Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

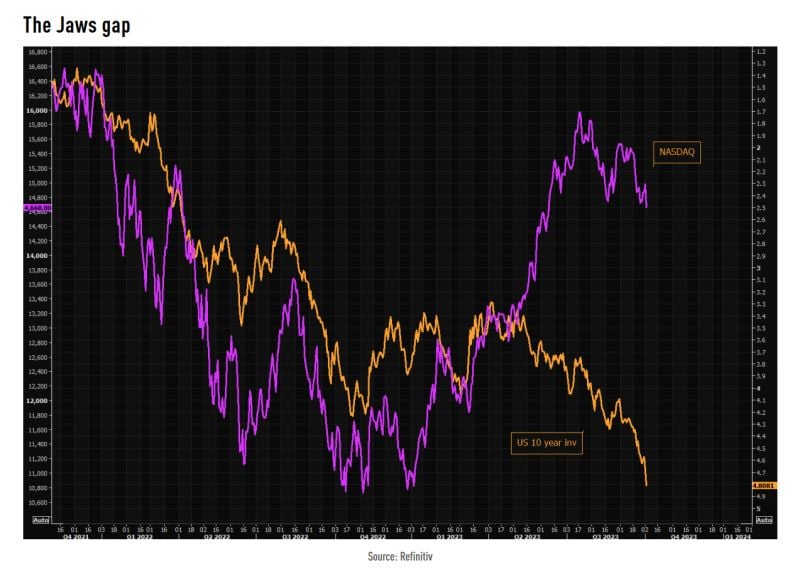

The gap between NASDAQ and the US 10 year (inv) remains absolutely massive

Source: TME

House ousts Kevin McCarthy as speaker, a first in U.S. history

This is likely to add to bond and equity markets volatility. OUR TAKE - This is a big event, at least politically. The House has no Speaker and business can be conducted until a new Speaker is installed. - There is a risk that this is an event for financial markets. The recent rise in bond yields is being driven by a lot of factors and political dysfunction is probably one of them. The US debt servicing cost has hit the inflection point for austerity at the same time basic governing is proving to be impossible. - More bond and equity markets volatility are likely Source: CNBC

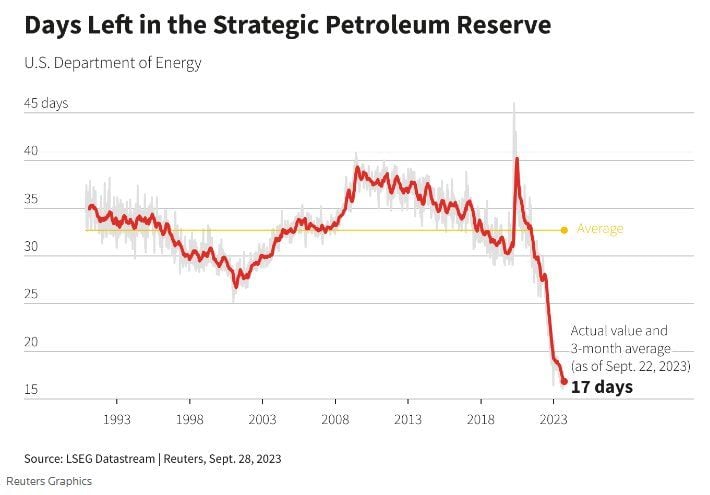

According to Reuters, the US currently has just 17 days of supply left in the Strategic Petroleum Reserves (SPR)

This is roughly half the historical average of ~33 days dating back to 1990. Meanwhile, oil prices are still almost 30% above the target price the US is set to refill… Source: The Kobeissi Letter

