Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

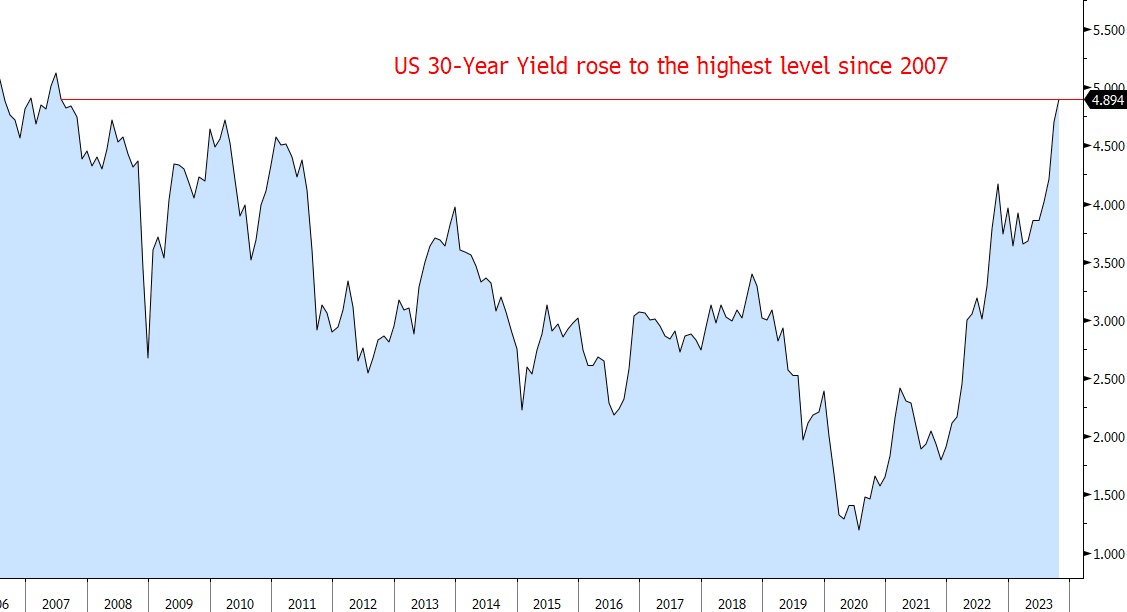

US 30Year Yield reaches 2007 High

The US 30-year yield rose to the highest level since 2007. This week's Treasury selloff came after US lawmakers managed to avert a government shutdown, prompting traders to increase bets that the Federal Reserve will raise rates in November.

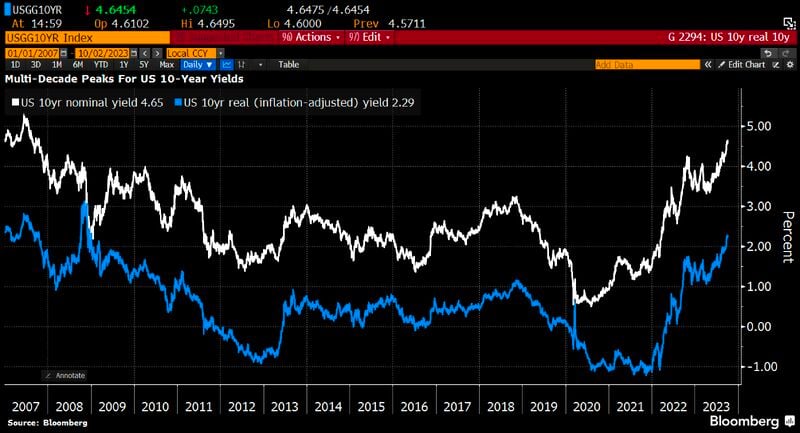

US 10y yields keep rising with most of the increase is due to the rise in real yields. US 10 year yields is now at 4.65%, 10 year real yields at 2.29%

Source: Bloomberg, HolgerZ

Bloomberg on the status of US "excess pandemic savings."

Source: Bloomberg

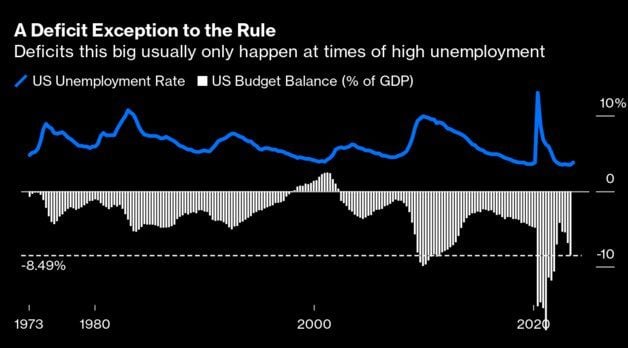

The US is running 10% deficit with record low unemployment

Imagine the deficit in next recession, whenever it may come. Enjoy these positive real rates as long as they last. Source: Michel A.Arouet, Bloomberg

In case you missed it:

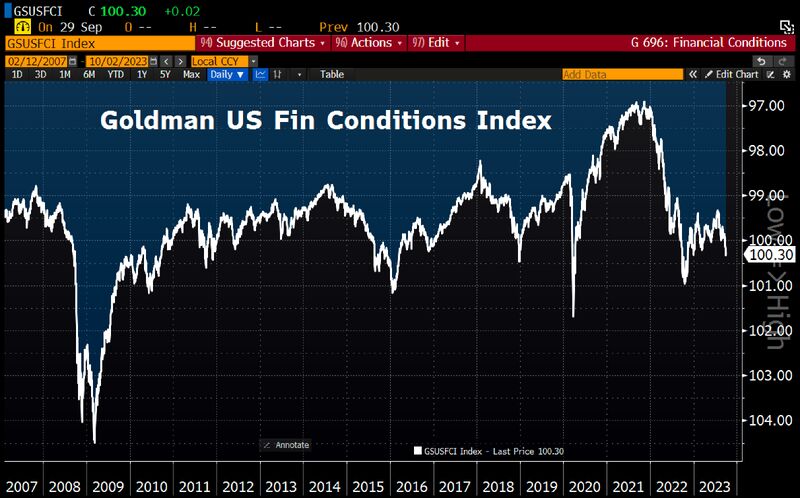

The past few months have brought a very significant tightening of US financial conditions; the Goldman Sachs Financial Conditions Index is now at the most restrictive point since November 2022. (HT GS) Source: HolgerZ, Bloomberg

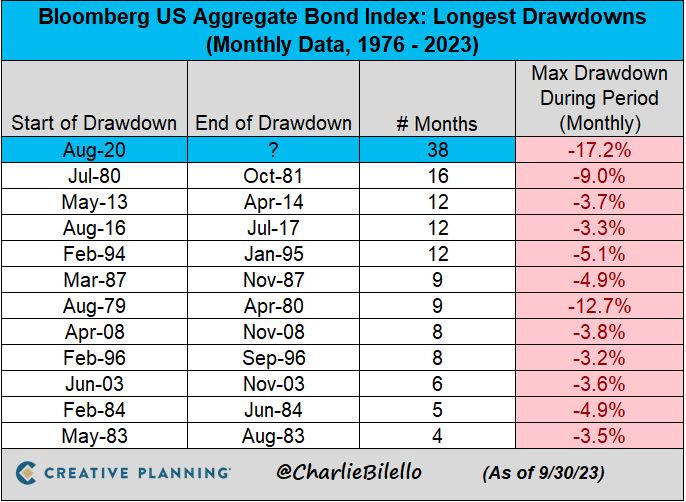

The US Bond Market has now been in a drawdown for 38 months, by far the longest bond bear market in history

The US Bond Market has now been in a drawdown for 38 months, by far the longest bond bear market in history

Congress Averts US Government Shutdown Hours Before Deadline – Bloomberg

The US narrowly averted a disruptive and costly shutdown of federal agencies as Congress passed compromise legislation to keep the government running until Nov. 17. The legislation, passed in both chambers Saturday just hours before a midnight deadline, buys Democrats and Republicans time to negotiate longer-term federal funding. It doesn’t include new funding for Ukraine. President Joe Biden signed the bill late Saturday night, capping an extraordinary day in Washington that began with the country careening to what appeared to be an inevitable and prolonged federal funding lapse.

Investing with intelligence

Our latest research, commentary and market outlooks