Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Hedge Funds betting on a decline in US and European stockmarkets have suffered an estimated $43bn of losses in a sharp rally over recent days.

Short sellers, many of whom had built up bets against companies exposed to higher borrowing costs over the past year or so, have been caught out by a “painful” rebound in “low quality” stocks this month, said Barclays’ head of European equity strategy Emmanuel Cau. That has come as the market has grown more confident that the US Federal Reserve’s cycle of rate rises is finally over. Funds suffered $43.2bn of losses on short bets in the US and Europe from Tuesday to Friday inclusive last week, according to calculations by data group S3 Partners, which do not take account of gains that funds may have made in other stocks they own. Source: FT

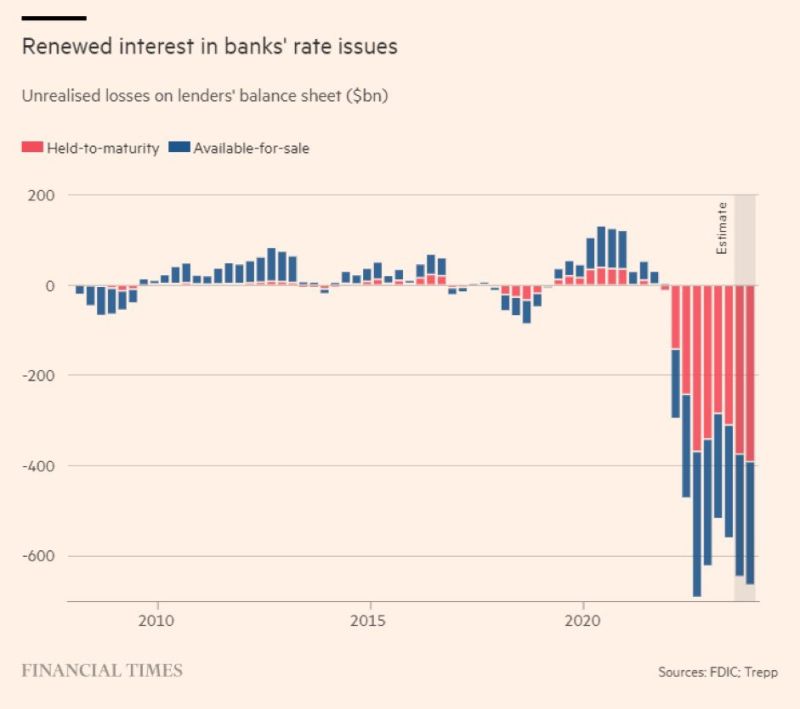

U.S. Bank Losses on held-to-maturity assets have soared to an ALL-TIME HIGH of $400 Billion! 👀

Source: Barchart, FT

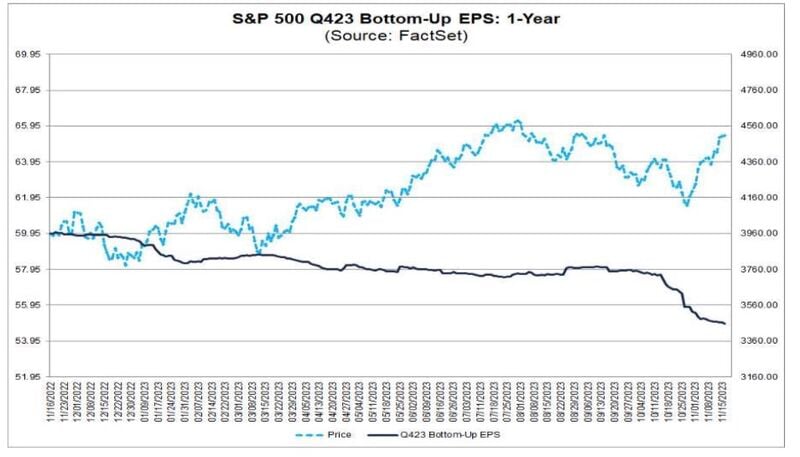

The rally in US stocks in recent weeks has taken attention away from what looks like a pretty concerning forward picture from earnings releases

Q4 earnings expectations have come down considerably in recent weeks, in contrast with equity market strength. Source: Bob Elliott, Factset