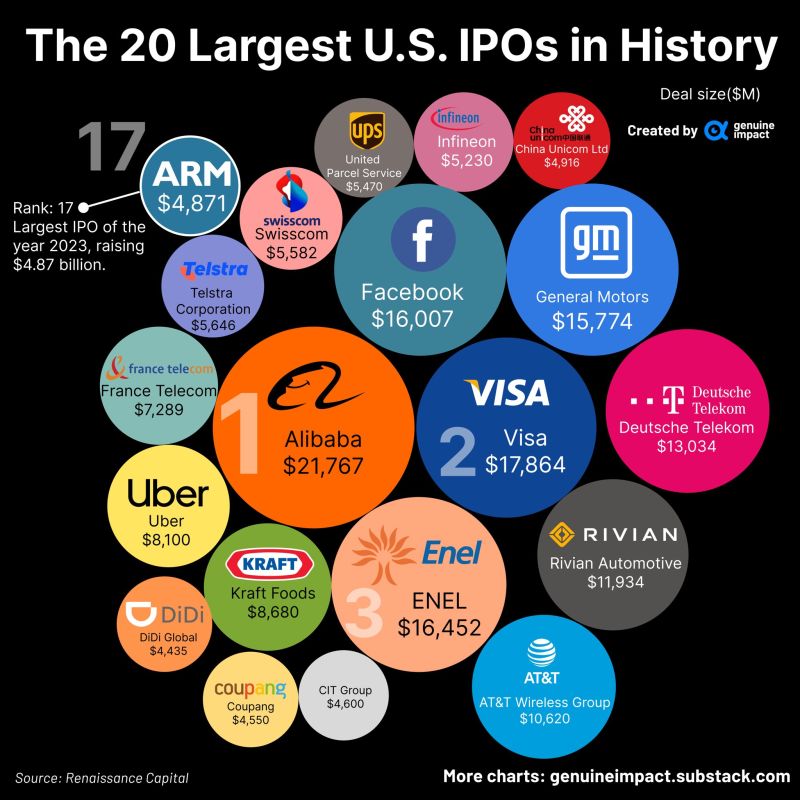

Arm takes the spotlight as the largest 2023 IPO, a year that has been almost deathly quiet for I.P.O.s.

The chip designer, which is owned by SoftBank, had priced its offering at $51 a share, raising $4.87B. Source: Genuine Impact

The Federal Reserve Board has just joined Instagram

The aim is to "increase the accessibility and availability of Board news and educational content." Let see if the young generation finds this picture inspiring...

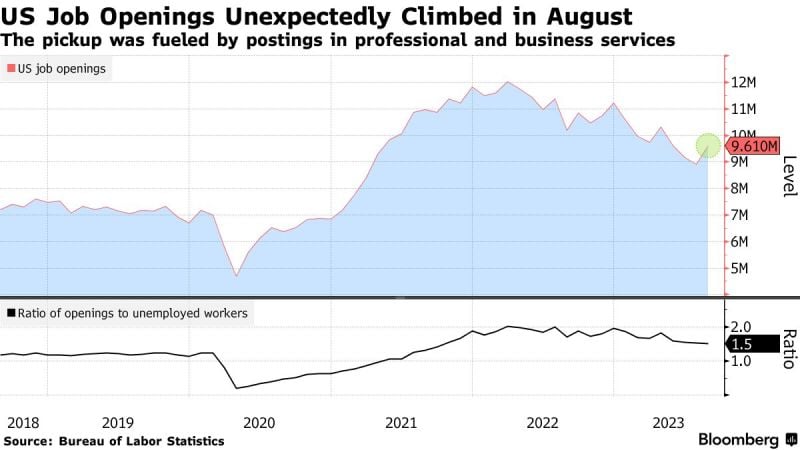

US job openings top all forecasts as white-collar positions jumped: equity markets tanking as US 10 year yields hit fresh 16y high with all of the increase is due to a rise in real yields

US 10y nominal yields is now at 4.73%, 10y real yields (nominal yields-10y inflation expectations) at 2.37%. THE FACTS - US job openings unexpectedly increased in August, fueled by a surge in white-collar postings, highlighting the durability of labor demand. - The number of available positions increased to 9.61 million from a revised 8.92 million in July, the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, or JOLTS, showed Tuesday. Hiring edged up, while layoffs remained low. - The level of openings topped all estimates in a Bloomberg survey of economists. - The so-called quits rate, which measures voluntary job leavers as a share of total employment, held at 2.3%, matching the lowest since 2020. Fewer quits implies Americans are less confident in their ability to find another job in the current market. OUR TAKE In the current context of "higher rates for longer" fears, investors are probably over-reacting to this report which is adding some confusion to the current trend (which has been a progressive cooling down of the job market). Source chart: Bloomberg

Incredibly, ultra long-duration Treasury bonds have now lost more in % terms than stocks did during Great Financial Crisis

The drawdown in extended duration Treasury ETF ( 58.3%) now exceeds PEAK-TO-TROUGH losses in S&P 500 during stock market crash of 2007 - 2009 (56.0%) Source: Jack Farley

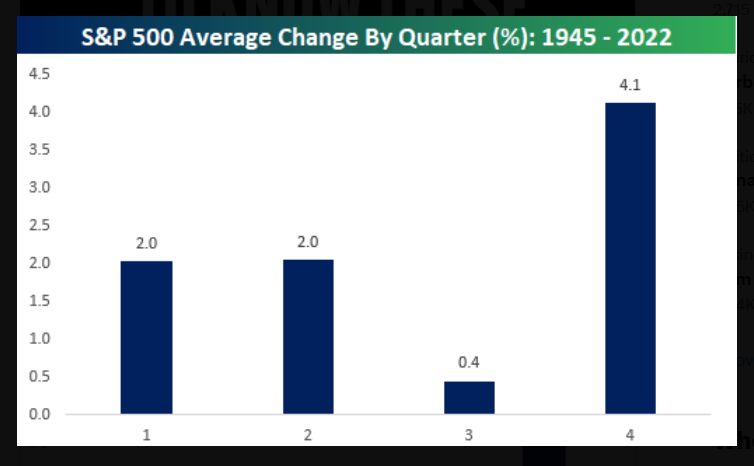

Q4 has easily been the strongest quarter of the year with an average gain that is more than twice the average of Q1 and Q2

Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks