Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

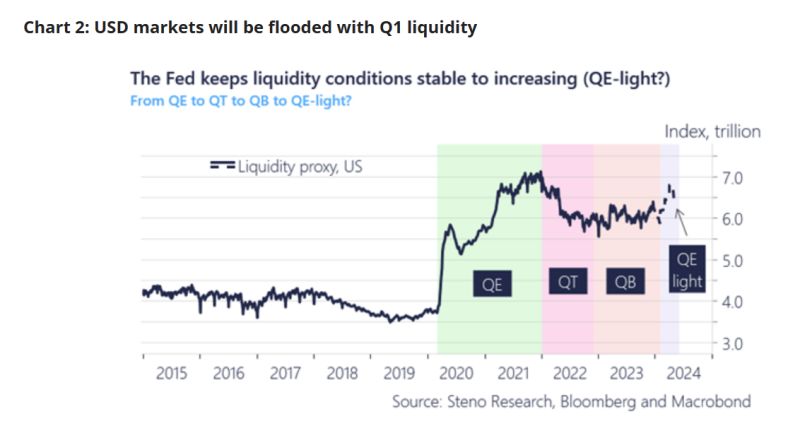

LIQUIDITY MATTERS... From QE (Quantitative Easing) to QT (Quantitative Tightening) to QB (Quantitative Balancing) to QE Light

Some interesting views by Andreas Steno Larsen (Steno Research / Macrobond): 2024 Q1 -> While we are celebrating our inflation-progress, Powell and Yellen intend on handing out "Stealth QE / QE light" gifts to the banking system in Q1-2024. Steno Research view is that USD liquidity is likely going to increase massively in Q1 due to a series of technicalities surrounding the BTFP, ON RRP and TGA facilities. These three liquidity adding mechanisms will more than outweigh the QT program (running at a little less than $95bn a month on average), leaving a very benign liquidity picture ahead for Q1-2024. By their estimates, liquidity will increase with $8-900bn until end-March, which almost resembles a QE-light / stealth QE scenario. This will in case be one of the fastest liquidity additions on record, only outpaced during the early innings of the pandemic! If this happens, such a liquidity injection might be a massive tailwind for risk assets...

Goldilocks continue with economic data (in red) remaining sluggish and financial conditions (in green) dramatically 'loosening'...

Source: www.zerohedge.com, Bloomberg

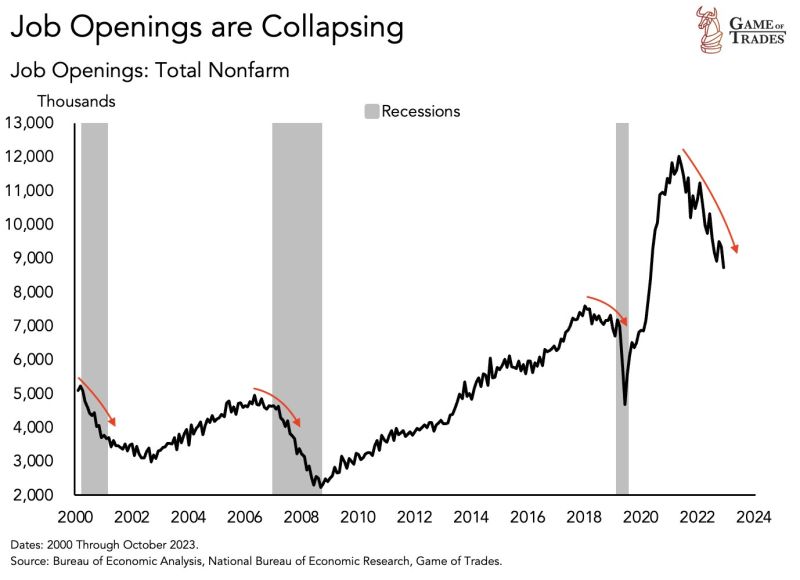

ALERT: Job openings are collapsing (but from a very high level)

Source: Game of Trades

BREAKING : Short Sellers

U.S. Stock Short Sellers have lost a reported $145 billion this year. Complete wipeout Source: Barchart

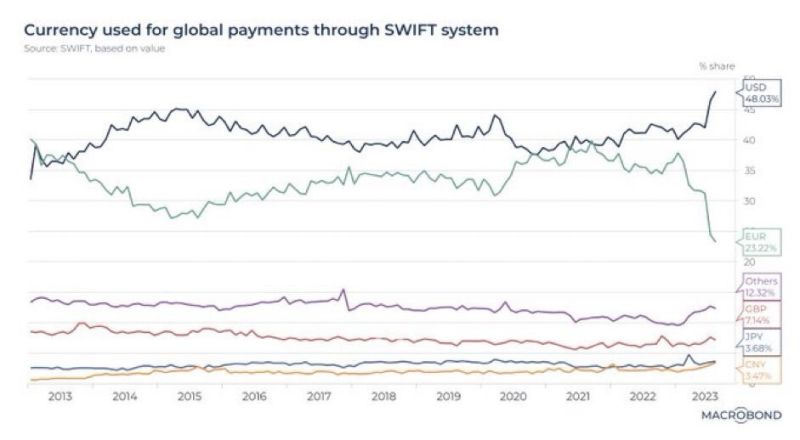

The U.S. dollar remains king and is now used in 48% of international payment transactions, the highest level in more than a decade

Source: Barchart. Macrobond

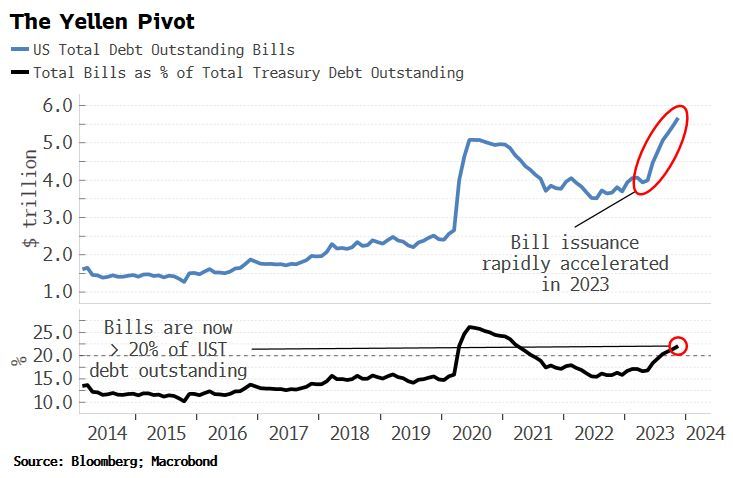

Simon White posted an excellent chart showing the potential short-term gain / long-term pain of the dual Yellen / Powell pivot

Phase 1: The Yellen Pivot. Early 2023, she decided skewing the Treasury's issuance towards bills. This bought time for risk assets, allowing Fed reserves to rise despite QT Phase 2: The Powell Pivot last week -> His dovish turn should buy more time for risk assets next year. He is literally trying to limit the growing amount of liquidity sucked from the government's ballooning interest-rate bill While this leads to short-term gain, there is a huge risk of long-term pain as these dovish operations have significantly increased long-term inflation risks and the prospect of even higher yields in the near-future. Source: Bloomberg, Macrobond

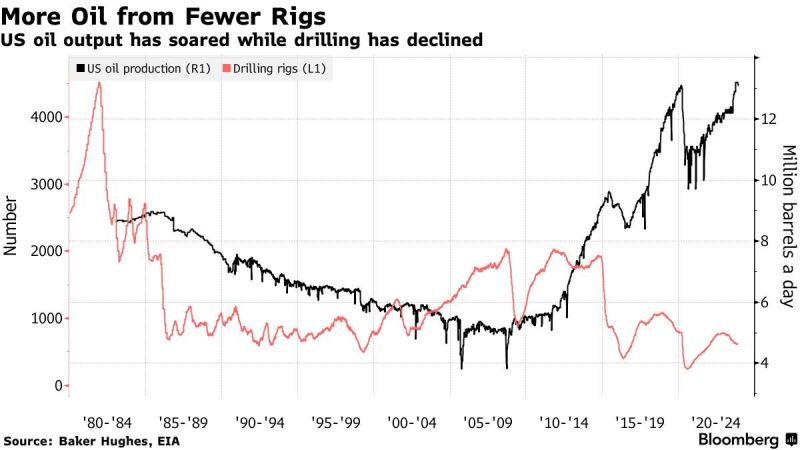

The US added the equivalent of a new Venezuela in oil supply during Q4, with less rigs producing more oil as technological efficiency ramps up

This supply growth has exceeded expectations and furled OPEC's attempt to put a floor under prices, at least for now. Source: Markets & Mayhem, Bloomberg

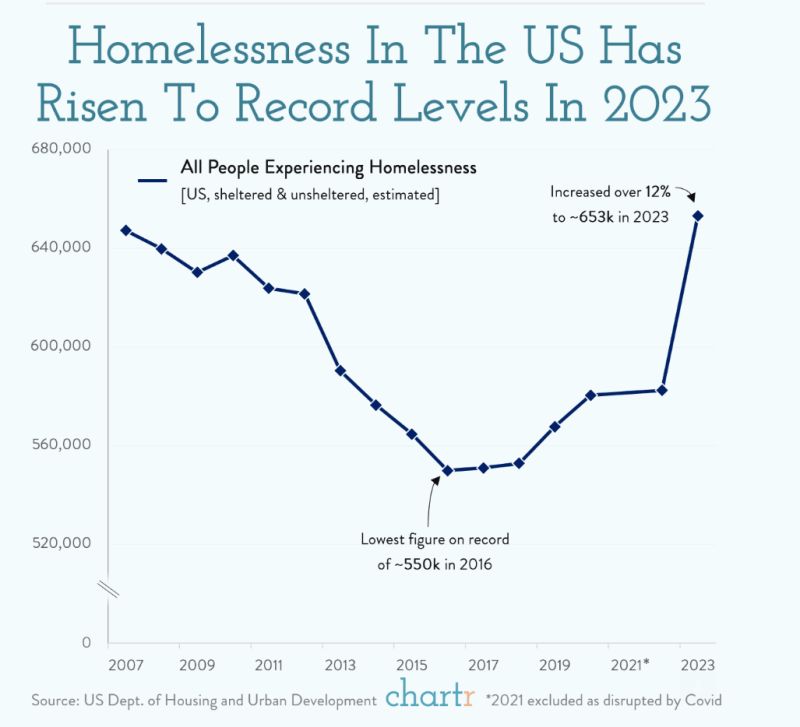

Homelessness in the US has grown to the highest level since the Department of Housing and Urban Development (HUD) started tracking the figure back in 2007

With a record 653,104 people experiencing homelessness at the latest annual count. The number of people experiencing unsheltered homelessness — those living on sidewalks or in abandoned buildings, bus stations, etc. — was up around 47k from last year, while the figure for people staying in emergency shelters, transitional housing programs, or safe havens grew 23k in the same period. Source: Chartr

Investing with intelligence

Our latest research, commentary and market outlooks