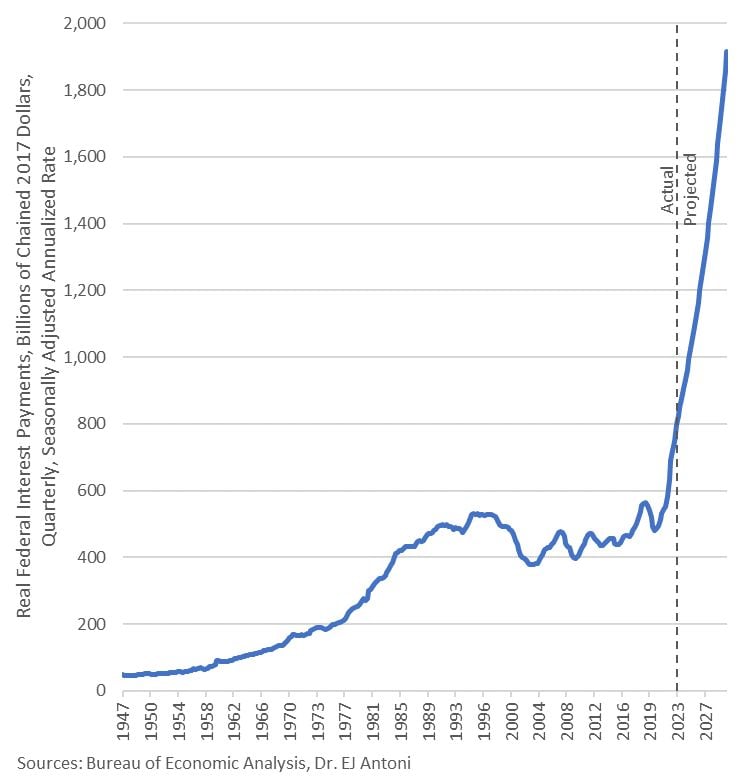

The US government collects about $2.5 trillion per year in personal income taxes. Of that about $1 trillion per year (40%) is being consumed by interest on the national debt

Interest on the debt is growing as old cheap debt matures and gets refinanced at the new higher rates. Plus new debt added every year. Within a few more years, at this pace, 100% of personal income taxes will be going to pay interest on the US national debt. Source: E.J Antoni, WallStreetSilver, BEA

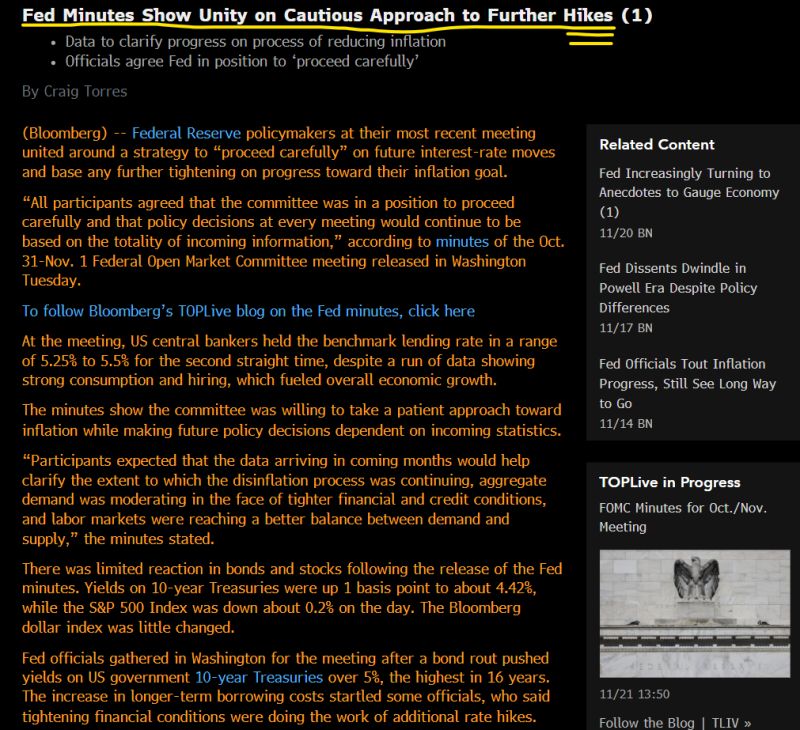

SUMMARY OF FED MEETING MINUTES (11/21/23):

1. All Fed Members agree to “proceed carefully” 2. Fed sees rates “remaining restrictive for some time” 3. Fed sees upside risks to inflation 4. Fed sees downside risks to growth 5. Meeting by meeting approach to resume It's amazing how US markets keep pricing cuts. When the Minutes reiterate, yet again, that while the Fed are cautious they still have a tightening bias.

