Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Q1 reporting us earnings season kicks off next week with the banks reporting on Friday.

Below is a sneak preview of what's to come during the first three weeks. Note: companies marked with * are currently unconfirmed. Watch for: $MSFT, $TSLA, $AMZN, $GOOGL, $META, $TSM, $JPM, $XOM, $MA, $V, $NFLX, $CAT, $ASML and more Source: Wall Street Horizon

In the us, soft data (less reliable) has surprised to the upside a lot more than the hard data (more reliable) since the start of the year.

Source: Bob Elliott, The Daily Shot

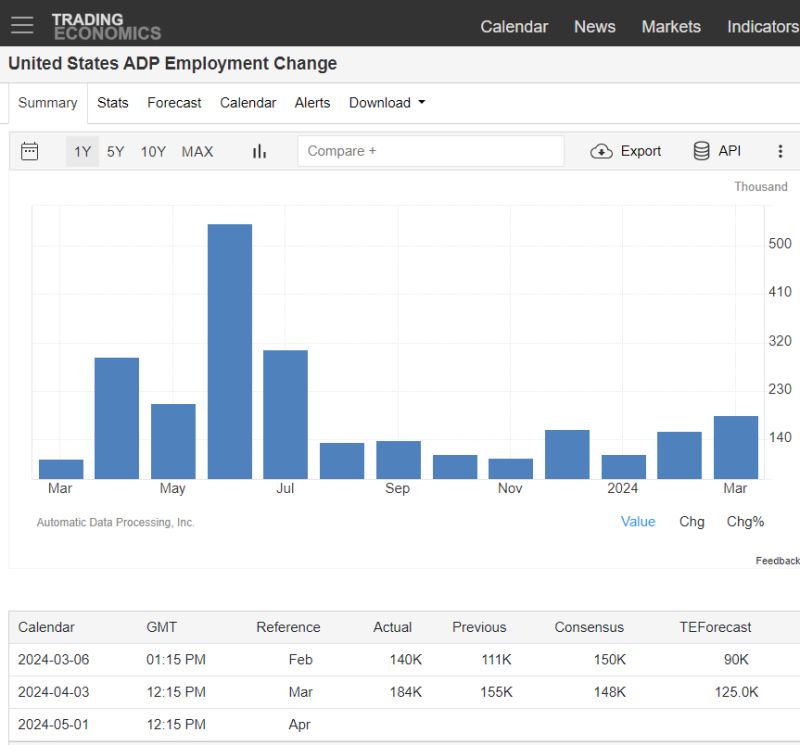

SUMMARY OF US MARCH ADP JOBS REPORT:

1. The U.S. economy added a higher-than-expected 184,000 jobs in March, as per ADP, easily beating forecasts for +148,000. 2. The number of monthly job gains was the highest in eight months (July 2023) 3. February number was also revised upwards. 4. Wage growth accelerated for those who changed jobs, rising +10% from a year earlier. Key Takeaway: The pickup in jobs growth supports the case that the labor market remains strong, and the economy continues to hold up better than expected. The ADP report does not point to imminent Fed rate cuts as markets continue to push back the timing of the first move. Source: Jesse Cohen, Trading Economics

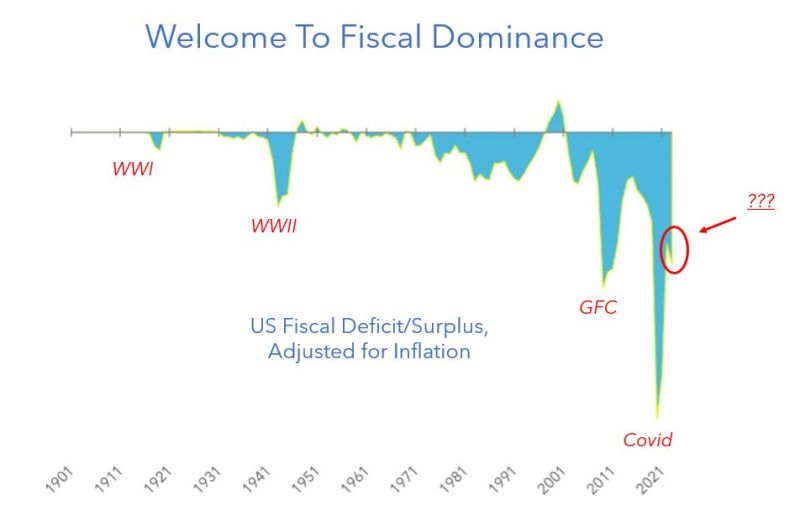

The era of fiscal dominance

source: MacroAlf. Inflation-adjusted US fiscal deficits popping up at: - World War I - World War II - Great Financial Crisis - Covid - 2023 Find the outlier...

Is there a chance for the us to start slowing down the pace of debt increase?

Well... think about this: "I'm the king of debt. I'm great with debt. Nobody knows debt better than me." - Donald Trump Source: Ronald-Peter Stoeferle, CMT, CFTe, MSTA

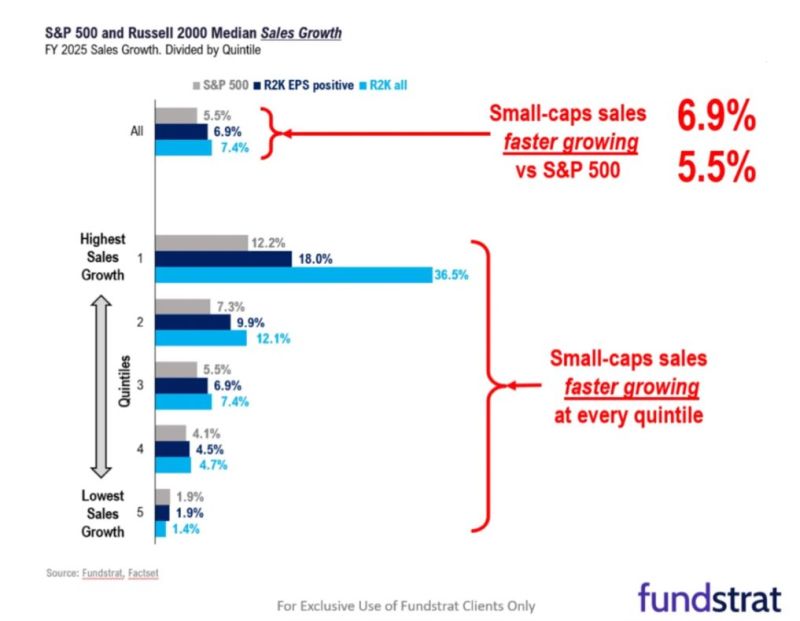

A contrarian idea on us small caps?

=> FUNDSTRAT: “.. Our top idea for 2024 is small-caps, where we see at least 50% upside .. Russell 2000 companies are set to grow .. faster than the $SPX .. Valuations are far more attractive .. when CEO confidence recovers, we also see the low valuations as setting the stage for synergistic M&A ..” Source: Carl Quintanilla, Fund strat

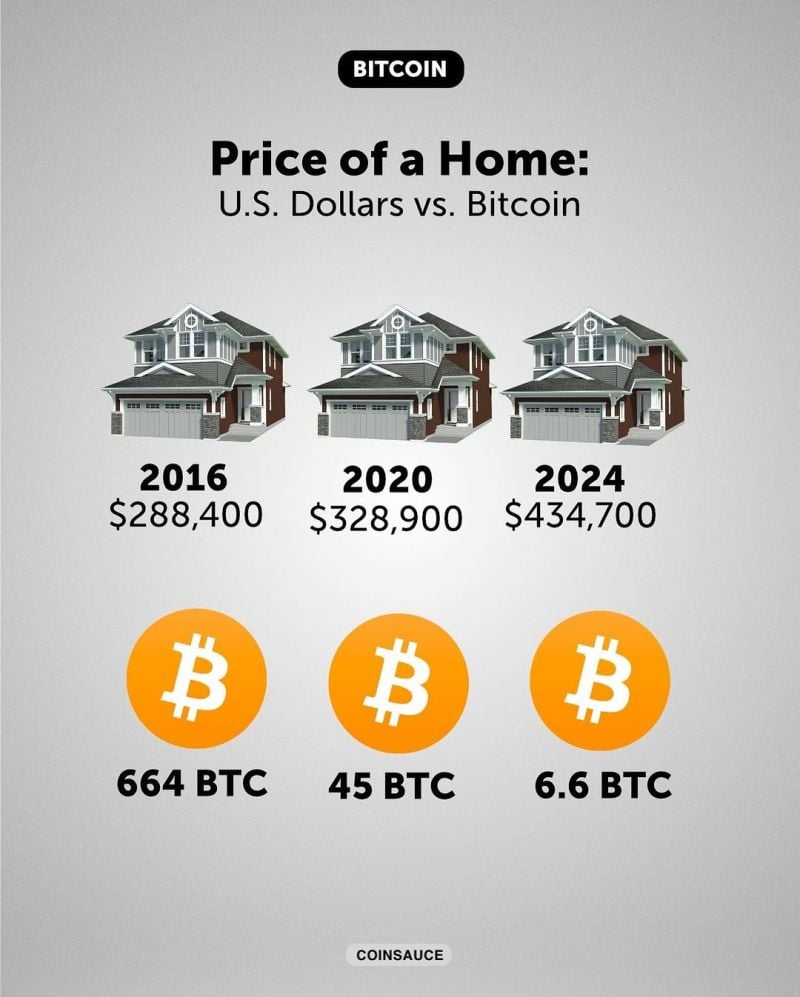

Price of a home in the us (median price) vs. bitcoin over time

Source: coinsauce

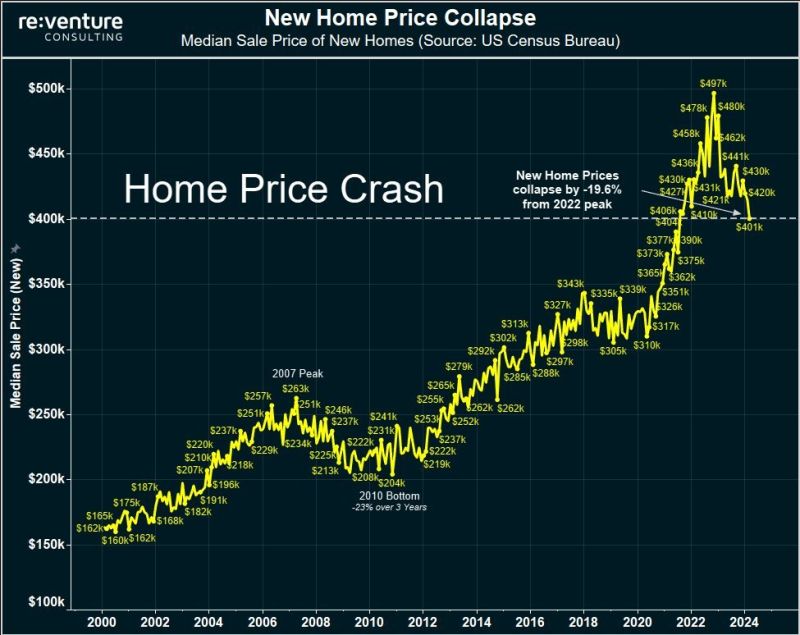

BREAKING: US new home prices are now down 20% from their highs, in bear market territory, and falling faster than rates seen in 2008, according to Reventure.

New home prices peaked in late-2022 at $497,000 and have fallen to $401,000 as of the latest data. In the financial crisis, new home prices dropped by 23% from 2007-2010, according to Reventure. US Home prices are down roughly the same amount in just 1.5 years, or half the amount of time. Still, new home prices are ~20% above pre-pandemic levels and existing home supply is near record lows. Is the hashtag#us housing market beginning to crack? Source: The Kobeissi Letter, Re-venture

Investing with intelligence

Our latest research, commentary and market outlooks