Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

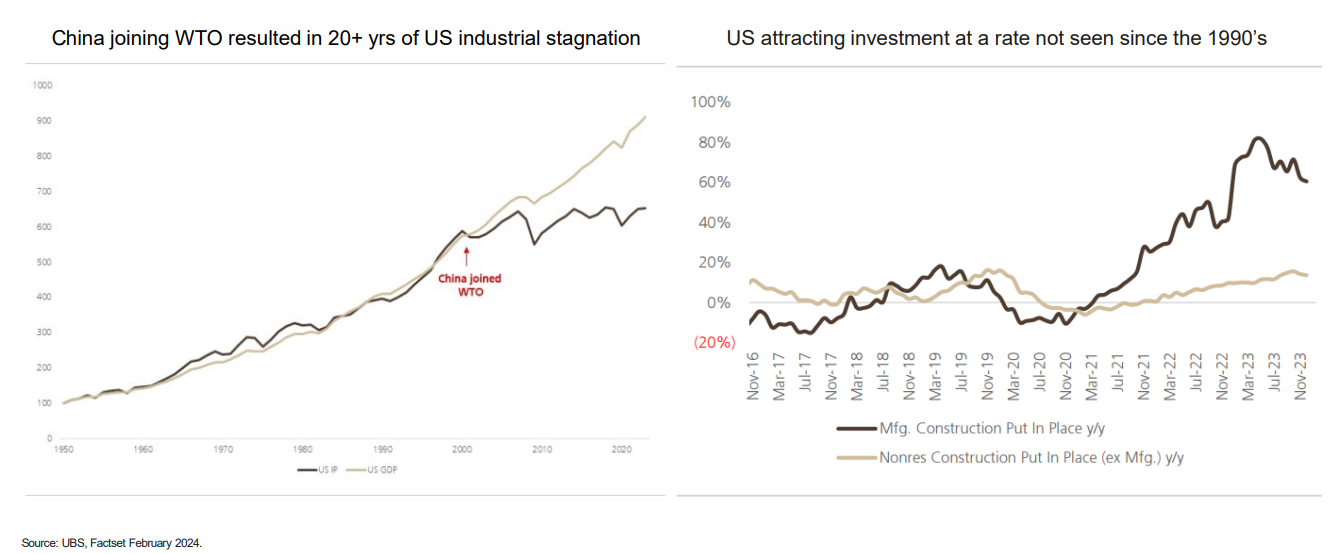

Trends in reshoring, electrification and AI are propelling US investment renaissance

Source: BNP Paribas Asset Management

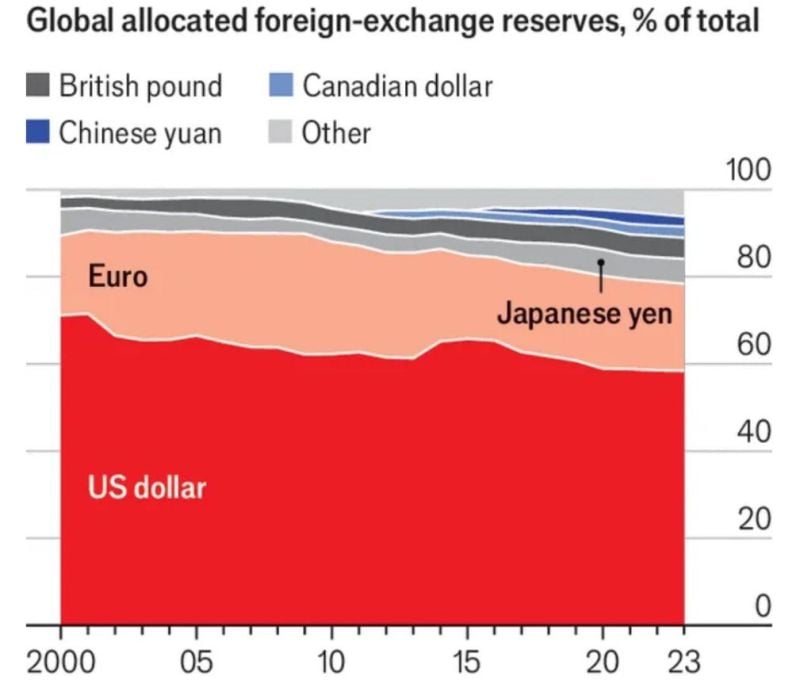

Global foreign exchange reserves.

The US dollar still dominates but share has been eroding sligthly Source: Michel A.Arouet

In case you missed it...

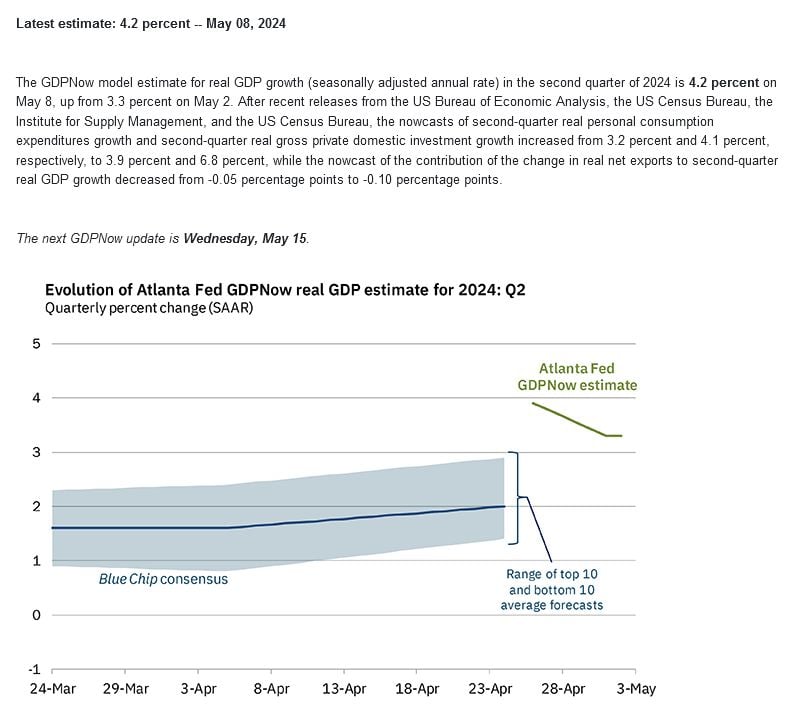

Atlanta Fed US Q2 GDP Now latest 4.18%, vs last 3.31%...

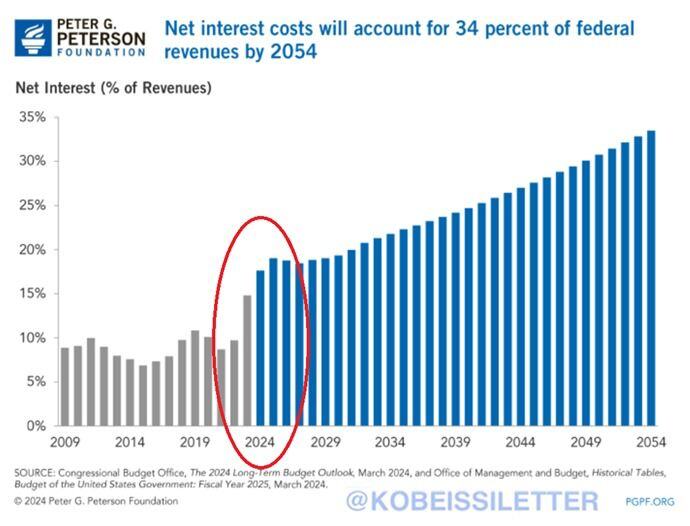

Shocking stat of the day by The Kobeissi Letter:

US net interest payments as a percentage of federal revenues are set to reach 34% by 2054. This means that ONE THIRD of all government revenue would be spent only to service the national debt. Over the past 8 years, the percentage has already doubled to ~15% and is at its highest in 3 decades. Meanwhile, nominal annualized interest payments have crossed above $1 trillion for the first time ever. We could see $1.6 trillion in annual interest expense by the end of the year if the Fed leaves rates steady. The US government needs lower interest rates more than anyone - i.e Fiscal policy leads monetary policy. Source: The Kobeissi Letter, Peter G.Peterson

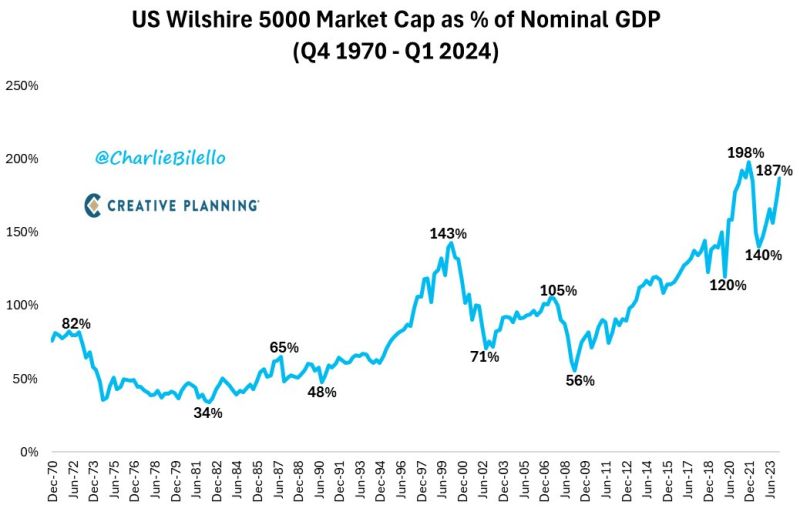

US Stock Market Capitalization as % of GDP...

1984: 42% 1994: 63% 2004: 93% 2014: 114% 2024: 187% Source: Charlie Bilello

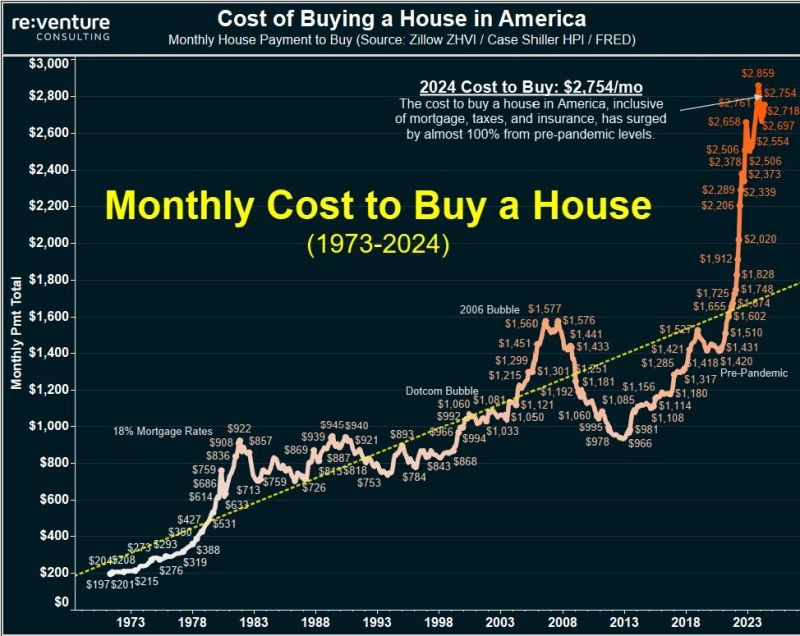

The cost of buying a home in the US rises to $2,750/month, the second highest ever recorded, according to Reventure.

Prior to the pandemic in 2022, the average home in the US would cost $1,400/month. In other words, it is now 100% MORE expensive to buy a home in 2024 compared to 2020. Even at the peak of the 2008 Financial Crisis, the average home payment peaked at $1,550/month. The average US family would need to spend 44% of their PRE-TAX income to buy a home today. Source: The Kobeissi Letter, re.venture

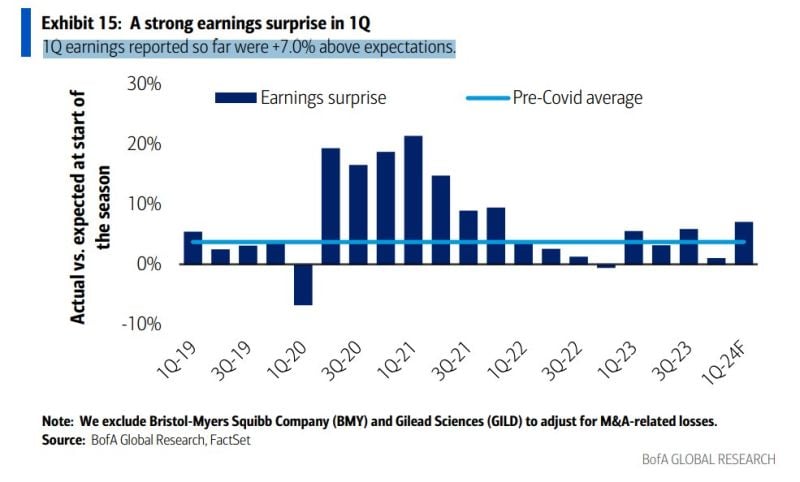

US earnings season UPDATE: 1Q earnings reported so far are +7.0% above expectations. (Clone)

Source: Mike Zaccardi, BofA

Investing with intelligence

Our latest research, commentary and market outlooks