Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

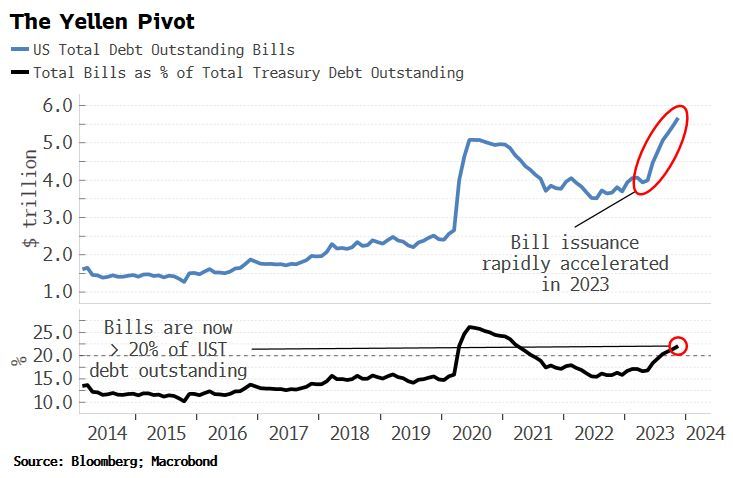

Simon White posted an excellent chart showing the potential short-term gain / long-term pain of the dual Yellen / Powell pivot

Phase 1: The Yellen Pivot. Early 2023, she decided skewing the Treasury's issuance towards bills. This bought time for risk assets, allowing Fed reserves to rise despite QT Phase 2: The Powell Pivot last week -> His dovish turn should buy more time for risk assets next year. He is literally trying to limit the growing amount of liquidity sucked from the government's ballooning interest-rate bill While this leads to short-term gain, there is a huge risk of long-term pain as these dovish operations have significantly increased long-term inflation risks and the prospect of even higher yields in the near-future. Source: Bloomberg, Macrobond

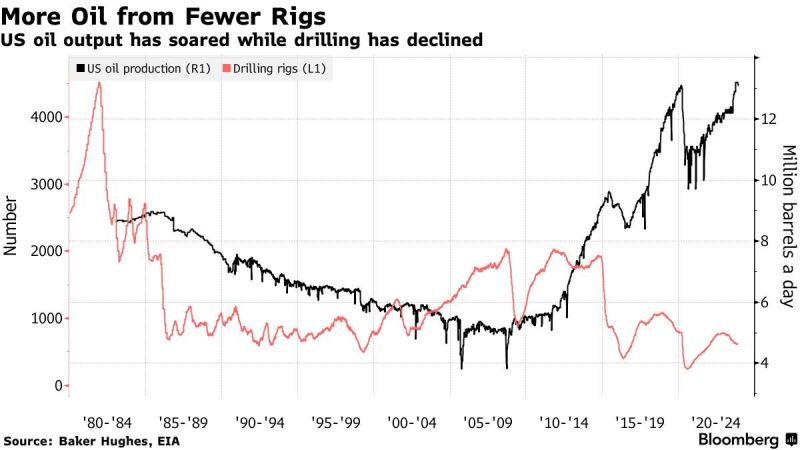

The US added the equivalent of a new Venezuela in oil supply during Q4, with less rigs producing more oil as technological efficiency ramps up

This supply growth has exceeded expectations and furled OPEC's attempt to put a floor under prices, at least for now. Source: Markets & Mayhem, Bloomberg

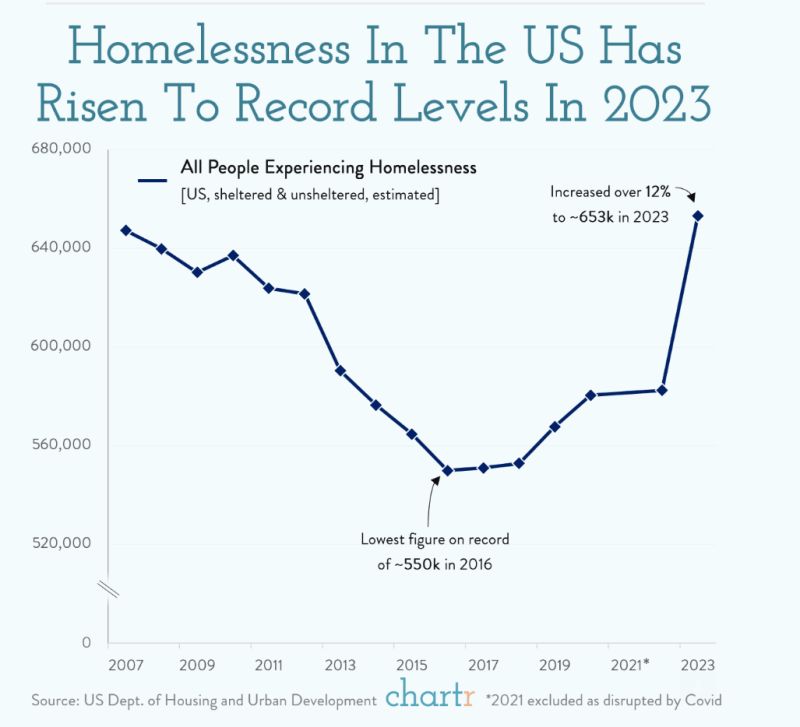

Homelessness in the US has grown to the highest level since the Department of Housing and Urban Development (HUD) started tracking the figure back in 2007

With a record 653,104 people experiencing homelessness at the latest annual count. The number of people experiencing unsheltered homelessness — those living on sidewalks or in abandoned buildings, bus stations, etc. — was up around 47k from last year, while the figure for people staying in emergency shelters, transitional housing programs, or safe havens grew 23k in the same period. Source: Chartr

The pain trade in one chart: Most shorted US stocks gained 11.3% this week. Performance YTD now on par w/S&P 500

Source: Bloomberg, HolgerZ

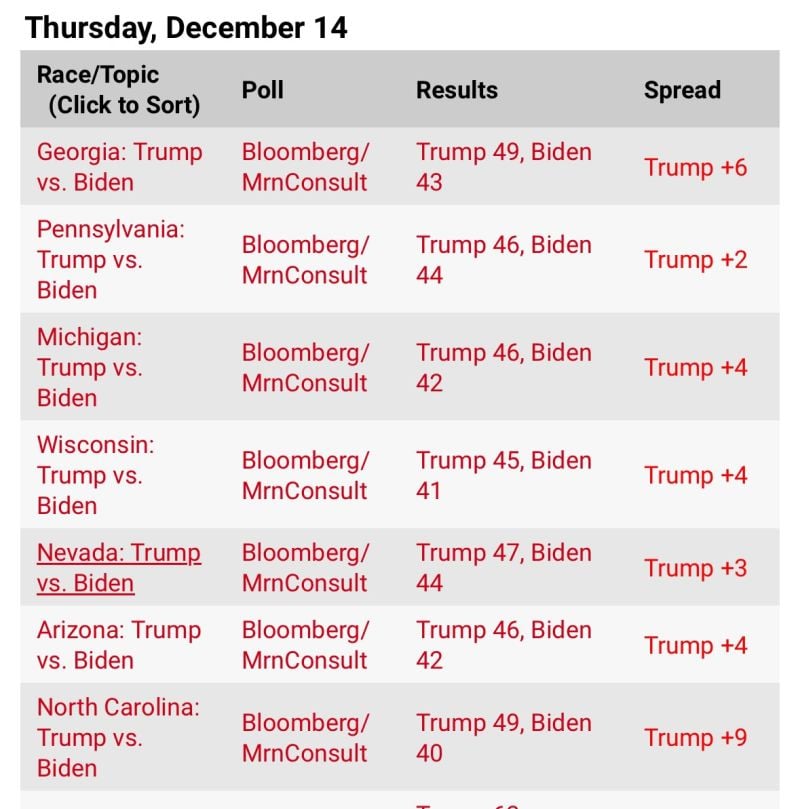

Was the FED ULTRADOVISH move on Wednesday driven by a "Trump fear"?

New swing state polling is brutal for Biden... It wasn't the case 3 weeks ago... Source: alx

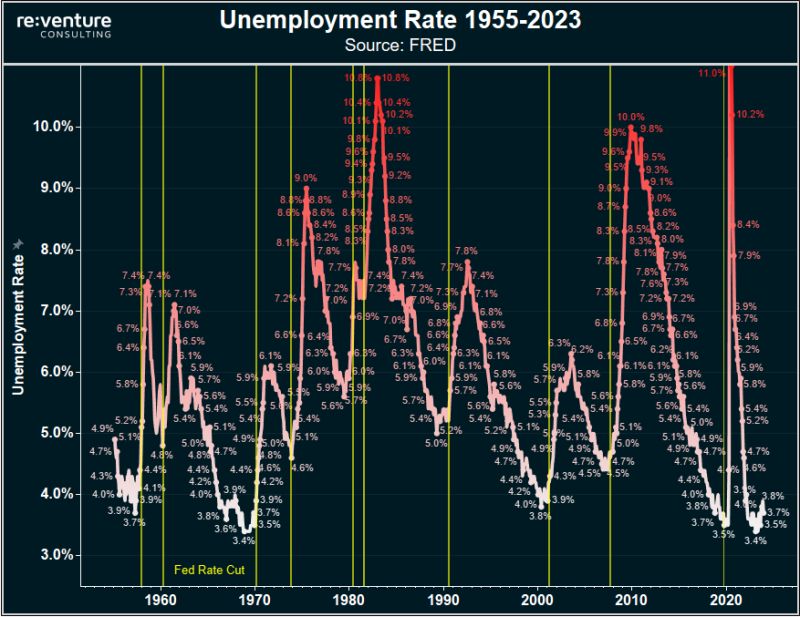

Unemployment rate in America from 1955-2023

Interesting how the unemployment rate tends to spike right after the Fed cuts rates. Suggesting that Fed policy easing is usually a negative signal for the economy. Not a positive one. Source: FRED, re:venture

BREAKING: US House votes to authorize an impeachment inquiry into President Biden.

This escalates a probe that has been open for months. The House voted 221 to 212 to open the inquiry. Biden family finances and businesses are in focus. Another historic development in 2023. Source: The Kobeissi Letter

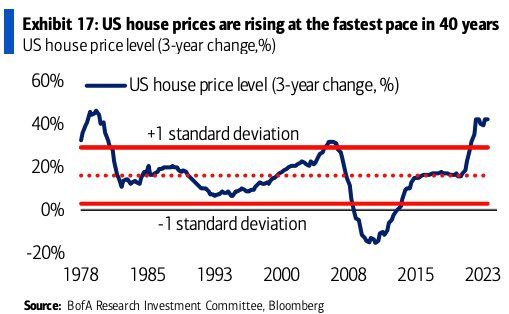

After 2 years of the most aggressive FED rate hike cycle since the 1980s, the price of US houses (3 years change) is rising at the fastest pace in 40 years...

that sounds a bit counterintuitive at first glance as most surveys show that the housing affordability is at record low Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks