Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

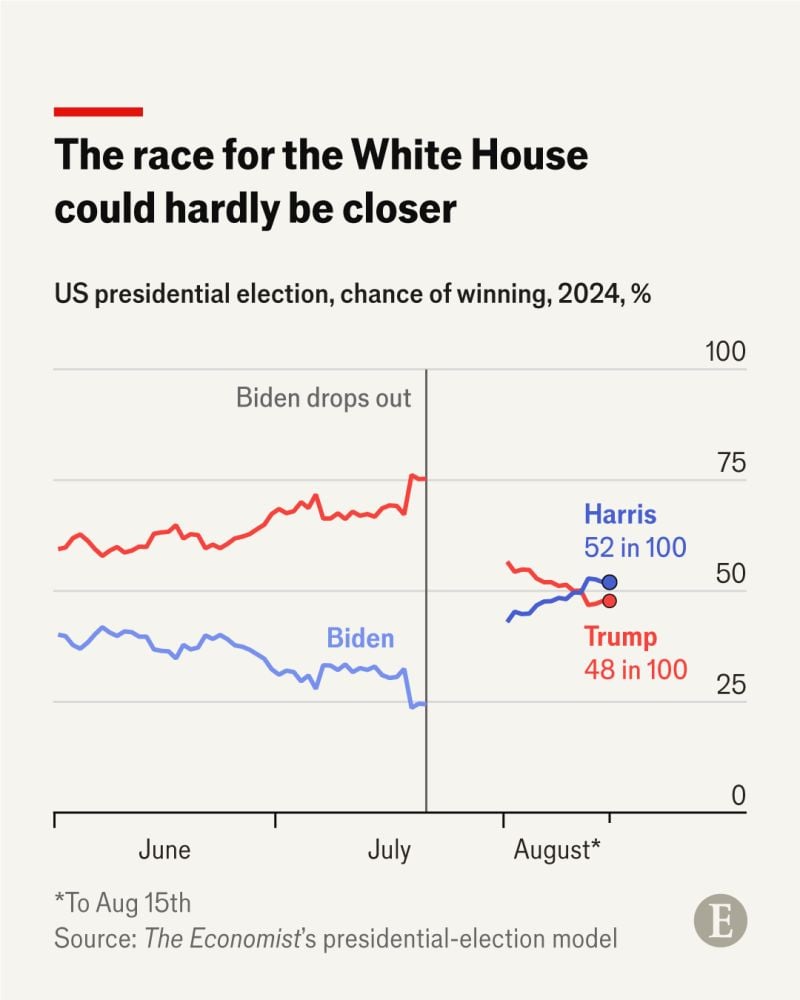

The Economist revised forecast shows the presidential election between Kamala Harris and Donald Trump is, in effect, a toss-up.

Source: The Economist

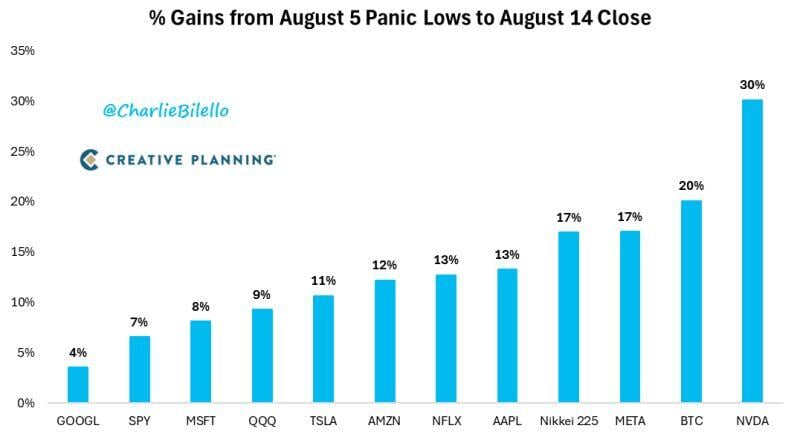

BREAKING 🚨 The S&P 500 has added nearly $4 TRILLION in market cap since the August 5th bottom

That's $4 trillion in 9 trading days or $444 billion PER TRADING DAY since August 5th. Source: The Kobeissi Letter

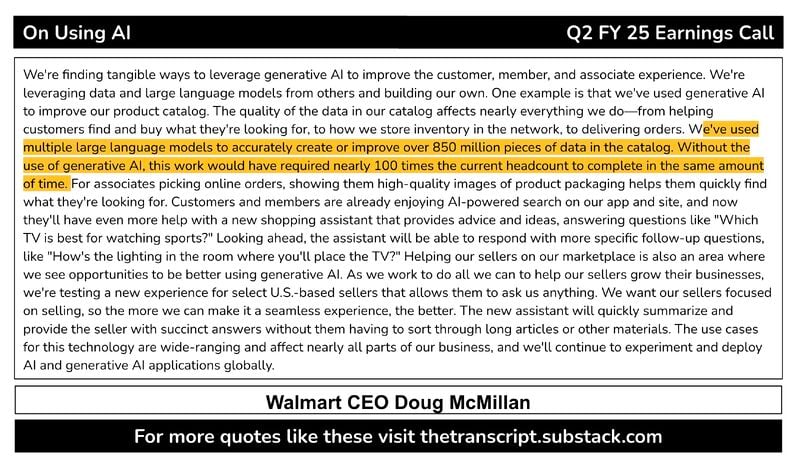

Walmart CEO on using AI

"We've used multiple LLMs to accurately create or improve over 850,000,000 pieces of data in the catalog. Without the use of hashtag#generativeAI, this work would have required nearly 100X the current headcount to complete in the same amount of time" $WMT Source: The Transcript

