Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

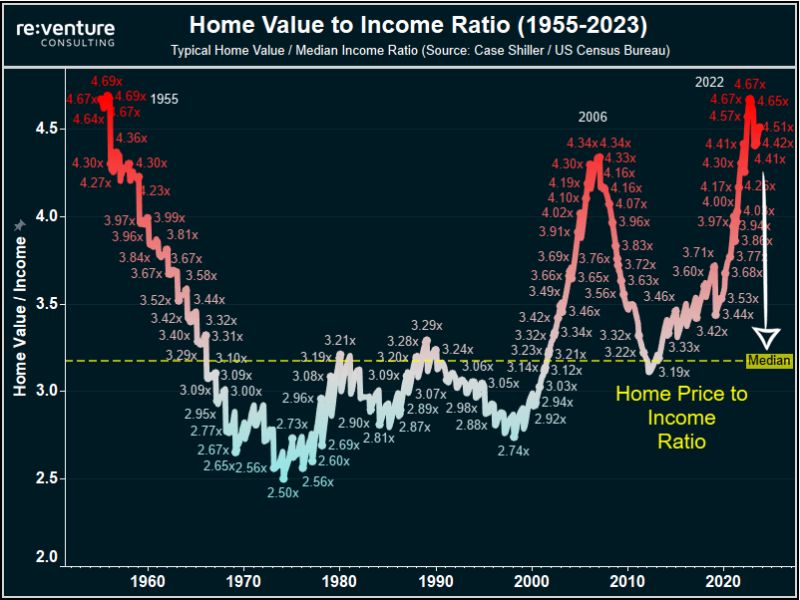

Home price to income ratios are now above 4.5x and at their highest levels since the 1950s

Even in the 2008 financial crisis, home price to income ratios did not cross 4.5x. This means that home price to income ratios are the same as the post-WW2 era in the US. The median home price to income ratio is 1.2x below current levels, at 3.2x. Either home values need to fall or income needs to rise. Source: The Kobeissi Letter

In case you missed it: now that the Fed's blackout window is over, everyone said the same thing in the days that follow the FOMC meeting: "higher for longer":

*FED'S COLLINS: FURTHER FED HIKES 'CERTAINLY NOT OFF THE TABLE', EXPECT RATES MAY HAVE TO STAY HIGHER FOR LONGER *FED's BOWMAN: MORE RATE HIKES LIKELY NEEDED TO GET INFLATION TO 2%, NEED TO REPEAT MONETARY POLICY ISN'T ON PRESET COURSE *FED'S DALY: I DON'T GET TO A POINT WHERE I'M READY TO DECLARE VICTORY, UNLIKELY INFLATION WILL REACH 2% GOAL IN 2024

Yields pushing higher

US 2Y yields hit their highest since July 2006 US 5Y yields highest since Aug 2007 US 10Y highest since Nov 2007 US 30Y highest since April 2011 Source: Bloomberg, www.zerohedge.com

In case you missed it...

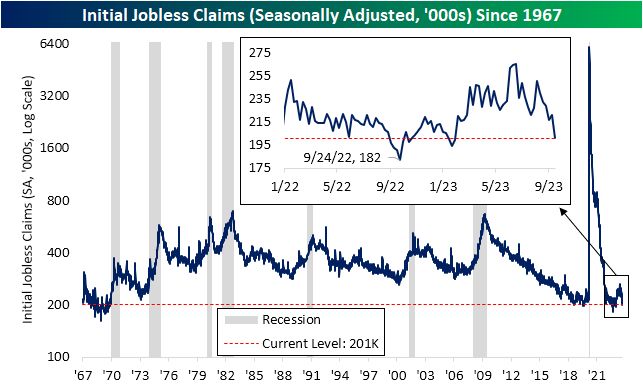

US Jobless Claims Fall to 201,000, Lowest Level Since January...There haven't been many times in the last 50+ years that #us initial jobless claims have been lower. Source: Bespoke

S&P 500 Index breaches 4400 level

The SPX Index breaches down its 4'400 Level and testing the 100 days Moving Averaged. Market continues yesterday downtrend after the Fed signaled it will keep rates higher for longer.

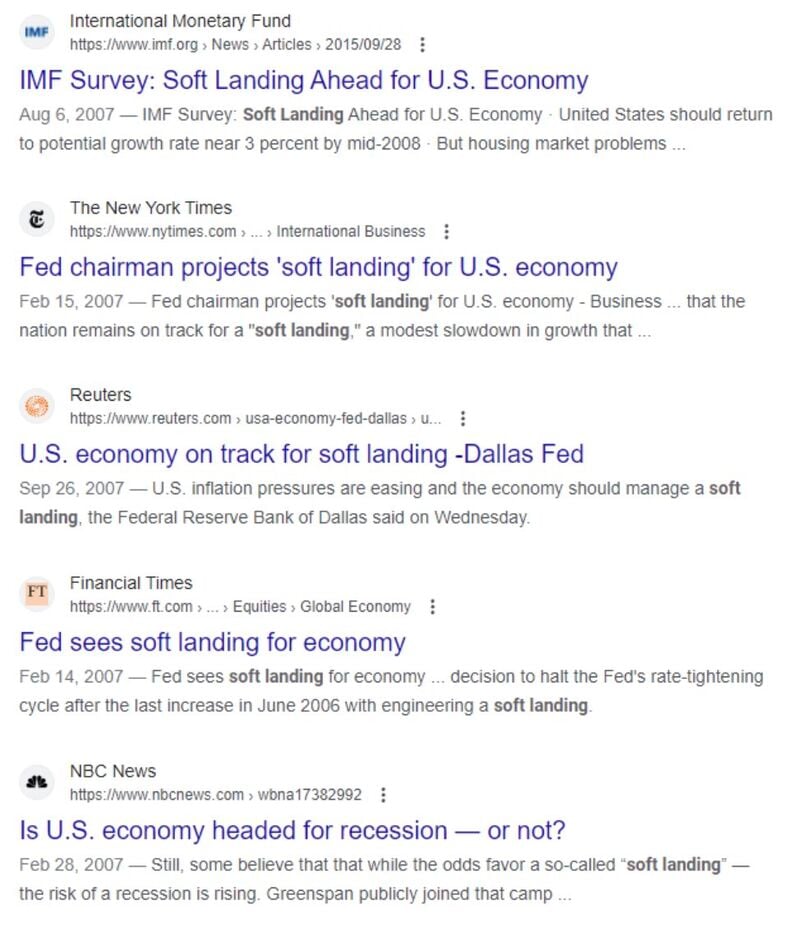

Soft landing narrative is not new. It’s quite common before each recession

Source: Michel A. Arouet

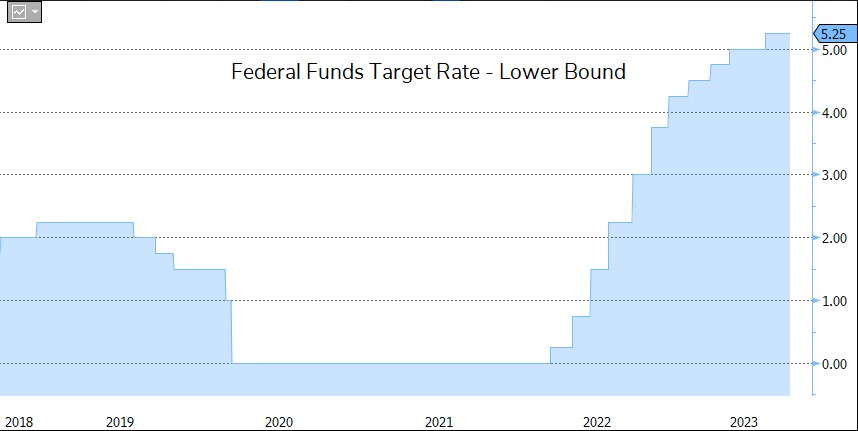

FED leaves rates unchanged, signals one more hike this year

The Federal Reserve left its benchmark interest rate unchanged while signaling one more hike this year. FOMC repeated language saying officials will determine the “extent of additional policy firming that may be appropriate.” The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while projections showed 12 of 19 officials favored another rate hike in 2023.

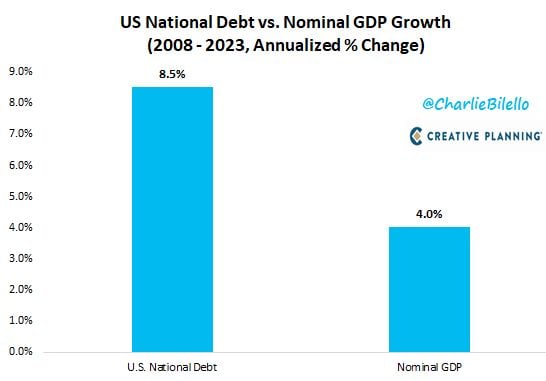

Over the last 15 years, the US National Debt has increased at a rate of 8.5% per year versus an increase in economic growth (nominal GDP) of 4.0% per year

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks