Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

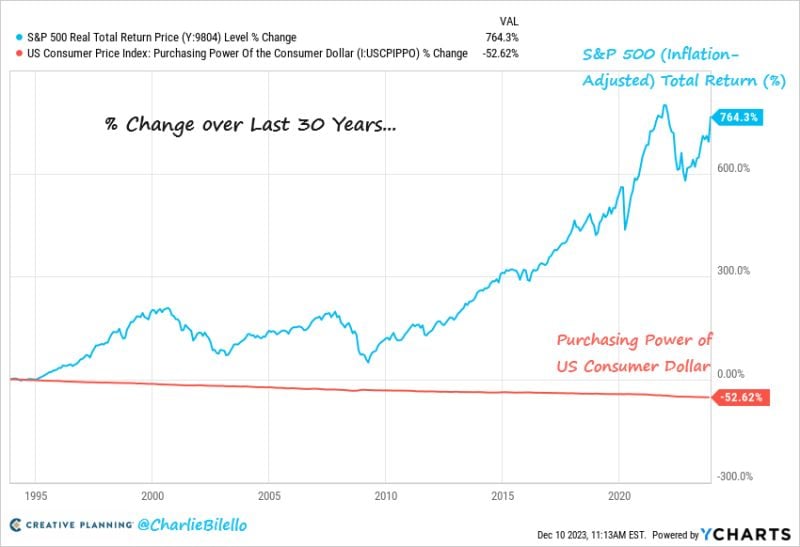

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation

At the same time, the S&P 500 has gained 764% (>7% per year) after adjusting for inflation. Source: Charlie Bilello

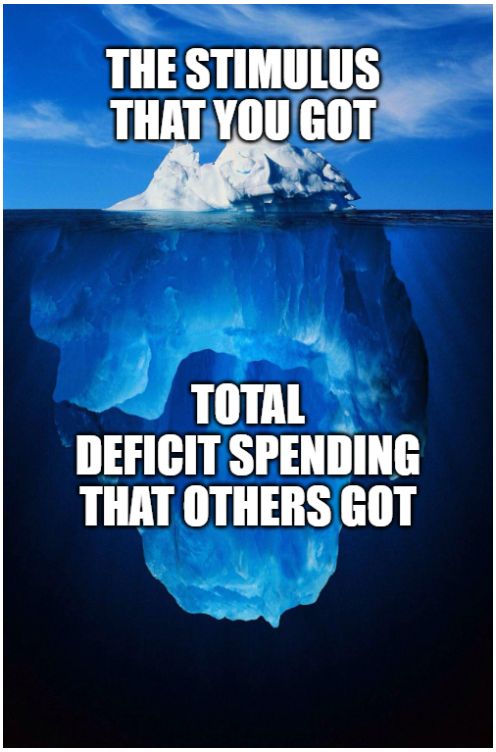

Nice one by Lyn Alden -> Since the start of 2020, the United States has taken on $10.7 trillion in new public debt (i.e. accumulated deficits)

That's about $80k per household in four years. Have households received that much in deficit spending? Some did, but likely very few of them... Source: Lyn Alden

U.S. ECONOMIC DATA THIS WEEK:

*CPI INFLATION (TUES.) *PPI INFLATION, FED POLICY DECISION (WED.) *RETAIL SALES, JOBLESS CLAIMS (THURS.) *NY FED MANUFACTURING INDEX, INDUSTRIAL PRODUCTION, SERVICES PMI & MANUFACTURING PMI (FRI.) Source: www.investing.com

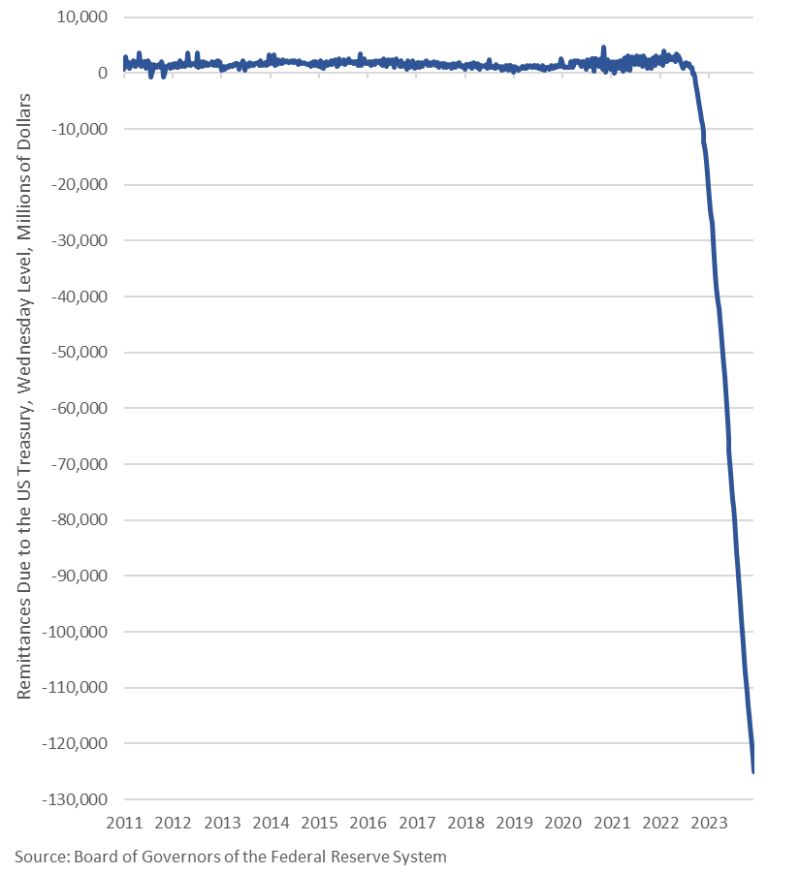

Losses at the Fed have now passed $125 billion

Source: Win Smart, CFA

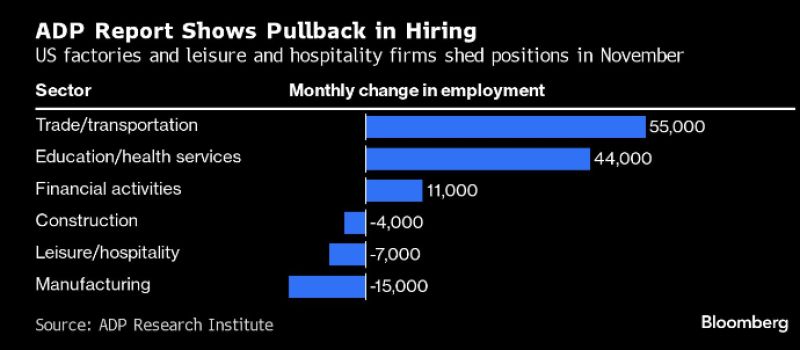

The ADP jobs report shows that the US labor market is cooling

U.S. firms scaled back hiring in November. Adding only 103k private payrolls compared 130k expected, according to ADP. Job cuts were seen in manufacturing, construction, and leisure/hospitality sectors. ADP’s report is based on payroll data covering +25 million US private-sector employees. Source: Genevieve Roch-Decter, CFA, Bloomberg

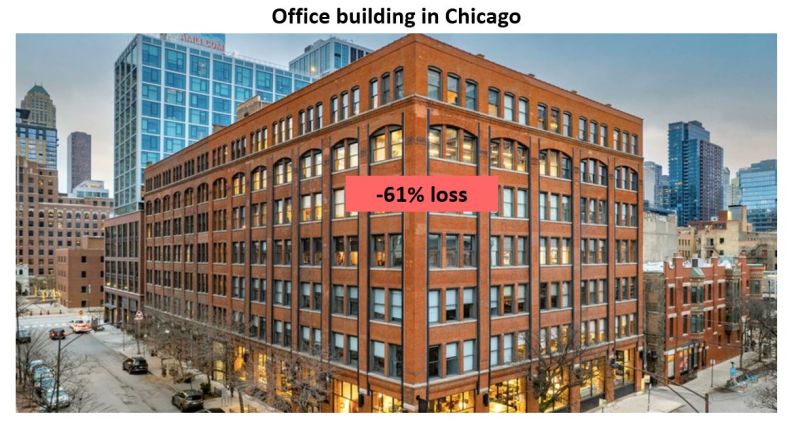

Here's one illustration of the US commercial real estate market meltdown: values of commercial real estate continues to get destroyed in Chicago...

A 155k SF office building in Chicago just sold for $17 million, or $109 per SF The seller took a huge 61% loss, paying $44 million for the building in 2017 Here's a worrying snippet from Crain's: "Thanks to remote work and higher interest rates, real estate investors can buy downtown office buildings on the cheap these days. Add a motivated seller trying to unload all of its office stock and the discount gets even steeper. Many office properties in the heart of the [Chicago] are now worth less than the mortgages tied to them, fueling a historic wave of distress." It will be interesting to see how bad the US commercial real estate meltdown gets (particularly in office) but it's certainly a story to keep an eye on in 2024 as big opportunities emerge". Source: TripleNetInvest

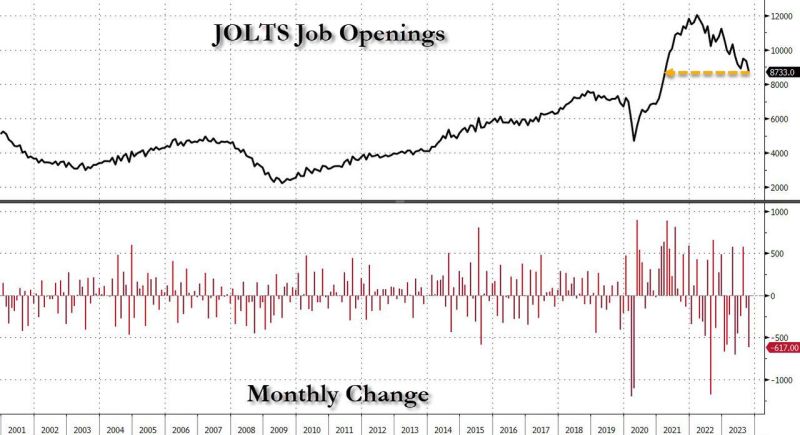

The US job market is starting to crater...

With consensus expecting only a modest drop from the reported September 9.553 million job openings, what the BLS reported moments ago instead was a stunning collapse of 617K job openings to just 8.733 million, the lowest since March 2021. This was a 6-sigma miss to the consensus estimate of 9.3 million... Source: www.zerohedge.com, Bloomberg

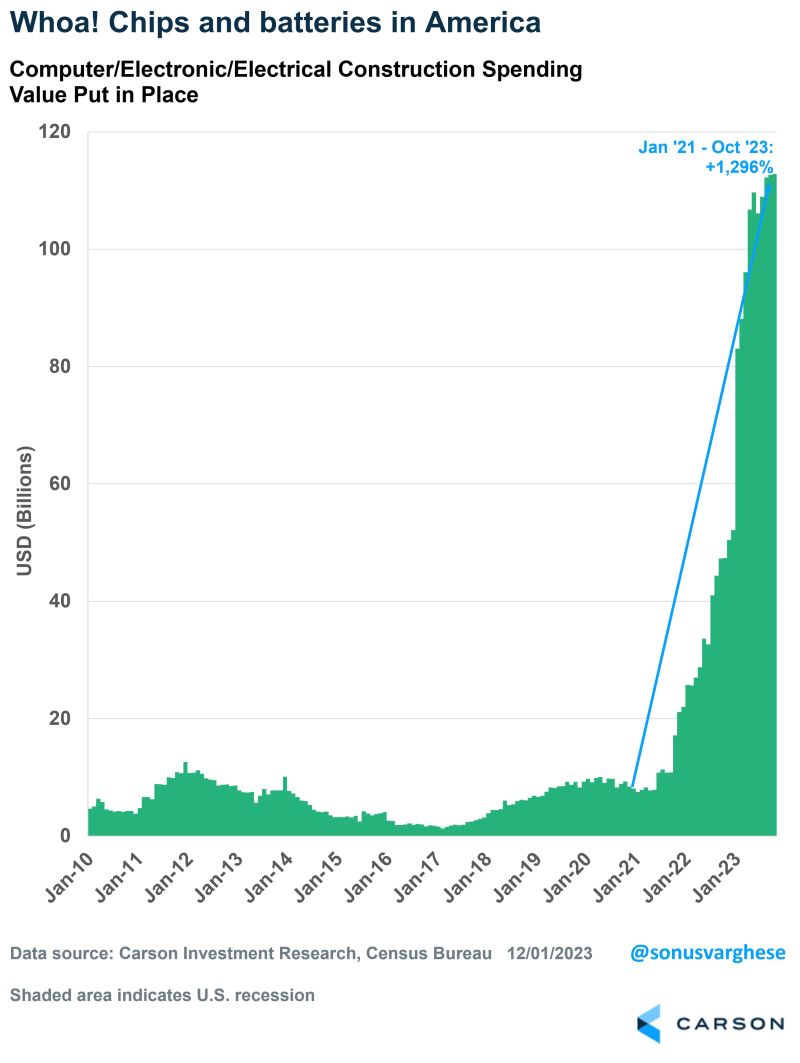

How do you say CHIPS act* in one chart?

Not all fiscal policy has to be a bad thing... this could indeed lead to a big increase in the productivity we will see over the coming years due to this. Source: Ryan Detrick, Carson * CHIPS Act -> In July 2022, Congress passed the CHIPS Act of 2022 to strengthen domestic semiconductor manufacturing, design and research, fortify the economy and national security, and reinforce America’s chip supply chains. The share of modern semiconductor manufacturing capacity located in the U.S. has eroded from 37% in 1990 to 12% today, mostly because other countries’ governments have invested ambitiously in chip manufacturing incentives and the U.S. government has not. Meanwhile, federal investments in chip research have held flat as a share of GDP, while other countries have significantly ramped up research investments. To address these challenges, Congress passed the CHIPS Act of 2022, which includes semiconductor manufacturing grants, research investments, and an investment tax credit for chip manufacturing. SIA also supports enactment of an investment tax credit for semiconductor design.

Investing with intelligence

Our latest research, commentary and market outlooks