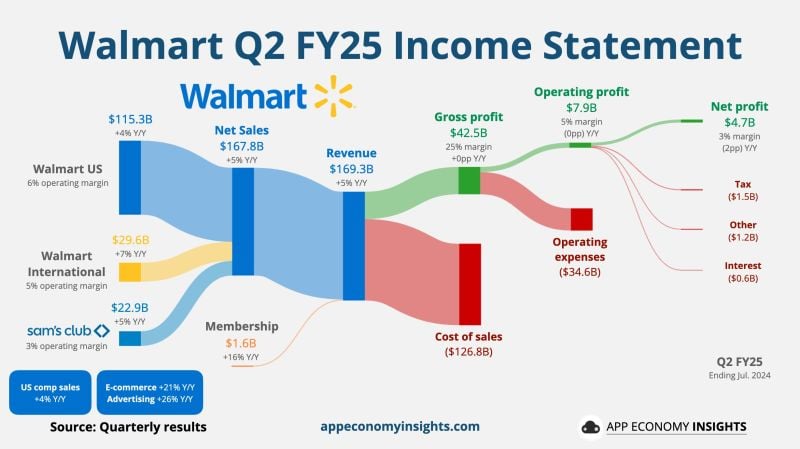

$WMT Walmart Q2 FY25 (ending in July):

• Revenue +5% Y/Y to $169.3B ($1.9B beat). • Non-GAAP EPS $0.67 ($0.02 beat). • Walmart US comp sales +4%. • E-commerce +21% Y/Y. • Advertising +26% Y/Y. FY25 Guidance: • Net sales +3.75% to 4.75% Y/Y (0.75% raise). Source: App Economy Insights

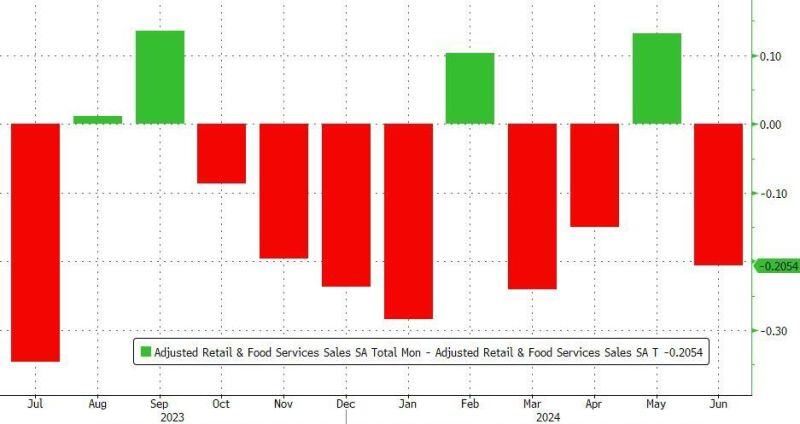

US retail sales prior month revisions: red means down...

Indeed, for the eighth month in the last year, the previous month's data was revised lower... thus making the current month 'beat' more impressive. Source: www.zerohedge.com

JP Morgan's Jamie Dimon wants to hit US millionaires with the "Buffet rule" to tackle the national debt

Source: Business Insider

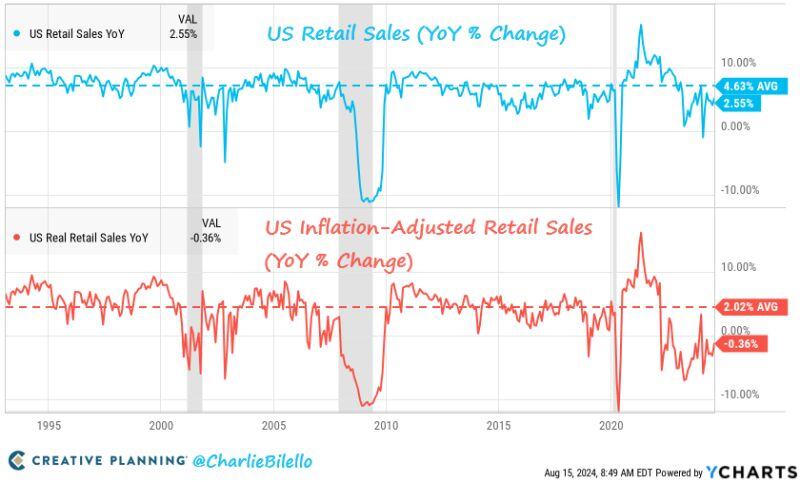

US Retail Sales increased 2.6% over the last year and this number is taken positively by markets

Retail sales came in better than expecting indicating that hashtag#consumers are still strong. Retail Sales month-over-month is the best number since January 2023. There are few caveats though: 1) After adjusting for higher prices they were down 0.4%. 2) Both of these numbers are well below the historical averages of +4.6% nominal and +2.0% real. 3) Previous numbers were revised downward Source: Charlie Bilello

Gains from last Monday's (8/5) panic lows...

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks