Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

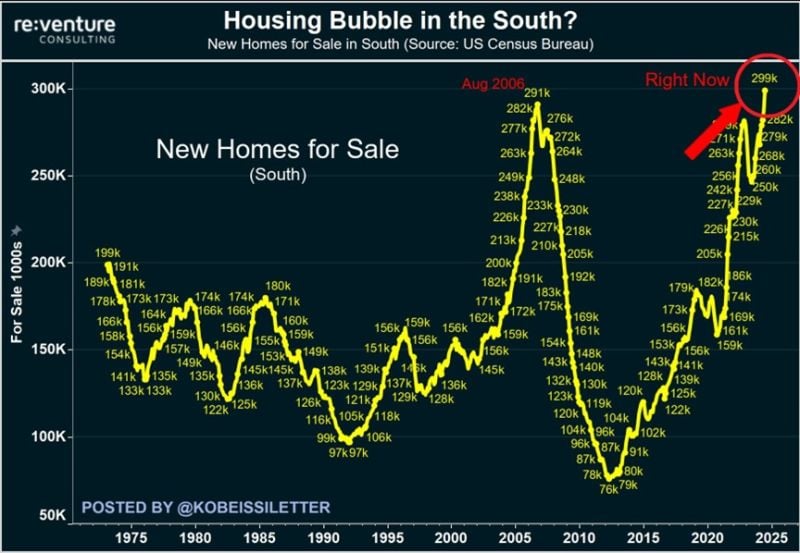

BREAKING: There are now a record 299,000 new homes for sale in the Southern US states, according to Reventure.

This is even higher than in 2006, a year before the housing market crash began. The number of new houses for sale in the South has nearly DOUBLED in just 4 years. Meanwhile, new home sales have officially dropped below pre-pandemic levels for the first time. It would take ~9 months current new inventory to sell if it sold at the current pace without new inventory coming to the market, 2nd longest duration since 2009. Source: The Kobeissi Letter, Reventure

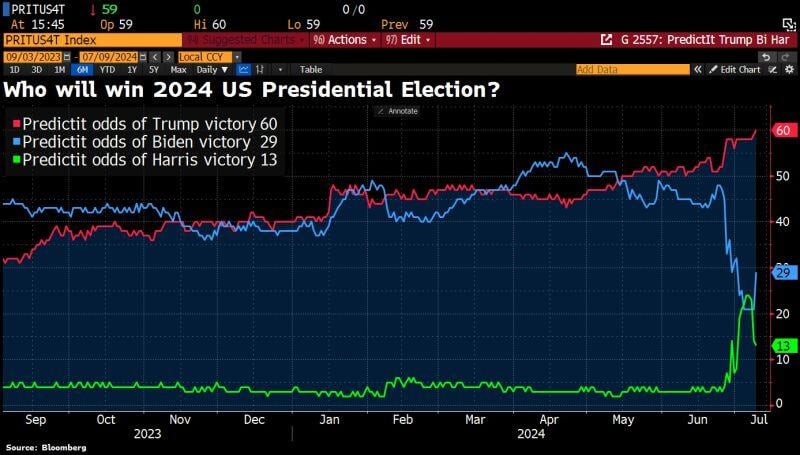

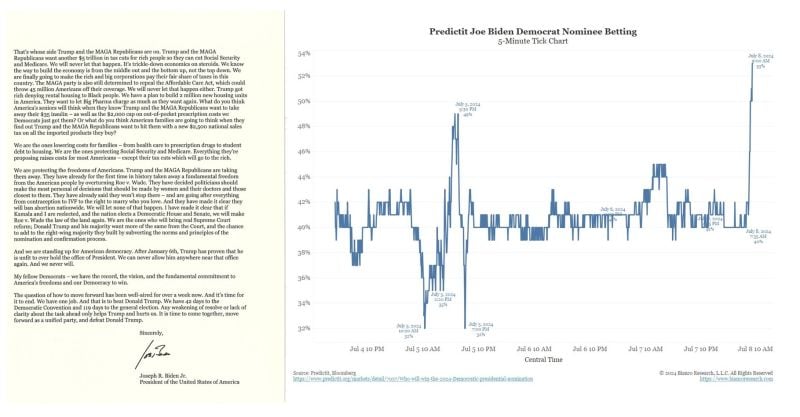

Looks like Biden keeps the lead on Democrats nomination and this means a high probability of Trump winning Presidential election

Source: HolgerZ, Bloomberg

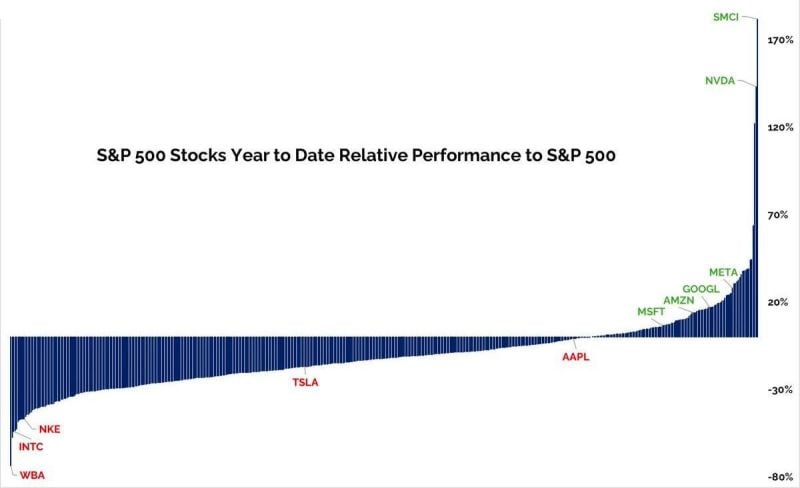

A good chart on how narrow the US market has been this year:

Source: Hidden Value Gems This was actually made originally by Grant Hawkridge https://lnkd.in/e8nwsZYA

Biden sent this letter to congressional Democrats on Monday morning saying he is 'firmly committed to staying in this race.'

Here is the reaction (this is a 5-minute chart of Predictit betting that Biden is the nominee) Source: James Bianco, Bianco Research

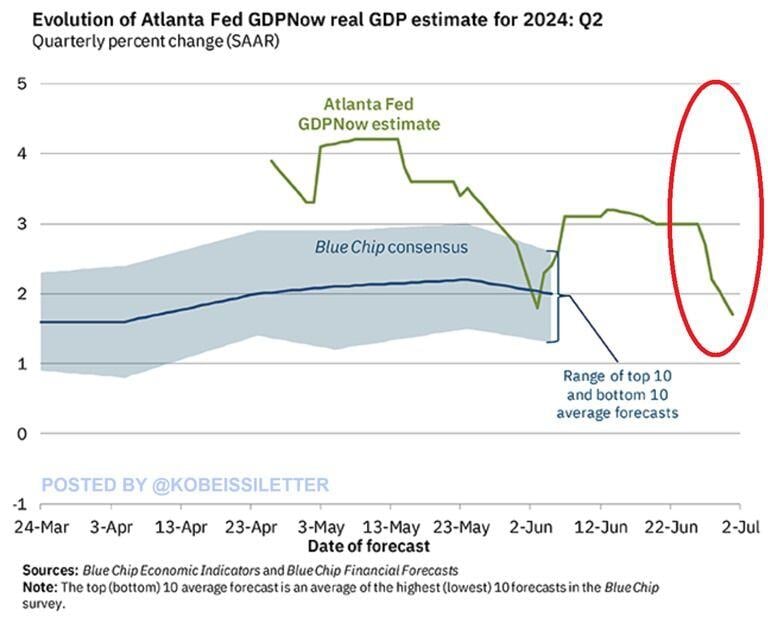

US GDP growth estimates are plummeting: The most recent Atlanta Fed estimate for real US GDP quarterly growth in Q2 2024 is down to 1.7%.

This estimate is down from 4.2% seen in mid-May and from 2.2% seen on June 28th. If this estimate turns out to be correct it will be the 2nd consecutive quarter of GDP growth below 2.0% after Q1 2024 GDP of 1.4%. Is the US economy finally slowing down? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks