Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

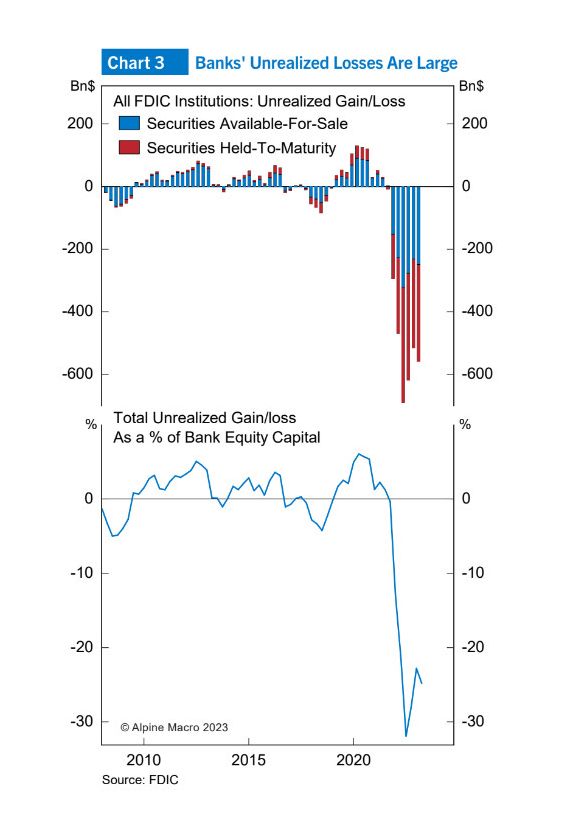

U.S. Banks are facing roughly $600 billion of unrealized losses which accounts for roughly 25% of total banking capital, near the highest levels in history

Source: Barchart, FDIC, Alpine Macro

The Timeline of U.S. Government Shutdowns ⏱️⏱️⏱️⏱️

House Republican leaders canceled a planned two-week recess as a government shutdown appeared more likely after they failed to pass a short-term spending bill with fewer than two days to avoid the shutdown. House Speaker Kevin McCarthy informed the GOP caucus of the canceled break at a closed-door meeting after more than 20 Republicans embarrassed him by voting with Democrats to defeat the bill. The government is scheduled to shut down at 12:01 a.m. ET Sunday if a funding bill is not approved by Congress and President Joe Biden. Source: Statista, CNBC

There we go again...

The game of chicken is on...The US government is now just 48 hours away from a SHUTDOWN. This comes less than 3 months after the largest debt ceiling crisis since 2011. Meanwhile, the government is borrowing over $14 billion PER DAY and spending $3 billion per day on interest expense alone. According to Goldman, a government-wide shutdown would reduce quarterly annualized growth by around 0.2% for each week it lasted after accounting for modest private sector effects. Goldman's baseline is that a shutdown could last for 2-3 weeks (the Trump government shutdown, the longest in history, lasted 35 days, from Dec 22, 2018 to Jan 25, 2019). - Meanwhile, Bloomberg also speculates that in an extreme tail event, the maximum hit to 4Q GDP would be a drag of 2.8% if the shutdown lasts for the entire quarter. Source cartoon: San Diego Tribune

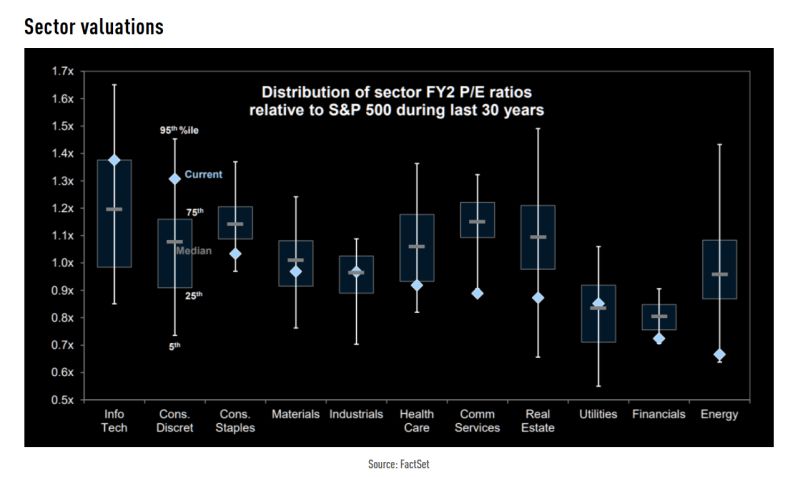

US equites sector valuations vs. history

>>> Energy as the standout cheap one< trades at a material discount to the S&P 500 due to lower growth characteristics and concerns about the duration of the cycle. Source: Goldman Sachs, TME

