Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

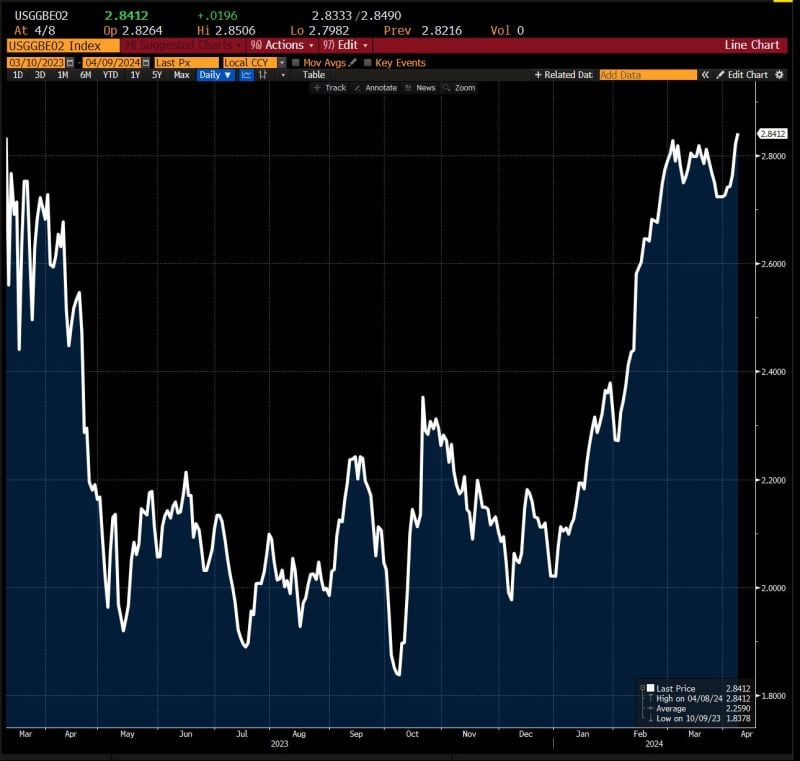

Ahead of US inflation numbers tomorrow (Wednesday), US 2-year breakeven rates just rose to 13-month highs...

Source: Bloomberg, David Ingles

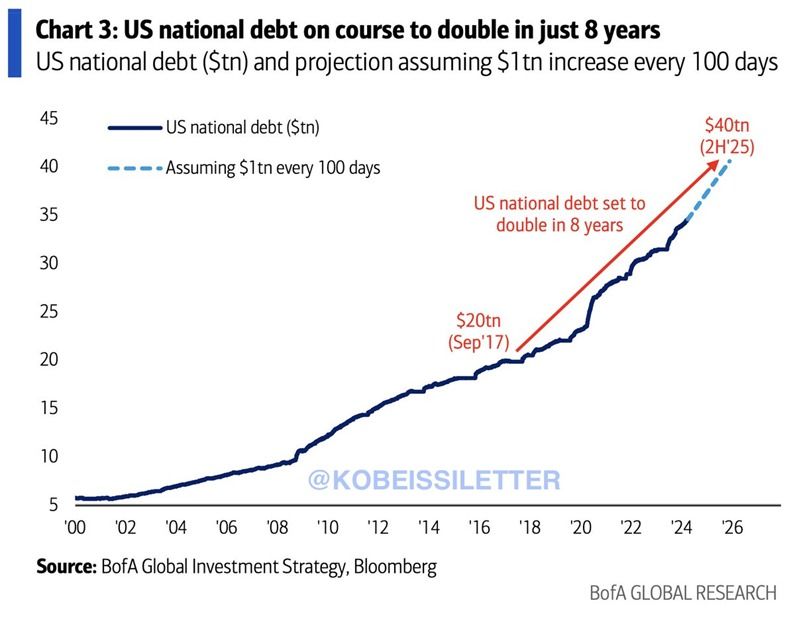

The US Federal debt is set to DOUBLE in just 8 years, rising from $20 trillion in 2017 to $40 trillion in 2025.