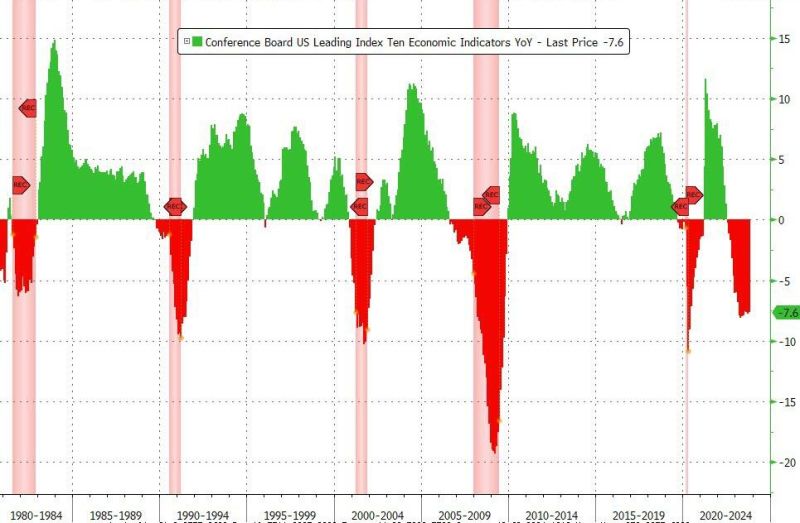

US Leading Indicators Tumble For 19th Straight Month

Worst Streak 'Since Lehman' on a year-over-year basis, the LEI is down 7.6% (down YoY for 16 straight months) - close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse... Source: Bloomberg, www.zerohedge.com

BREAKING: Binance >>>

Department of Justice is seeking a penalty of $4 billion from Binance in order to settle a criminal investigation Crypto exchange Binance is nearing a settlement with the U.S. Department of Justice to resolve a criminal investigation into alleged money laundering, bank fraud, and sanctions violations, unnamed sources told Bloomberg. If the settlement deal goes through, it would be one of the largest-ever penalties in a crypto case. Negotiations have included the possibility of criminal charges against Binance's founder and CEO Changpeng Zhao, also known as CZ. However, as it currently stands the deal would allow the crypto exchange—the world's largest by volume—to keep operating while holding its leadership accountable. If finalized, Binance would likely pay the fine as part of a deferred prosecution agreement. This would require Binance to meet prescribed conditions like overhauling compliance programs, according to the report. Source: Decrypt, Altcoin Daily

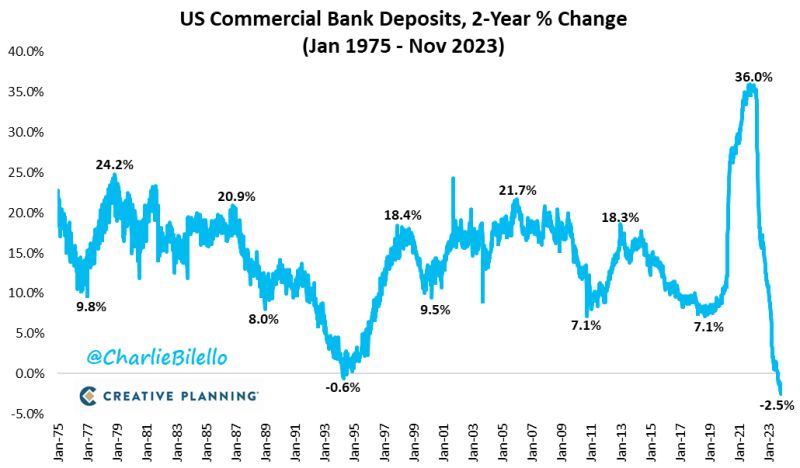

US Commercial Bank deposits fell 2.5% over the last 2 years, the largest 2-year decline on record

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks