Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

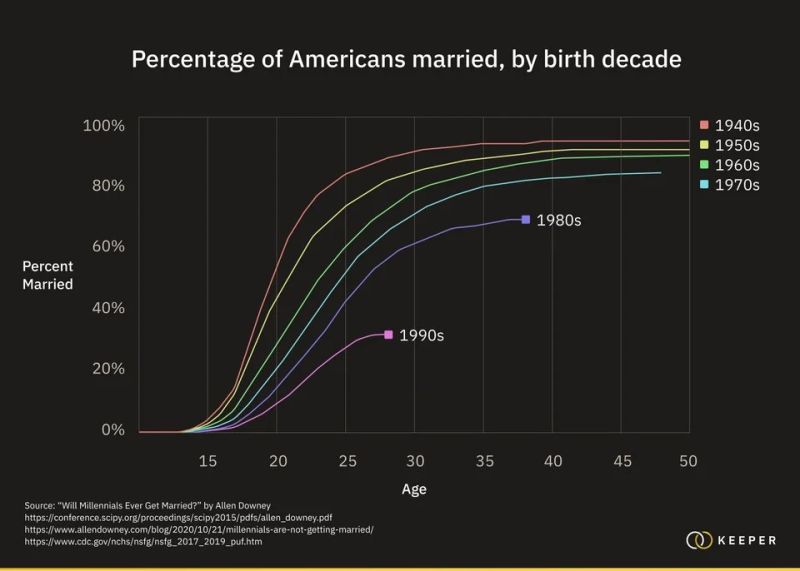

Less and less Americans are getting married.

This is negatively impacting family formation and leading to a slower population growth rate as a result. Source: Markets & Mayhem, Bloomberg

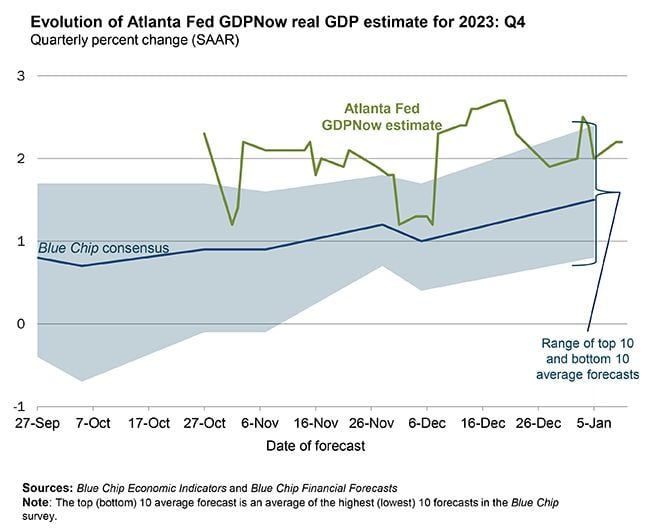

On January 10, the GDPNow model nowcast of us real GDP growth in Q4 2023 is 2.2%

Source: Atlanta Fed

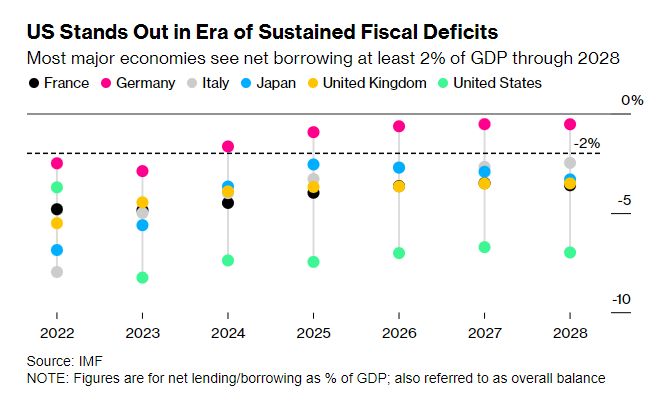

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before

Saddled with the kind of bloated deficits that were once unthinkable, these countries — along with Japan — will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.

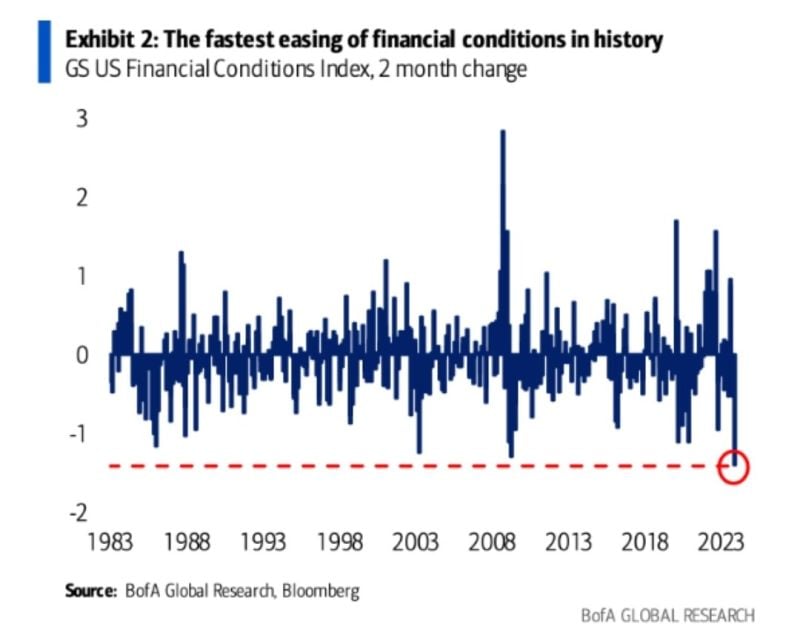

FASTEST easing of Financial Conditions in HISTORY

Source: WinSmart, BofA

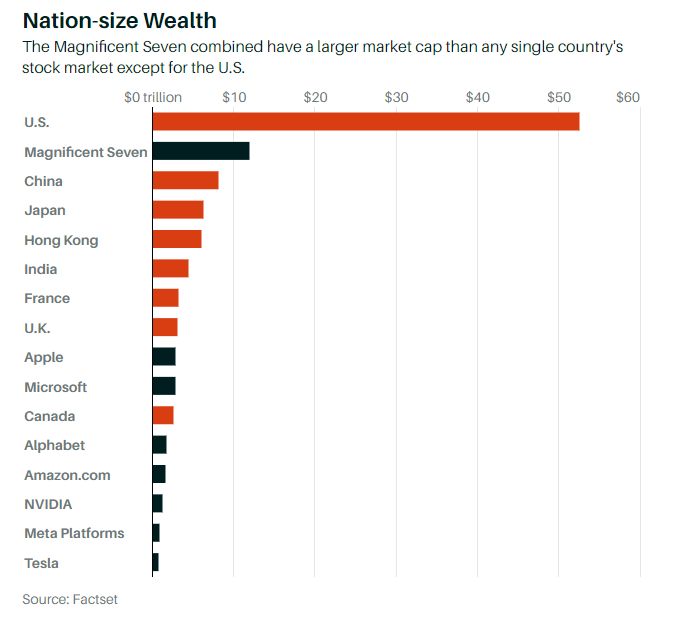

The Magnificent Seven have a larger market cap than any country's entire stock market except the US

Source: Barchart

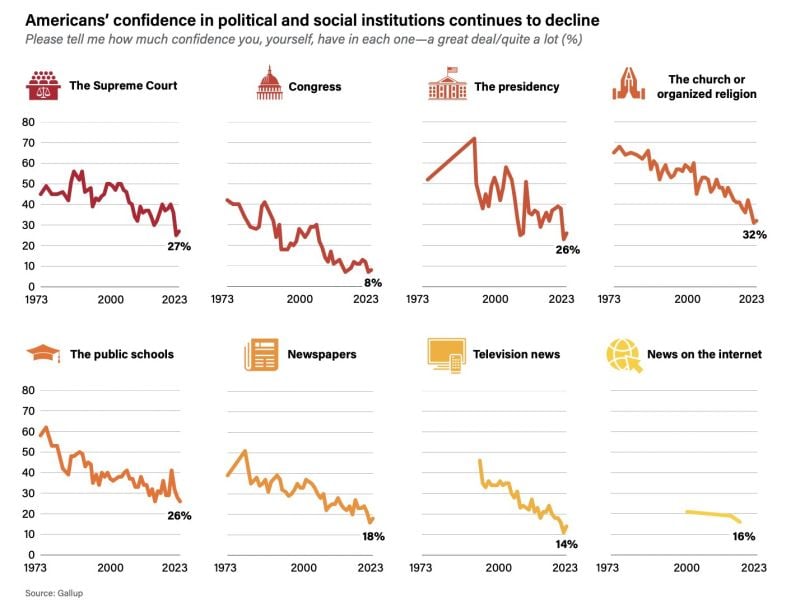

This chart from Eurasia Group's Top Risks 2024 Report shows how far Americans' trust in institutions has eroded

And the chart gives a feel for the upcoming election campaign, which is unlikely to be a trust-building measure. And should Trump win, he 'would take steps to consolidate exec power, weaken checks & balances, & undermine the rule of law,' the authors write. Source: HolgerZ

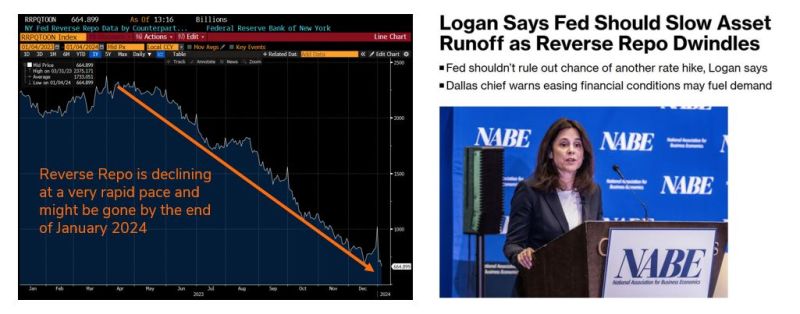

Bank of America Corp. expects the Federal Reserve to announce plans to begin tapering the runoff of its Treasuries holdings in March, coinciding with its first 25 basis points interest-rate cut.

- The Reverse Repo ("RRP") is de facto QE-infinity $ printed during 2020-21 that was sitting dormant. It's now being used to buy up US Treasuries. Problem: it is declining at a very rapid pace and might be gone by the end of January 2024. - Something needs to be done to preserve QB / liquidity. - This is why the Fed is now thinking about slowing down the pace of QT. Over the week-end, Dallas Fed chief Logan said the Fed should slow Asset runoff as Reverse Repo dwindles - 2024 is an election year and we expect net liquidity to be supportive for the economy, bond markets and risk assets

Investing with intelligence

Our latest research, commentary and market outlooks