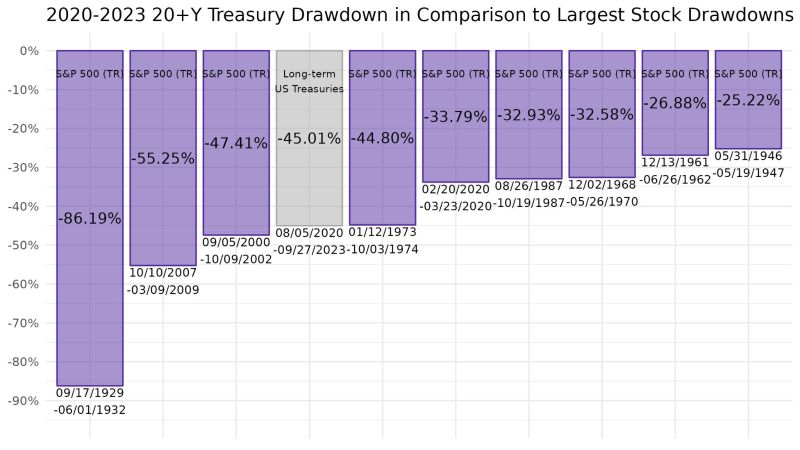

If US Treasuries would the stock market, the current drawdown for long for the stock market in history

Source: Michael Gayed

Billionaire investor Ray Dalio is watching closely the “risky” U.S. fiscal situation

“We’re going to have a debt crisis in this country (...) How fast it transpires, I think, is going to be a function of that supply-demand issue, so I’m watching that very closely.” Dalio is concerned there are more headwinds for the economy than just high debt levels, saying growth could fall to zero, give or take 1% or 2%. “I think you’re going to get a meaningful slowing of the economy,” Dalio said. Source: CNBC

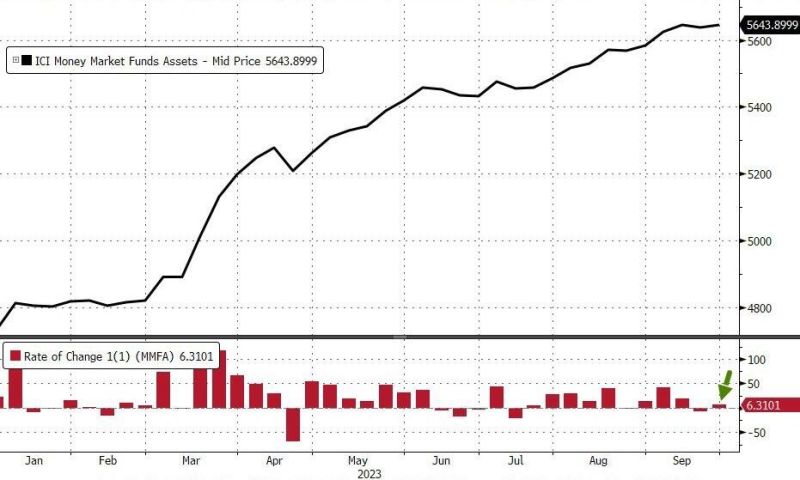

A lot of US banks deposits are going into money market funds which saw a $6.3 billion inflow last week, up to $5.64 trillion

Money market funds paying 5%+ interest rates have become the new safety trade. Source: www.zerohedge.com, Bloomberg, The Kobeissi Letter Activate to view larger image,

US Housing | The National Association of Realtors’ index of contract signings tumbled 7.1% to 71.8 from July, the group reported Thursday

The decline was larger than all estimates in a Bloomberg survey of economists. *US AUG. PENDING HOME SALES FALL 7.1% M/M; EST. DOWN 1% *US AUG. PENDING HOME SALES FALL 18.8% FROM PREVIOUS YEAR Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks