Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

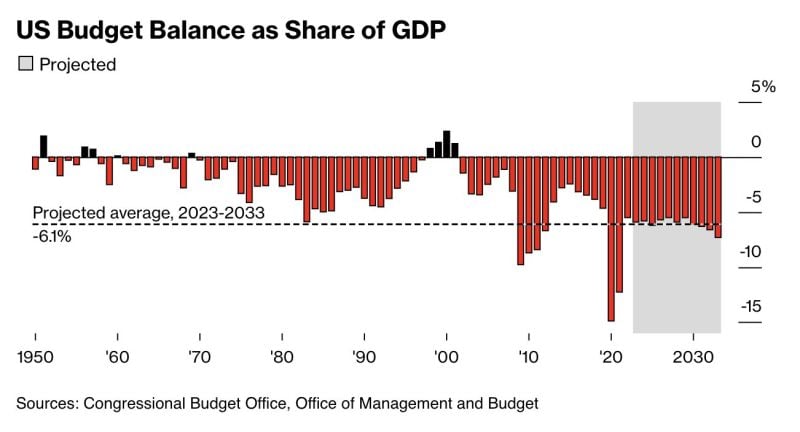

Very strange to see the US spending like we are in a recession while calling for a "soft landing."

As highlighted by The Kobeissi Letter, the US is now spending 44% of GDP per year, the same levels as World War 2. Deficit spending alone is a massive 6% of GDP per year. Since the debt ceiling crisis, the US has been borrowing ~$14 billion PER DAY to cover deficit spending. By 2033, Bloomberg projects deficit spending will be ~7% of GDP... Source: CBO, The Kobeissi Letter

US 10 year yields keep rising in tandem with oil

WTI oil now trades at $93.5/bbl. So is oil & inflation fears the only reason for bond yields to move upward? Probably not. The fact that real yields are also on the rise shows that inflation is not the only culprit. Investors are adjusting to the reality of rates staying high for longer than expected. They are also requesting positive real yield to get compensated for being invested in US treasuries at the time the US Treasury is issuing massive amount of debt while the FED keeps shrinking its balance sheet through QT. Source chart: Bloomberg

The Total US Bond Market ETF now has a negative return over the last 7 years. $BND

Source: Charlie Bilello

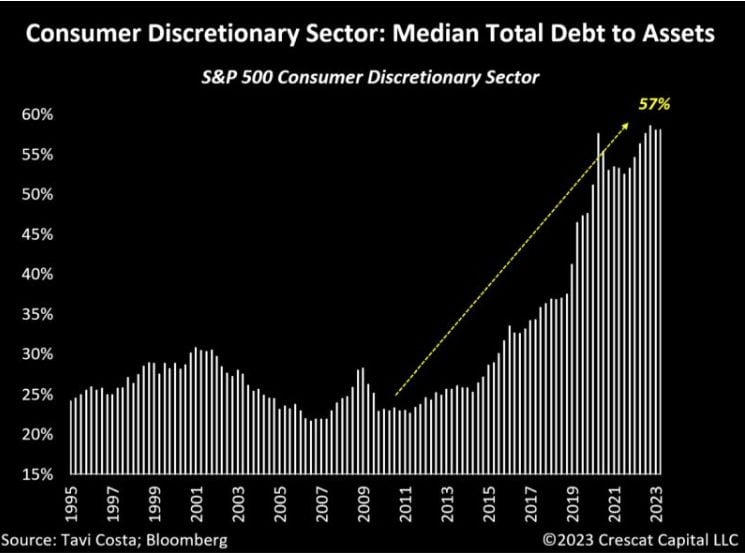

Consumer balance sheets are getting stretched

Accumulating debt during a low interest rates environment is one thing. But in light of the continuous surge of the price of money, the US consumer is probably starting to feel the pain Source: Crescat Capital, Bloomberg

GS Financial conditions index is tightening significantly, now at the tightest since November 2022...

This is probably what the FED wants to see...until something breaks... Source: www.zerohedge.com, Bloomberg

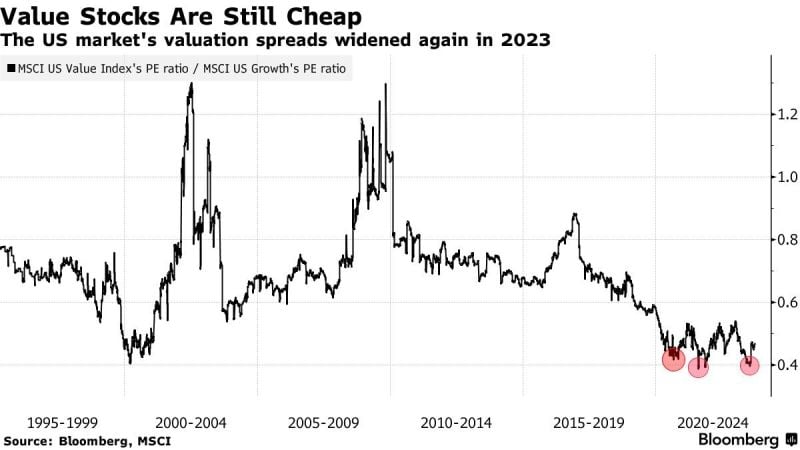

Value Stocks are trading near the cheapest levels of the past 30 years

Source: Barchart

US 10-year Treasury yield is skyrocketing and now at 4.63%, its highest since June 2007

Since last week’s Fed meeting, the 10-year note yield is up 35 basis points. Since the last Fed rate hike in July, the 10-year note yield is up 60 basis points. Meanwhile, Fed rate HIKE expectations have NOT changed. As highlighted by the Kobeissi Letter, odds of another rate hike have actually gone DOWN. But, a long Fed PAUSE is being priced-in now. All as record levels of US Treasuries are being issued while FED balance sheet reduction pace has been accelerating (QT). This bear steepening is pushing the dollar UP and weighing on stocks valuations especially long duration ones, i.e tech darlings. Source. CNBC, The Kobeissi Letter

This chart by Goldman shows the regime change which has been in place over the last few weeks

Despite the rise in 30-year real yields, short duration stocks (i.e value and the likes) were underperforming long duration ones (i.e IT/growth stocks). Things are now normalizing as short duration stocks are progressively catching up in terms of relative performance. The growth/IT basket probably needs 30-year real yield to reverse trend in order to outperform again...

Investing with intelligence

Our latest research, commentary and market outlooks