Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

How is it possible? Below is the number of initial filings for unemployment insurance.

Five of the last six weeks, the exact same number. Effectively the same number in the last 11 weeks, except for the holiday weeks (President's Day and Easter). As highlighted by Jim Bianco, how is this statistically possible? --- Consider The US is a $28 trillion economy. It has 160 million workers. Initial claims for unemployment insurance are state programs, with 50 state rules, hundreds of offices, and 50 websites to file. Weather, seasonality, holidays, and economic vibrations drive the number of people filing claims from week to week. Yet this measure is so stable that it does not vary by even 1,000 applications a week. Just the number of applications incorrectly filed out every week should cause it to vary more than this...

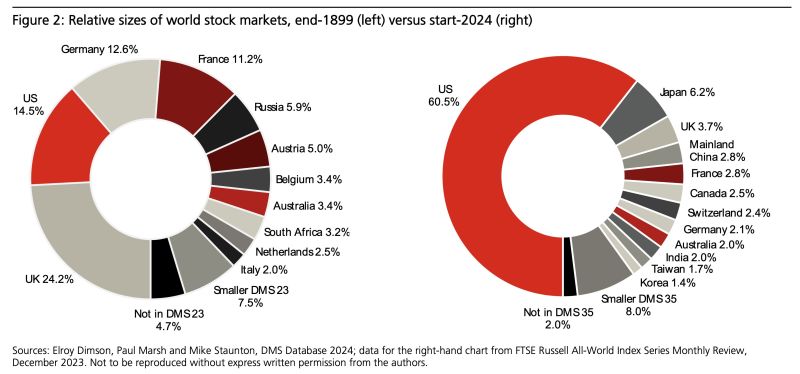

Is the US stock market becoming THE world stock market?

Source: Sam Ro

"Make America Great Again" by Joe Biden

Micron $MU is set to receive over $6 Billion in chip grants from the 🇺🇸 to help pay for domestic factory projects - Bloomberg Source: Bloomberg, Evan

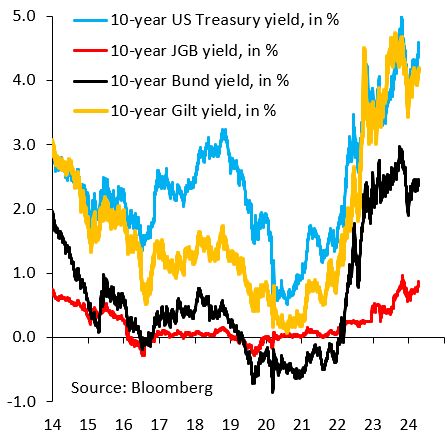

The 10-year US Treasury yield (blue) is marching back towards its high last October.

Recall that - at the time - US Treasury announced that it would issue less longer-term paper, which is what stopped that rise. That card has now been played and yields are rising again... Source: Robin Brooks

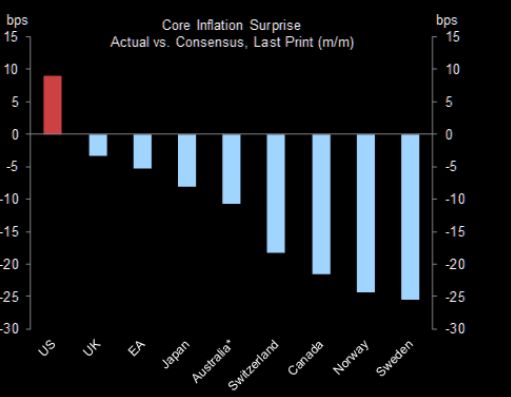

Did you know that the US is the only G10 economy where the latest core inflation print surprised to the upside?

Source: Goldman Sachs, TME

The "East-West divide" in one cartoon.

China is dumping their US Treasury debt and buying hard assets. Many other countries around the world are doing the same. Source: WallStreetSilver

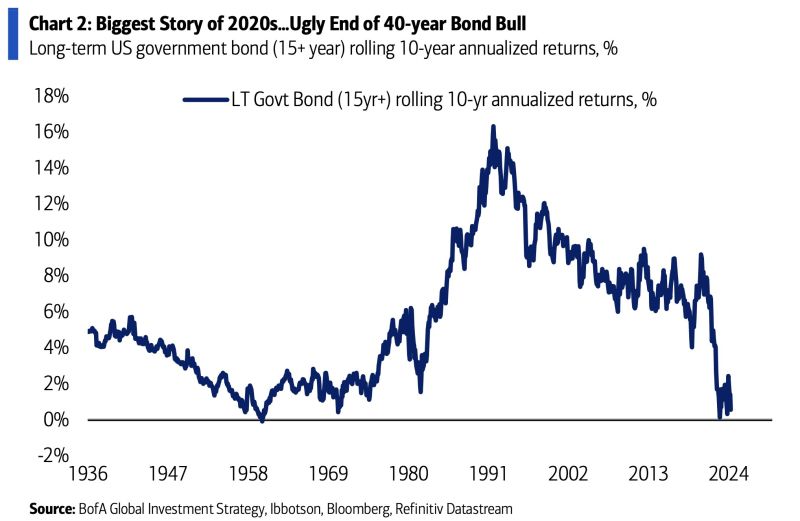

The 10y annualized return of US Treasuries has dropped to a 65-year low of 0.6%.

The 2020s era of war, protectionism, fiscal excess, scarce energy/housing/labor killed the 4 decades-long bond bull market. Source: BofA; HolgerZ

US inflation continues to rise, with no decrease in sight according to Zerohedge.

Since January 2021, inflation has not fallen in a single month, leading to an overall increase of 19% in less than four years. Additionally, the US has not seen a year-over-year inflation print below 3% in 36 consecutive months. The Fed's 2% target has also been surpassed for 37 straight months. This compounding inflation may have long-term impacts on the economy. Source: The Bobeissi Lezzer

Investing with intelligence

Our latest research, commentary and market outlooks