Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Brent Oil hits $90/bbl for 1st time since Nov as Saudi Arabia extended its unilateral oil production cut by another three months

Source: Bloomberg, Holger

Soccerflation...Perks that Neymar Júnior will receive in Saudi Arabia:

• €100M-a-year salary • House with 25 bedrooms • 40x10 meter swimming pool and 3 saunas • 5 full-time staff for his house • Bentley Continental GT • Aston Martin DBX • Lamborghini Huracán • 24-hour driver • all bills for hotels, restaurants and various services during his OFF days will be sent to the club headquarters to be paid • Private plane at his disposal for his travels • €500,000 for each social media post that promotes Saudi Arabia Source: The world of Statistics

Saudi Arabia reduced its US treasury holdings by $3.2 Billion in June to the lowest level in nearly 7 years.

Source: FT

According to a FT article, Saudi Arabia and the United Arab Emirates are buying up thousands of the high-performance Nvidia chips

These chips are crucial for building artificial intelligence software, joining a global AI arms race that is squeezing the supply of Silicon Valley’s hottest commodity. The Gulf powerhouses have publicly stated their goal of becoming leaders in AI as they pursue ambitious plans to turbocharge their economies. But the push has also raised concerns about potential misuse of the technology by the oil-rich states’ autocratic leaders. According to people familiar with the moves, Saudi Arabia has bought at least 3,000 of Nvidia’s H100 chips — a $40,000 processor described by Nvidia chief Jensen Huang as “the world’s first computer [chip] designed for generative AI” — via the public research institution King Abdullah University of Science and Technology (Kaust).

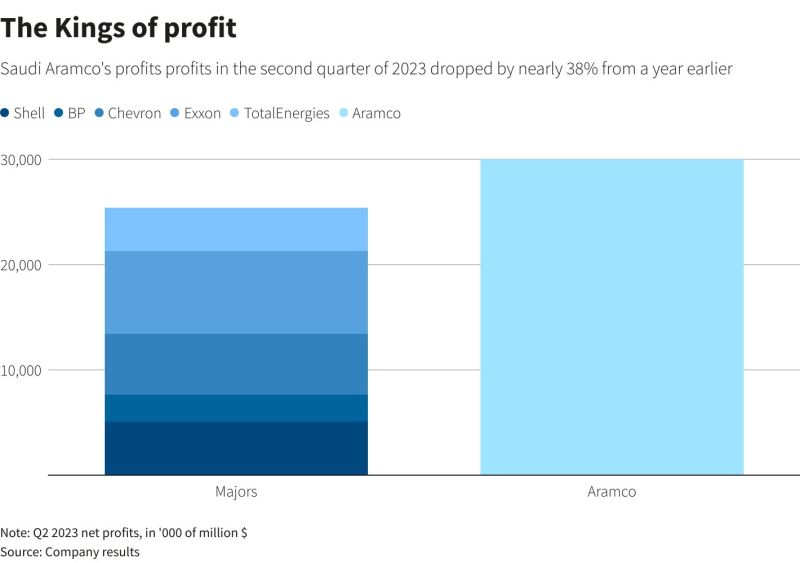

Saudi Aramco 2Q 2023 profit vs. profits of the Majors

Source: company results

BlackRock names Saudi Aramco CEO Amin Nasser to board

Middle East and Saudi Arabia strategic importance for the global economy and financial markets is growing at a fast pace. BlackRock said Monday that Amin Nasser, the CEO of Saudi Aramco, the world’s largest oil company, is joining the asset manager’s board of directors. The world’s largest asset manager said the move reflects the firm’s emphasis on the Middle East as part of its long-term strategy. BlackRock had more than $8 trillion in client assets under management as of 2022. (NB: Not sure that the #esg activists will like it...) Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks