to help build out the datacenter infrastructure Source: Stocktwits

🚨BREAKING: Trump's $1.2T Qatar Deal - The BIGGEST deal in US-Gulf history.

➡️ Boeing and GE Aerospace Deal: The centerpiece of the agreements is a $96 billion deal with Qatar Airways for the purchase of up to 210 Boeing 787 Dreamliner and 777X aircraft, powered by GE Aerospace engines. This is described as the largest widebody aircraft order in Boeing’s history, expected to support approximately 154,000 U.S. jobs annually during production and delivery. ➡️ Defense and Security Investments: The deal includes a statement of intent for $38 billion in future investments in Qatar’s Al Udeid Air Base, as well as other air defense and maritime security capabilities, strengthening U.S.-Qatar security cooperation. ➡️ Other Commercial Agreements: Additional private sector deals include: McDermott’s $8.5 billion in energy infrastructure projects in Qatar. Parsons securing 30 projects worth up to $97 billion for engineering services. A joint venture between Quantinuum and Al Rabban Capital for up to $1 billion in quantum technologies and workforce development in the U.S.

Investing with intelligence

Our latest research, commentary and market outlooks