Currently, US Federal debt is rising by a whopping $1 trillion every 100 days. To put this in perspective, if US debt hits $40 trillion in 2025 that would be a $17 TRILLION increase since 2020. That would be a ~570% jump in US Federal debt since 2000, a 25-year period. The worst part? This analysis assumes that we are on track for a "soft landing." What happens if a recession hits? Source: The Kobeissi Letter, BofA

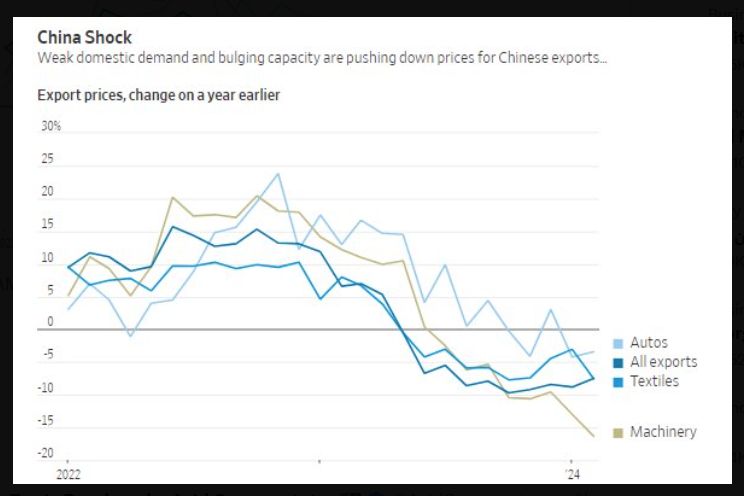

Will the big deflationary wave out of China offset the inflationary pressures stemming from rising oil prices and hot job market in the US?

Source: Michel A.Arouet

US inflation has officially been at 3% or higher for exactly 3 years.

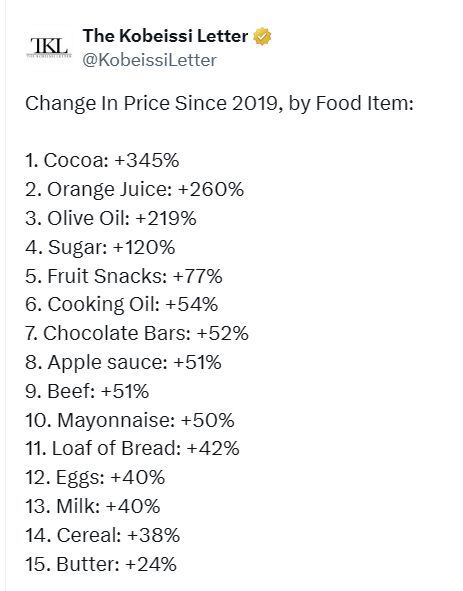

The Average American is now paying nearly 40% MORE for groceries than what they were paying in 2019. Over 100 food items have seen inflation above 50% since 2019...

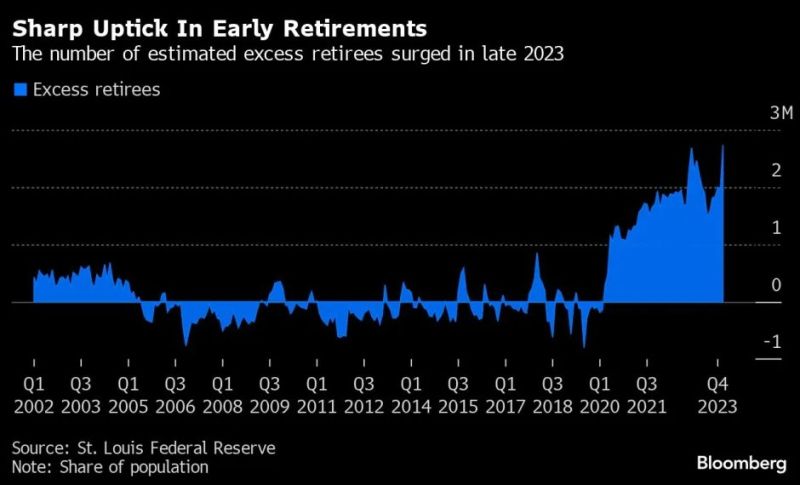

Early retirements surged again in late 2023 with the gains in the stock market and home prices, leading to a record 2.7 million excess retirees in the US.

Source: Bloomberg, Charlie Bilello

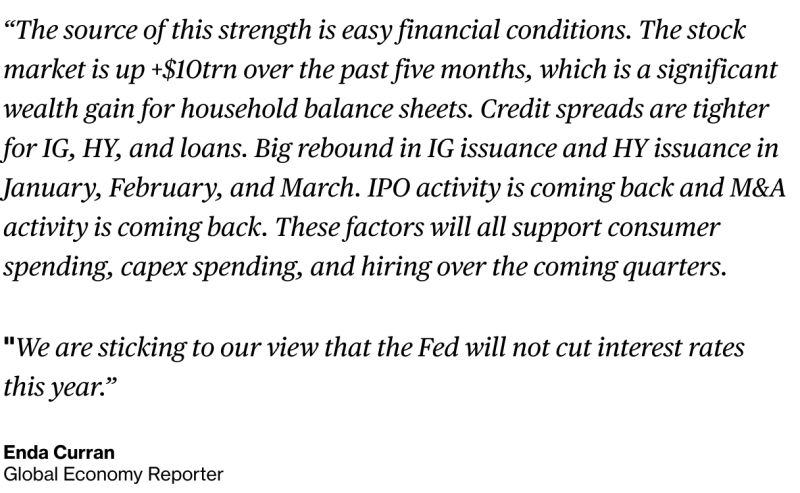

Torsten Slok at Apollo is sticking to his view that there will be no US rate cut this year...

Source: Markets & Mayhem, Apollo

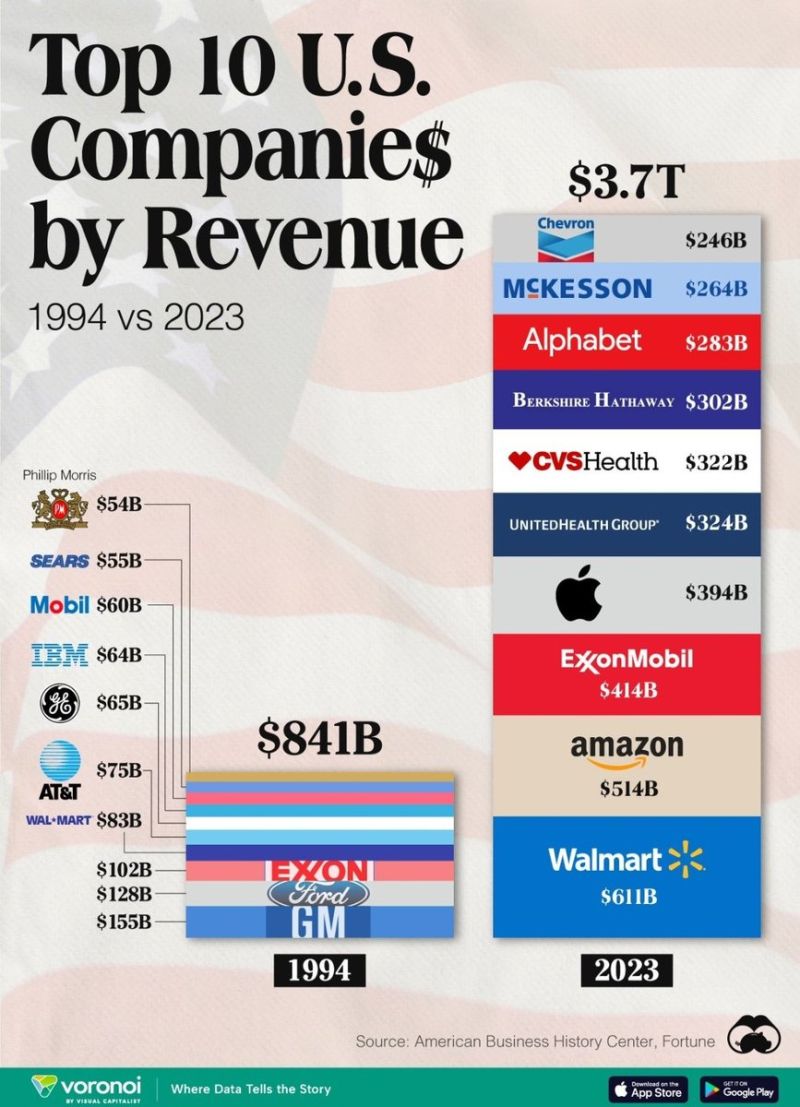

Top Companies by Revenue - Now vs. 3 Decades Ago

Source: Visual Capitalist thru Win Smart

Investing with intelligence

Our latest research, commentary and market outlooks