Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

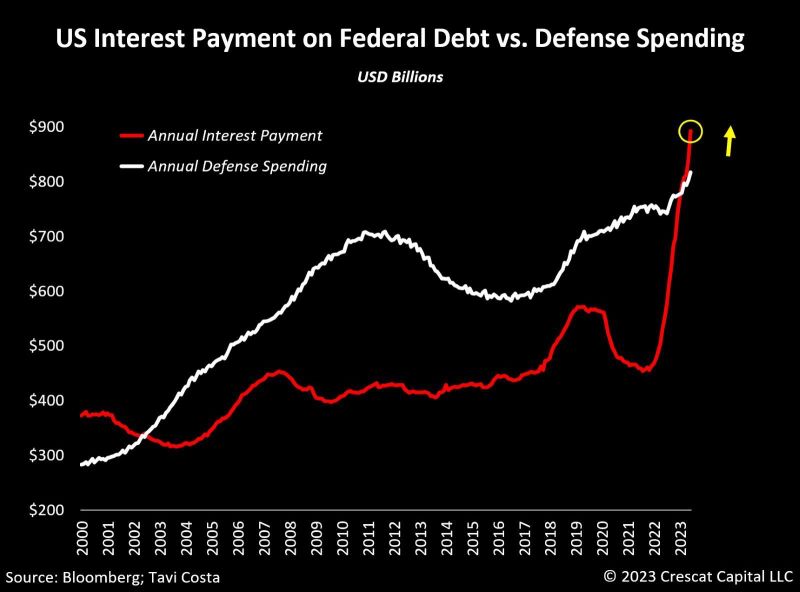

As highlighted in the Kobeissi Letter and in the chart below from Tavi Costa >>> Annualized interest expense on US Federal debt is nearing $1.1 TRILLION

To put this in perspective, 2023 defense spending was $821 billion. This means the US is on track to spend 34% MORE on interest expense than defense spending. In 2023, the US government produced $4.4 trillion in revenue. This means that 25% of receipts in the entire 2023 are equivalent to Uncle Sam's annual interest expense. Rising rates and falling tax revenue are both occurring at the same time. A tricky combination

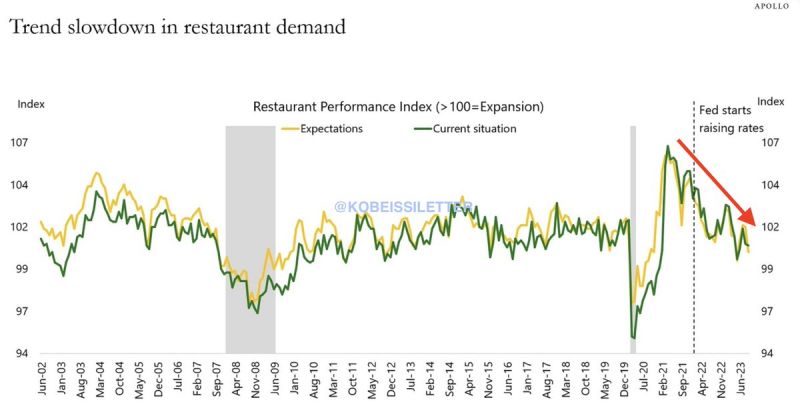

Interesting development highlighted by The Kobeissi Letter:

Is the slowdown in restaurant activity signalling that a FED pivot Indicators of restaurant activity continue to show signs of weakness in the US. Interestingly, this has been almost perfectly correlated with the Fed raising rates. Restaurant activity in the US hit an all time high in August 2021. Since the Fed started raising rates in March 2022, restaurant activity has moved in a straight line lower. As excess savings are depleted and inflation remains an issue, consumers are cutting back. And more credit card debt is not the solution here.

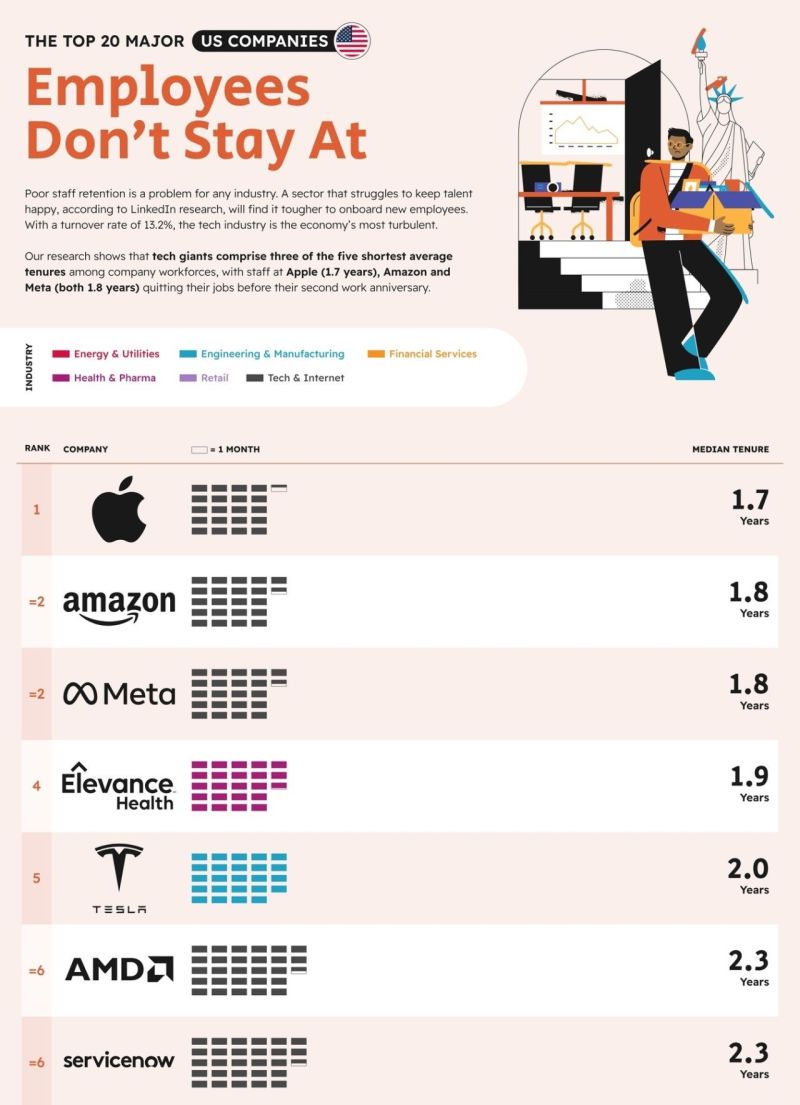

Ranked: Worst U.S. Companies for Employee Retention 💼

This graphic by NeoMam Studios is part of Visual Capitalist’s Creator Program, featuring work from the world’s top data-driven talent ✅

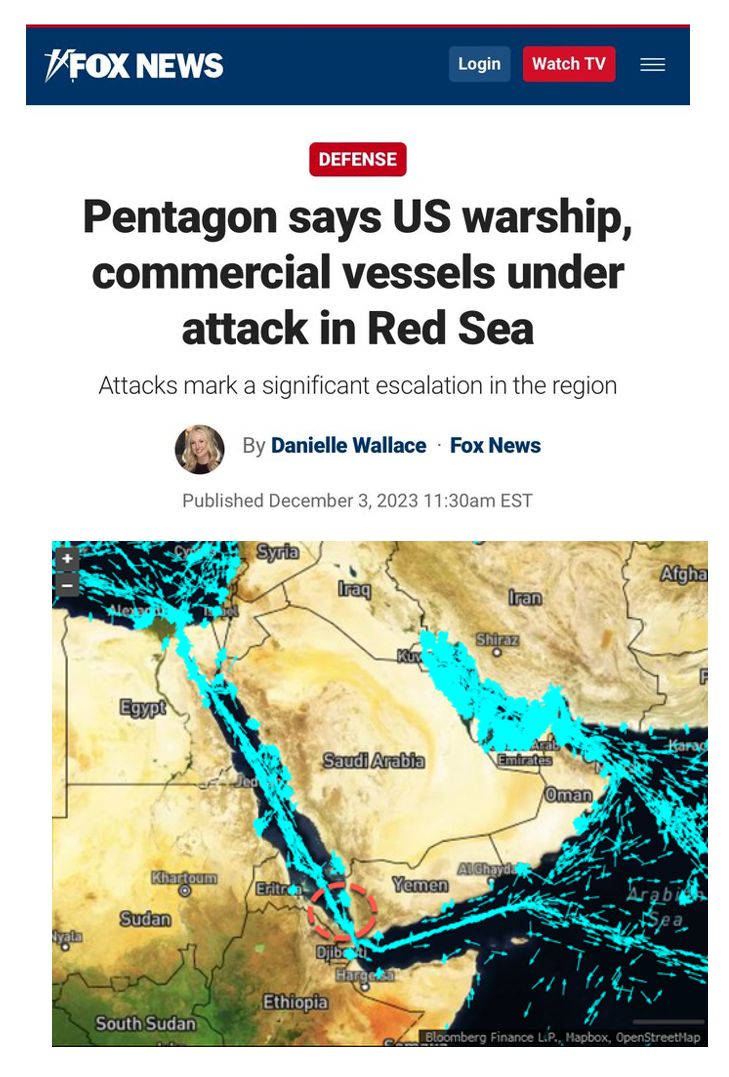

The Pentagon said Sunday a U.S. warship and multiple commercial vessels are under attack in the Red Sea.

‘We’re aware of reports regarding attacks on the USS Carney and commercial vessels in the Red Sea and will provide information as it becomes available,’ the Pentagon said, according to the Associated Press.” Meanwhile, "Gulf of Tonkin" is trending on X in the US. Source: Fox News, www.zerohedge.com

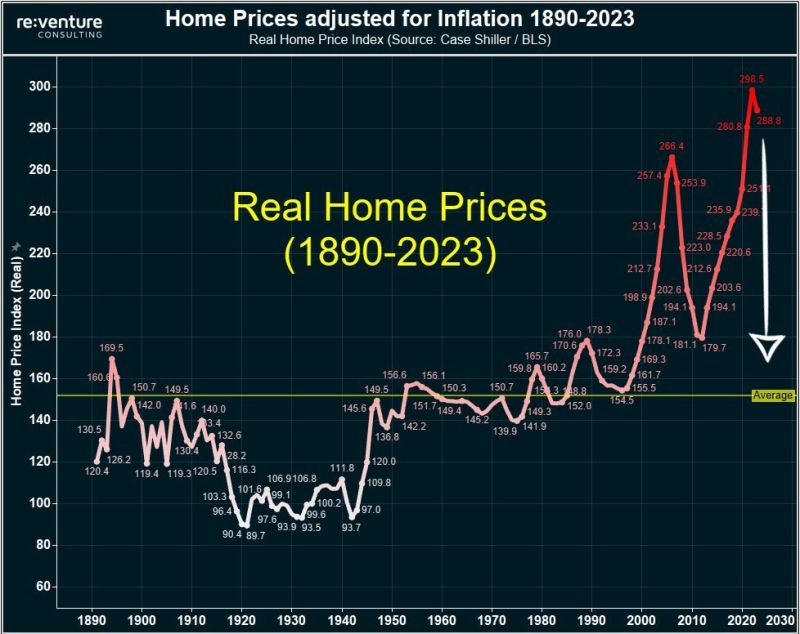

As highlighted by The Kobeissi Letter, the US housing market is having its historical moment

The US housing market is having its historical moment. Indeed, Real home prices in the US are currently almost 10% MORE expensive than they were in 2008. In fact, real home prices are now 80% ABOVE the 130-year historical average, according to Reventure. This means that even on an inflation adjusted basis, home prices have never been more expensive. Meanwhile, housing supply is 40% below the historical average. All while mortgage demand is at its lowest since 1994 and the median homebuyer now has a $3000/month payment. Source: The Kobeissi Letter, Reventure

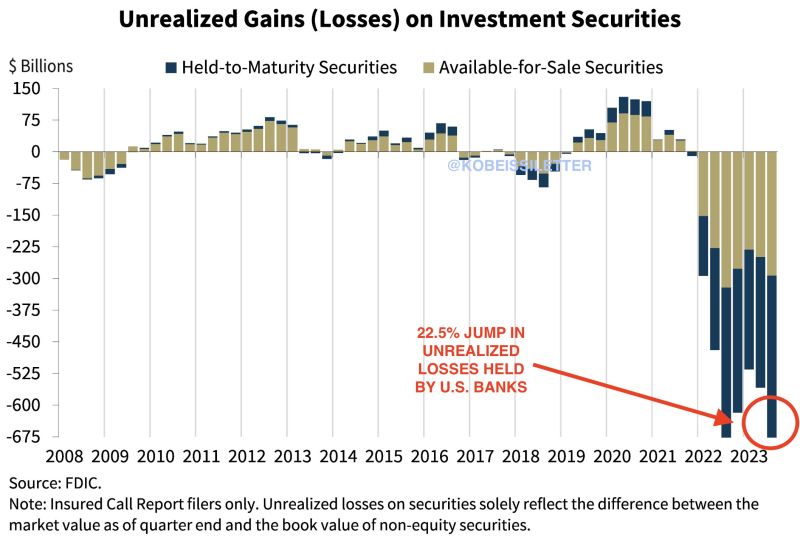

Is the US banking crisis really over?

Unrealized losses on investment securities held by US banks hit $684 billion in Q3, according to the FDIC. This marks a 22.5% jump compared to unrealized losses seen last year. The jump was primarily driven by rising mortgages rates reducing the value of mortgage-backed securities held by banks. Despite these challenges, the FDIC states that banks remain "well capitalized." This comes as usage of the Fed's emergency funding facility for banks hit another record high of $114 billion. Source: The Kobeissi Letter

Buying a home is now 52% more expensive than renting, the highest premium on record (note: the premium peaked at 33% during the last housing bubble in 2006)

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks