Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

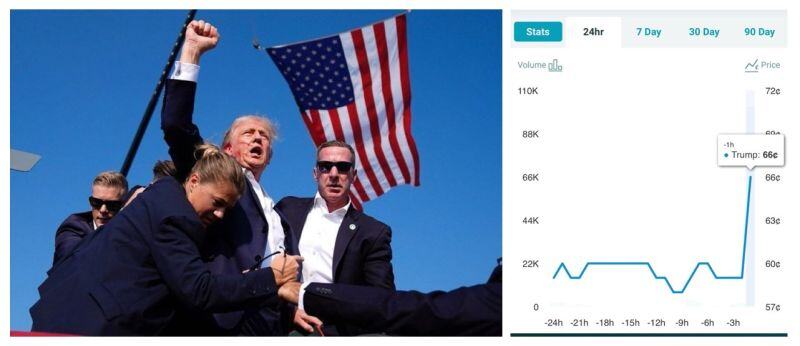

Trump Media shares $DJT surge 50% in premarket trading after assassination attempt

.

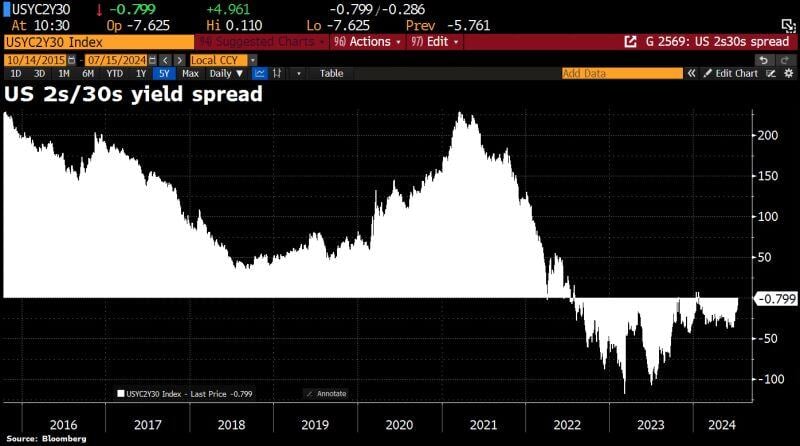

US 2s/30s yield spread briefly turns positive for 1st time since January

Source: HolgerZ, Bloomberg

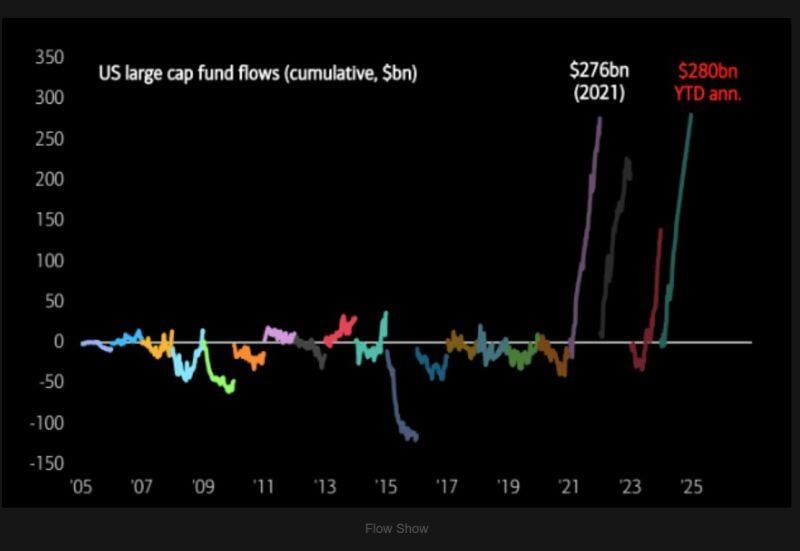

Inflows to US large cap funds on pace for 2nd largest on record.

Source: Flow Show, TME

Probably the best aerial pic of Saturday's drama via @nypost

.

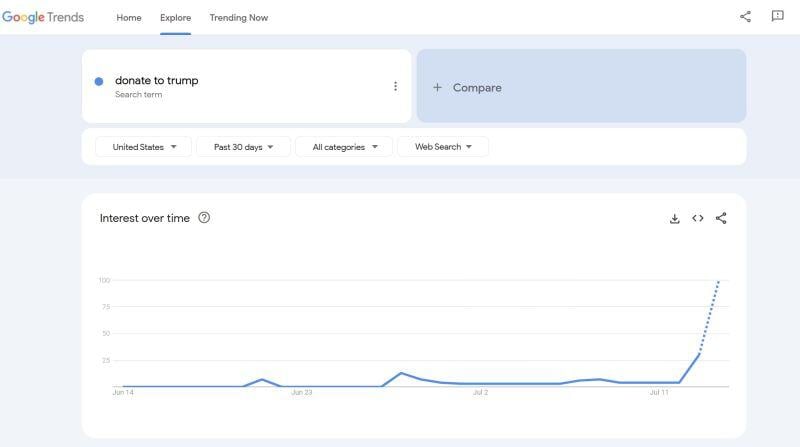

Surge In "Donate To Trump" Searches After Assassination Attempt

Source: Google Trends

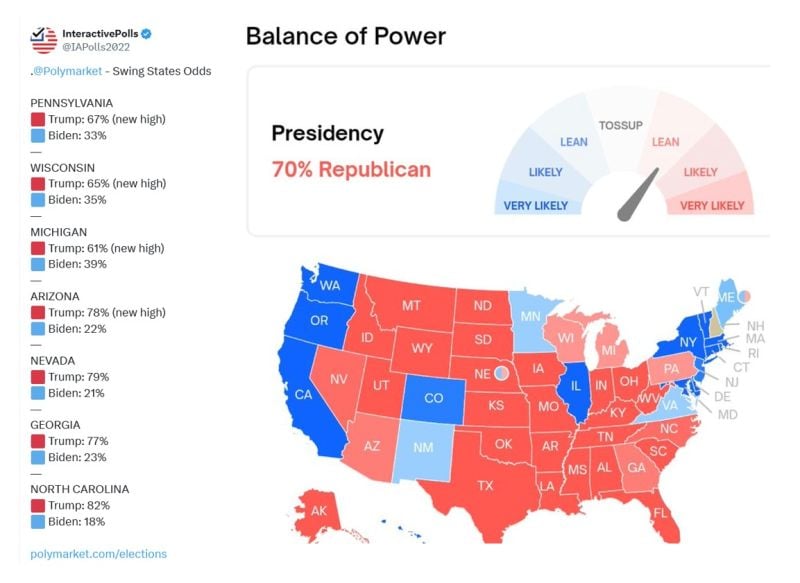

Swing States Odds by https://lnkd.in/eEVhR_yt

Source: Interactive Polls

Trump's strength in such a tough moment makes the contrast to Biden even larger...

This assassination attempt (the 1st of its kind in 43 years) took place 4 months before the Presidential election and days before Trump is to be officially named the Republican nominee at his party's convention. It is most likely a boost to his election - just watch the odds on PredictIt on the right. Worldwide, the image of a bloodied 78 years old man raising fist just a minute after the shooting is very powerful. But it also highlights how split America is.

Investing with intelligence

Our latest research, commentary and market outlooks