Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

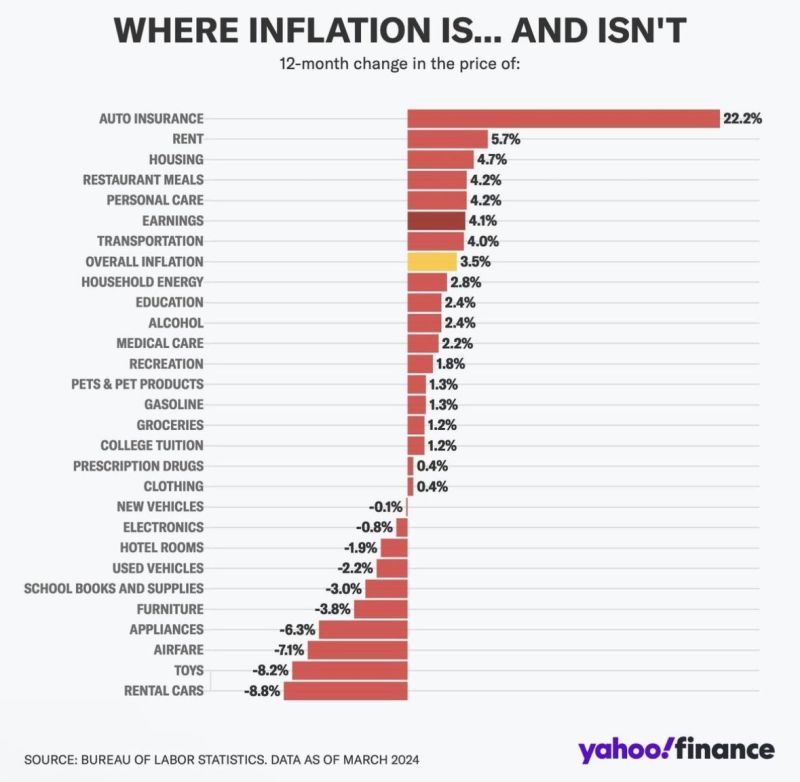

Where US inflation is and where it isn’t 👀

Source: Yahoo Finance, Evan

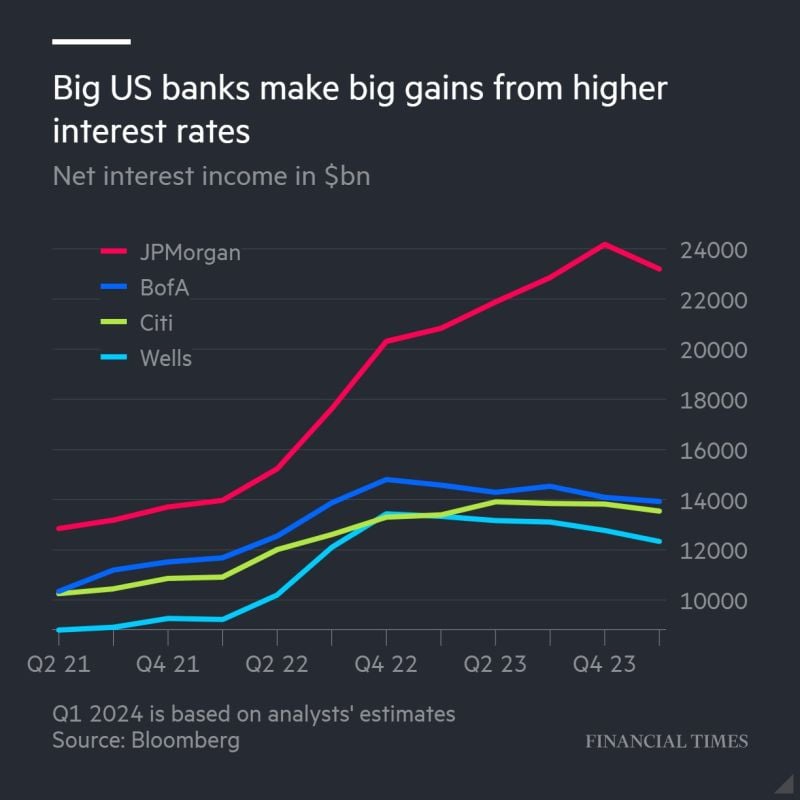

The largest US banks are set to earn higher profits than expected this year

As the Federal Reserve looks likely to make only modest cuts to benchmark interest rates. Source: FT

CLS declines delaying FX cutoff as US stock changes loom

CLS Group, the largest currency settlement system, said on Tuesday it will not change its cut-off time for payment instructions for foreign exchange trades, dealing a blow to foreign asset managers hoping for some reprieve from a new U.S. rule putting them at risk of transaction failure. Beginning May 28, the U.S. Securities and Exchange Commission requires investors start settling U.S. equity transactions one day after the trade, or T+1, instead of the current two days. source : investing

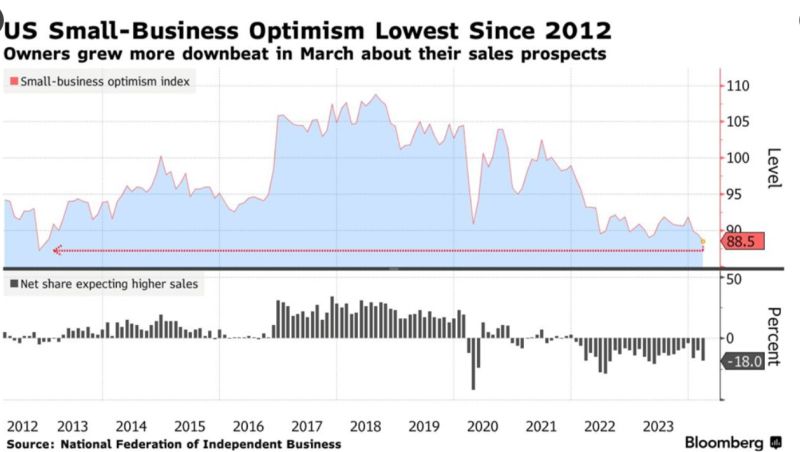

US Small-Business Optimism Falls to a More Than 11-Year Low

source : Bloomberg

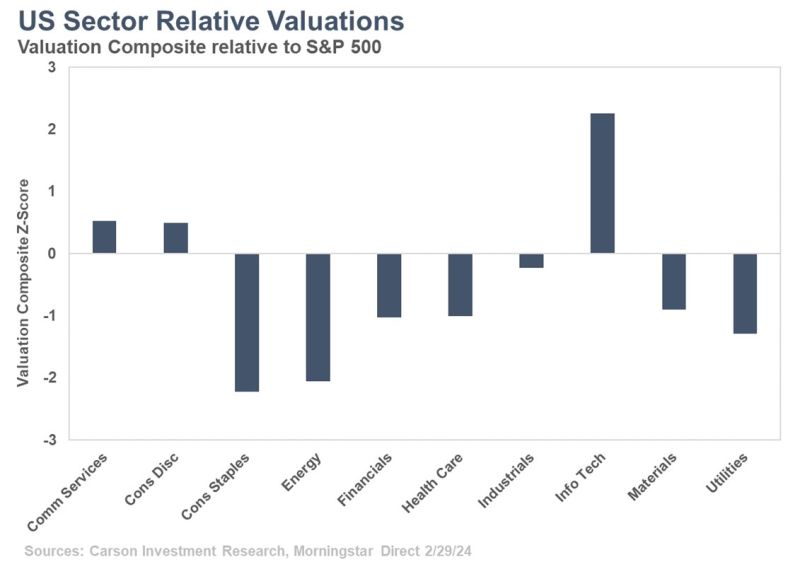

US stocks are expensive. That is true, but it is mainly due to tech.

If you look around you'll notice that areas like the cyclicals (energy, financials, materials, and industrials) are all fairly valued and in some cases outright cheap. Source: Carson Investment Research

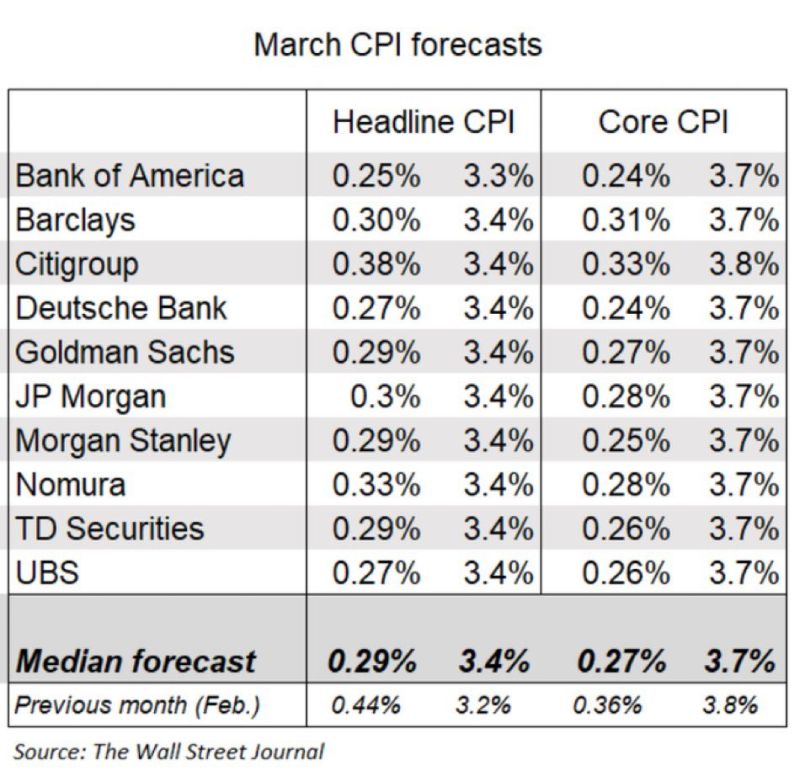

Here’s what Wall Street is expecting for US CPI today

Source: WSJ

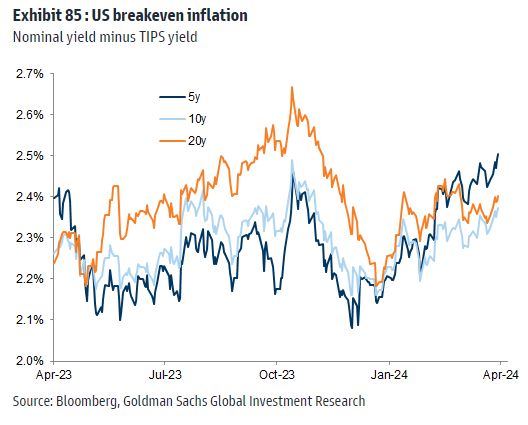

US breakeven inflation rates rising

Source: Win Smart; Goldman Sachs, Bloomberg

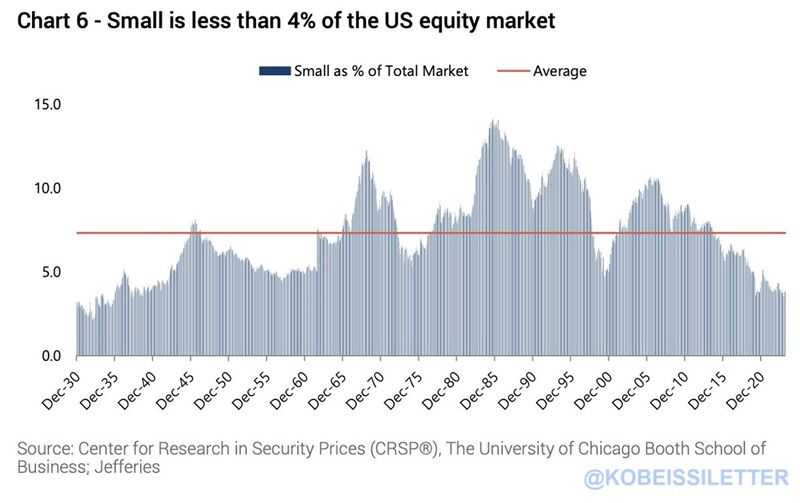

US smallcap stocks now account for less than 4% of the entire US equity market.

They now reflect the same percentage of the market as 1930 before the Great Depression. As AI-hype as spreads, small cap stocks have significantly underperformed large caps. Currently, more than one-third of the Russell 2000 index has negative earnings, down from ~45% in 2020. Small-cap stocks are now hated more than ever. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks