Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

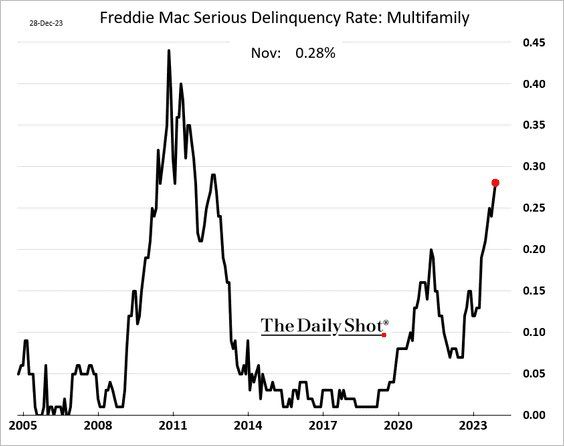

Freddie Mac Serious delinquency rate US multifamily homes

thru The Daily Shot

BREAKING: The US job market remains strong

In December, the US economy added 216,000 jobs, above expectations of 170,000. This means that the US economy has now added jobs for 36 consecutive months. The US Unemployment Rate held steady at 3.7% in December (consensus estimate was for an increase to 3.8%). Wages actually increased to 4.1% year over year from 4% in November. The market reaction is as you'd expect - yields higher, with fewer rate cuts being priced in for 2024. In light of these numbers, there is a problem with the number of FED rate cuts being priced in. Source: Bloomberg

Could a hot US job print invalidate the downward trend in bond yields?

The US 10 year is flirting with the massive 4% levels again. A close above it and things could become even more "dynamic" to the upside. Note 21 day right here, while 50 day remains way higher. Source: Refinitiv, TME

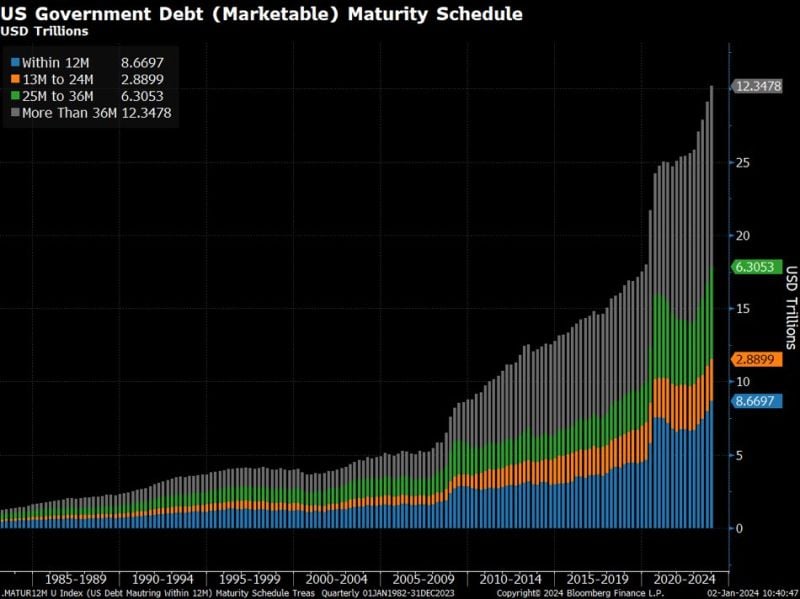

The government debt maturity wall

Bloomberg thru Jeroen Bloklan / M_McDonough

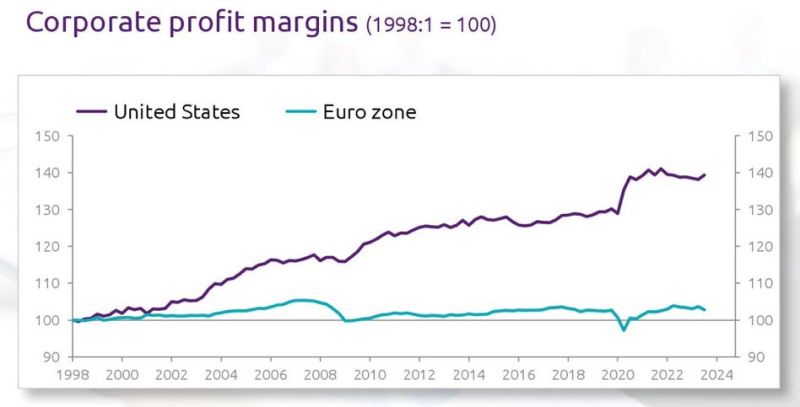

A remarkable chart. The sector composition probably does not explain everything

Source: Michel A.Arouet

FED meeting minutes key takeaways:

1) rates likely at or near their peak 2) 2pct inflation target is maintained 3) monetary policy is likely to stay restrictive for some time 4) clear progress has been made on inflation (dixit the Fed) 5) see rate cuts by the end of 2024 FOMC views continue to diverge from market expectations (2x more rate cuts are currently priced vs. Fed guidance) Source: CNBC, The Kobeissi Letter

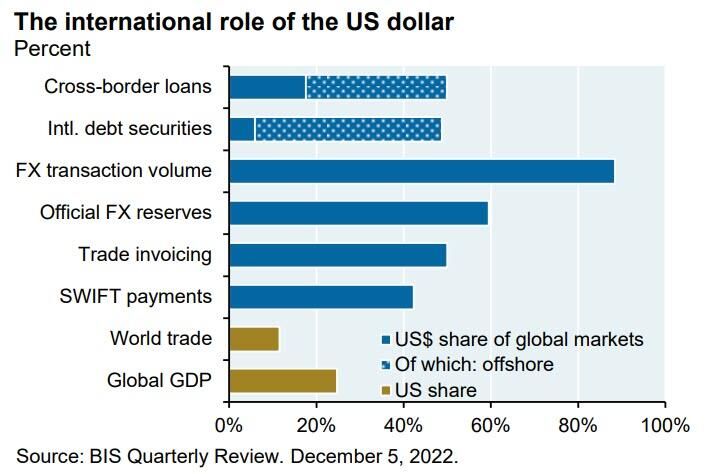

The international role of the US dollar in one chart

Source: JP Morgan

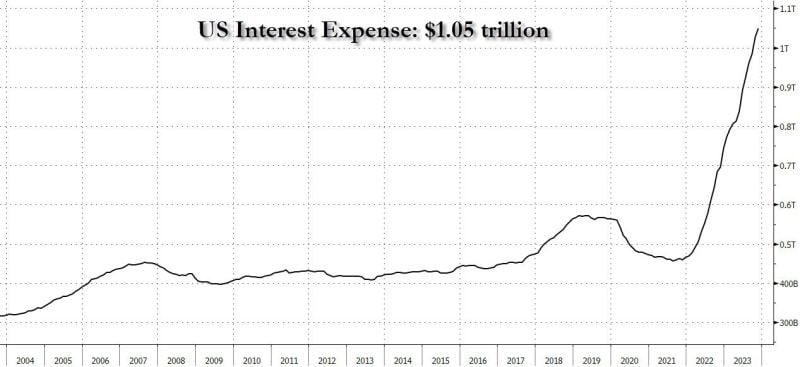

US Interest expense ~$1.1 trillion as of today

That's $250BN more than the Defense Budget; $250BN more than spending on Medicare, $200BN more than spending on health, and will surpass the $1.35 trillion spending on Social Security this year, becoming the single biggest outlay Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks