Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

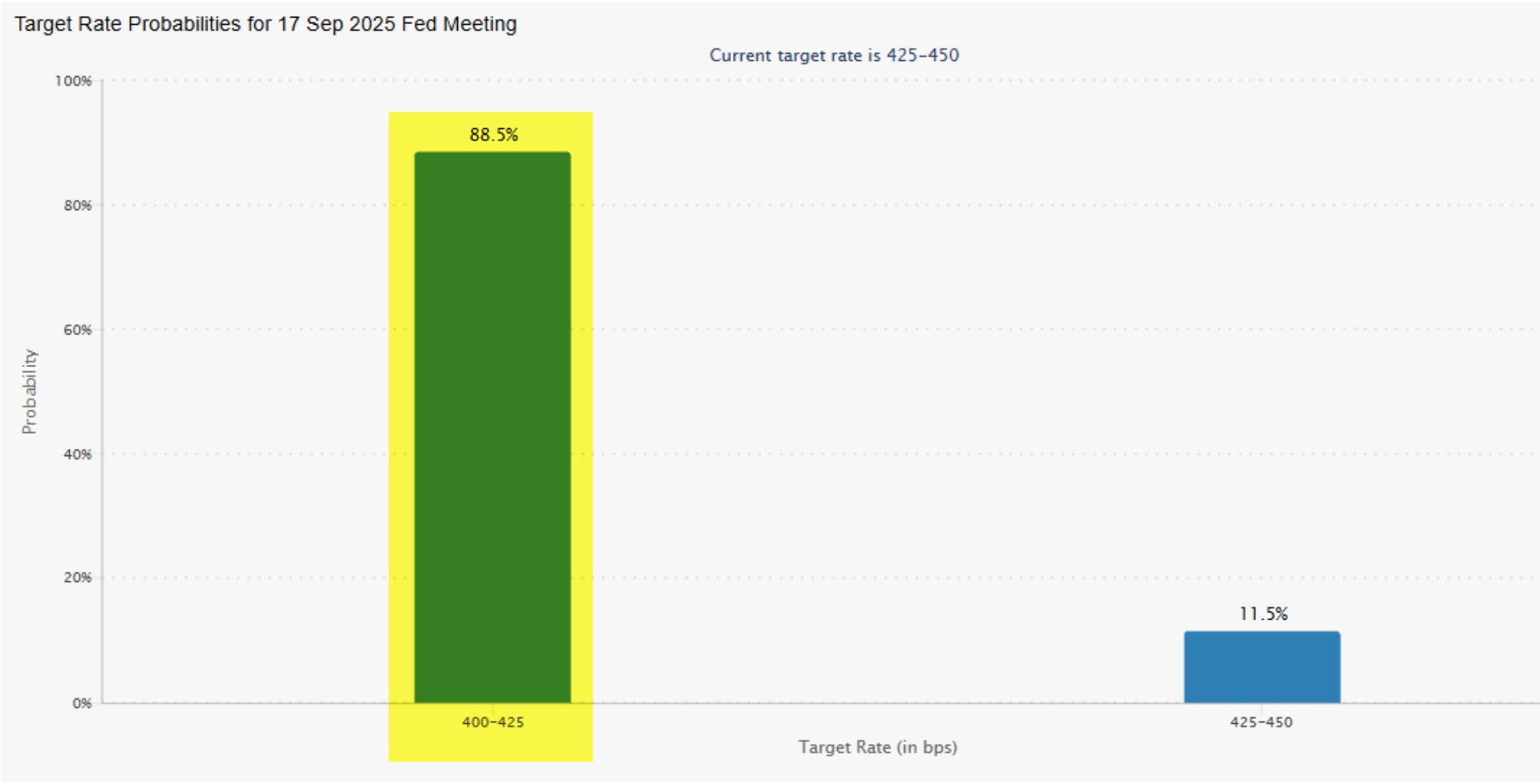

September rate-cut odds of 99.9% yesterday have now fallen down to 88.5%.

From "guaranteed" to "not so fast." Source: Bespoke

An important remainder by Otavio Costa

Inflation data came in hotter than expected, but it is not just about tariffs. Inflation is fundamentally a monetary phenomenon. You don’t solve it with a 7% fiscal deficit and a money supply hitting record highs. Source: Tavi Costa, Bloomberg

US margin debt has hit $1 trillion for the first time in history.

This is a ~65% surge over the last 3 years. Source: Global Markets Investors

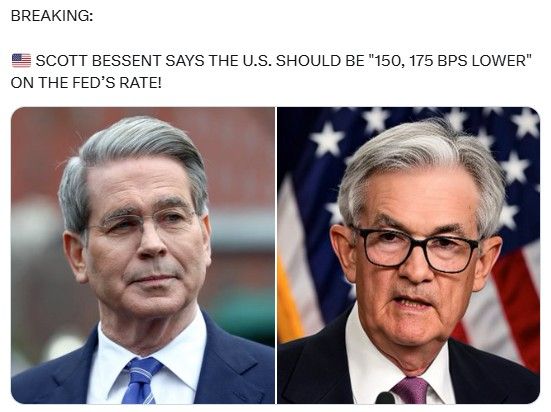

🔴 Scott Bessent says the U.S. should be "150, 175 bps lower" on the Fed's rate ‼️

😨 Vows to cut 50 bps at next Fed meeting. ⚠️ Bashes critics saying he can't be head of treasury and Fed at the same time - “If Elon can run two things at once, why can't I?” 🚀 🚀 🚀 Source: Coinvo

The us budget deficit disaster continues with renewed momentum.

Source: zerohedge through Peter Mallouk on X

US small-caps are breaking higher in a substantial factor rotation.

As highlighted by Andreas Steno Larsen on X, being short Russell 2000 index is a very crowded trade. A short-squeeze in the making?

🔴 US President Trump says he is looking at reclassifying marijuana.

The weed stocks and AdvisorShares Pure Cannabis ETF ($YOLO) surged yesterday. ▶️ President Donald Trump said Monday his administration was “looking at reclassification” of marijuana and intends to make a decision in the upcoming weeks. ▶️ “It’s a very complicated subject base,” he said during a press briefing. “I’ve heard great things having to do with medical and bad things having to do with just about everything else.” ▶️ His comments come after a Friday Wall Street Journal report indicated Trump was considering reclassifying the drug as less dangerous. Source: Markets & Mayhem, Politico

Trump Nobel Peace Prize odds soar to record highs.

12% chance. Source: Polymarkets

Investing with intelligence

Our latest research, commentary and market outlooks