Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Continuing Jobless Claims Surges To 2 Year High

The number of Americans filing for jobless benefits for the first time last week jumped to 231k (from an upwardly revised 218k), up to its highest since August...Worse still, continuing claims keeps rising, to 1.864mm - the highest since November 2021... Source: Bloomberg, www.zerohedge.com

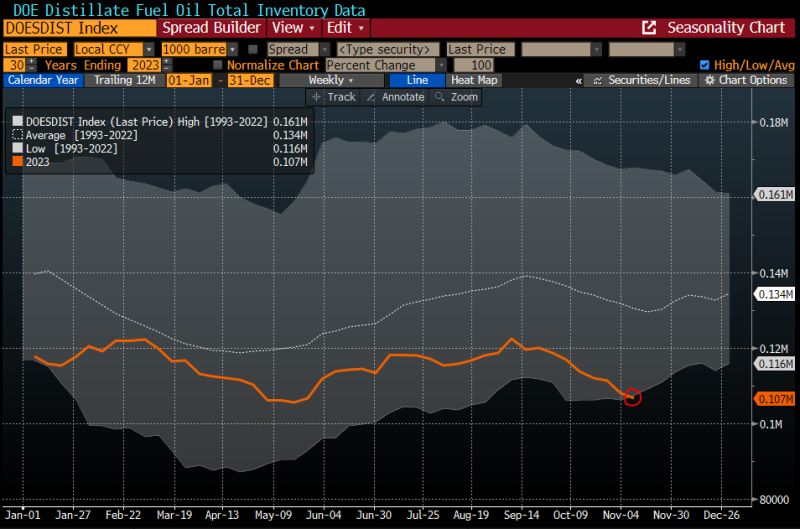

Let's hope the US economy is truly slowing down -- particularly manufacturing --, and that the winter is mild

US stocks of distillate fuel (diesel and heating oil) are ending the fall season at their lowest **seasonal** level in data since 1982 | Source: Javier Blas, Bloomberg

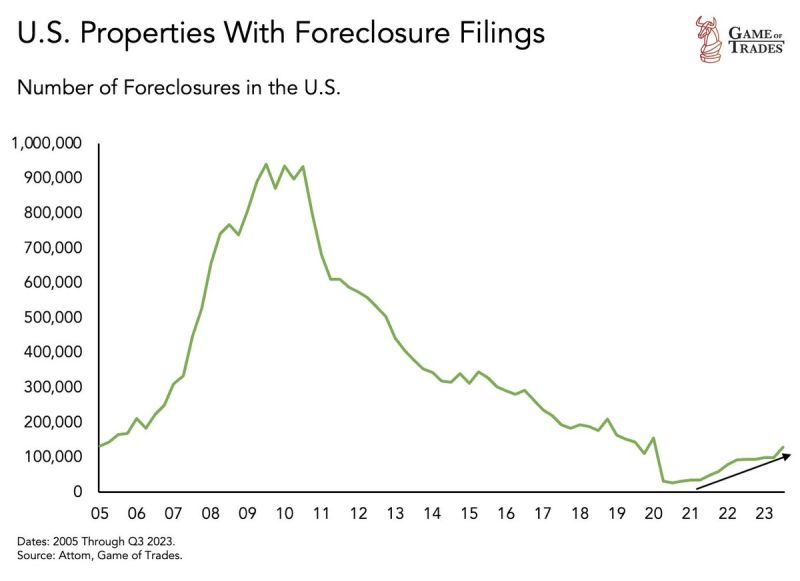

Property foreclosure filings have been increasing recently

This is the result of high interest rates resulting in rising mortgage defaults. Source: Game of Trades

President Joe Biden and China’s President Xi Jinping have their first in-person meeting in about a year

This is the first time since 2017 that Xi has stepped foot on American soil. Although the US-China relationship is breaking, experts and U.S. officials caution not to expect markedly improved relations post-meeting. Mrs Yellen might be rather in favor of some kind of cooperation... Source image: Michel A.Arouet

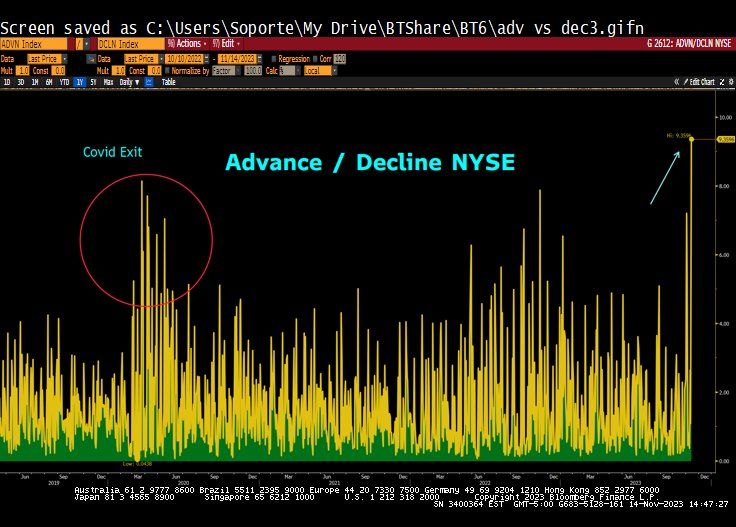

Yesterday was the best market breadth day in the US since the Covid-19 stress exit...

Source: Lawrence McDonald, Bloomberg

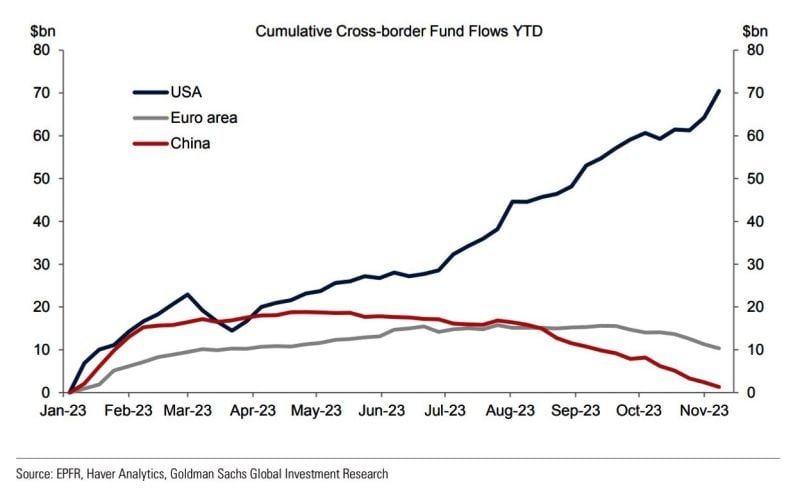

Fund flows continue to move to the US at the expense of the rest of the world

Source: Michael A. Arouet, Goldman Sachs

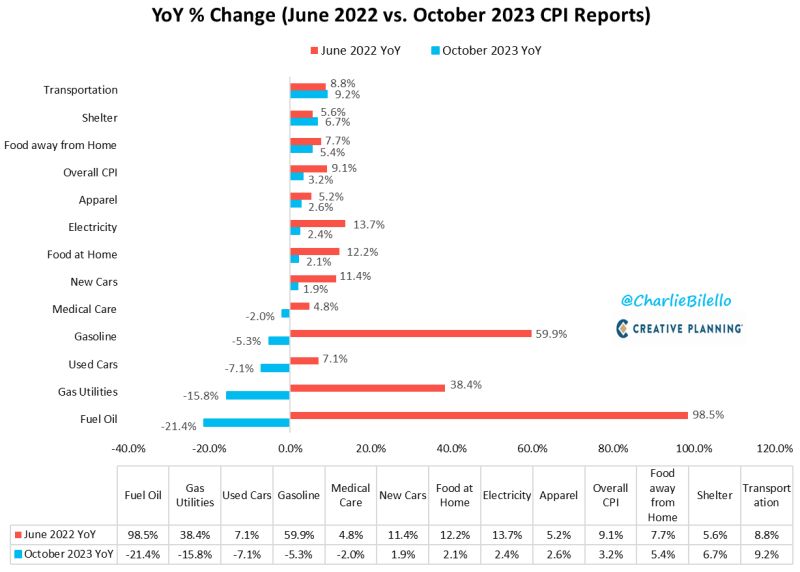

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Used Cars, Gasoline, Medical Care, New Cars, Food at Home, Electricity, Apparel, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

Has there been a better pairs trade than long US, short world... ever?

This relationship has generated steady alpha for a decade and a half now. Growth over value and large over small have also been excellent long / short pairs. Source: Steven Strazza

Investing with intelligence

Our latest research, commentary and market outlooks